When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

Answer: Some might think that having $4 million is enough for a luxury retirement, but with so much economic uncertainty, it makes sense to ask this question.

One of the trickiest elements of retirement planning is figuring out a savings target. It’s virtually impossible to come up with a precise estimate of what retirement will cost because there are too many unknowns, from inflation to longevity to what health care will cost.

The Elite 3%: Where $4 Million Stands in America’s Wealth Ladder

Let’s be real—when someone mentions having $4 million in net worth, most of us immediately think, “Wow, that person is RICH!” But is $4 million actually a lot of money in today’s economy? As someone who’s been researching personal finance for years, I wanted to dig into this question and share what I’ve learned

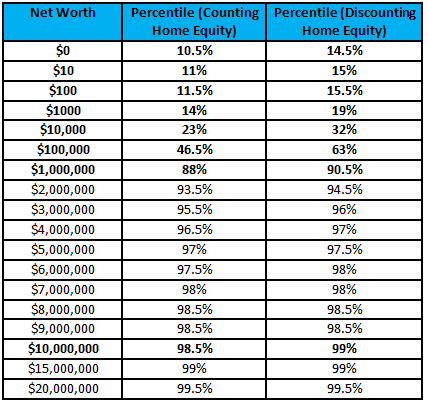

The short answer? Yes, $4 million is definitely a lot of money According to data from the Federal Reserve, having a net worth of $4 million places you in the top 3% of American households. That’s pretty darn exclusive!

To put it in more concrete terms, Leigh Baldwin & Co. Advisory Services reports that only about 4,473,836 US households have amassed $4 million or more in wealth. This represents approximately 3.44% of all households in the country.

So if you’ve got $4 million to your name, congratulations—you’re wealthier than about 97% of Americans. But numbers only tell part of the story, and what matters more is what that money means for your financial security and lifestyle.

How $4 Million Compares to Average American Wealth

Most Americans aren’t anywhere close to having $4 million in net worth. Let’s look at some sobering statistics:

- According to the Federal Reserve Survey of Consumer Finances, the average American’s retirement savings is $334,000

- The median retirement savings (which is more representative of the typical American) is just $86,900

- Having $1 million in tax-advantaged retirement accounts would put you in the top 3.2% of retirement savers

That means the average American has less than 10% of that $4 million figure saved for retirement. Pretty eye-opening, right?

When I talk to friends about retirement planning, most of them feel overwhelmed by these big numbers. They’re struggling just to pay their bills and maybe put a few hundred dollars away each month. The idea of accumulating millions seems impossible.

The $4 Million Retirement Goal: Realistic or Ridiculous?

Interestingly, despite most people being nowhere near $4 million in savings, a recent survey from New York Life found that today’s workers believe they would need an average of $4.3 million to retire comfortably. That’s a huge disconnect between expectations and reality!

As Michelle Richter-Gordon, co-founder of Annuity Research and Consulting in New York City, explained, “People don’t know how much they need at all. They also don’t know when they will retire.”

Many folks are relying on online retirement calculators that often overestimate how much money they’ll need. These calculators can make people feel overwhelmed or discouraged about their retirement prospects. And it’s worth noting that some of these calculators come from investment firms that benefit financially when people contribute more to their investments.

Breaking Down What $4 Million Gets You in Retirement

So what could you actually do with $4 million in retirement? Let’s crunch some numbers:

Using the popular 4% withdrawal rule (which suggests you can safely withdraw 4% of your nest egg annually with minimal risk of running out of money), $4 million would give you:

- Annual income: $160,000 (before taxes)

- Monthly income: Approximately $13,333 (before taxes)

That’s a very comfortable retirement income that would put you well above the median household income in the United States, which was around $74,580 in recent years.

With this kind of income, you could:

- Live in a high-cost-of-living area

- Travel extensively

- Pay for quality healthcare

- Help support family members

- Leave a substantial inheritance

But here’s the thing—most people don’t actually need $4 million to retire comfortably. Many experts suggest that aiming for around $1 million to $2 million in retirement savings may be more realistic for most Americans, especially when factoring in Social Security benefits and other sources of income.

Do You Actually Need $4 Million to Retire?

The amount you need for retirement depends on several key factors:

- Your desired lifestyle: Do you want to travel the world, or are you happy with a simpler lifestyle?

- Where you plan to live: Housing costs vary dramatically between regions

- Healthcare needs: This is one of the biggest variables in retirement planning

- Longevity: How long do you expect to live in retirement?

- Other income sources: Will you have Social Security, pensions, or part-time work?

For many Americans, a retirement nest egg of $1-2 million combined with Social Security can provide a comfortable retirement with an annual income between $70,000-$120,000.

I’ve spoken with retirees who are living quite comfortably on much less than $4 million. My neighbor Bob retired with about $1.2 million and receives around $2,800 monthly from Social Security. He lives in a modest home in a medium cost-of-living area and travels to visit his grandkids several times a year. He’s not living extravagantly, but he’s secure and happy.

