Debt-to-income (DTI) ratio compares your recurring monthly debt payments against your monthly gross income, expressed as a percentage.

Hey there, fam! If you’re wondering, “Is a 30% DTI good?” let me hit ya with the quick answer right off the bat Hell yeah, it’s darn good! A 30% Debt-to-Income (DTI) ratio means you’re in a sweet spot—your debt ain’t eating up too much of your paycheck, and lenders are likely to see you as a safe bet. But hold up, there’s a lot more to this number than just a pat on the back. At our lil’ corner of financial wisdom here, we’re gonna break it down real simple, show ya why 30% is a win, and give you the tools to keep your money game strong—or get it there if you’re not quite yet

So, grab a coffee (or a beer, I ain’t judging), and let’s dive deep into what DTI really means, why 30% is a big deal, how it stacks up, and how you can use this knowledge to boss up your finances Whether you’re eyeing a new house, a car, or just wanna sleep better at night without debt stress, I gotchu covered

What the Heck Is a Debt-to-Income Ratio (DTI)?

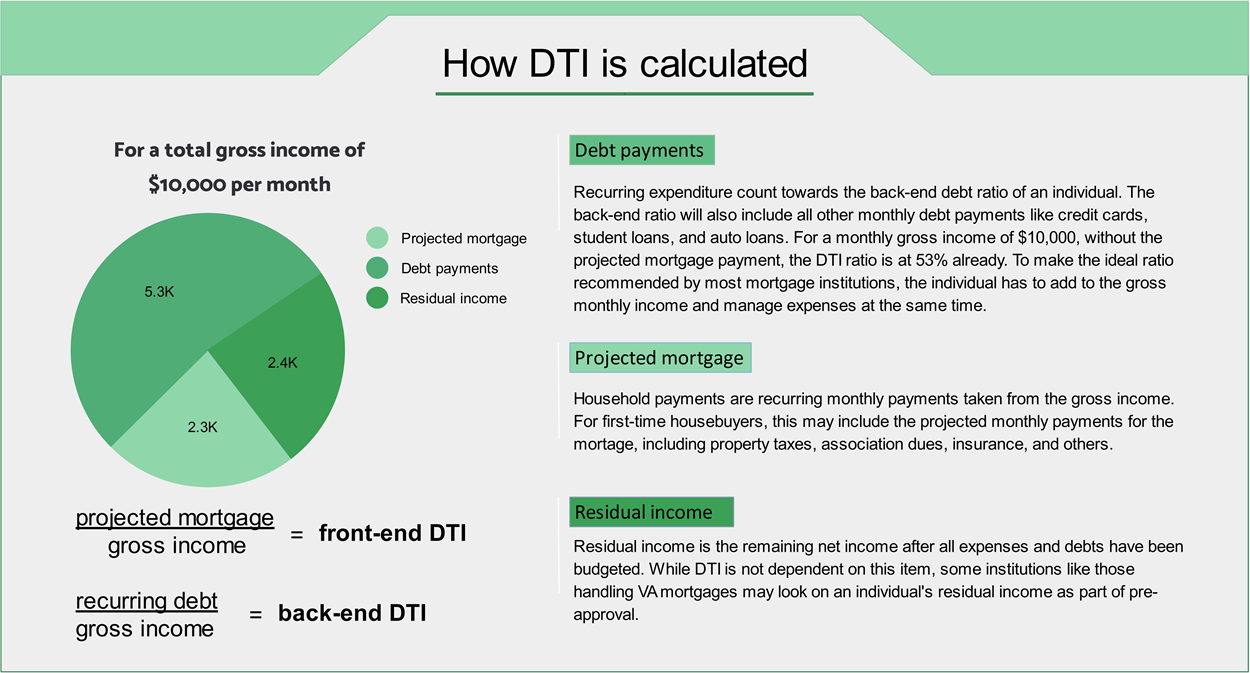

Alright, let’s start with the basics Your Debt-to-Income ratio, or DTI, is basically a snapshot of how much of your monthly cash goes to paying off debts compared to how much you’re bringing in. Think of your income as a big ol’ pie. DTI tells ya how big a slice of that pie is getting gobbled up by bills like credit cards, car loans, student loans, or your mortgage The rest? That’s what you got left for living, saving, or splurging on tacos.

