Navient and Nelnet — ever find yourself scratching your head about the difference between these two major student loan servicers?

Ahead, we will dissect Navient and Nelnet, highlighting their similarities, differences, and the potential impact of recent shifts in the federal student loan servicing landscape on your loans. Buckle up for a thorough guide designed to help you smoothly navigate the often confusing world of student loan repayment!

Hey there, if you’re knee-deep in student loan drama, you’ve probably heard of Navient and Nelnet. And I bet you’ve wondered, “Are Navient and Nelnet the same?” Spoiler alert: they ain’t. These two giants in the student loan world might seem like peas in a pod, but they’ve got some big differences that can mess with how you manage your debt. So, let’s break it down real simple-like, and I’ll walk ya through what sets ‘em apart, why it matters, and how to keep your head above water with all this loan nonsense.

I remember when I first started dealing with student loans—total headache I didn’t even know who was handling my payments half the time! If you’re in that boat, don’t sweat it We’re gonna clear up the confusion around Navient and Nelnet, dive into their quirks, and make sure you’ve got the tools to handle your loans like a pro.

The Short Answer: Nope, They’re Different Beasts

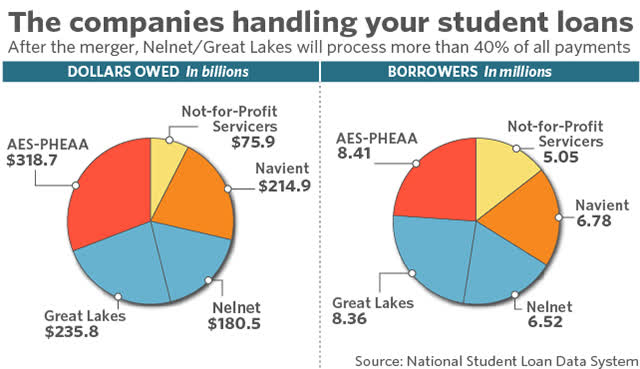

Let’s cut to the chase Navient and Nelnet are not the same They’re both major players in the student loan servicing game, meaning they handle payments, repayment plans, and all that jazz for millions of borrowers. But they’ve got different focuses, strengths, and even reputations. Navient plays in both the federal and private loan sandbox, while Nelnet sticks mostly to federal loans. Plus, one’s got a better rap for customer service (hint it’s not Navient). Stick with me, and I’ll lay out the nitty-gritty.

Breaking Down Navient: The Big Player with a Mixed Bag

Navient’s a heavyweight in the student loan world. They’ve been around for a while, handling a massive chunk of loans—both federal and private. But here’s the kicker: they stopped servicing federal direct loans back in late 2021. If you had federal loans with ‘em before then, they’ve likely been shipped off to another servicer called Aidvantage. Now, Navient’s main gig is managing private student loans and some government-issued loans called Federal Family Education Loans (FFEL) that private lenders own.

What’s cool about Navient? They’ve got some slick features for managing loans, especially if you’ve got FFEL loans or private ones. Need to refinance a private loan to snag a better rate? Navient’s got options for that. But, full disclosure, they’ve had their share of drama. Legal issues, lawsuits, complaints about mismanaging accounts—you name it. I ain’t saying they’re the bad guy, but their customer service rep ain’t exactly sparkling.

Oh, and heads up Navient’s planning to hand over the servicing of their remaining student loan portfolio (think millions of accounts) to another company called MOHELA sometime in 2024 They’ll still own the loans, but MOHELA will handle the day-to-day. If that’s you, keep your eyes peeled for updates, and make sure your contact info’s current with ‘em.

Nelnet: The Federal Loan Champ with a Friendlier Vibe

Now, let’s chat about Nelnet. These folks, around since ‘96, focus mainly on federal student loans. They work on behalf of the U.S. Department of Education and some guaranty agencies to manage loans like Direct Subsidized, Unsubsidized, PLUS, and Consolidation loans. Unlike Navient, they don’t mess with private loans directly (though there’s a separate thing called Nelnet Bank for that).

What makes Nelnet stand out? Their customer service game is strong. Borrowers tend to give ‘em props for being easier to deal with compared to Navient. They’ve also got a solid setup for income-driven repayment plans if you’ve got federal loans owned by the Department of Education. Plus, they scooped up another big servicer, Great Lakes, a few years back, and they’ve been merging those accounts into their system. If you’re with Great Lakes, expect a transfer to Nelnet eventually, with a new account number and all.

Navient vs. Nelnet: A Head-to-Head Smackdown

Still fuzzy on how they differ? I gotchu. Let’s throw ‘em into a quick comparison table to see what’s what. This’ll help you figure out which one might be handling your loans—or both!

| Feature | Navient | Nelnet |

|---|---|---|

| Loan Types Serviced | Federal (FFEL) & Private Loans | Federal Loans (Direct, PLUS, etc.) |

| Private Loan Options | Yes, including refinancing | Nope (but Nelnet Bank offers private loans) |

| Customer Service Rep | Spotty—higher complaint rates | Better—often praised by borrowers |

| Recent Changes | Stopped federal direct servicing in 2021; transferring to MOHELA in 2024 | Acquired Great Lakes; ongoing account merges |

| Special Features | Strong FFEL & private loan management | Expanded income-driven repayment options |

See? They’ve got their own flavors. Navient’s your go-to if you’ve got private loans or need refinancing, but Nelnet might be your buddy if you’re all about federal loans and want less hassle when you call for help.

