Have you ever heard of brokered deposits but weren’t quite sure what they are? I was in the same boat until I did some digging. These financial instruments play a major role in our banking system, yet many people don’t understand how they work or why they matter.

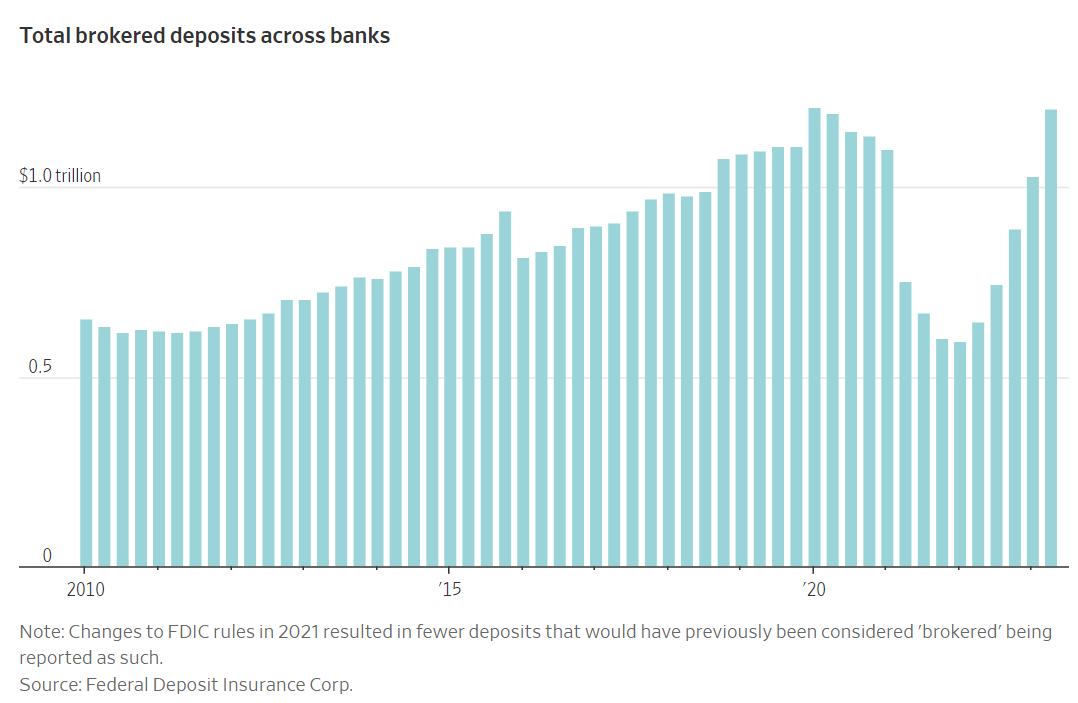

Brokered deposits represent a significant portion of bank funding – with nearly $986 billion held in insured U.S. depository institutions as of a few years ago. That’s about 8% of all domestic deposits! So yeah we’re talking about a pretty big deal in the banking world.

In this article, I’ll break down everything you need to know about brokered deposits – from what they are and how they work to their benefits and regulations. Whether you’re a curious investor or just someone trying to understand financial terms better, this guide has got you covered.

What Exactly Are Brokered Deposits?

A brokered deposit is basically a deposit made to a bank through a third-party intermediary known as a deposit broker. Unlike regular deposits where you directly put your money into a bank account, brokered deposits involve this middleman who facilitates the placement of other people’s deposits with insured financial institutions like banks.

Typically banks will sell deposits (often in the form of large-denomination certificates of deposit) to these deposit brokers. The brokers then divide these large deposits into smaller investments that they can resell to individual investors or smaller banks.

The most common form of brokered deposits are large CDs that get broken down into smaller pieces. For example, a bank might issue a $1 million CD, which a broker purchases and then sells to multiple investors in smaller chunks.

The Key Players in Brokered Deposits

There are three main players involved in brokered deposit transactions:

- Banks – They issue the deposits and receive the funds

- Deposit Brokers – The middlemen who facilitate the placement of deposits

- Investors – Individual customers or smaller banks who purchase portions of the deposits

According to the FDIC (Federal Deposit Insurance Corporation), a deposit broker is defined as “an individual or firm that facilitates the placement of other peoples’ deposits with insured institutions.” This definition is pretty broad and can include various financial professionals.

How Brokered Deposits Work in Practice

Let’s walk thru a typical brokered deposit scenario to understand how it works:

- A bank needs additional funding or liquidity

- The bank creates a large-denomination deposit product (usually a CD)

- A deposit broker purchases this large deposit

- The broker divides the large deposit into smaller pieces

- These smaller pieces are sold to individual investors

- The investors receive a higher interest rate than traditional deposits

- The bank gets the funding it needs

- The broker earns a fee for their services

For investors, brokered deposits are attractive because they typically offer higher interest rates than traditional bank deposits. For banks, these deposits provide a way to increase their liquidity and access a larger pool of potential investment funds.