Here’s how it works in plain English:

- Take all your monthly debt payments (think rent or mortgage, car payments, credit card minimums—anything you owe regular).

- Divide that by your gross monthly income (that’s your pay before taxes and all that jazz).

- Multiply by 100 to get a percentage.

So, if you’re shelling out $1,500 a month on debts and you make $5,000 before taxes, your DTI is 30%. Easy peasy, right? It’s like a report card for your financial health, and lenders use it to figure out if you can handle more debt without cracking.

Why Is 30% DTI Considered Good?

Now, let’s talk about why 30% is a number to brag about. Based on what I’ve seen over the years helping folks with their money, a DTI of 30% or lower puts you in the “excellent” zone. It means only about a third of your income is tied up in debt, leaving you plenty of wiggle room for other stuff—saving for a rainy day, handling surprise bills, or just living life without sweating every penny.

Here’s the lowdown on why 30% rocks:

- Lenders Love It: Banks and loan folks see a low DTI as a sign you’re not overextended. You’re less risky to them, which can mean better interest rates or easier approval when you wanna borrow.

- Financial Breathing Room: With 70% of your income free, you ain’t living paycheck to paycheck. You got space to save, invest, or deal with life’s curveballs.

- Flexibility for Goals: Wanna buy a house or start a side hustle? A 30% DTI means you’re in a solid spot to take on new challenges without drowning in payments.

I’d say if you’re at 30%, give yourself a high-five. It’s a manageable level, and ideally, you wanna keep it under 35% to stay in that sweet spot. Anything below that threshold just screams “I got my money under control!”

How Does 30% DTI Stack Up? Let’s Compare the Ranges

Not all DTIs are created equal, so let’s put 30% in context with other ranges. I’ve whipped up a lil’ table to show ya where you stand and what lenders typically think about these numbers. Check it out:

| DTI Range | What It Means | Lender’s View |

|---|---|---|

| 35% or Less | Excellent! Debt is super manageable. | Looking good! You’re a safe bet. |

| 36% to 49% | Okay, but room to improve. Might feel tight. | Manageable, but they might dig deeper. |

| 50% or More | Danger zone. You’re stretched thin. | Red flag. Borrowing options may be limited. |

At 30%, you’re sittin’ pretty in the “excellent” bracket. Compare that to someone at 36%, which is still decent but not as comfy, or 43%, which is often the max for getting a mortgage. And if you’re over 50%? Whew, that’s when things get dicey—lenders start worrying you can’t keep up, and honestly, you might feel the pinch yourself.

I remember a buddy of mine who was at 48% DTI a while back. He was getting by, but every unexpected bill—like a car repair—sent him into a spiral. He worked hard to get it down to around 32%, and man, the relief on his face was real. So, if you’re at 30%, you’re ahead of the game compared to a lotta folks.

Why Lenders Care About Your DTI (Especially at 30%)

Let’s get into why this number matters so much when you’re trying to borrow money. Whether it’s a mortgage for your dream crib or a personal loan to fix up your ride, lenders are all up in your DTI to figure out if you’re a risk. At 30%, you’re basically walking in with a gold star on your forehead.

Here’s what they’re thinking:

- Can You Pay Us Back? A lower DTI like 30% tells them you’ve got enough income left after bills to cover new payments. They ain’t worried you’ll default.

- How Much Can You Handle? Especially with big loans like mortgages, they wanna make sure your total debt doesn’t push past a certain point. Most prefer 36% or less total, with some capping mortgage-related debt at 28%. At 30%, you’re usually well within their happy zone.

