According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

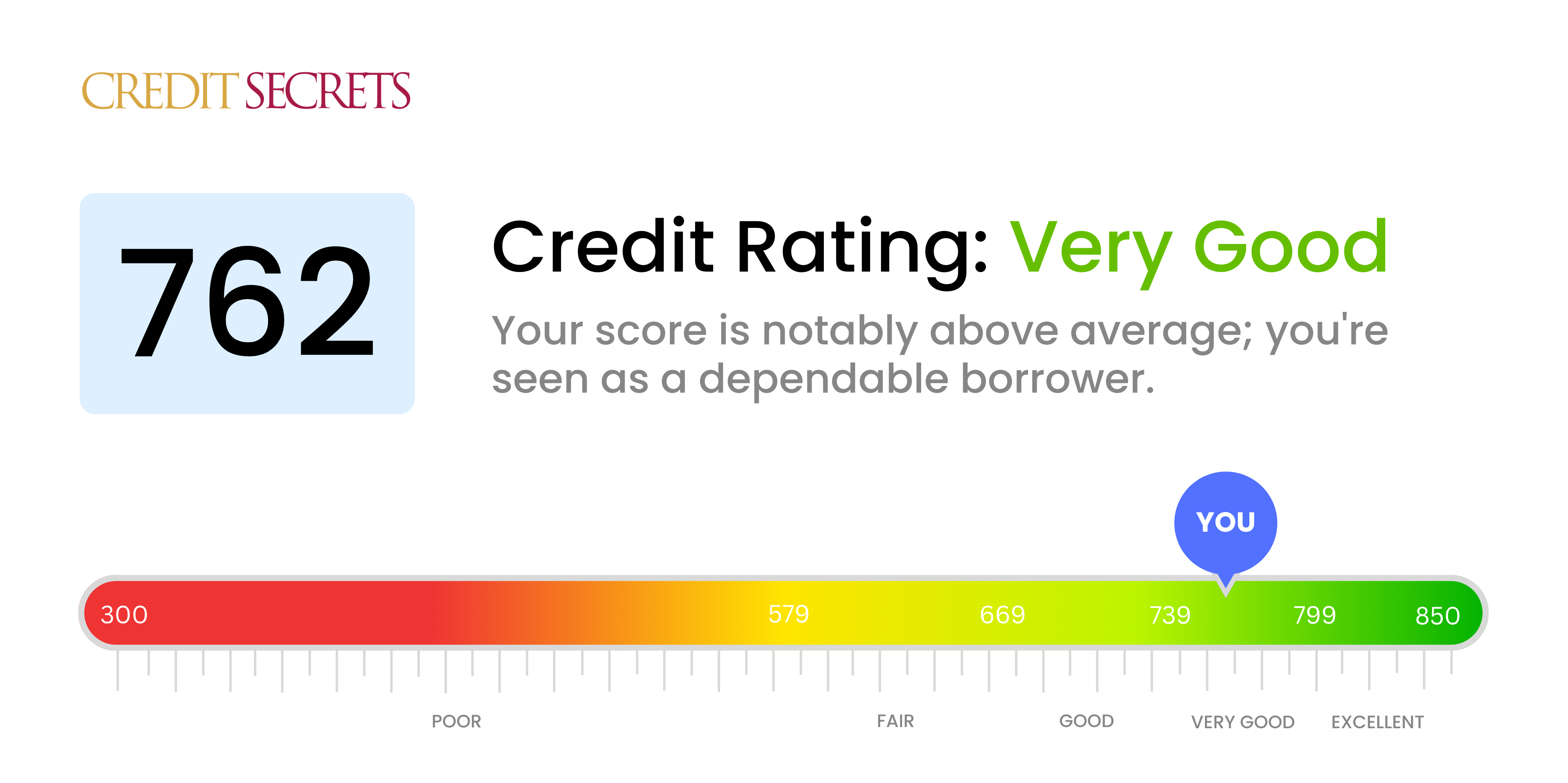

A credit score of 762 is considered a very good score by both major credit scoring models, FICO® and VantageScore. With this score, you’ll likely qualify for the best loan terms and interest rates available. However, there are still steps you can take to improve your score even more.

