Investing isn’t just for people with loads of cash, nor is it reserved for stock markets and blockchain. Investments include personal savings, insurances, and assets, and they’re not exclusive to just very wealthy people! Everyone can—and should—be investing.

The first step to being an investor is understanding the stages of becoming an active investor. Not everyone gets to this stage, but those who do are generally categorized into three types: personal investors, angel investors, and venture capitalists.

Knowing the stages and types of investors is essential, not just for people who are diversifying their portfolios. It’s also crucial information for people who do business with investors, such as startups, or anyone else thinking about starting a business.

Let me tell you something important right away – investing isn’t just for wealthy people or stock market experts! Everyone can (and should) be an investor in some capacity But when it comes to funding businesses, there are three main types of investors you need to know about

The 3 Main Types of Investors Explained

According to research and industry standards, these are the three primary types of investors you’ll encounter when seeking funding for your business:

1. Personal Investors

These are the people closest to you – your friends, family members and close acquaintances. They’re usually the first people entrepreneurs turn to when starting a business.

Key characteristics of personal investors:

- Invest smaller amounts of capital

- Usually invest in the early stages of a business

- Easier to access than other investor types

- Investment capacity is limited

- Requires proper documentation to avoid complications

- May need legal counsel to ensure agreements are properly set up

Most startups begin with support from personal investors because they’re easily accessible. However, their capital is limited, and these arrangements should be properly documented with legal counsel to avoid complications down the road.

2. Angel Investors

Angel investors are typically wealthy individuals who invest their personal funds in early-stage startups in exchange for equity ownership. They’re often entrepreneurs themselves or industry experts who want to help promising new businesses.

Key characteristics of angel investors

- Usually wealthy entrepreneurs, business professionals, or industry insiders

- Invest in startups with high potential, sometimes still in incubation programs

- Provide substantial investments hoping for significant returns

- Offer more favorable terms compared to other investors

- Focus on helping the startup grow rather than immediate profits

- Can work independently or pool resources with other angels

- Bring valuable mentorship and connections to the table

Angel investment is typically either a one-time funding to propel the business forward or ongoing support during the initial stages. These investors usually offer more favorable terms because they invest in the entrepreneur rather than just focusing on the company’s viability.

3. Venture Capitalists (VCs)

Venture capitalists are professional investors who manage funds from various sources to invest in startups with high growth potential. They’re more selective and typically invest larger amounts than angel investors.

Key characteristics of venture capitalists:

- Can be well-off individual investors or partners in financial institutions

- Invest significant capital in startups with long-term growth potential

- More selective than angel investors

- Often secure startup shares and decision-making rights

- Provide mentorship to help startups grow

- Look for substantial returns on their investments

- Focused on companies with scalable business models

- In VC deals, large portions of ownership are sold to investors

VCs put their resources into companies they believe have the potential to grow significantly. In return, they demand equity in the company and get a say in the business decisions. When you take VC funding, you’re not just getting capital – you’re also gaining access to experienced advisors who can help guide your business.

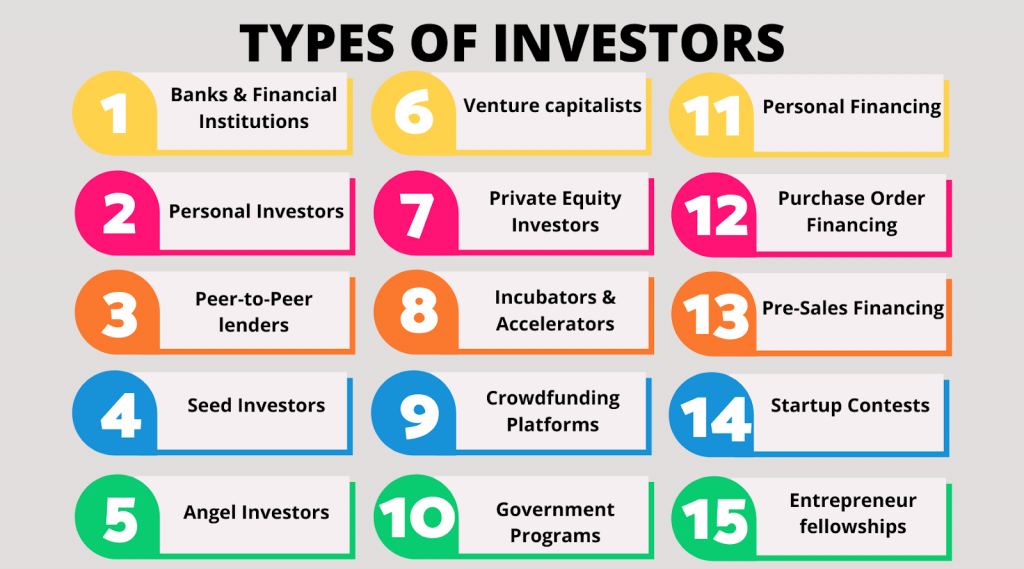

Other Types of Investors Worth Knowing

While the three main types above are the most common, there are other investor types you might encounter:

Peer-to-Peer Lenders

These are groups or individuals who provide capital to small business owners through platforms like Lending Club or Prosper. Business owners apply through these platforms, and if approved, lenders decide whether to fund the business.

Incubators and Accelerators

These programs help develop business ideas or accelerate the growth of early-stage startups. They often provide seed money (usually between $10,000 to $120,000) along with resources, mentorship, and connections to larger investors.

Corporate Investors

These are established companies that invest in smaller businesses. They might be looking to diversify their assets, identify talent and innovation, or gain access to new technologies that could benefit their own operations.

