Its an age-old question we receive, and to answer it requires that we start with the basics: What is the definition of a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report. Your payment history, the amount of debt you have and the length of your credit history are some of the factors that make up your credit scores.

There are many different credit scoring models, or ways of calculating credit scores. Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Credit scores help creditors determine how likely you are to pay back money they lend.

Its important to remember that everyones financial and credit situation is different, and theres no credit score “magic number” that guarantees better loan rates and terms.

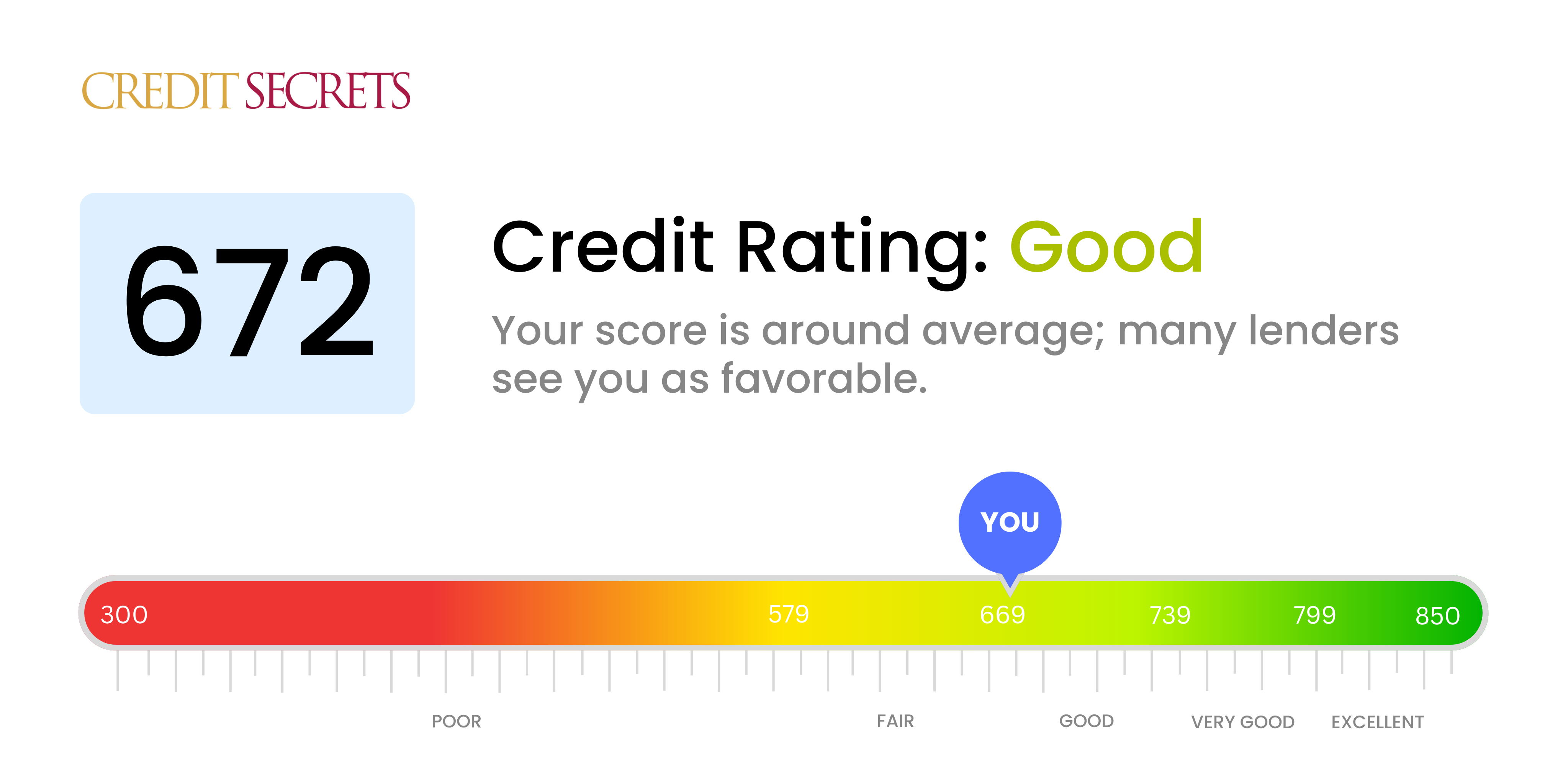

Your credit score is one of the most important numbers in your financial life. It gives lenders an idea of how likely you are to repay debt, and can affect everything from whether you qualify for a loan to how much interest you’ll pay. So where does a 672 credit score land you? Is 672 considered a good credit score?

The short answer is yes, 672 is generally considered a good credit score by both FICO and VantageScore models But diving deeper into what makes up your score, and how it’s calculated, can help you understand what that 672 means for your finances

What is a Credit Score?

A credit score is a three-digit number calculated based on information in your credit report, This report details your history of paying bills and managing debt Lenders use your credit score along with other factors to determine your creditworthiness when you apply for financing

The two most common credit scoring models used in the U.S. are:

-

FICO score: Developed by Fair Isaac Corporation, this model evaluates your credit based on five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. FICO scores range from 300 to 850.

-

VantageScore: Created by the three major credit bureaus, TransUnion, Experian, and Equifax, the VantageScore also uses a 300 to 850 scale. It weighs the same factors as FICO but applies them slightly differently.

Most lenders check FICO scores when evaluating credit applications. But both models categorize scores into ranges, so you can see where you stand in general terms.