What Credit Score Ranges Define a Good Score

FICO® and VantageScore, the two most widely used credit scoring models, have slightly different score ranges that define good to excellent credit:

-

FICO® Ranges

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

-

VantageScore Ranges:

- 781-850: Excellent

- 661-780: Good

As you can see, a credit score of 762 falls into the “Very Good” range on the FICO® model and the “Good” range for VantageScore. But the minor difference between these models isn’t significant

A 762 Credit Score Compared to the Average

According to the most recent data, the average FICO® score in the United States is 716. So a score of 762 is well above the national average, a great sign for your credit health.

Specifically, a 762 FICO® score ranks in the 80th percentile, meaning it’s higher than 80% of consumers. Only about 25% of people have credit scores in the Very Good range.

What a 762 Credit Score Means for Loan and Credit Card Approval

A 762 credit score makes you look very attractive to potential lenders and creditors for several reasons

-

It shows a long history of responsible credit usage. Lenders like to see you can properly manage debt over time.

-

The score indicates low credit risk. There’s only a small chance you’ll default on a loan or credit card payment.

-

You may qualify for lower interest rates, saving significantly on borrowing costs. Rates are based partly on credit scores.

With a 762 score, you should have a good shot at approval for most credit card and loan products. Expect:

- Credit card approval with high credit limits and great rewards offers

- The ability to qualify for a prime rate mortgage

- Approval for a low-rate auto loan or personal loan

However, a 762 credit score doesn’t guarantee approval. Lenders also weigh factors like your income, existing debts, and down payment amount when making lending decisions.

How to Raise Your 762 Credit Score Even Higher

While a 762 credit score gives you access to great loan offers already, here are some tips to improve it even more:

-

Lower credit utilization – Keep balances low compared to limits, ideally below 30%.

-

Pay all bills on time – Payment history is a huge factor, so never miss payments.

-

Check credit reports – Dispute any errors found on your reports.

-

Limit hard inquiries – Too many credit checks from applications hurt scores.

-

Ask for credit line increases – Higher limits help lower utilization and raise scores.

-

Diversify credit mix – Open different types of accounts, not just credit cards.

Putting some of these steps into action could push your credit into the 800+ “exceptional” range. But increasing an already high score has limited benefits. Focus instead on maintaining your current score level.

How a 762 Credit Score Helps with Financial Goals

A very good 762 credit score opens doors to favorable loan terms that support major financial goals:

-

Buying a Home – Excellent mortgage rates make purchasing power stronger.

-

Buying a Car – With great auto loan rates, you can keep payments manageable.

-

Paying for College – Student loans are easier to obtain and pay back.

-

Starting a Business – You’ll have an easier time securing startup business loans and credit.

-

Booking Travel – Good scores help you qualify for premium travel rewards cards.

-

Recovering from Debt – Secured credit cards to rebuild credit are more accessible.

So a 762 credit score provides a helpful foundation for reaching your biggest money objectives.

What a 762 Credit Score Means for Interest Rates

The higher your credit score, the lower the interest rate lenders will likely offer you. According to Experian, people with “good” FICO® scores in the 762 range could expect to see average rates around:

-

Mortgages – 3.668% for a 30-year fixed-rate loan

-

Auto Loans – 4.398% for a 5-year new car loan

-

Personal Loans – 9.898% for a 3-year $10,000 personal loan

These rates are significantly lower than what subprime borrowers with poor credit (under 579) would receive. Excellent credit saves you thousands over the life of a loan.

How to Monitor and Track Your 762 Credit Score

To keep tabs on your 762 credit score and try to inch it higher, be sure to check your scores regularly. Some options include:

-

Getting free credit scores through your credit cards or bank accounts

-

Using free score services like Credit Karma

-

Paying for scores and full credit reports directly from Equifax, Experian, or TransUnion

-

Enrolling in free credit monitoring through Experian or Credit Sesame

Checking your credit scores frequently enables you to quickly catch any sudden drops. Monitoring also lets you track progress as your credit improves.

