Credit scores are three-digit numbers, typically between 300 and 850, that represent your overall credit risk at a glance. Credit scores help lenders decide whether to grant you credit.

Credit scores are calculated based on past financial behavior. This includes your payment history on credit accounts, the credit you use compared to total credit available, and the length of your credit history. It may also include negative financial events, such as: a bankruptcy and past-due accounts that have been turned over to a collection agency.

Your credit score is one of the most important numbers in your financial life It impacts everything from whether you can get approved for a credit card or loan to how much interest you’ll pay So is a 764 credit score good? What does it mean for your finances, and what can you do to boost your score even higher?

What Credit Scores Mean

First, it helps to understand what credit scores represent. Your credit score is a three-digit number calculated based on information in your credit reports, which track your history of borrowing money and paying bills.

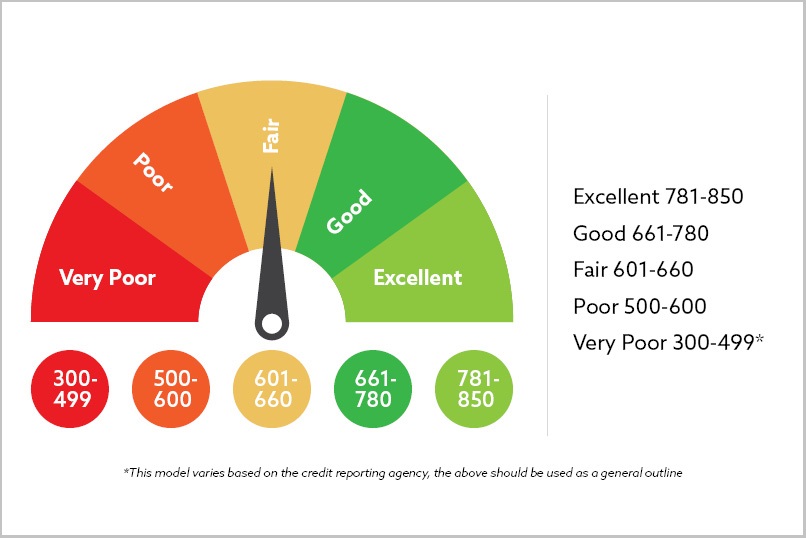

Credit scores range from 300 to 850 The most common scores used by lenders are calculated by the FICO and VantageScore formulas Here’s how the score ranges generally break down

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-850: Exceptional

So with a 764 credit score, you’re in the “very good” range But what does that really signify?

The Benefits of a 764 Credit Score

A 764 credit score is considered very good or even excellent. Here are some key benefits of having credit in this range:

-

Approval odds: With very good credit, you have high approval odds for credit cards, auto loans, mortgages, and other lending products. Many lenders view 764 as an indicator of low risk.

-

Interest rates: Excellent credit means qualifying for the lowest interest rates available from lenders, saving substantially on financing costs over time.

-

Loan terms: In addition to low rates, having very good credit also allows access to the most favorable loan terms like high credit limits and low down payments.

-

Rewards: A 764 score makes you eligible for premium credit cards with lucrative ongoing rewards and perks like airport lounge access.

So while a 764 credit score isn’t perfect, it provides significant advantages when borrowing money or applying for credit. Those with lower scores have fewer options, pay more, and may face more frequent denials.

How a 764 Credit Score Compares

Looking at credit score data shows how a 764 score stacks up:

-

Only 15.4% of adults age 18-29 (Gen Z) have credit scores of 750 or higher currently.

-

For adults age 30-44 (Millennials), 24.4% have 750+ scores.

-

In the 45-65 (Gen X) age range, 26.1% of people score 750 or above.

-

For Baby Boomers age 66-80, 44.1% have 750+ credit.

-

Finally, 58.7% of the Silent Generation (over age 80) reach top-tier credit scores of 750 or higher.

So while 764 is an objectively very good score, it’s also very good relative to other consumers. With higher scores than 76% of adults under age 45, your credit is above-average for younger borrowers.

How to Raise Your Credit Score from 764

While a 764 credit score provides access to excellent credit offers already, you may wonder how to improve it even more. Here are some tips:

-

Lower credit utilization – Keep balances low on credit cards and other revolving credit below 10% of your limits.

-

Pay bills on time – Payment history is a major factor, so never miss due dates. Set up autopay if it helps.

-

Limit new credit applications – New hard inquiries can ding your score, so only apply for credit selectively.

-

Increase credit history – Letting accounts age helps. Keep old accounts open unless there’s a compelling reason to close them.

-

Monitor your credit reports – Dispute any errors with the credit bureaus to maximize your scores.

-

Practice healthy habits – Managing credit responsibly over time lets your scores improve. Good financial habits compound.

With diligent work over time, you can likely raise your credit score well into the 800s. But even improving 10 or 20 points to the mid-770s can help your odds.