The Stages of Being an Investor

Before we dive deeper, it’s worth understanding the stages most investors go through:

-

Pre-Investor: This is where everyone starts – characterized by a lack of financial knowledge or motivation. Pre-investors don’t know much about investments or how to transform capital into assets.

-

Passive Investor: At this stage, people employ financial planning to maximize returns with minimal risk. This might include investing in real estate, retirement plans, or savings accounts.

-

Active Investor: These investors take a hands-on approach, researching the market and making calculated moves to protect themselves from losses. The three types of investors we discussed above are all examples of active investors.

How to Choose the Right Investor for Your Business

Finding the right investor is more than just securing capital – it’s about building a partnership. Here’s what to consider:

-

Understand different funding options: Make a list of your expectations before approaching investors. Know what you need and what you’re willing to give up.

-

Know where to look: Use online databases like Angel Capital Association, AngelList, or Angels Den. Network at business events and pitch competitions.

-

Create an investor shortlist: Narrow down potential investors based on their reputation, previous partnerships, and mutual connections.

-

Leverage your networks: Investors prefer working with entrepreneurs they know or who come recommended. Use your connections to get introductions.

-

Perfect your pitch: Once you have an investor’s attention, you need a compelling pitch. Make it visually appealing and start with something that grabs their attention.

-

Look for industry expertise: Ideally, your investors should understand your industry and its challenges.

-

Evaluate functional expertise: Check if the investor has relevant skills and experience that could benefit your business.

-

Review their track record: Research their investment history. Have they worked with similar companies? What’s their success rate?

-

Consider their financial capacity: Think about future funding rounds. Will your current investor be able to participate in later rounds?

Types of Investors to Avoid

Not all investors are beneficial for your business. Watch out for:

- Predatory investors who offer unfair terms or try to take control of strategic decisions

- Litigious investors who are prone to legal disputes

- Investors without sufficient capital who can’t deliver on their promises

- Investors with misaligned goals who might create conflicts down the line

Why Would Investors Fund Your Business?

Understanding investor motivations can help you craft better pitches. Here’s what they look for:

- Return on investment: Investors want to make money. Show them how your business will generate returns.

- Hard data: Present solid numbers that demonstrate your business’s financial performance.

- A solid business plan: This shows you’re serious and have thought through how to make money.

- Clear allocation of funds: Explain exactly what you need the money for and when they can expect returns.

- A clear investment structure: Have a business structure that allows for outside investment and clearly defines ownership rights.

Final Thoughts

Finding the right investor for your business isn’t just about getting money – it’s about finding a partner who believes in your vision and can help you achieve it. The three main types – personal investors, angel investors, and venture capitalists – each offer different benefits and come with different expectations.

Take your time to research potential investors and make sure they’re a good fit for your business. Remember, the right investor can provide more than just capital – they can offer mentorship, connections, and valuable industry insights that could be the difference between success and failure.

Three Types Of Active Investors

Active investors differ in the capital they’re willing to invest, their strategies, and their motivations. Startups need to know the types of investors they might encounter and that they’ll likely need to help get their business off the ground.

Most startups begin with support from personal investors: family, friends, and acquaintances. These people are easily accessible, but the capital is limited. Plus, it requires careful documentation and legal counsel to make sure these agreements are free of complications.

Angel investors are usually wealthy entrepreneurs, business professionals, or industry insiders who want to leverage capital by investing in startups with high potential. Sometimes these startups are still in startup incubation, which is defined as companies still in incubator programs. These business angels make substantial investments in the hopes of receiving significant returns if or when a startup is acquired or goes public.

Though angel investors are usually independent, some pool their capital together and act as a group to buy larger chunks of a startup.

A venture capitalist (VC), who can be a well-off investor or a partner in a financial institution, invests significant capital in startups with long-term growth potential. They’re similar to angel investors, but they’re more selective. VCs often secure startup shares, giving them the right to make decisions, take up positions, etc. That said, VCs often offer mentorships to help the growth of startups they’ve invested in.

The Stages Of Being An Investor

There’s an investor in all of us. And all it takes to awaken that financially responsible mindset is financial education. Here are the stages each investor goes through to realize that:

Everyone starts as a pre-investor. It’s a stage characterized by a lack of financial knowledge or motivation. A pre-investor doesn’t know about investments, or if they do, they are unaware of how to transform capital into assets.

The financial world of a pre-investor is usually characterized by high consumption and little savings, prioritizing lifestyle over long-term financial security. That said, it’s easy to advance yourself from the pre-investor stage by learning more about personal finance and how you can grow money based on your needs and capacities.

A passive investor is someone who employs financial planning—a simple approach to maximize returns on capital with minimal risk, including investing in real estate, retirement plans, asset allocation, and savings. If done early, passive investments may be enough to guarantee a comfortable lifestyle later in life.

This stage is the starting point for financial security, and it’s ideal for people who are too busy to focus on actively investing, such as those with demanding jobs, families, or other interests.

An active investor takes a more hands-on approach to investing. They take the time to research the market, as well as different investment opportunities. They’re like passive investors, except they don’t leave their capital to the market’s movement. Instead, they’re able to make calculated moves to protect themselves from possible losses through learned skills.

Active investors make sure that their money is working for them. Their financial decisions are specifically aimed at ensuring they receive high returns later on.

3 Types of Investors–Which type are you?

FAQ

How do investors get paid?

Is an investor an owner?

What are the 3s of investing?

Diversification. Dividends. Discipline. Christopher Quinley, CFP®, CIMA®, AAMS®, the co-founder of Liang & Quinley Wealth Management, says that one of his key tips for financial health is to invest using the three Ds: diversification, dividends, and discipline.

Who are the big three investors?