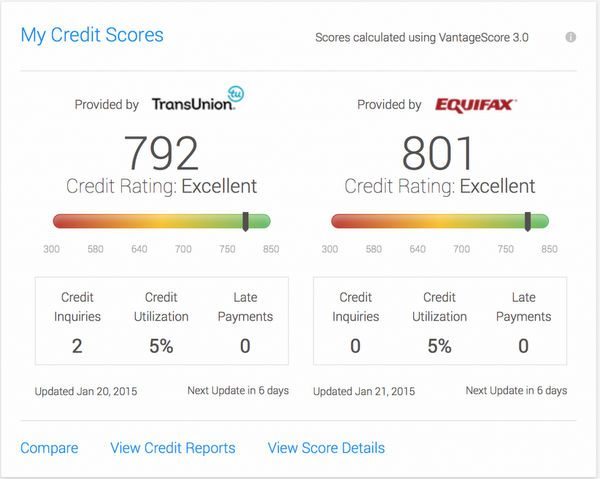

Credit Karma is a popular free credit score service that allows you to access your credit scores from TransUnion and Equifax whenever you want. However, Credit Karma provides VantageScore credit scores, not FICO scores. This often leads to some confusion when comparing Credit Karma scores to scores from other sources. In many cases, Credit Karma scores can be lower than your actual FICO credit scores. Let’s take a deeper look at why this happens and how much you should rely on Credit Karma for monitoring your credit.

Why Credit Karma Uses VantageScore Instead of FICO

The main reason why Credit Karma scores are different from FICO scores is that they use VantageScore credit scoring models rather than FICO.

FICO scores are produced by the Fair Isaac Corporation and are the most commonly used credit scores by lenders when making lending decisions. FICO has several different credit score models, with the FICO 8 and FICO 9 being the most widely used

VantageScore is a credit scoring model that was created jointly by the three major credit bureaus – Equifax, Experian, and TransUnion. The latest version is VantageScore 40

Credit Karma utilizes VantageScore because the credit bureaus own VantageScore and can easily provide unlimited free credit scores to Credit Karma users. On the other hand, FICO scores cost money for each score pulled, so it would be much more expensive for Credit Karma to provide FICO scores.

Since the credit bureaus own VantageScore, they are happy to provide unlimited free VantageScores to consumers through Credit Karma in order to get more visibility for their credit scoring model. But keep in mind that lenders most often use FICO when making lending decisions.

How VantageScore and FICO Credit Scoring Models Differ

The VantageScore and FICO credit scoring models vary in the way they calculate credit scores. Here are some of the key differences:

-

Scoring scale – Both score ranges are 300-850, but a VantageScore of 700 does not equal a FICO of 700. The same score from each model will likely represent a different degree of creditworthiness.

-

Credit reporting history – FICO scores require at least one account to have been open for six months or more. VantageScore only requires one month of credit history.

-

Balances – VantageScore looks at the credit utilization ratio across all accounts. FICO looks at utilization on individual revolving accounts.

-

Credit mixes – FICO places more emphasis on having a mix of both revolving (credit cards) and installment (loans) accounts.

-

Paid collections – VantageScore continues to penalize paid collection accounts for up to 24 months. FICO only looks at them for the first 12 months after being paid.

-

Closed accounts – VantageScore considers all accounts for as long as they remain on your credit reports, even if closed. FICO only looks at closed accounts for up to 10 years after being closed.

These scoring differences mean that the same credit report can produce a very different VantageScore than FICO score. This is why Credit Karma scores are often lower than FICO scores pulled from other sources.

Real User Examples of Lower Credit Karma Scores

To illustrate this point, here are some real world examples shared by users comparing their VantageScore from Credit Karma to their actual FICO scores:

-

Tikistrong signed up for a LendingClub loan and was surprised when LendingClub showed his TransUnion FICO score at 711 while his VantageScore on Credit Karma was only 609.

-

Rmduhon has seen her Credit Karma VantageScores lower and higher than her real FICO scores. Currently her TransUnion VantageScore is lower than her TU FICO, while her Equifax VantageScore is higher than her Equifax FICO.

-

Horseshoez noticed a difference of 50-75 points between his Credit Karma VantageScore and real FICO scores. After a bankruptcy fell off his report, his FICO score increased by 135 points while his VantageScore only increased slightly. His FICO score became higher than his VantageScore.

-

BuckyB shared that his average VantageScore is about 80 points lower than his average FICO score.