- Are There Exceptions? Now, some lenders might stretch to 43% DTI for a mortgage if other stuff (like a killer credit score) checks out. But at 30%, you don’t even gotta sweat those extra hoops.

I’ve seen peeps with higher DTIs still snag loans, but they often pay more in interest or get hit with stricter terms. So, staying at or below 30%? That’s your ticket to better deals and less hassle.

Is 30% DTI Good for Everyone? Let’s Get Real

Now, before we get too cozy with this 30% vibe, let’s chat about whether it’s good in every situation. Truth is, it depends a bit on your life. For most of us, 30% is awesome sauce, but there are some quirks to think about.

- Income Levels Matter: If you’re making bank—like, six figures— a 30% DTI might still leave you with tons of cash to play with. But if you’re scraping by on a lower income, even 30% might feel tight after rent and groceries. I’ve been there, trust me—every dollar feels heavier when the paycheck’s slim.

- Lifestyle Choices: You a big spender? Love them fancy dinners or weekend trips? A 30% DTI might not leave as much for fun as you’d like. On the flip side, if you’re a frugal ninja, you might feel fine even at a higher ratio.

- Future Plans: Thinking of buying a house soon? Lenders for mortgages often want that DTI under 36%, with some picky ones aiming for closer to 28% just for housing costs. At 30%, you’re golden, but if you’re planning more debt, watch out.

So, while 30% is generally a thumbs-up, take a sec to look at your own money flow. Does it feel good to you, or are ya still stressing? That’s the real test.

How to Keep Your DTI at 30% (Or Get It There)

Alright, let’s talk action. If you’re already at 30%, props to ya—let’s keep it that way. If you’re higher up, don’t trip; I’ve got some straight-up tips to lower that DTI and get you in the zone. Here’s how we do it at our crew:

- Pay Down High-Cost Debt First: Focus on stuff like credit cards with crazy interest rates. Knockin’ out those big payments drops your monthly debt load fast and cuts your DTI. I always tell folks to tackle the pricey stuff before anything else.

- Boost That Income, Baby: Easier said than done, I know, but even a lil’ side gig can help. Drive for a rideshare, freelance, or ask for a raise at work. More cash coming in means your DTI percentage shrinks, even if debt stays the same.

- Track Your Spendin’: Get a budget goin’. Figure out where your money’s slipping through the cracks—maybe it’s them daily lattes or subscription apps you forgot about. Cut back a bit, and throw that extra toward debt.

- Refinance or Consolidate: If you got loans with high rates, look into refinancing for a lower payment. Or bundle debts into one loan with better terms. It can slash your monthly outflow and help that DTI look prettier.

- Avoid New Debt (For Now): Tempted by a shiny new car or credit card offer? Hold off if your DTI ain’t where you want it. Piling on more payments will only jack up that ratio.

I remember when I was tryna get my own DTI down, I started with just an extra $50 a month toward my credit card. Felt like nothing at first, but over time, it snowballed, and my ratio dropped like a rock. Small steps, big wins.

What If Your DTI Is Over 30%? Don’t Panic

If you’re sittin’ at 40% or even 50% DTI, don’t freak out just yet. Yeah, it’s not ideal, but it ain’t the end of the world neither. You’ve got options, and I’m here to walk ya through ‘em.

- Assess the Damage: First, figure out exactly where you stand. Calculate your DTI if you haven’t already. Seeing the number in black and white helps ya face it head-on.

- Prioritize Debt Reduction: Like I said earlier, hit them high-interest debts hard. Even if it’s just a bit extra each month, it adds up.

- Talk to Pros if Needed: If you’re over 50%, might be worth chattin’ with a credit counselor. They can hook you up with a debt management plan and maybe even negotiate lower rates with creditors. I’ve seen folks turn things around with a lil’ outside help.

