You’re ready to pay down your credit card debt, but you carry a balance on multiple cards. What should you do: Pay off one card? Which one? Pay them all down equally? Stagger the payment amounts? The following tips could help you understand how to pay off credit card debt and decide which credit card to pay off first.

Having multiple credit cards with balances can be overwhelming. When you finally have some extra money to put toward debt, you may wonder if it’s better to pay off one card entirely or spread payments between multiple cards. There’s no one-size-fits-all answer, but this guide examines the pros and cons of different approaches to help you make the best choice for your financial situation.

How To Decide Which Credit Card Debt Strategy Is Right For You

Here are some key factors to consider when deciding whether to pay off one card or split payments:

Your Credit Score Goals

If your priority is to raise your credit score quickly, focus on lowering the utilization rate (percent of credit limit used) on each individual card, especially any maxed out cards. Paying off one maxed card entirely may help your score more than making partial payments on multiple cards in this case.

Interest Rates

Paying the card with the highest interest rate first, known as the debt avalanche method, will save you the most on interest charges over time. After the high-rate card is paid off, roll its payment amount to the card with the next highest rate.

Account Balances

The debt snowball method involves paying the smallest balance first, then rolling that payment to the next smallest balance once the first card is paid off. This gives a psychological boost from quick “wins” eliminating small debts first.

Available Funds

Factor how much you can realistically afford to pay towards debt each month Can you pay off an entire card balance at once or will it take several months? Making minimum payments on all cards is essential

Timing

If you need your credit score to be as high as possible very soon for a major financing need (auto loan mortgage etc.), then pay down balances on multiple cards to lower overall utilization quickly rather than pay one card off gradually.

Pros Of Paying Off One Credit Card Entirely

Focusing all your extra debt payments on one card at a time offers these benefits:

-

Saves money by eliminating interest payments on that account and avoids risk of going over your credit limit if a maxed out card accrues interest charges.

-

Frees up minimum payment that was going to that account to put towards the next card.

-

Can improve credit utilization more than splitting payment between cards if one card is maxed out.

-

Simplifies tracking progress when focused on one card at a time,

-

Provides motivation to keep tackling debts one by one until all are paid off.

Cons Of Paying Off A Single Credit Card

There are also some potential drawbacks to focusing on a single credit card:

-

It can take longer to pay off all debts versus distributing payments.

-

You may miss out on interest savings from paying down highest APR cards first.

-

Credit score improvement may be slower if you don’t pay down multiple card balances simultaneously.

-

Risk of re-running up balance on paid off card before others are paid off.

-

If paid off card has an annual fee, you may choose to close it, which can decrease your total available credit and length of credit history.

Pros Of Paying Down Multiple Credit Cards

Splitting your extra debt payments between multiple cards has advantages like:

-

Lowers credit utilization quickly across all cards to give a fast credit score boost.

-

Allows you to target high APR cards first to save the most in interest charges.

-

Reduces risk of maxing out cards by spreading payments around.

-

Can pay off debts faster overall than focusing on one card at a time.

-

Keeps all cards active to maintain available credit amount and lengthen credit history.

Cons Of Making Split Credit Card Payments

However, there are some potential disadvantages to dividing payments between multiple cards:

-

It takes longer to fully pay off any given card.

-

More cards report balances, which can negatively impact credit scores compared to fewer open accounts reporting debt.

-

Harder to track payoff progress when splitting focus.

-

Interest savings opportunities lost by not eliminating all interest on one card.

-

Temptation to overspend on all cards until a zero balance is achieved.

-

Need significant organizational skills to distribute payments efficiently each month.

Tips For Determining The Best Approach

Deciding how to pay down credit card debt depends largely on your financial situation. Here are some tips:

-

List all cards with balances and their interest rates, organized from highest to lowest APR.

-

Calculate total amount you can pay towards debt each month.

-

If your credit limit is maxed on any cards, paying them down should take priority.

-

Weigh if saving interest or raising your credit score more quickly is your top priority.

-

Understand consequences of closing accounts in terms of available credit and length of credit history.

-

If you will apply for major financing soon, minimizing balances across multiple cards may help approval odds more than eliminating one card slowly.

-

If motivation is an issue, pay off a small balance card first for a quick “win.”

-

Automate payments to avoid late fees if paying multiple cards manually.

-

Consider consolidating high-interest debts to a lower rate balance transfer card.

-

If finances allow, pay more than the minimum on all cards to pay off debt faster.

The right approach depends on your goals, current finances, willpower and other personal factors. Pay close attention to interest rates, credit utilization, your budget and future borrowing needs as key considerations when deciding to pay off one card or split payments between multiple cards. With some strategic thinking, you can make the best choice to knock out credit card debt efficiently.

How to pay off multiple credit cards

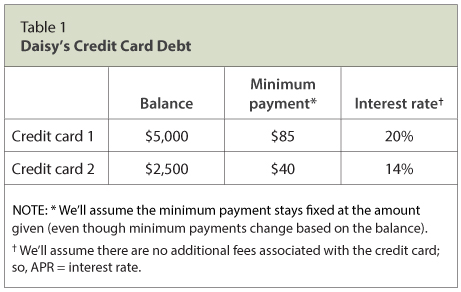

The best way to pay off multiple credit cards will depend on several factors, including your current debt levels and the annual percentage rate (APR) on each credit card. Here are some methods for paying down credit card debt.

Pay off the credit card with the smallest balance first

Another method to pay off multiple credit cards focuses first on the credit card with the smallest balance. This is the “debt snowball method.”

Think of it this way: A snowball starts small at the top of a hill, but as it rolls it gathers more snow and grows bigger and bigger. Apply this analogy to your credit card debt. When you pay off the smallest balance first, you can then take that monthly payment and add it to your next smallest credit card balance. As you pay off each balance, the amount you can pay on the next credit card grows larger and larger.

Why Paying High Interest Debts First Doesn’t Work

FAQ

What is the 2/3/4 rule for credit cards?

Is it better to pay off a credit card or pay it down?

It’s a good idea to pay off your credit card balance in full whenever you’re able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Why did my credit score drop 40 points after paying off debt?

Is it better to make multiple payments on credit card or one big payment?

Paying your balance more than once per month makes it more likely that you’ll have a lower credit utilization rate when the bureaus receive your information. And paying multiple times can also help you keep track of your spending and cut back on any overspending before you fall into debt.