Credit Score Ranges

Though the models differ in their precise ranges, here is how FICO and VantageScore group scores:

| Credit Score Range | Credit Rating |

|---|---|

| FICO | |

| 800-850 | Exceptional |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 300-579 | Poor |

| VantageScore | |

| 781-850 | Excellent |

| 661-780 | Good |

| 601-660 | Fair |

| 500-600 | Poor |

| 300-499 | Very Poor |

So in both systems, a 672 score falls into the good credit range. What does that mean for borrowers?

What a Good Credit Score Means

A good credit score demonstrates that you have an established credit history and manage it responsibly. Lenders see you as a lower-risk borrower compared to those with fair or poor scores.

Benefits of having a credit score in the good range include:

-

Better loan approval odds: Lenders are more likely to approve you for mortgages, auto loans, credit cards and other financing.

-

Better terms: You may qualify for lower interest rates and more favorable loan terms compared to applicants with lower scores.

-

More options: A good score opens up a wider variety of credit products. Lenders reserve their best offers for consumers with excellent credit.

So while a 672 score doesn’t guarantee the lowest rate or access to the most exclusive rewards cards, it still provides significant advantages.

What Makes Up a 672 Credit Score

To understand what your 672 score means, it helps to look at what goes into calculating it. Here are the main factors that influence your FICO and VantageScores:

-

Payment history (35% of FICO score): Whether you pay bills on time, have any late payments, bankruptcies or accounts referred to collections. The best way to improve this factor is to always pay on time.

-

Utilization rate (30% of FICO score): The ratio of credit you’re using compared to your total available credit limits. Experts recommend keeping this below 30%.

-

Credit history length (15% of FICO score): How long you’ve had credit accounts opened. Older accounts help raise this.

-

New credit (10% of FICO score): How much new credit activity you have, like recently opened accounts. Too many new accounts can lower scores temporarily.

-

Credit mix (10% of FICO score): Whether you have experience with different types of credit, including installment loans and revolving credit like credit cards.

Your 672 score indicates you likely have a relatively short but well-managed credit history. You may have a late payment here or there, or use more of your available credit than ideal. But overall, you demonstrate responsibility that makes lenders comfortable extending financing.

How to Raise a 672 Credit Score

While a 672 credit score provides access to favorable rates and terms, you may want to increase it further. Raising your score could help you qualify for top-tier rewards credit cards, the lowest mortgage and auto loan rates, and interest savings over time.

Here are some tips to help boost your 672 score:

-

Lower credit utilization: Pay down balances to decrease your ratio of credit used. Spreading balances across multiple cards can help as well.

-

Pay all bills on time: Set up autopay or reminders to avoid missed or late payments if needed. Payment history is the biggest factor in your score.

-

Limit hard inquiries: Only apply for credit when you need it to avoid too many inquiries lowering your score temporarily. Comparison shop within a short window as the bureaus count multiple auto or mortgage inquiries as one.

-

Monitor your credit: Review your credit reports regularly and dispute any errors you find with the bureaus. This ensures mistakes don’t inadvertently hurt your score.

-

Let credit age: Avoid closing old credit card accounts as credit longevity helps your score. Use your oldest cards periodically to keep them active.

The most important thing is developing consistently healthy credit habits over time. Be patient, as improving your credit score doesn’t happen overnight. But sticking to wise financial practices will steadily raise your score and unlock better borrowing terms.

The Takeaway

A FICO or VantageScore of 672 is considered a good credit score, though not quite excellent. It demonstrates responsible management that makes lenders comfortable extending financing, though not necessarily at the very best rates or terms. With diligent credit habits, you can potentially improve your 672 score to reach higher tiers and access the top rewards and interest rates. But even at 672, your credit is good enough to provide significant borrowing options.

What are credit score ranges and what is a good credit score?

Credit score ranges vary depending on the scoring model. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores.

- 740 to 799: Very Good Credit Score Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good Credit Score Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair Credit Score Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor Credit Score Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, its likely youll need to take steps to improve your credit scores before you can secure any new credit.

Lenders use credit scores along with a variety of other types of information — such as information you provide on the credit application (for example: income, how long you have lived at your residence, and other banking relationships you may have) in their loan evaluation process. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

Is A 672 Credit Score Good? – CreditGuide360.com

FAQ

Can you buy a house with a 672 credit score?

Generally, a credit score of 672 is considered to be good for both main credit scoring models (between 661 to 780 for VantageScore and 670-739 for FICO). This means your chances of being able to buy a home or take out an auto loan are higher than someone with a credit score in a lower range.

What can you do with a 672 credit score?

Is a 700 a good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Can you get a car with a 672 credit score?

There isn’t one specific score that’s required to buy a car because lenders have different standards. However, the vast majority of borrowers have scores of 661 or higher.Jun 9, 2025

Is a 672 credit score a fair score?

Our content is accurate to the best of our knowledge when posted. A 672 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range.

What is the best credit card for a 672 credit score?

The best type of credit card for a 672 credit score is a card with low fees and either rewards or a low APR promotion. You should compare credit cards with rewards if you plan to use your card for everyday purchases that you can pay off by the end of the month.

Is a 672 FICO score good?

A 672 FICO ® Score Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

How do I get a 672 credit score?

Borrowing Options: Most borrowing options are available, but the terms may not be very attractive. For example, you should be able to qualify for unsecured credit cards and personal loans, but the interest rate may be fairly high. Best Way to Improve a 672 Credit Score: Apply for a credit card and pay the bill on time every month.

Can you get a student loan with a 672 credit score?

Student loans are some of the easiest loans to get with a 672 credit score, seeing as more than 60% of them are given to applicants with a credit score below 700. A new degree may also make it easier to repay the loan if it leads to more income.