Keeping your debt at a manageable level is one of the foundations of good financial health. But how can you tell when your debt is starting to get out of control? Fortunately, there’s a way to estimate if you have too much debt without waiting until you realize you can’t afford your monthly payments or your credit score starts slipping.

Your debt-to-income ratio (DTI) and credit score are two crucial numbers lenders examine when you apply for a loan or credit card But which one matters more DTI or credit score? The answer depends on the type of credit you’re seeking

What is Debt-to-Income Ratio?

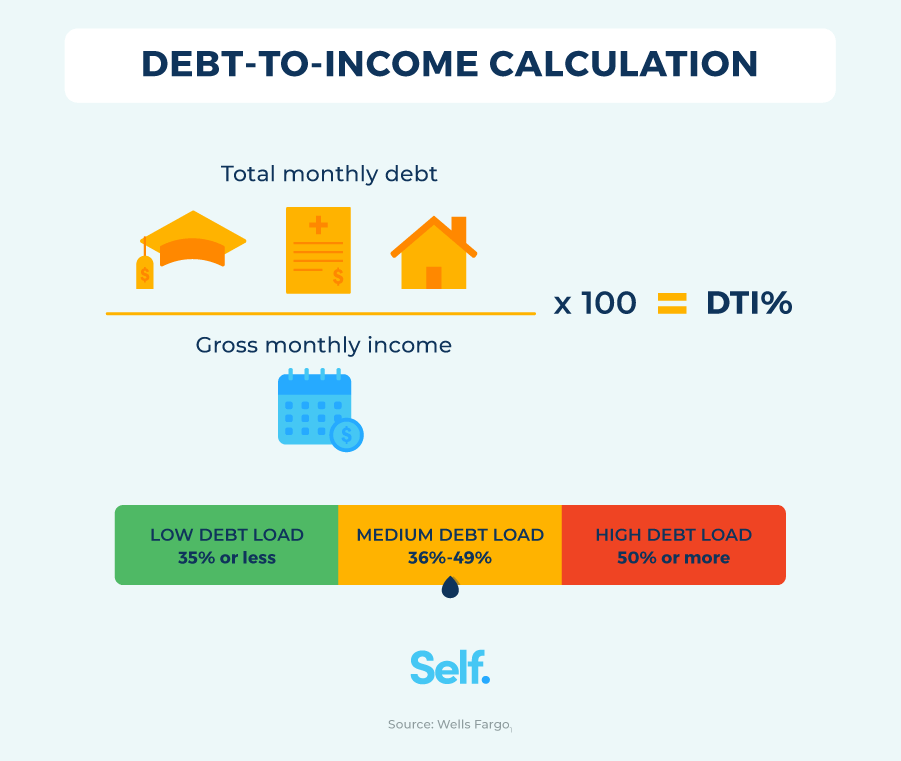

Your debt-to-income ratio compares your monthly debt payments to your monthly gross income. It’s calculated by dividing your total monthly debt payments by your total monthly gross (pre-tax) income.

For example, if you have $2,500 in total monthly debt payments and a gross monthly income of $6,000, your DTI is 42% ($2,500/$6,000 = 042).

General DTI guidelines:

- Under 36% – Excellent

- 36% to 49% – OK

- 50%+ – Potential problems getting approved

DTI gives lenders an idea of your ability to manage additional debt payments. The lower your DTI, the better.

What is Credit Score?

Your credit score is a three-digit number ranging from 300 to 850 that summarizes your creditworthiness. It’s calculated based on factors like:

- Payment history

- Credit utilization

- Credit age

- Credit mix

- New credit inquiries

Higher credit scores represent lower credit risk. Anything above 720 is generally considered excellent.

Your credit score reflects how well you’ve managed debt in the past. It doesn’t consider your income or ability to pay.

When DTI Matters More Than Credit Score

Mortgages

For mortgages, your DTI often carries more weight than your credit score when getting approved. That’s because mortgage lenders want to confirm you can actually afford the monthly payments.

Many lenders limit DTI to 45% or even 43% for mortgage approvals. Even a great credit score can’t offset a high DTI for mortgages.

Debt Consolidation Loans

Lenders also scrutinize DTI closely for debt consolidation loans. They want to ensure your income can support the new consolidated monthly payment. Expect your DTI to be a bigger factor than your credit scores here too.

Other Large Loans

Anytime you apply for a sizable loan that significantly impacts your monthly cash flow, DTI takes precedence over credit scores. That includes large personal loans, auto loans, student loans and more.

