Student loans can be a great investment in your future, but they come with serious financial obligations. Defaulting on your student loans happens when you fail to make payments for an extended period of time. Understanding what causes default and how to avoid it is critical for anyone with student loan debt.

What Is Student Loan Default?

Default occurs when you have not made a payment on your federal student loans for 270 days. After 270 days without a payment, your loan is considered to be in default.

For other types of student loans like private loans the rules may be different. Private student loans can default anywhere from 120 days to 270 days without payment. Check your loan documents to find out the default policy for your specific loans.

Once your loan is in default, the entire balance becomes due immediately. This means your lender can take action to recover the money you owe, including:

- Withholding your tax refunds

- Garnishing up to 15% of your wages

- Garnishing portions of your Social Security benefits

- Taking legal action against you

Default also damages your credit score and makes it harder to qualify for future loans or credit cards

How Do Student Loans Go Into Default?

Missing a single payment will not cause your loan to go into default right away There is a process that leads up to a default status

1. Missed Payment

As soon as you miss your first payment, your loan becomes delinquent. At this point, there are no serious consequences other than perhaps a late fee.

2. 90 Days Delinquent

After 90 days without a payment, your loan servicer will report the delinquency to the three major credit bureaus (Experian, Equifax, and TransUnion). This damages your credit score.

3. 270 Days Delinquent

At 270 days without a payment, your federal student loan is officially in default. Your lender can now begin the collections process to recover the money you owe.

4. Collections

In collections, your lender can garnish your wages, tax refunds, and government benefits to pay off your defaulted loan balance. You will also be responsible for paying collection costs and penalties.

