Buying a home is an exciting milestone in life. However, navigating the homebuying process can feel overwhelming, especially when it comes to credit scores. You may be wondering, “Is a 678 credit score good enough to buy a house?”

The short answer is – it depends. A credit score of 678 is considered good, but some lenders may require a higher score With a bit of preparation, a 678 credit score can still allow you to become a homeowner

In this article, we’ll break down everything you need to know about what credit scores home lenders look for, what a 678 credit score means, and tips to improve your score.

What Credit Score Do You Need to Buy a House?

When applying for a mortgage, lenders will check your credit report and score to assess your creditworthiness. They want to see that you are financially responsible and can manage debt.

The minimum credit score needed for a mortgage isn’t set in stone It varies by the type of loan and lender Here are general credit score requirements to qualify for a home loan

-

Conventional Loans – The minimum is usually 620 to 640. Many lenders prefer scores of 680 or higher for the best terms.

-

FHA Loans – You can qualify with a minimum score of 500. But for the lowest down payment, at least 580 is recommended.

-

VA Loans – VA doesn’t set a minimum score. But most lenders want at least 620. Some may approve with scores as low as 580.

-

USDA Loans – No strict minimum, but scores below 640 may face tighter approval criteria.

As you can see, a 678 credit score meets the minimum requirements for most mortgage loan programs. However, a higher score in the good to excellent range (680+) unlocks better loan terms and lower interest rates.

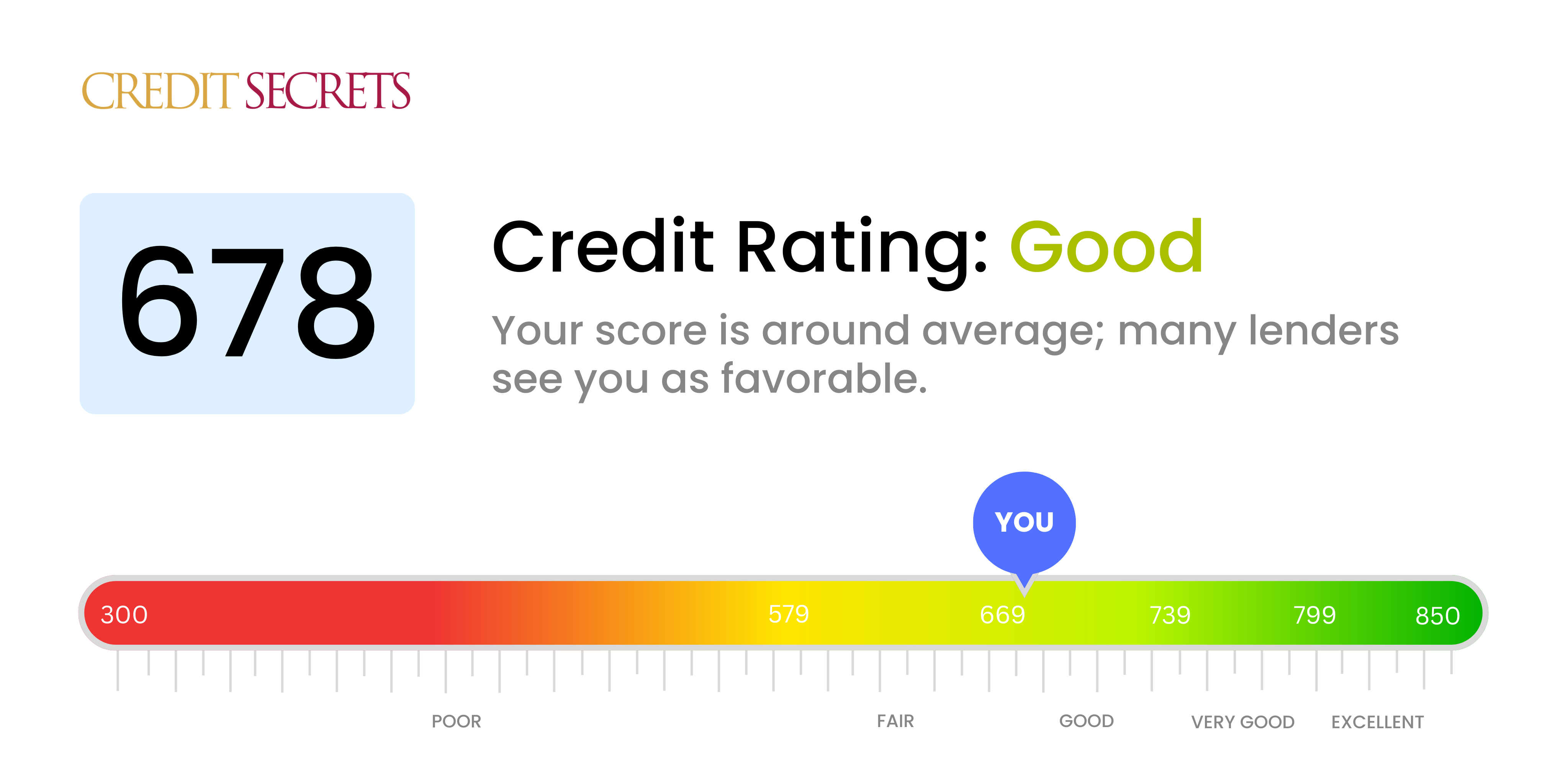

What Does a 678 Credit Score Mean?