The Psychology of Big Numbers: Why We Think We Need More

There’s something about retirement planning that makes us think we need enormous sums of money. I believe several factors contribute to this:

- Fear of the unknown: Retirement is a major life transition filled with uncertainties

- Healthcare anxiety: Americans are particularly worried about healthcare costs

- Inflation concerns: Will today’s dollars be worth much less in the future?

- Longevity risk: People are living longer than ever before

- Media messaging: We’re constantly bombarded with articles about “retirement crises”

These concerns are valid, but they can lead us to set unrealistic targets that make us feel hopeless about our financial futures. If you believe you need $4 million to retire but you’ve only saved $100,000 by age 50, you might just give up entirely.

Strategies to Build Toward $4 Million (Even If You Don’t Get There)

If building toward $4 million in net worth is your goal, here are some practical strategies that have worked for the people who actually achieve this milestone:

1. Start Early and Be Consistent

The power of compound interest is incredible. Starting in your 20s rather than your 30s can literally double your retirement savings.

2. Maximize Tax-Advantaged Accounts

Make full use of 401(k)s, IRAs, and HSAs to reduce your tax burden and grow your wealth faster.

3. Develop Multiple Income Streams

Many people with high net worth have several income sources beyond their primary job.

4. Invest in Real Estate

Real estate has been a reliable path to wealth for many Americans. Whether through rental properties or just the appreciation of your primary residence, real estate can significantly boost net worth.

5. Live Below Your Means

The most common trait among wealthy individuals is that they spend less than they earn—often significantly less.

6. Invest in the Stock Market for the Long Term

Despite short-term volatility, the stock market has historically been one of the best ways to build wealth over decades.

7. Continuously Educate Yourself

Financial literacy correlates strongly with wealth accumulation.

Real Talk: What If You Don’t Reach $4 Million?

Let me be honest—most of us will never reach a $4 million net worth. And that’s completely OK!

The good news is that you can have a fulfilling, comfortable retirement without hitting this arbitrary number. Here’s what I’ve learned from talking to happy retirees:

-

Happiness in retirement isn’t directly proportional to wealth. Beyond covering your basic needs and some comforts, additional money doesn’t necessarily translate to additional happiness.

-

Relationships and health matter more than money. Retirees consistently report that family, friends, and good health contribute more to their happiness than wealth.

-

Purpose is priceless. Having meaningful activities, hobbies, and ways to contribute to society is invaluable in retirement.

-

Adaptability is key. Being willing to adjust your lifestyle and expectations as needed leads to greater satisfaction.

The Bottom Line: Yes, $4 Million Is a Lot, But It’s Not Everything

So, to directly answer the question: Yes, a net worth of $4 million is objectively a lot of money. It puts you in the top 3% of American households and provides substantial financial security.

However, it’s not the only path to a successful retirement. Setting more achievable goals based on your personal circumstances and needs is likely to be more productive than fixating on a specific large number.

What matters most is developing good financial habits, saving consistently, investing wisely, and planning for the retirement lifestyle that will make YOU happy—not what some calculator or article says you should want.

We all have different dreams, needs, and circumstances. Whether your retirement number is $1 million, $4 million, or somewhere in between, the most important thing is to have a plan and take consistent action toward your goals.

I’d love to hear your thoughts! Do you think $4 million is a realistic retirement goal for you? What strategies are you using to build your net worth? Drop a comment below and let’s discuss!

From just $107.88 $299 for Kiplinger Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

When it comes to setting a savings target, the best thing many of us can do is estimate a number and run with it.

There’s some data on how much money it might take to afford a comfortable retirement. Northwestern Mutual recently reported that $1.46 million was the magic number. Theres also guidance that you can adjust for your personal situation. Fidelity, for example, recommends having 10 times your ending salary saved by age 67.

If you’re 60 and have $4 million saved for retirement, you might be wondering where you stand and what retirement might look like if you were to wrap up your career immediately.

The truth is that a $4 million nest egg gives you a lot of leeway. However, it’s important to envision the retirement you want in detail.

Is a $4M Net Worth Enough for Retirement?

FAQ

Is $4 million net worth wealthy?

The Numbers That Matter. According to DQYDJ’s analysis of the Federal Reserve’s data: About 6.26 million U.S. households have a net worth of $4 million or more. That works out to roughly 4.8% of all households.

Can I retire with 4 million net worth?

million net worth can be enough to retire comfortably, potentially allowing for an annual income of around

to

using the 4% or 5% rule, respectively.

However, the actual feasibility depends on individual factors like spending habits, healthcare costs, desired lifestyle, and the age of retirement.What percentage of Americans have net worth of $5 million?

In fact, reliable data suggests that households with $5 million or more in net worth represent a small fraction of the population. According to DQYDJ, in 2023, approximately 4.8 million American households had a net worth above $5 million, representing roughly 3.7% of all U.S. households.

What net worth is considered upper class?