Credit scoring systems comb and analyze credit reports to evaluate how you manage credit. They focus on factors such as your payment history, your total debt, usage of available credit, length of credit history, credit mix and new credit.

Credit scoring systems such as the FICO® ScoreΠ8 and VantageScore® analyze credit report information to predict whether youll pay your debts as agreed. The software essentially uses advanced algorithms to comb your credit history for signs of good (and bad) credit management habits.

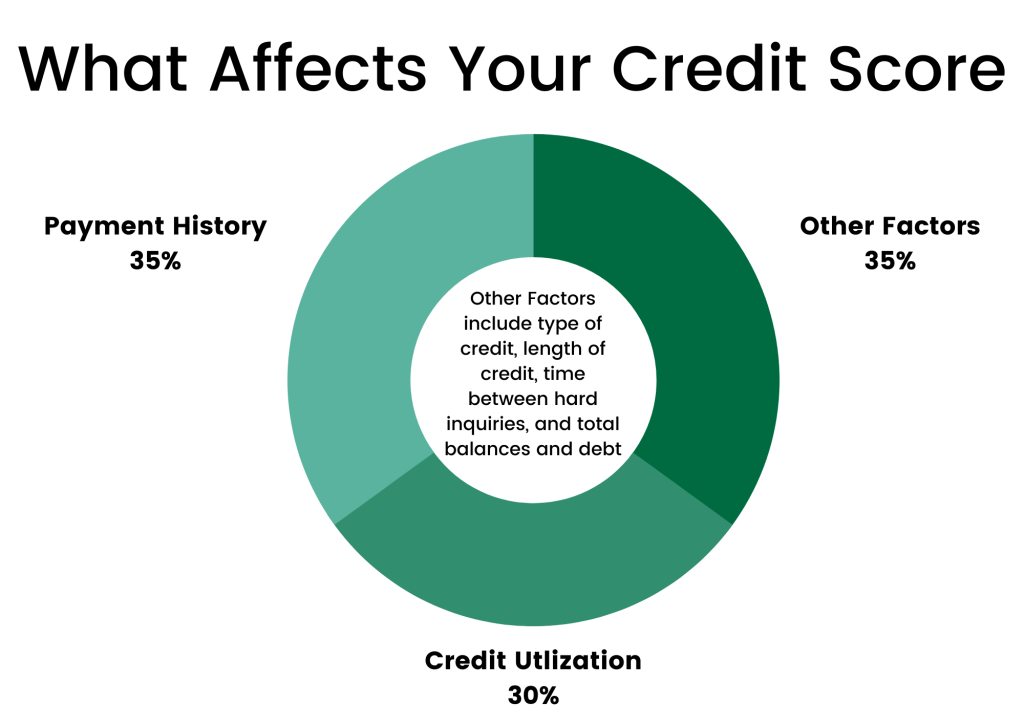

The calculations that produce credit scores are closely kept trade secrets, but the underlying factors they consider (as well as how theyre weighted) are public knowledge. The following factors and percentage weightings apply to the FICO® Score, which is used by 90% of top lenders.

VantageScore credit score factors differ somewhat, but adopting the habits described below will promote improvement on any credit score derived from credit report data.

Your credit score is one of the most important factors lenders consider when deciding whether to approve you for new credit. A high score signals that you’re a responsible borrower who pays bills on time, while a low score tells lenders you may be a high-risk customer.

Many things can cause your credit score to drop But some actions hurt your score more than others Here are two of the biggest threats to your credit score and how to avoid them,

1. Missing Payments

Missing payments on loans and credit cards is one of the fastest ways to damage your credit score. Payment history typically makes up 35% of your score. When you miss payments, it suggests you may have trouble managing debt responsibly.

As soon as an account becomes 30 days past due, the late payment can show up on your credit report. A single late payment can knock your score down by over 100 points if you previously had excellent credit.

The more severe the delinquency, the worse it hurts your score. If an account becomes 90 days past due, your score will take an even bigger hit. Negative information like late payments can stay on your report for up to seven years.

To avoid late payments:

- Set up automatic bill payments or payment reminders.

- Maintain an emergency fund to cover bills if money is tight.

- Contact your lender at the first sign of financial hardship to discuss alternative repayment options.

Catching up on past due payments can start to rebuild your credit score over time. But it’s better to avoid missed payments altogether.

2. High Credit Utilization

The second biggest threat to your credit score is high credit card utilization. This measures how much of your available credit you’re using.

Experts recommend keeping your credit utilization below 30%. Maxing out cards can show lenders you may be overextended.

Credit utilization makes up 30% of your score calculation. Let’s say your credit limit is $5,000 and your balance is $4,500. Your utilization would be 90% ($4,500/$5,000). Such high utilization can cause a 100+ point drop in your score.

To lower your utilization:

- Pay down balances to reduce how much you owe.

- Ask for a higher limit from issuers after making on-time payments for several months.

- Open a new card only if you need one and can manage the additional credit responsibly.