Bottom Line: Is a 762 Credit Score Good?

In short – yes, a credit score of 762 is very good and considered well above average. At this level, you should qualify for the most competitive loan and credit card interest rates available. A 762 score demonstrates responsible credit usage over time. Maintaining this high of a score enables you to unlock your most important financial goals.

While a score above 800 is possible, it’s not essential for excellent approval odds and loan terms. Focus instead on sustaining your current 762 score through continuous careful money management. By keeping tabs on your credit with frequent check-ins, you can act quickly on anything that threatens your score.

What’s a utilization ratio or debt-to-credit ratio?

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that you’re a higher-risk borrower.5 That’s because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

What’s a good credit score?

It depends on the scoring model used. In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it’s likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score.2 The credit score range is anywhere between 300 to 900.2 The higher your score, the better your credit rating.2

Your credit score helps lenders to assess your credit capacity.1 The higher your score, the more likely you are to get approved for loans and credit.1 It may also be checked when applying to rent a property or when applying for certain jobs.1 However, everyone’s financial situation is different and your credit score will change over time based on your credit history and the amount of debt you owe.

According to the Government of Canada, your credit history is a record of your debt repayments on credit cards, loans and lines of credit.1 Your credit history helps determine your credit score.1 That’s why it’s important to be smart about how you use and manage your credit.

How to check your credit score

The federal government says it’s important to check your credit score so you know where you stand financially. Both Equifax and TransUnion provide credit scores for a fee.

Check your credit score

You can check your credit score with the TransUnion CreditView® Dashboard in the TD app. Checking in the TD app will not affect your credit score in any way. Learn more

How to increase your credit score

The Government of Canada states that your credit score will increase if you manage credit responsibly and decrease if you have trouble managing it.1

Here are some tips from the Government of Canada to help improve your credit score:

- Establish credit history by getting a credit card and using it for things you would buy anyway.3 You can access and view your credit history by obtaining a credit report through a credit bureau. You’re able to request a free copy of your credit report every 12 months from Equifax and Transunion with no impact on your credit score. You can order the report by phone, email and online.4

- Try to pay your bills on time and in-full in order to maintain a good repayment history and improve your score.3 If you can’t pay the full bill, aim to meet the minimum payment.3 Contact your lender if you think you’ll have trouble paying your bill.3

- Don’t apply for credit or switch credit cards too often.3 Make an effort to keep your total debt in check and don’t let small balances add up.3

And here’s a tip from us: Try to get the most out of your credit card and stay on track when it comes to paying it off. One way to help stay on top of your payments could be to set up pre-authorized payments from your bank account to your credit card.

Check out this video that breaks it down in simple terms:

Is 762 A Good Credit Score? – CreditGuide360.com

FAQ

What can I do with a 762 credit score?

Key Things to Know About a 762 Credit Score

Borrowing Options: Most borrowing options are available, and the terms are likely to be attractive. For example, you might be able to qualify for the best credit cards and the best personal loans.

Is 762 a good credit score to buy a car?

According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a used-car loan around 9.06% or lower. Superprime: 781-850.

Is 762 an excellent credit score?

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 762 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

Can I buy a house with a 762 credit score?

Buying a home with an 762 credit score

To illustrate this, as of Nov. 1, 2022, the average mortgage APR in the U.S. was approximately 7.1%. Borrowers with a 760 FICO Score or higher received an average APR of 6.61%, while those in the 700-759 range had an average APR of 6.83%.

Is a 762 credit score good?

A 762credit score is Very Good, but it can be even better. Boosting your score into the Exceptional range could let you qualify you for the very best interest rates and terms. A great starting point is to get your free credit reportfrom Experian and check your credit scoreto find out the specific factors that impact your score the most.

What does a 762fico score mean?

37% Individuals with a 762FICO®Score have credit portfolios that include auto loan and 38% have a mortgage loan. Shield your credit score from fraud People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history.

What is the average utilization rate for a 762 credit score?

Among consumers with FICO®credit scores of 762, the average utilization rate is 23.7%. The best way to determine how to improve your credit score is to check your FICO®Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file.