If you are getting started with options trading, you may have seen that your broker has several options trading levels, each with their own strategies. Reaching higher levels as an options trader gives you more flexibility with how you trade options and may potentially profit from stock price movements but may also come with greater potential risk of losses. Some traders want every options trading choice, while others prefer to only have the basics. Understanding how each options trading level works will help you determine which level makes sense for you.

Have you ever wondered what separates the casual options traders from the pros? The answer might be Level 4 options trading permissions. As someone who’s navigated the complex world of options trading for years, I can tell you that reaching Level 4 is like getting the keys to the kingdom – but it’s definitely not for everyone!

What Exactly Are Level 4 Options?

Level 4 options represent the highest level of options trading permissions offered by brokerages like Interactive Brokers. Unlike the more restricted Levels 1-3, Level 4 grants you access to all options strategies available in the market, including the most complex and potentially risky ones.

According to Interactive Brokers’ official documentation, Level 4 is defined simply as “All option strategies are allowed.”

But what does this really mean for you as a trader? Let’s break it down,

The 4 Levels of Options Trading Permissions

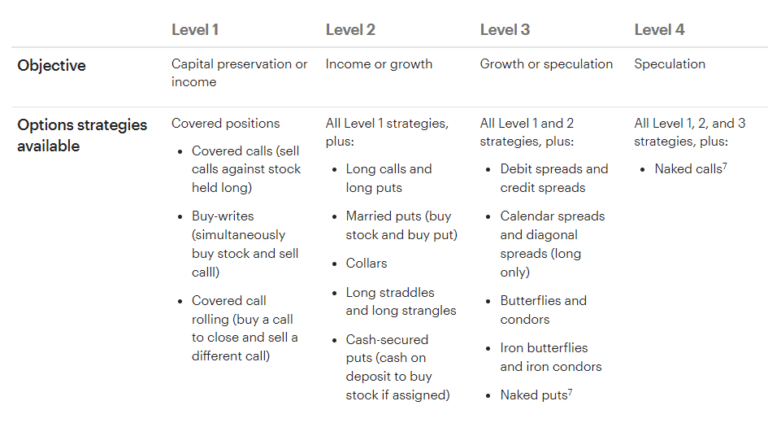

Before diving deeper into Level 4, let’s understand the progression of options trading levels:

| Level | Options Strategies Allowed |

|---|---|

| Level 1 | Covered calls (short call vs long equal quantity of underlying) |

| Level 2 | Covered options positions as defined by FINRA Rule 2360 with restriction that long option expiration must be on or after short option expiration in spreads |

| Level 3 | Option strategies with limited maximum potential loss |

| Level 4 | All option strategies |

Interactive Brokers introduced Levels 1 and 2 to provide options trading access to traders who wouldn’t qualify for the more advanced permissions (previously called Limited and Full now known as Levels 3 and 4).

Strategies Exclusive to Level 4 Options Trading

When you get Level 4 options permissions, you unlock several advanced strategies that aren’t available at lower levels:

- Short Naked Calls: Selling call options without owning the underlying stock

- Short Straddles: Simultaneously selling a call and put at the same strike price

- Short Strangles: Selling out-of-the-money calls and puts

- Short Synthetic: Complex position that mimics being short the underlying

- Calendar Spread – Credit: Time spread that generates a net credit

- Diagonal Spread – Long leg expires first: Cross-expiration, cross-strike spread with specific expiration setup

These strategies have one thing in common: they all have potentially unlimited risk. This is precisely why brokerages restrict them to their most experienced traders.

Why Level 4 Options Trading Isn’t for Everyone

I’ve seen too many newbie traders eager to jump straight to Level 4, but there’s good reason brokerages make it the hardest level to qualify for:

- Unlimited Risk Exposure: Many Level 4 strategies expose you to theoretically unlimited losses

- Margin Requirements: These strategies typically require substantial margin

- Complex Risk Management: Managing these positions effectively requires advanced knowledge

- Psychological Factors: The stress of managing positions with unlimited downside requires exceptional emotional discipline

As one of my trading mentors used to say, “Just because you CAN do something doesn’t mean you SHOULD.” This applies perfectly to Level 4 options strategies.

How to Qualify for Level 4 Options Trading

Want to reach Level 4? Here’s what you’ll need:

Account Requirements

- Account Type: Margin account (Cash and IRA accounts can only request levels 1-3)

- Minimum Equity: At least $2,000 net liquidating equity

- Age Requirement: At least 21 years old (all clients are eligible for Level 1, but Levels 2-4 require 21+)

Personal Requirements

Interactive Brokers and most brokerages evaluate:

- Liquid Net Worth: Higher net worth generally means easier approval

- Investment Objectives: Must align with speculative strategies

- Product Knowledge: Must demonstrate understanding of complex options

- Prior Experience: Proven track record with less risky options strategies

How to Request Level 4 Permissions

Using Interactive Brokers as an example, here’s how to request or update your options permissions:

- Log into Client Portal

- Select the User menu (head and shoulders icon in top right) followed by Settings

- Under Account Settings, find the Trading section

- Click on Trading Permissions

- Locate Options section, select Add/Edit or Request under Options

- Select Level 4 permissions and click Continue

- Review and sign the disclosures and agreements

- Click Continue and follow the on-screen prompts

Review typically takes 24-48 hours. If rejected, you may need to update your financial information or trading experience in your profile.