- Be Patient: Dropping your DTI don’t happen overnight. Keep at it, and celebrate the small drops—every percent down is a step closer to freedom.

A higher DTI just means you gotta work a bit harder, but it’s doable. I’ve been in tight spots myself, and trust me, getting that number down feels like shedding a heavy backpack.

The Bigger Picture: Why DTI Ain’t Everything

Before we wrap this up, let’s zoom out a sec. While a 30% DTI is awesome, it’s not the only thing that defines your money game. Lenders and life look at other stuff too.

- Credit Score: Got a banging credit score? That can offset a slightly higher DTI sometimes. Keep paying on time and managing cards well.

- Savings and Assets: If you’ve got a fat emergency fund or other resources, a higher DTI might not sting as bad. It’s all about balance.

- Your Peace of Mind: Numbers are one thing, but how do you feel? If 30% still got you stressed, maybe aim lower. Financial health is as much about your headspace as your wallet.

I always say, use DTI as a guide, not gospel. It’s a tool to help you see where you’re at, but your gut matters just as much.

Final Thoughts: Rock That 30% DTI and Beyond

So, is a 30% DTI good? Bet your bottom dollar it is! It’s a sign you’re managing your debt like a champ, leaving room for life’s ups and downs, and setting yourself up for success when you need to borrow. We’ve walked through what DTI means, why 30% is a stellar spot, how it compares, and what you can do to maintain or reach it. Whether you’re already there or working toward it, remember that every step counts.

Keep an eye on that ratio, make smart moves with your debt, and don’t be afraid to hustle for extra income. At the end of the day, it’s all about building a life where money works for you, not against ya. Got questions or wanna share where your DTI’s at? Drop a comment—I’m all ears and ready to help ya crush it!

Income Typically NOT Included

- One-time payments or windfalls (inheritance, lottery)

- Income from household members not on the loan application

- Temporary income sources expected to end soon

- Unverifiable cash income without documentation

Debt-to-Income Ratio Guidelines

Most lenders like a DTI ratio of not more than 35% or 36%. Sometimes, mortgage lenders will still approve your loan if your DTI is up to 45% (or 50% for an FHA loan). Your DTI ratio is too high if it exceeds your lender’s max DTI ratio, making you ineligible for the loan.

For example, Freddie Mac is a government-created company that buys mortgages from banks and lenders. Its general cutoff point for the DTI ratio is 36%, but borrowers can have a DTI ratio up to 45% in certain circumstances. Borrowers with a DTI ratio higher than 45% are ineligible to be sold to Freddie Mac.

Another government-sponsored company, Fannie Mae, has a general cutoff point of 36%. Its higher cutoff point is 45% for borrowers meeting certain criteria and 50% for loans underwritten using Fannie Mae’s proprietary system.

Improving your credit score can help compensate for a higher DTI ratio that doesn’t meet your lender’s guidelines. It won’t reduce your ratio, but it may help your chances of approval.

How to Calculate Your Debt to Income Ratios (DTI) First Time Home Buyer Know this!

FAQ

Is 30 a good debt-to-income ratio?

35% or less: Looking Good – Relative to your income, your debt is at a manageable level. You most likely have money left over for saving or spending after you’ve paid your bills. Lenders generally view a lower DTI as favorable.

What does a debt ratio of 30% mean?

If your DTI ratio is 30%, for example, that means that 30% of your monthly gross income is used to pay your monthly debt.

What is a good DTI ratio to buy a house?

Your DTI is a key factor in mortgage approval, with most lenders seeing DTI ratios of 36 percent or below as ideal. With a lower DTI, you’re more likely to be approved, and you’ll get a better interest rate.

What is a realistic debt-to-income ratio?

Lenders use your DTI ratio to help assess how likely you are to repay when applying for a personal loan, mortgage, or other credit product. Lenders generally prefer a DTI ratio of no more than 36%, but the cutoff can sometimes be as high as 50%.