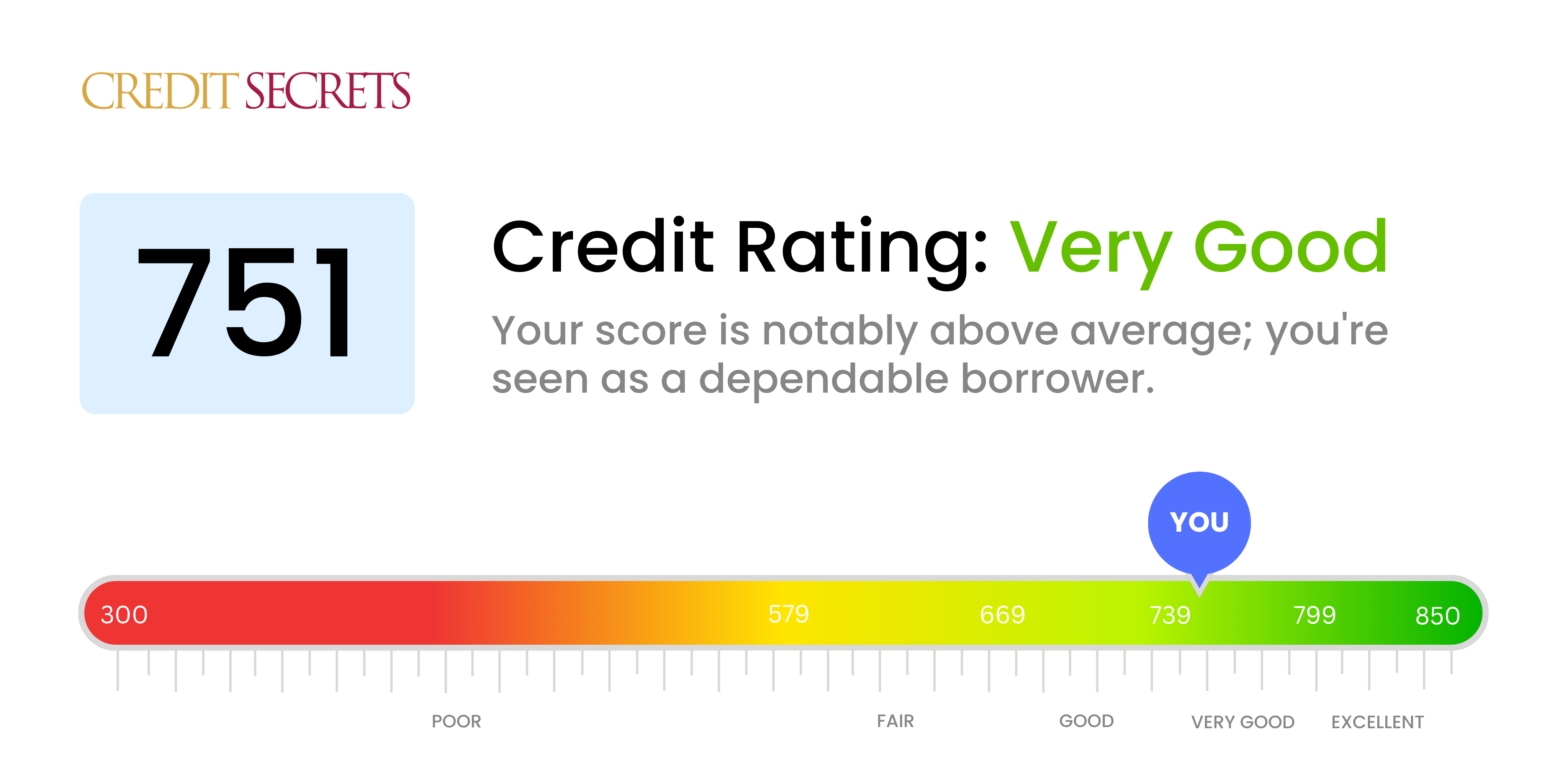

Your FICO® ScoreΠfalls within a range, from 740 to 799, that may be considered Very Good. A 751 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders better interest rates and product offers.

In statistical terms, just 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

Your credit score is one of the most important numbers in your financial life It determines everything from whether you can get approved for new credit cards and loans to the interest rates you’ll pay So when you check your credit score and see that nice 751 number, you probably wonder – is 751 considered a good credit score?

According to the wise Reddit community. the resounding answer is yes – 751 is a fantastic credit score that will open up great opportunities for you!

Reddit Users Say 751 is an Awesome Score

On the r/personalfinance subreddit Redditors regularly discuss credit scores and what specific numbers mean. When one user posted that their score is 751, the comments were overwhelmingly positive

- “751 is a great score! Well done!”

- “Congrats on the 751, that’s awesome.”

- “751 is a solid score, you should be proud.”

- “You’re killing it with a 751 credit score!”

The consensus on Reddit is clear – a credit score of 751 is something to celebrate. You’ve worked hard to build strong credit and maintain responsible money habits. Give yourself a pat on the back!

Why the Experts Consider 751 an Excellent Credit Score

Credit scoring companies like FICO and VantageScore also view 751 as an excellent score. Here’s a breakdown of the credit score ranges and what they mean:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- Under 580: Poor

As you can see, 751 falls into the “very good” range according to the experts. Compared to the average American credit score of 695, a 751 puts you well above your peers.