Knowing your three-digit credit score is key to assessing your mortgage readiness. But what does a score of 678 actually mean?

Credit scoring models like FICO and VantageScore grade scores using the following ranges:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

So a 678 falls into the good credit range. This means you generally make on-time payments, have a reasonable amount of balances compared to your credit limits, and have diverse credit history. Lenders see you as a well-qualified borrower.

With some effort, you can potentially reach a score of 700 or higher, which unlocks the best loan interest rates and terms.

Can I Buy a House with a 678 Credit Score?

The short answer – yes, you can buy a house with a 678 credit score. This score makes you eligible for most mortgage programs from reputable lenders.

However, your experience getting approved with a 678 score can vary:

-

You may face stricter requirements on debt-to-income ratios, down payment, and cash reserves.

-

Interest rates may be up to 0.5% higher vs. borrowers with excellent credit.

-

On government-backed loans, you may pay an upfront mortgage insurance premium.

-

Lenders may ask you to pay for points to buy down the interest rate.

-

Some niche loan programs may be out of reach without a higher score.

While not impossible, buying a home with a 678 score may involve more effort to find the right lender and loan program. Shopping around is key. Consider options like credit unions, community banks, or online lenders.

Tips for Improving Your Credit Score

The higher your credit score, the better your chances of getting approved for a mortgage with great terms. Here are some tips to improve your credit score quickly:

Pay Down Balances

-

Lower credit utilization below 30% of limits on cards and revolving credit.

-

Pay down installment loan balances like auto loans.

Fix Any Errors

- Dispute and remove any inaccurate information on your credit reports.

Become an Authorized User

- Ask a family member with excellent credit to add you as an authorized user on a long-standing account.

Limit New Credit

- Avoid applying for new credit before applying for a mortgage. Too many hard inquiries can ding your score.

Make Payments on Time

- Set up autopay to avoid any late payments. Payment history is a big factor in credit scores.

Monitor Your Credit

- Sign up for free access to your credit reports and FICO scores. Watch for changes and trends.

The Bottom Line

A 678 credit score is on the lower end of what most lenders want to see for a mortgage approval. While it meets the minimum requirements, you’ll have better success getting approved and snagging the best interest rates with a score of 700 or higher.

The good news is that with diligent credit management, you can improve your score and mortgage eligibility over time. Check your credit reports, reduce balances, and make timely payments.

Shop around with multiple lenders to find the best mortgage rates for your situation. Consider options like FHA, VA, and USDA loans that offer flexible credit guidelines. With patience and persistence, homeownership can become a reality even with less-than-perfect credit scores.

For USDA loans: Flagstar Bank

-

Annual Percentage Rate (APR)

Apply online for rates.

-

Types of loans

Conventional, FHA, VA, USDA, jumbo, renovation, Destination Home Mortgage, HomeReady, Home Possible, HELOC, refinancing, ReFi Now, Refi Possible

-

Terms

15-year and 30-year fixed-rate loans; 5-year, 7-year, 10-year intro period for adjustable-rate loans

-

Credit needed

620 for conventional, 600 for Destination Home Mortgage

-

Minimum down payment

3% for conventional loans, 0% for VA, USDA and Destination Home Mortgage

Flagstar will approve USDA loans for applicants with scores as low as 580, compared to the 620 most lenders want to see. With the Flagstar Gift Program, eligible first-time homebuyers can receive 3% of their homes purchase price to put toward their down payment or closing costs.

Mortgage credit score FAQs

Most lenders want to see at least a 620 FICO score for a conventional mortgage. You can get a FHA loan with a score as low as 500, however, if you can put 10% down.

Minimum Credit Score to Buy a House | Retail Mortgage

FAQ

Can I buy a house with a 678 credit score?

Buying a house with a 678 credit score

Some lenders may require a larger down payment, charge higher interest rates or have stricter loan terms. Whatever you decide, carefully review and compare various lenders and loan options to find your best fit for your specific circumstances.

What can I get with a 678 credit score?

What credit score is needed to buy a $300K house?

How common is an 800 credit score?