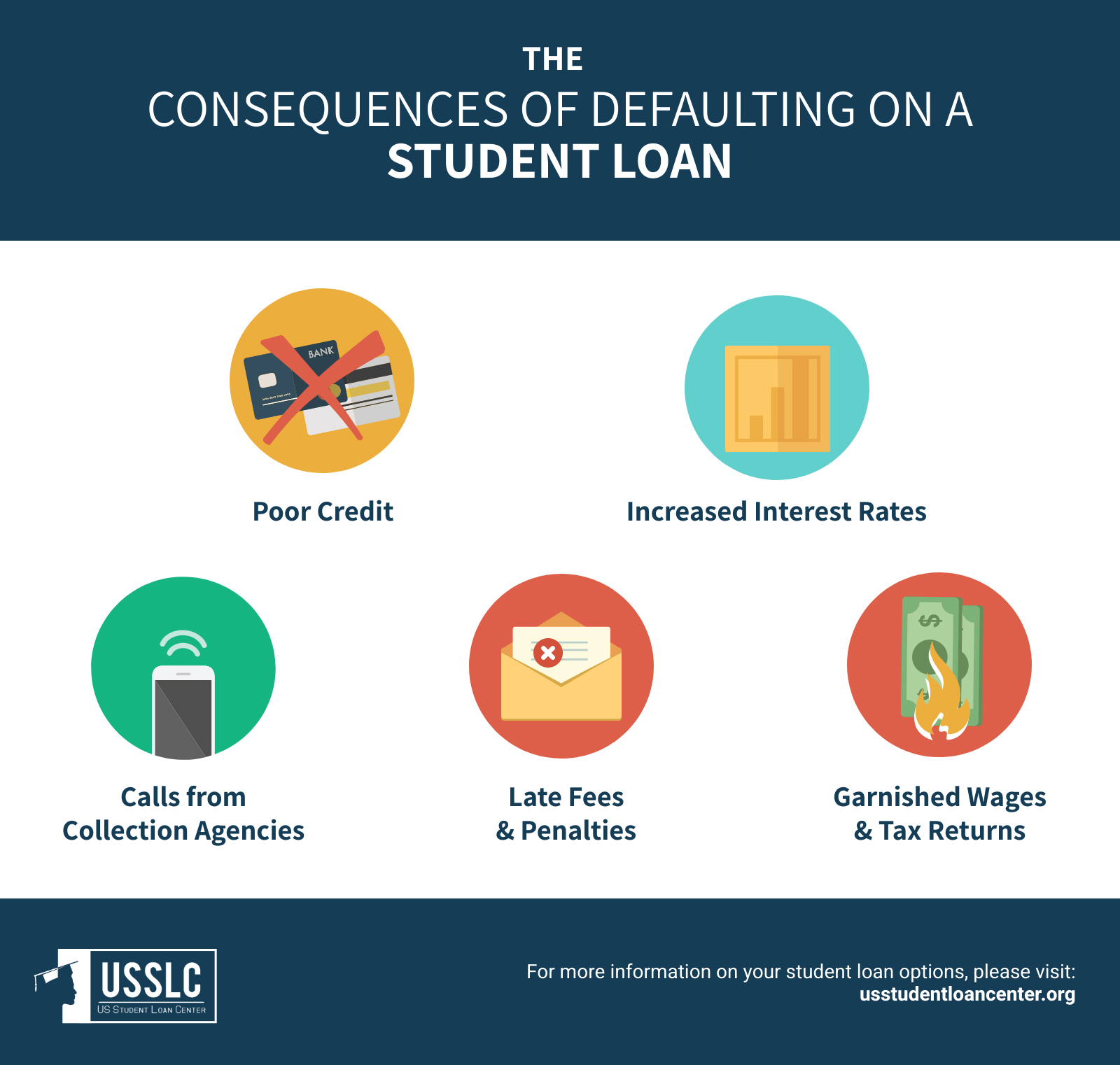

Consequences of Student Loan Default

Defaulting on your student loans has serious financial consequences:

-

Credit damage – Default is one of the worst marks that can appear on your credit report. It will stay on your report for 7 years after the defaulted account is brought current.

-

Collections – Your lender can garnish your wages, tax refunds, and government benefits to pay off your defaulted loan balance, fees, and collection costs.

-

Legal action – You can be sued and taken to court for your defaulted student loan debt.

-

Owe the entire balance – When you default, your entire loan balance becomes due immediately.

-

Loss of federal aid eligibility – You lose eligibility for additional federal student aid if you default.

-

No deferment or forbearance – You cannot access deferment or forbearance options if your loan is in default.

-

Difficulty qualifying for credit – Poor credit resulting from default will make it very hard to get approved for credit cards, mortgages, auto loans, and more.

How To Avoid Student Loan Default

You have options to avoid defaulting on your student loans:

-

Contact your lender – If you are struggling to make payments, reach out to your lender immediately to discuss alternative repayment plans.

-

Apply for deferment – Deferment allows you to temporarily stop making payments for reasons like unemployment, military service, or going back to school.

-

Request forbearance – Forbearance allows you to temporarily reduce or suspend your payments for up to 12 months due to financial hardship.

-

Change repayment plans – You may qualify for an income-driven repayment plan that bases your monthly payments on how much you earn.

-

Refinance or consolidate – Refinancing or consolidating your loans could help you lower your interest rate or monthly payments.

-

Sell assets – Consider selling assets like your car, jewelry, electronics, etc. to come up with extra money for your student loan payments.

-

Find a roommate – Getting a roommate can help lower your cost of living and free up more cash to put toward your loans.

What To Do If You Default On Student Loans

Even if you do default, it is possible to move your loans out of default status. Here are a few options:

-

Loan rehabilitation – Make 9 on-time monthly payments over 10 months to rehabilitate your loan and remove the default from your credit history.

-

Loan consolidation – Consolidating will allow you to get out of default, but the default will remain on your credit report.

-

Payment in full – While difficult, you can pay your loan balance, fees, penalties and collection costs in full to get out of default.

-

Loan forgiveness – In very limited cases, you may qualify to have your defaulted student loan forgiven in bankruptcy if you can prove undue hardship.