Benefits of Having a 751 Credit Score

A 751 credit score unlocks some nice perks, which Redditors are quick to highlight. Here are some of the key benefits:

-

Lower interest rates: With excellent credit, you’ll qualify for the lowest rates on mortgages, auto loans, and credit cards. This saves you thousands over the life of the loan.

-

Better approval odds: Lenders want to approve borrowers with 751+ scores. You’re seen as a low-risk customer.

-

Higher credit limits: Credit card companies will be more generous with your spending limit.

-

Lower insurance rates: In some states, car insurance companies use credit scores to set premiums. Excellent credit means lower prices.

-

Card upgrades: Issuers may bump you up to premium rewards cards with lucrative signup bonuses and perks.

-

Security deposits waived: Landlords and utility companies often require high credit scores to waive deposits.

You’re in the Top 15% of Americans!

Another bragging point is that a 751 credit score puts you in rare company. According to Experian data, only 15% of Americans have credit scores in the very good range. The latest average FICO score is only 716.

So with your 751 score, you’re doing way better than most people! Given how high credit card debt and delinquencies are nowadays, scoring 751 with responsible habits makes you elite.

Reddit’s Tips for Maintaining a 751

The Reddit community doesn’t just congratulate people with 751 credit scores. They also provide tips to keep your score high well into the future. Here are some of their top recommendations:

-

Always pay bills on time. Payment history is the biggest factor in your credit score. Set up autopay if you have to.

-

Keep balances low. High utilization hurts your score. Try to keep balances under 30% of your credit limit.

-

Monitor credit reports. Dispute any errors with the credit bureaus to protect your score.

-

Limit hard inquiries. Each application for credit dings your score a bit. Only apply for what you need.

-

Ask for credit line increases. With higher limits, you can keep utilization low as your expenses grow.

The Bottom Line

A 751 credit score puts you in rare air. Less than 15% of people have a score that high. It qualifies as “very good” or “excellent” across all scoring models.

Lenders will roll out the red carpet for you by offering low rates and generous terms. Insurance, cell phone companies, landlords, and employers may also give you preferential treatment thanks to your 751 score.

Redditors agree this is an accomplishment worth celebrating. Keep up the stellar financial habits, monitor your credit carefully, and your 751 score should continue paying dividends for years to come. Congrats on being a credit superstar!

Improving your 751 Credit Score

A FICO® Score of 751 is well above the average credit score of 714, but theres still some room for improvement.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive information about ways you can boost your score, based on specific information in your credit file. Youll find some good general score-improvement tips here.

Staying the course with your Very Good credit history

Your 751 credit score means youve been doing a lot right. To avoid losing ground, be mindful of avoiding behaviors that can lower your credit score.

Factors that can have negative effects on Very Good credit scores include:

Utilization rate on revolving credit Utilization, or usage rate, is a measure of how close you are to “maxing out” credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the cards borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits (including the limits on cards with no outstanding balances).

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts recommend keeping your utilization rates at or below 30%â on individual accounts and all accounts in totalâto avoid lowering your credit scores. The closer any of these rates gets to 100%, the more it hurts your credit score. Utilization rate is responsible for nearly one-third (30%) of your credit score.

Late and missed payments matter a lot. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments. If late or missed payments are part of your credit history, youll help your credit score significantly if you get into the routine of paying your bills promptly.

Time is on your side. If you manage your credit carefully and stay timely with your payments, however, your credit score will tend to increase with time. In fact, if all other score influences are the same, an longer credit history will yield a higher credit score than a shorter one. Theres not much you can do to change this if youre a new borrower, other than be patient and keep up with your bills. Length of credit history is responsible for as much as 15% of your credit score.

Debt composition. The FICO® credit scoring system tends to favor multiple credit accounts, with a mix of revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make monthly payments of varying amounts) and installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods). Credit mix is responsible for about 10% of your credit score.

Credit applications and new credit accounts typically have short-term negative effects on your credit score. When you apply for new credit or take on additional debt, credit-scoring systems flag you as being at greater risk of being able to pay your bills. Credit scores drop a small amount when that happens, but typically rebound within a few months, as long as you keep up with all your payments. New credit activity can contribute up to 10% of your overall credit score.

When public records appear on your credit report they can have severe negative impacts on your credit score. Entries such as bankruptcies do not appear in every credit report, so they cannot be compared to other credit-score influences in percentage terms, but they can overshadow all other factors and severely lower your credit score. A bankruptcy, for instance, can remain on your credit report for 10 years. If there are liens or judgments on your credit report, its in your best interest to settle them as soon as possible.

The Bank Called Saying I Owed $850,000 On A Mortgage I Never Signed For A Luxury House I’d Never…

FAQ

How good of a credit score is 751?

A 751 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range (800-850), you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

Can I buy a house with a 751 credit score?

While credit score requirements vary based on loan type, lenders generally require a credit score of at least 620 to buy a house with a conventional mortgage.Jul 24, 2024

What credit score do I need to buy a $400,000 house?

How rare is a 750 credit score?