-

ExpatCanuck finds that his VantageScores are very sensitive to reported balances. Even with high FICO scores above 800, his VantageScores drop below 800 if he is carrying any balances.

As you can see from these real world examples, it is quite common for Credit Karma VantageScores to come in lower than FICO scores. The differences can sometimes be very significant.

Should You Rely on Credit Karma to Monitor Your Scores?

Credit Karma can still provide value in monitoring changes in your VantageScore over time. The trends in your VantageScore are likely to be generally similar to what is happening with your real FICO scores.

If your Credit Karma VantageScores are increasing over time, it is a good sign that your FICO scores are also improving. If your VantageScores are decreasing, it could indicate your FICO scores are dropping too.

However, you cannot depend on your Credit Karma VantageScore alone to make important credit decisions. Due to the differences in VantageScore and FICO models described above, your actual FICO scores could be significantly higher or lower than what Credit Karma shows.

Before applying for a mortgage, auto loan, credit card or other line of credit, you should check your real FICO scores from MyFICO.com or the free FICO scores provided by your bank or credit card company. This will give you an accurate picture of how lenders will evaluate your creditworthiness.

Some examples of when checking your true FICO score is critical:

-

Applying for a mortgage – The minimum credit scores for approval vary by lender but tend to be in the range of 620-700. Knowing your true FICO scores is key.

-

Refinancing student loans – Student loan refinancing lenders often look for minimum credit scores around 650 or higher. Check your FICO first.

-

Getting approved for the best credit cards – Rewards cards often require very good FICO scores above 700. Check your real scores first.

-

Qualifying for a good auto loan rate – The interest rate you get is directly tied to your actual FICO score, so check it before applying.

-

Monitoring credit after being turned down – If you’ve been turned down due to your credit, check your true FICO scores to understand why.

So while Credit Karma can provide general guidance on the direction of your credit, rely on your real FICO scores when it comes to making major borrowing decisions.

Tips to Improve Your Credit Karma and FICO Scores

If your Credit Karma VantageScores are lower than you would like, here are some tips to try to increase both your VantageScore and FICO scores:

-

Lower credit utilization – Pay down balances to get utilization below 30%, and optimally below 10% on each card. This can significantly boost FICO and VantageScores.

-

Pay down debt – Paying down installment loan balances can also help increase your scores.

-

Avoid new hard inquiries – Limit new credit applications to avoid too many hard inquiries dragging scores down.

-

Mix up credit types – Open a new installment loan or credit card if you only have one type now. Mixing credit improves FICO scores.

-

Wait for score impacts to fade – Negative score impacts from hard inquiries, late payments, and other dings gradually improve over 6-24 months.

-

Dispute reporting errors – Incorrect negative information dragging your score down can potentially be removed by disputing errors on your credit reports.

With time and focused effort, you can improve both your VantageScore shown by Credit Karma and your real FICO scores. Getting both scores into a strong range will maximize your ability to qualify for credit and get the best possible rates.

The Bottom Line

You can use Credit Karma to monitor general trends in your credit scores, but for making important credit applications, always check your actual FICO scores from MyFICO or other sources. Knowing your true FICO score will allow you to qualify for the best loans and credit cards at the lowest interest rates.

Focus on improving credit utilization, reducing debt, avoiding inquiries, diversifying credit, and correcting reporting errors. This will help increase your VantageScore and FICO score over time so you can access the affordable credit you need. With some patience and diligent effort, you can maximize your approval odds and get the ideal rates.

Here’s why there may be credit score differences between what you see on Credit Karma and elsewhere.Updated Thu, Oct 31 2024

On Tuesday afternoon, consumers took to Twitter to express their frustration over their credit scores on Credit Karma, the personal finance company owned by Intuit.

The issue for most wasnt that the credit scores they were finding on the Credit Karma website were low—rather they were too high.

Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit, only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma.

The specific tweet that started off the conversation can be found here. Twitter users were quick to follow up and joke about how inflated their credit scores looked on Credit Karma.

But they were on to something important when it comes to checking your credit score.

Below, CNBC Select breaks down why you can expect your credit scores to differ, depending on where you check them.

Is Credit Karma score usually lower than FICO?

FAQ

How far off is Credit Karma from your actual score?

Why is my Credit Karma score lower than my actual score?

score differences are common and the result of small variations of when info is reported and the weight of that info. Large gaps are usually caused by scoring model differences or what and when info is displayed. You might expect all credit scores to be the same or slightly around the same, but they usually aren’t.

Does Credit Karma lower your credit score?

Which credit score is most accurate?