Avoiding Student Loan Default Is Critical

Defaulting on your student loans can damage your finances and credit for many years. If you are struggling to make payments, take action immediately by talking to your lender, looking into alternative repayment plans, or consulting a financial advisor. While default may feel like the only option, there are ways to avoid it and get your loans back in good standing.

Consequences of Default and Actions to Take

Default is failure to repay a loan according to the terms agreed to in the promissory note. For most federal student loans, you will default if you have not made a payment in more than 270 days. You may experience serious legal consequences if you default.

What are the consequences of Default?

|

Being delinquent or defaulting on a loan may affect many areas of your life: |

|

|---|---|

|

Student Loans |

-You will lose eligibility for loan deferment, forbearance, and repayment plans. -You will not be eligible for additional federal student aid. -You may be required to immediately repay the entire unpaid amount of your loan. This is known as acceleration. |

|

Future Income |

-You may not be eligible for certain types of employment. -You may be denied a professional license (Doctors, Engineers, Teachers, etc.). -Your loans may be turned over to a collection agency and you will have to pay additional charges, late fees, and collection costs. -You may have part of your income withheld by the federal government. This is known as wage garnishment. -Your federal and state income tax refunds may be withheld and applied to your debt. This is known as a tax offset. |

|

Credit Score |

-Your credit score will be damaged. -You may have difficulty qualifying for credit cards, car loans, or mortgages, and will be charged much higher interest rates. -You may have difficulty signing up for utilities, getting car or home owners insurance, or getting a cell phone plan. -You may have difficulty getting approval to rent an apartment (credit checks may be required). |

Unforeseen circumstances can make it difficult for borrowers to repay their federal loans. Borrowers who have difficulty making their loan payments should contact the loan servicer as soon as possible to find out which options are available to them. Some options may include alternative repayment plans to lower monthly payments, or deferments and forbearances which temporarily suspend monthly loan payments.

Education Dept. resumes collecting student loans in default

FAQ

What happens if a student loan defaults?

What happens when a loan defaults?

Why did my defaulted student loans disappear?

Are defaulted student loans forgiven after 20 years?

Yes, federal student loans may be forgiven after 20 years under certain circumstances. But only certain types of loans are eligible for forgiveness, and you must be enrolled in a qualifying repayment plan. You’ll also need to stay out of default on your loans.

What is a student loan default?

Best Student Loan Refinance Lenders. What Is Student Loan Default? Student loan default means you have failed to make payments on your student loans for a specified period of time, which is outlined in the terms of your loan. “With federal loans, once a payment is missed, it is considered delinquent.

What happens if I default on my federal student loans?

Outside of this forbearance period, however, loans in default can have a crippling effect to other areas of your life and finances. Here’s what you need to know: Defaulting on your federal student loans comes with some serious consequences. Here are just a few examples highlighted on the federal student aid website:

What percentage of student loans are in default?

As a result, there could be almost 10 million borrowers in default in a few months. When this happens, almost 25 percent of the federal student loan portfolio will be in default. Only 38 percent of borrowers are in repayment and current on their student loans.

How long does a student loan take to default?

Default timelines vary for different types of student loans. Federal student loans. Most federal student loans enter default when payments are roughly nine months, or 270 days, past due. Federal Perkins loans can default immediately if you don’t make any scheduled payment by its due date.

How do I get Out of default on a student loan?

If you’ve fallen into default on a student loan, there are four main options for getting out of default. Loan rehabilitation is a good choice for getting out of student loan default as it removes the negative mark from your credit report, and any collections or garnishments will stop. But it takes time.

How do I know if my student loan is in default?

The best way to find out if your student loans are currently in default is to contact your loan servicer. You can also log in to your My Federal Student Aid account to see the repayment status of your student loan or check your credit report for any listed defaults. Can You Go Back to School With Defaulted Student Loans?