Brokered Deposits vs. Core Deposits: What’s the Difference?

To really understand brokered deposits, it’s helpful to compare them with core deposits. These are the two main types of deposits that make up a bank’s deposit liabilities:

| Characteristic | Core Deposits | Brokered Deposits |

|---|---|---|

| Definition | Checking accounts, savings accounts, and CDs held by individuals | Deposits placed through a third-party broker |

| Stability | Generally stable in the long term | More sensitive to interest rate fluctuations |

| Cost | Predictable costs | Can be more expensive for banks |

| Risk Level | Lower risk | Higher risk |

| Interest Rates | Typically lower | Usually higher |

| Relationship | Direct relationship between customer and bank | Relationship is through a broker |

Core deposits are considered the backbone of a bank’s funding because they tend to be stable, have predictable costs, and are less vulnerable to interest rate changes. Brokered deposits, while providing liquidity, are considered a riskier source of funds because they’re more sensitive to interest rate fluctuations.

Benefits of Brokered Deposits

Brokered deposits offer several advantages to different parties involved:

Benefits for Banks:

- Improved Liquidity – Provides banks with the capitalization they need to make loans

- Efficiency – Can be more cost-effective than handling numerous smaller deposits

- Access to Funds – Gives banks access to a larger pool of potential investment funds

- Flexibility – Allows banks to quickly raise funds when needed

Benefits for Investors:

- Higher Interest Rates – Typically pay better rates than traditional deposits

- Diversification – Allow investors to spread money across multiple banks

- FDIC Insurance – Still covered by FDIC insurance (up to applicable limits)

- Convenience – Can manage multiple CDs through a single broker

Benefits for the Banking System:

- Improved liquidity within the banking system

- Enhanced flow of capital

- Support for lending activities

FDIC Regulations on Brokered Deposits

The FDIC plays a critical role in regulating brokered deposits in the United States. These regulations are designed to protect the stability of the banking system and prevent risky funding practices.

Under FDIC rules, only well-capitalized banks with sufficient assets can solicit and accept brokered deposits without restrictions. Adequately capitalized banks may accept them after being granted a waiver, while undercapitalized banks cannot accept them at all.

Section 29 of the Federal Deposit Insurance Act specifically restricts institutions that are less than well capitalized from accepting brokered deposits. This section also prohibits these institutions from offering rates on deposits that are significantly higher than the prevailing rates in their market area.

In December 2020, the FDIC updated its regulations to establish a new framework for analyzing whether certain deposit arrangements qualify as brokered deposits. The new rule set bright-line standards for determining if an entity meets the definition of “deposit broker” and established a consistent process for application of the primary purpose exception.

Recent Regulatory Developments

The FDIC has been actively updating its approach to brokered deposits in recent years. In December 2020, they approved a final rule that modernizes the brokered deposit regulations. This rule:

- Created a new framework for analyzing deposit arrangements

- Established bright-line standards for determining who qualifies as a “deposit broker”

- Identified business relationships that automatically meet the “primary purpose exception”

- Set up an application process for entities seeking exceptions

- Amended the methodology for calculating the national rate cap

These changes reflect the evolution of the marketplace for brokered deposits, which has developed in response to technological advances and new business relationships.

Potential Risks of Brokered Deposits

While brokered deposits offer many benefits, they also come with certain risks that should be considered:

Risks for Banks:

- Volatility – More sensitive to interest rate changes

- Higher Costs – May cost more than core deposits

- Regulatory Scrutiny – Subject to stricter regulatory oversight

- Potential Funding Instability – Can lead to liquidity problems if mismanaged

Risks for Investors:

- Early Withdrawal Penalties – Often have strict penalties for early withdrawal

- Limited FDIC Coverage – Insurance limits apply across all deposits at the same institution

- Less Relationship Banking – May miss out on other banking services and relationships

Banks that rely too heavily on brokered deposits may face additional regulatory scrutiny and could be viewed as having a less stable funding base. During the 2008 financial crisis, for instance, heavy reliance on brokered deposits was identified as a contributing factor to some bank failures.

How to Evaluate if Brokered Deposits Are Right for You

As an investor, you might be wondering whether brokered deposits are a good choice for your portfolio. Here are some factors to consider:

- Investment Goals: Are you looking for income or capital preservation?

- Time Horizon: Can you commit funds for the full term of the CD?

- Interest Rate Environment: How do brokered CD rates compare to other options?

- FDIC Insurance Needs: Do you have large sums that need FDIC protection?

- Liquidity Requirements: Will you need access to your funds before maturity?