Can You Have Loans with Both? Heck Yeah, But Watch Out

Here’s a fun lil’ fact: you can totally have loans serviced by both Navient and Nelnet. Maybe you’ve got some old FFEL loans with Navient and a Direct Loan with Nelnet. It happens. But lemme tell ya, juggling loans with two servicers can be a pain in the neck. It might mess with your eligibility for stuff like Public Service Loan Forgiveness (PSLF)—more on that later. Plus, tracking payments across two platforms? Ugh, nightmare.

If you’re in this boat, my advice? Keep super-detailed records. I’m talkin’ spreadsheets, screenshots, whatever works. And double-check which loans qualify for which forgiveness or repayment plans, ‘cause mixing ‘em up could cost ya.

Why Ain’t My Loans Showing Up on StudentAid.gov?

Ever logged into StudentAid.gov and thought, “Where the heck are my Navient or Nelnet loans?” Don’t panic just yet. Sometimes, the info takes a hot minute to update—think 7 to 10 days, or even longer for payment history (up to 90 days). Schools, servicers, and lenders gotta send the data over, and they ain’t always speedy.

If it’s been weeks and still nada, reach out to your school or servicer directly. They can sort out any glitches. And if that don’t work, file a complaint with the Federal Student Aid Ombudsman or the Consumer Financial Protection Bureau. We’ve all been there, trust me—nothing’s more frustrating than invisible loans.

Loan Forgiveness and Repayment: What’s the Deal?

Alright, let’s talk about the good stuff—getting outta debt. Both Navient and Nelnet handle federal loans, so they’re tied to forgiveness and repayment options. But depending on who’s servicing your loan, things can play out different. Let’s unpack this.

Public Service Loan Forgiveness (PSLF)

If you work full-time for a government or nonprofit gig, PSLF might be your ticket. Make 120 qualifying payments on a Direct Loan under a qualifying plan, and poof—remaining balance gone. Here’s the catch: FFEL loans with Navient don’t count for PSLF unless you consolidate ‘em into a Direct Loan first. Nelnet’s federal loans are often already Direct, so you’re golden. Check with your servicer to confirm.

Income-Driven Repayment (IDR) Plans

Struggling to pay? IDR plans adjust your monthly bill based on your income and family size. Options like Income-Based Repayment (IBR) or Pay As You Earn (PAYE) can be a lifesaver. Nelnet’s got a rep for making these plans easy to navigate for federal loans, while Navient offers ‘em too but mostly for FFEL if they’re federally owned after consolidation. There’s also a one-time IDR waiver floating around that counts past forbearance or deferment periods toward forgiveness—huge win if you qualify.

Biden’s Big Forgiveness Plan

You’ve probably heard about President Biden’s plan to forgive up to $20,000 for federal loan borrowers makin’ less than $125,000 a year (or $250,000 for couples). It’s tied up in legal battles right now, but if it passes, both Navient and Nelnet borrowers with federal loans could benefit. Fingers crossed, y’all.

Navient-Specific Forgiveness

Navient’s got a deal to forgive FFEL loans for some folks—specifically, public service workers or those who’ve been repaying for 20 years as of late 2022. If that’s you, it’s a massive relief. They’re not handing out forgiveness like candy, though, so check your status.

Servicer Changes: Why’s My Loan Moving Around?

The student loan world’s been shakin’ things up lately. Navient’s exit from federal direct servicing in 2021 meant a lotta loans moved to Aidvantage. Now, their remaining portfolio’s heading to MOHELA in 2024. Nelnet, meanwhile, is absorbing Great Lakes accounts, which might mean a new account number for some of y’all.

Why’s this happening? The Department of Education’s trying to boost customer service and hold servicers accountable. They’ve contracted with a new batch of players, including MOHELA, Aidvantage, and Nelnet, to streamline things. But let’s be real—changes can be a mess. You might deal with lost payment records or weird balances if things go sideways. I’ve seen buddies stress over this kinda thing, and it ain’t pretty.

My tip? Stay on top of it. Log into your accounts, save your payment history, update your contact deets, and don’t be shy about callin’ your servicer if something looks off.

Practical Tips for Dealing with Navient and Nelnet

So, now that we’ve hashed out the differences, how do you handle these servicers without losin’ your mind? I’ve got some down-to-earth advice to keep things smooth.

- Track Everything Like a Hawk: Whether it’s Navient, Nelnet, or both, keep tabs on your loan details. Use a spreadsheet or an app to log payments, balances, and due dates. I swear, this saved me from missing a payment once.