The Pros and Cons of Level 4 Options Trading

Pros

- Complete Strategic Freedom: Access to every options strategy available

- Income Generation: Strategies like naked calls can generate significant premium income

- Advanced Hedging: More sophisticated risk management capabilities

- Profit in Any Market: Strategies designed for any market condition

Cons

- Unlimited Risk: Many strategies have uncapped potential losses

- Higher Margin Requirements: Ties up more capital

- Complexity: Requires deep understanding of options mechanics

- Stress Factor: Can be emotionally challenging to manage

- Account Restrictions: May face PDT rules and other regulatory constraints

My Experience with Level 4 Options

I still remember my first naked call – talk about nerve-wracking! I’d spent years working my way up through the options levels, and thought I was ready for the big leagues. The stock was a relatively stable blue-chip that I’d analyzed thoroughly, and the premium seemed too juicy to pass up.

Then came earnings week, and the stock gapped up 15% overnight on unexpected news. I woke up to a margin call and a valuable lesson: with Level 4 options, things can go south FAST.

That said, after gaining more experience, I’ve found certain Level 4 strategies like short strangles on low-volatility ETFs to be reliable income generators when properly managed with strict position sizing and well-defined management rules.

Level 4 Options Strategies Explained

Let’s look closer at some key Level 4 strategies:

Short Naked Calls

This involves selling call options without owning the underlying stock. The maximum profit is limited to the premium received, while the theoretical maximum loss is unlimited if the stock price rises significantly.

Example: Selling a $50 call on XYZ stock currently trading at $45 for $2 premium. If XYZ stays below $50, you keep the $200 premium ($2 × 100 shares). If XYZ rises to $60, you lose $800 (($60-$50) × 100 – $200 premium).

Short Straddles

With this strategy, you simultaneously sell a call and put at the same strike price, typically at-the-money. You profit if the stock trades in a narrow range around the strike price.

Risk profile: Maximum profit is the total premium received. Maximum loss is theoretically unlimited on the upside and substantial on the downside (limited only by the stock falling to zero).

Short Strangles

Similar to short straddles but using out-of-the-money options, giving you a wider profit range but less premium.

Calendar Spreads – Credit

These time spreads involve selling a near-term option and buying a longer-dated option, structured to create a net credit.

Risk Management for Level 4 Options Traders

If you’re serious about Level 4 options, you MUST have solid risk management:

- Position Sizing: Never risk more than 1-3% of your portfolio on any single position

- Define Your Exit Points: Know exactly when you’ll exit for profit or loss

- Diversification: Don’t concentrate in one sector or strategy

- Hedging Techniques: Use other positions to offset potential losses

- Continuous Monitoring: Level 4 strategies require active management

Alternatives to Level 4 Options Strategies

Not ready for Level 4 yet? Here are some effective Level 2 and 3 strategies that might serve your needs:

- Long Call/Put Spreads (Level 2): Defined risk with potential for solid returns

- Iron Condors (Level 3): Great for range-bound markets with defined risk

- Butterflies (Level 3): Precise strategies with limited risk and high reward potential

- Calendar Spreads – Debit (Level 3): Time-based strategies with limited risk

Frequently Asked Questions

Can I trade Level 4 options in an IRA?

No. According to Interactive Brokers, IRA accounts can only request levels 1-3, as Level 4 strategies involve margin requirements not compatible with retirement accounts.

How long does it typically take to get approved for Level 4?

While the review process takes 24-48 hours, most traders spend months or years building up their experience and financial qualifications before receiving approval.

Are the options levels the same at every brokerage?

While the concept is similar, different brokerages may have slightly different naming conventions and requirements. Always check with your specific broker.

What happens if I attempt a Level 4 strategy without proper permissions?

Your order will simply be rejected by the system. Brokerages have safeguards to prevent trading strategies beyond your approved level.

Conclusion: Is Level 4 Options Trading Right for You?

Level 4 options trading isn’t a status symbol – it’s a responsibility. The ability to execute any options strategy comes with significant risks that require proper experience, capital, and discipline to manage.

If you’re new to options trading, focus on mastering Levels 1-3 first. The strategies available at these levels can provide plenty of opportunities with more defined risk parameters.

For those who’ve put in the time, built the knowledge base, and have the financial stability to handle the potential downsides, Level 4 options can open up new dimensions in your trading arsenal.

Remember what my old trading mentor used to say: “In options trading, it’s not about how much you can make, but how much you can keep.” This wisdom becomes even more critical when you enter the world of Level 4 options.

Have you had experiences with Level 4 options trading? What strategies have worked best for you? I’d love to hear your thoughts in the comments!

Happy trading!

Level 1: Covered Calls and Cash-Secured Puts

Level 1 lets you access covered calls and cash-secured puts. These strategies are generally less risky when compared to other advanced strategies and can be good for beginners. If you want to sell a covered call, you must have 100 shares of the underlying company. If you have a $50-per-share cost basis for 100 shares and sell a covered call with a $55 strike price, you have to sell your shares at $55 per share at expiration if the stock hits or exceeds $55 per share. If not, you get to keep the premium. Having the underlying shares before selling the call limits your losses and lets you get immediate income through the premium. However, there are two big risks of this strategy. Losing money if the stock price declines below the breakeven point and the opportunity risk of not participating on the upside in case of a large stock price rise past the strike price of the call option.

Level 4: Naked Contracts

Naked contracts are the highest level of options trading because of the risks. Only the most experienced options traders should use naked call contracts. These contracts are like covered calls and cash-secured puts but without the protection of having the underlying assets. .These traders can sell uncovered calls and puts to earn the premiums. A trader will have to raise enough funds before the expiration date to purchase 100 shares for a

naked call if its exercised. Naked puts are risk defined when compared to naked calls. A naked calls theoretical risk is unlimited since theres no cap to how high a stock price can rise. A naked put s potential loss is also substantial, but limited to the strike price minus the premium received if the stock goes to zero. Meet