Brokered deposits might be a good fit if you’re looking for higher yields and don’t anticipate needing the funds before maturity. They’re also useful for spreading larger sums across multiple banks to maintain FDIC insurance coverage.

Common Misconceptions About Brokered Deposits

There are several misconceptions about brokered deposits that are worth addressing:

Misconception #1: Brokered deposits aren’t FDIC-insured.

Reality: Brokered deposits are eligible for FDIC insurance coverage up to the applicable limits, just like regular deposits.

Misconception #2: Only struggling banks use brokered deposits.

Reality: Many well-capitalized banks use brokered deposits as part of their overall funding strategy.

Misconception #3: Brokered deposits always indicate risky banking practices.

Reality: While excessive reliance can be problematic, responsible use of brokered deposits is a legitimate funding tool.

Misconception #4: Brokered deposits are only for wealthy investors.

Reality: The breaking down of large CDs makes these investments accessible to many individual investors.

The Future of Brokered Deposits

The marketplace for brokered deposits continues to evolve in response to technological developments and new business relationships. The FDIC’s recent regulatory updates reflect these changes and aim to provide greater clarity while maintaining necessary safeguards.

We’re likely to see further evolution in this space as digital banking continues to transform the financial landscape. Fintech companies and online platforms are changing how deposits are gathered and managed, potentially blurring the lines between traditional and brokered deposits.

So, what’s the bottom line on brokered deposits? They’re a legitimate and important part of the banking system that offers benefits to both banks and investors. For banks, they provide a source of liquidity and funding. For investors, they typically offer higher interest rates than traditional deposits.

However, they’re not without risks and considerations. Banks need to manage their reliance on brokered deposits carefully to maintain a stable funding base. Investors should understand the terms, including early withdrawal penalties, and ensure they’re staying within FDIC insurance limits.

Whether brokered deposits are right for you depends on your specific financial situation and goals. As with any investment, it’s important to do your homework and understand what you’re getting into.

In my opinion, brokered deposits can be a valuable addition to a diversified portfolio, particularly in a low-interest-rate environment where every bit of additional yield counts. Just make sure you understand the terms and how they fit into your overall financial plan.

Have you ever invested in brokered deposits? What was your experience? I’d love to hear your thoughts in the comments below!

Why should my financial institution accept brokered deposits?

If youre responsible for generating deposits for your institution, you have a responsibility to your owners to increase your bottom line by researching all viable funding alternatives.

The good news is that if your financial institution is well capitalized, you can accept brokered deposits without limitation. In fact, the prudent use of brokered deposits within legal requirements is entirely acceptable to the FDIC. Brokered deposits should be treated and assessed as any other funding alternative, having their own special advantages and disadvantages.

Before issuing federally insured CDs through SimpliCD, Primary Financial recommends that you create a policy on accepting brokered deposits to satisfy regulators and auditors. We also recommend that your institution employ proper funds management policies, perform adequate due diligence when assessing deposit brokers and brokered deposits, and diversify its portfolio.

With a policy in place to accept rate-sensitive deposits, taking brokered deposits has several benefits:

- You have access to a larger market of investors than you do when you accept deposits only from your local market area.

- You can open deposits at rates cheaper than when you solicit rates nationally through rate services.

- You save operational costs by having one central contact instead of many.

- Accepting larger pieces saves you time and resources over multiple smaller pieces.

Who can accept brokered deposits?

Section 29 of the FDI Act, implemented by Part 337 of the FDIC Rules and Regulations, states that a well capitalized, insured depository institution is allowed to solicit and accept, renew or roll over any brokered deposit without restriction. An adequately capitalized , insured depository institution may accept, renew or roll over any brokered deposit once it has applied for and been granted a waiver by the FDIC. An undercapitalized insured depository institution may not accept, renew, or roll over any brokered deposit.

What are Brokered Deposits

FAQ

What is an example of a brokered deposit?

Typically, banks will sell deposits (often in the form of large-denomination certificates of deposit) to deposit brokers, who will then segment these large deposits into smaller investments to be re-sold to individual investors or smaller banks at an attractive interest rate.

What are the benefits of brokered deposits?

You have access to a larger market of investors than you do when you accept deposits only from your local market area. You can open deposits at rates cheaper than when you solicit rates nationally through rate services. You save operational costs by having one central contact instead of many.

Are brokered deposits high risk?

Deposit brokers provide intermediary services for banks and investors. This activity is considered higher risk because each deposit broker operates under its own guidelines for obtaining deposits.

Can brokered deposits be FDIC insured?

Custodial deposits held in the name of a broker on behalf of their investors and deposited in an FDIC insured financial institution are covered by federal deposit insurance, the same as if the funds had been deposited directly by the broker’s clients in the same institution.