You can also consider consolidating balances to a lower-rate personal loan. This pays off cards with a fixed-rate installment loan. Then you make just one monthly payment instead of many credit card payments.

Other Ways Credit Scores Can Drop

While missed payments and high utilization cause the most credit damage, there are other mistakes that hurt your score:

- Maxing out cards: Maxing out even one card can lower your score significantly.

- Too many hard inquiries: Applying for many new accounts in a short period can lower your score.

- Closing old accounts: Doing so can shorten your credit history and raise your utilization.

- Defaults and collections: Having unpaid debts sent to collection damages your score.

- Errors on your report: Incorrect negative information drags down your score.

- Name changes: After major life events, update your name with creditors to avoid issues.

- Using only one type of credit: Lenders want to see you can manage different types responsibly.

How to Check Your Credit Score

To monitor your credit score, you can:

- Get your free credit reports annually from AnnualCreditReport.com.

- Check your score for free through many banks and credit card issuers.

- Purchase your FICO score from MyFICO.com.

- Use a credit monitoring service that tracks your reports and scores.

Checking your credit score regularly lets you quickly notice and dispute any errors. It also helps you see the impact of your financial choices.

Recovering After Credit Score Damage

If your credit score takes a hit, here are some tips to rebuild it:

- Bring all accounts current and make on-time payments going forward.

- Pay down balances below 30% of your credit limits.

- Limit new credit applications until your score recovers.

- Avoid account closures and balance transfers.

- Wait for negative marks to fade per the seven-year credit reporting timeline.

- Add positive payment history by becoming an authorized user on someone else’s account.

With time and diligently positive financial habits, you can rebuild your credit after a drop. Be patient and focus on responsible behaviors to improve your chances of approval next time you apply for new credit.

The Bottom Line

Missed payments and high utilization are two of the quickest ways to tank your credit score. If you’re struggling with payments, communicate with lenders immediately. And reduce balances below 30% of your limits.

Check your credit score regularly and understand how different money moves impact it. Financial discipline now can save you from credit damage down the road.

Amounts Owed: 30%

The total amount youve borrowed affects your credit score, as does the portion of your available credit tied up in outstanding balances. Your credit utilization ratio, or rateâthe percentage of your total borrowing limit youre using on your credit cards and other revolving-credit accountsâis a significant factor in determining credit scores. It is also one of the factors thats most responsive to your actions. For instance, paying off a high-balance credit card one month can help you see a credit score boost once the payment is reported to the credit bureaus and a new score is calculated.

To calculate your utilization, divide your outstanding balance on each revolving account by its credit limit and multiply by 100 to express the answer as a percentage. Credit scoring systems consider the utilization rate on all accounts individually and on the total of all accounts, as in the following example:

| Credit Limit | Balance | Utilization (Balance/Limit) | |

|---|---|---|---|

| Credit card 1 | $6,500 | $1,600 | 25% |

| Credit card 2 | $4,800 | $1,500 | 31% |

| Credit card 3 | $8,000 | $1,300 | 16% |

| Total: | $19,300 | $4,400 | 23% |

Individuals with the highest credit scores tend to keep their utilization rates below about 10%, and utilization rates of roughly 30% or greater will more negatively impact credit scores. Paying down higher balances can bring relatively quick score improvement, so in this example, focusing on reducing the balance on card 2 could lead to a relatively quick increase in credit scores.

Amounts owed are responsible for about 30% of your FICO® Score.

Length of Credit History: 15%

It makes intuitive sense that experience with credit accounts will tend to make you better at managing debt, and thats borne out by statistical analysis. For that reason, all else being equal, the longer your credit history, the higher your credit score will tend to be. The FICO® Score evaluates your experience with credit by measuring the age of your oldest credit account, the age of your newest credit account and the average age of all your accounts.

Note that closing accounts and paying off loans in full caps the payment history for those accounts, but it doesnt immediately cancel out their ages for purposes of calculating length of credit history. Accounts you choose to close in good standing (meaning with no late payments) remain on your credit report for as long as 10 years.

The length of your credit history accounts for about 15% of your FICO® Score.

What Affects Credit Score?

FAQ

What can hurt credit score?

Late or missed payments hurt your score. Amounts Owed or Credit Utilization reveals how deeply in debt you are and contributes to determining if you can handle what you owe. If you have high outstanding balances or are nearly “maxed out” on your credit cards, your credit score will be negatively affected.

What has the 2nd largest impact on your credit score?

Your payment history and how much of your credit limits you use are the two biggest credit scoring factors.

What are 2 items that are not in your credit score?

- Your race, color, religion, national origin, sex and marital status. …

- Your age. …

- Your salary, occupation, title, employer, date employed or employment history. …

- Where you live.

- Any interest rate being charged on a particular credit card or other account.

What is the single worst thing you can do to your credit score?

1. Making late payments. The factor that has the biggest impact on your credit score is payment history, so even one late payment can hurt your score.