- Set Up Autopay: Both servicers offer autopay, and some even knock a tiny bit off your interest rate (like 0.25%). It’s one less thing to worry about each month.

- Know Your Forgiveness Options: Look into PSLF, IDR, or even Biden’s plan if it survives court. Don’t just hope for the best—apply for what you qualify for.

- Consolidate if Needed: Got FFEL loans with Navient and wanna chase PSLF? Consolidate ‘em into a Direct Loan. There’s a deadline for some IDR adjustments (like April 2024), so don’t sleep on it.

- Reach Out Early: If your loans switch servicers, don’t wait for a problem to hit. Call ‘em, set up your online account, and make sure payments are goin’ through.

- Double-Check StudentAid.gov: It’s your go-to for federal loan info. If something’s missing, don’t just shrug—follow up.

Why Does This Matter to You?

Look, I get it—student loans are a drag. Figuring out if Navient and Nelnet are the same might seem like small potatoes, but it’s huge for your financial peace of mind. Knowing who’s handling your loans, what they offer, and how to play their game can save you cash and stress. Maybe Nelnet’s better customer service will make your life easier, or Navient’s refinancing could cut your private loan costs. Either way, you’ve gotta be in the know.

I’ve been down this road, stressing over late notices and servicer switches. Heck, I even forgot to update my address once and missed a key update, oops. Learn from my mess-ups. Whether you’re dealing with one of these giants or both, take control. You’ve got enough on your plate without loan drama piling up.

Wrapping It Up: Stay Sharp and Stay Ahead

So, are Navient and Nelnet the same? Nah, not by a long shot. Navient’s the versatile one with federal FFEL and private loans, though they’ve got a rocky rep and are shifting servicing to MOHELA soon. Nelnet’s your federal loan pal, with a knack for customer service and a focus on Department of Education loans. They’ve got their differences, from loan management perks to how they treat ya on the phone, and those quirks can shape your repayment journey big time.

We’ve covered the basics, the forgiveness options, and the headaches of servicer changes. Now it’s on you to stay sharp. Track your loans, explore repayment plans, and don’t let a servicer switch catch ya off guard. If you’ve got questions or weird stuff goin’ on with your account, drop a comment below—I’m all ears. Let’s tackle this student loan beast together, ‘cause we ain’t gotta do it alone. Keep hustlin’, and you’ll get through this!

Navient vs. Nelnet: Breaking Down the Key Differences

Navient and Nelnet each bring their own strengths to the table, and understanding these differences can simplify your student loan journey. Navient is known for its comprehensive loan management features, whereas Nelnet excels in providing superior customer service and support. Let’s dissect these differences.

Navient offers unique loan management features, particularly for the privately-held Federal Family Education Loans it services for guaranty agencies. In addition, Navient services private student loans, which may be refinanced through Navient or a new student loan refinancing lender, offering borrowers potential flexibility.

On the other hand, Nelnet provides similar options for the FFEL loans it services, but it goes one step further for the Ed-owned federal student loans it services for the federal government. In this case, Nelnet offers expanded Income-Driven Repayment plans, giving borrowers additional ways to manage their loan repayments.

While both companies present a variety of loan options, the additional features provided by each could sway borrowers depending on their specific needs and circumstances.

Navigating Dual Loans: Can You Have Loans with Both Nelnet and Navient?

Absolutely! It’s possible to have loans serviced by both Nelnet and Navient. Each company services different types of loans, like federal or private student loans, and provides a range of repayment options and loan management features. But remember, juggling loans with both companies could complicate things when tracking loan details. It may also affect your eligibility for specific student loan forgiveness and repayment options.

For example, any FFELP Loans you have with Navient aren’t eligible for the Public Service Loan Forgiveness Program. To qualify for PSLF, you must consolidate your Navient federal student loans into a Direct Loan and then apply for cancellation due to your public service work.

You can submit a loan consolidation application for free on the Federal Student Aid website.

Is Navient the same as Great Lakes?

FAQ

Will Nelnet be included in student loan forgiveness?

Nelnet borrowers can qualify for Nelnet student loan forgiveness through federal programs from the U.S. Department of Education. Here are the forgiveness or cancellation options that are available for federal borrowers.

Are Navient and Nelnet the same?

Nelnet: Breaking Down the Key Differences. Navient and Nelnet each bring their own strengths to the table, and understanding these differences can simplify your student loan journey. Navient is known for its comprehensive loan management features, whereas Nelnet excels in providing superior customer service and support …

Are Navient student loans eligible for forgiveness?

Income-driven repayment (IDR) forgiveness

Plus, you may be eligible to receive Navient student loan forgiveness once you reach the end of your repayment schedule. Depending on the plan that you choose, you’ll be eligible for forgiveness in 20 to 25 years.

Why were my student loans transferred to Nelnet?

Why do loans get switched or transferred to a different servicer? Sometimes, we need to transfer loans from one servicer to another—for example, when a servicer’s contract with us ends. Even if we transfer your loans to a new servicer, we (the U.S. Department of Education) still own your loans.