How Lenders View a 764 Credit Score

While your 764 credit score is in the top tier, lenders look at more than just your scores. Here is how they may view a 764 when making decisions:

-

Credit cards – A 764 score makes you a prime candidate for premium rewards cards. But issuers also consider your income, existing accounts, and utilization.

-

Auto loans – Excellent credit means qualifying for top rates from lenders. But they’ll look at your debt, assets, employment, and the vehicle as well.

-

Mortgages – A 764 score is a great start, but lenders will dive deep into your credit history, assets, income, and down payment funds.

So a 764 credit score puts you in a strong starting position with lenders. But it’s not a guarantee of approval. Be ready to provide supporting details on income, assets, and overall financial health.

Tips for Monitoring and Improving Your Credit Score

-

Check your credit scores frequently using a free service so you can catch any sudden changes.

-

Review your credit reports at least once a year to check for errors and identify areas to improve.

-

Set up automatic bill payments so you never miss a payment due date. Even one late can hurt.

-

Keep everyday credit card balances low, under 10% of your credit limits if possible.

-

Be selective about applying for new credit, which can cause hard inquiries on your reports.

-

Pay down balances rather than moving debt between cards to lower utilization.

-

Contact creditors directly if you have an issue making payments on time.

-

Hold onto old credit accounts unless there’s a compelling reason to close them.

-

Build savings so you can rely less on credit long-term.

The Bottom Line

A 764 credit score is firmly in the “very good” range, meaning you have access to great loan terms and should get approved easily for new credit. Excellent credit saves you money over time thanks to low interest rates.

But there’s still room for improvement. Take steps like minimizing balances, avoiding late payments, limiting new credit applications and letting credit history age, and you may be able to inch up to the mid-770s or even the 800s. While 764 is great, the higher your credit score, the more options and savings open up. Monitor your credit frequently and continue practicing good financial habits.

How do average credit scores compare state by state?

The average credit score in the United States as of March 2024 is 705, based on the VantageScore 3.0 credit score model. Here are the average credit scores by state.

| State/ Territory | Average VantageScore March 2024 | State/ Territory | Average VantageScore March 2024 |

|---|---|---|---|

| Alaska | 709 | Montana | 720 |

| Alabama | 685 | North Carolina | 699 |

| Arkansas | 688 | North Dakota | 720 |

| Arizona | 703 | Nebraska | 720 |

| California | 712 | New Hampshire | 727 |

| Colorado | 720 | New Jersey | 717 |

| Connecticut | 717 | New Mexico | 695 |

| District of Columbia | 704 | Nevada | 691 |

| Delaware | 705 | New York | 713 |

| Florida | 698 | Ohio | 706 |

| Georgia | 686 | Oklahoma | 687 |

| Hawaii | 719 | Oregon | 717 |

| Iowa | 719 | Pennsylvania | 713 |

| Idaho | 718 | Puerto Rico | 695 |

| Illinois | 712 | Rhode Island | 713 |

| Indiana | 704 | South Carolina | 692 |

| Kansas | 712 | South Dakota | 722 |

| Kentucky | 695 | Tennessee | 697 |

| Louisiana | 680 | Texas | 686 |

| Massachusetts | 723 | Utah | 719 |

| Maryland | 706 | Virginia | 712 |

| Maine | 720 | Vermont | 726 |

| Michigan | 710 | Washington | 722 |

| Minnesota | 730 | Wisconsin | 727 |

| Missouri | 705 | West Virginia | 693 |

| Mississippi | 675 | Wyoming | 713 |

Why do I have more than one credit score?

Its a myth that you only have one credit score. You actually have multiple credit scores and they may vary depending on the source.

There are three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®. These NCRAs may use similar but not identical formulas to calculate credit scores. In situations where the NCRAs use the same formula, the credit data in each of the NCRAs may be slightly different. Other credit scoring companies use their own formulas. Credit scoring models generally take the same parts of your borrowing history into account when calculating your credit score. Differences in the credit scores happen because of the different scoring models that providers use to evaluate your credit history and calculate credit scores. Where one model might focus on your payment history, another may focus on your total debts. Differences in focus may result in different credit scores. Also, each credit scoring model may use slightly different data and formulas to calculate credit scores.

Is 764 A Good Credit Score? – CreditGuide360.com

FAQ

Can I buy a house with a 764 credit score?

While credit score requirements vary based on loan type, lenders generally require a credit score of at least 620 to buy a house with a conventional mortgage.Jul 24, 2024

What is a respectable credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Is 764 a good credit score to buy a car?

According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a used-car loan around 9.06% or lower. Superprime: 781-850.

What does a credit score of 764 mean?

A credit score of 764 is considered excellent and indicates to lenders that you are highly likely to repay your debts responsibly.