When Credit Score Matters More

Credit Cards

For credit card approvals, issuers focus more on your credit scores and reports than DTI. They want to see you’ve reliably repaid debt in the past. Your income is less important.

That said, a very high DTI could still jeopardize a credit card approval despite excellent credit scores. But in most cases, your scores carry more weight.

Personal Loans

With smaller personal loans that don’t drastically impact your monthly payments, credit scores tend to be more important than DTI. Lenders still consider your DTI, but good scores hold more sway.

Auto Loans

For auto loans, lenders look at both DTI and credit scores. But your scores play a bigger role in determining your interest rates and loan approval odds. If your income can support the payment, scores are key.

Tips for Managing DTI and Credit Scores

-

To lower DTI, pay down debts aggressively and avoid new loans before major borrowing needs.

-

To raise credit scores, pay all bills on time, lower credit utilization, and let negative marks age off your reports.

-

Check both numbers at least annually and focus improvement efforts based on your near-term borrowing needs.

-

For overall financial health, aim to lower DTI while boosting scores by paying down debts.

The Bottom Line

When applying for a mortgage or large loan, lenders focus heavily on your DTI to confirm affordability. For credit cards and smaller loans, your credit scores take precedence to evaluate repayment risk.

For the best rates and approvals, strive to maintain a low DTI under 36% along with credit scores of 720 or higher. Check and monitor both numbers regularly to ensure you’re maximizing your borrowing potential.

What is a good debt-to-income ratio?

The lower your ratio, the better. The preferred maximum DTI varies by product and from lender to lender. For example, the cutoff to get approved for a mortgage is often around 36 percent, though some lenders will go up to 43 percent. Generally, a ratio of 50 percent or higher is considered an indicator of financial difficulties.

Can my debt-to-income ratio affect my credit score?

No, not directly. The ratio itself is not used to calculate your credit score. But factors that contribute to your ratio can also affect your credit. High credit card balances, for example, could hurt both your debt-to-income ratio and your credit score. Likewise, low balances could help both.

The Debt To Income Ratio & Why It’s More Important Than Your Fico Score!

FAQ

What is more important, credit score or debt-to-income ratio?

Debt-to-credit and debt-to-income ratios can help lenders assess your creditworthiness. Your debt-to-credit ratio may impact your credit scores, while debt-to-income ratios do not. Lenders and creditors prefer to see a lower debt-to-credit ratio when you’re applying for credit.

Does income matter more than credit score?

Your income doesn’t directly impact your credit score, though how much money you make affects your ability to pay off your loans and debts, which in turn affects your credit score. “Creditworthiness” is often shown through a credit score.

Why did my credit score drop 40 points after paying off debt?

Is a 7% debt-to-income ratio good?

Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

Does your debt-to-income ratio affect your credit score?

Understanding the balance between your debt-to-income (DTI) ratio and your credit score can make or break major financial decisions, like buying a home or getting a loan. Hi, I’m Steve Rhode, the Get Out of Debt Guy.

Can a high debt-to-income ratio prevent you from taking out new credit?

A high debt-to-income ratio can prevent you from taking out new credit. Your credit utilization ratio, which is how much debt you have divided by the amount of credit you have access to, plays a huge role in determining your credit scores. With the FICO Score model, credit utilization makes up 30% of your credit score.

What does a high debt to income ratio mean?

A high debt to income ratio, typically above 36%, can indicate to lenders that you may be over-extended and at risk of defaulting on your debt payments. This can lead to higher interest rates or even loan rejection. Credit: youtube.com, Does Your Debt To Income Ratio Affect Your Credit Score? | Does Your Income Show Up On Your Credit?

How does a low DTI ratio affect your credit score?

Your DTI ratio can affect your credit score, as lenders want to ensure you can afford new debt. A lower DTI ratio indicates a good balance between debt and income, making you a more attractive borrower. To calculate your DTI ratio, consider all your monthly recurring debt and expenses, including housing, credit cards, and other loans.

What is a debt to income ratio?

Your debt to income ratio is a key factor in determining your creditworthiness, and it’s calculated by dividing your total monthly debt payments by your gross income. This ratio can have a significant impact on your ability to get approved for loans and credit cards.

Can a good credit score save you money?

A good credit score can save you thousands of dollars in interest payments over the life of a loan. According to the article, a debt-to-income ratio of 36% or less is considered healthy, while a ratio above 43% can start to negatively impact your credit score.