Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

No single number defines a bad credit score for a car loan. In general though, if your credit score is below the mid-600s, you can expect higher interest rates and more difficulty getting a loan.

Because lenders consider many factors when approving loans, people with bad credit scores do get auto loans every day. They may have to supply more information to lenders, make bigger down payments, choose a less expensive car or accept higher rates.

When it comes to buying a car your credit score plays an important role in determining the loan terms you’ll be offered. While creditors don’t see a 650 credit score as an excellent rating by any means they certainly don’t see it as horrible either. As a result, they’ll typically allow for a car loan with that rating based on the loan provider. 600 is, generally speaking, seen as the lowest score that a lender will loan to.

But is 650 considered a good credit score by auto lenders? Will you get approved for a car loan with a 650 credit score? What kind of interest rates can you expect? This article provides an in-depth look at what a 650 credit score means for your auto loan options.

What Does a 650 Credit Score Mean?

Before diving into how a 650 credit score affects your ability to get a car loan, it’s important to understand what that score represents.

There are a few different credit scoring models, with the FICO score and VantageScore being two of the most common. Both score ranges go from 300 to 850. So a 650 score falls right in the middle, considered fair credit on both scoring systems.

Here’s a quick breakdown of the different credit tiers according to FICO and VantageScore:

FICO Credit Score Ranges

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

VantageScore Credit Score Ranges

- 750-850: Excellent

- 700-749: Good

- 650-699: Fair

- 550-649: Poor

- 300-549: Very Poor

So a 650 credit score is viewed as fair by both scoring models. It’s not terrible, but not great either. You have some positive credit history, but also likely have late payments or other negative marks bringing down your score.

Can You Get Approved for a Car Loan with a 650 Credit Score?

The good news is that 650 is generally high enough to get approved for an auto loan these days. According to Experian data, over 15% of auto loans went to borrowers with credit scores between 601-660. So lenders are clearly approving applicants with 650 credit scores.

However, it’s important to understand that there is no specific minimum credit score requirement to buy a car. Every lender has their own standards when it comes to creditworthiness.

For example, some buy-here-pay-here dealerships may approve borrowers with scores as low as 500. Meanwhile, luxury automakers’ financing arms often require 700+ scores for lease or financing approval.

So a 650 credit score doesn’t automatically qualify or disqualify you. Lenders look at your entire financial profile, including your income, existing debts, down payment amount, etc.

But with a 650 score, you should have a decent shot at getting approved as long as the rest of your financials are in decent shape. Just be prepared for higher than average interest rates.

What Interest Rate Can You Get with a 650 Credit Score?

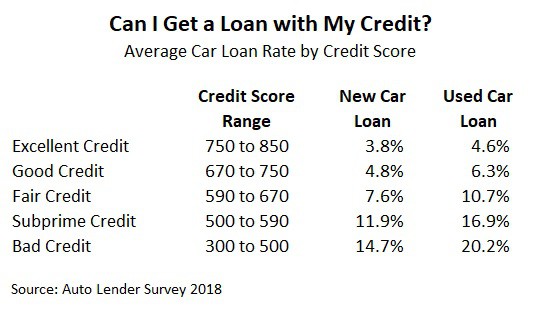

While a 650 credit score is fair, it’s still considered subprime by most lenders’ standards. So expect to pay higher interest rates than borrowers with good or excellent credit.

Here are some average used auto loan rates currently being offered to borrowers based on credit score, according to Bankrate:

- 850-740: 3.113%

- 739-670: 4.162%

- 669-650: 7.356%

- 649-590: 11.664%

- 589-500: 17.457%

For borrowers with excellent credit in the 800s and 700s, average rates are below 5%. But for 650 credit score borrowers, average used car loan rates jump up over 7% on a 5-year loan.

However, that doesn’t mean a 7% rate is the best you can get. Rates vary between lenders. Do some shopping around to see if you can beat the average. Get pre-qualified with several lenders, including banks, credit unions, and your own auto insurance provider.

While you’ll likely pay a higher interest rate than those with excellent credit, 650 is still a decent score and should allow you to secure reasonable auto financing. Just be sure to shop around for the best rate possible.

What’s the Typical Car Loan Amount with a 650 Credit Score?

In addition to affecting your interest rate, your credit score can also impact the size of the loan you qualify for. Lenders generally offer smaller loan amounts to higher risk borrowers.

According to data from Experian, here were the average new and used car loan amounts by credit tier:

- Super Prime (781-850): $32,187 new, $25,495 used

- Prime (661-780): $31,289 new, $21,817 used

- Non-Prime (601-660): $27,021 new, $17,163 used

- Subprime (501-600): $22,186 new, $13,563 used

So with a 650 credit score, you can expect to get approved for more than subprime borrowers but less than prime borrowers. The average used car loan amount for non-prime borrowers was around $17,000.

Of course, the loan amount also depends on factors like your income, existing debts and expenses. But credit history clearly impacts lending limits. With a 650 score, you may not qualify for as large of a loan as you hoped.

If your budget requires financing over $20,000 but you’re only approved for $15,000, adjusting your budget to opt for a less expensive vehicle may be necessary.

Tips for Getting a Car Loan with a 650 Credit Score

While a 650 credit score makes auto loan approval very possible, follow these tips to strengthen your case even more:

-

Save for a larger down payment: Putting down 20% or more shows the lender you’re financially committed. It also lowers the amount financed.

-

Reduce debt: Pay down credit cards and other debts to lower your DTI ratio before applying.

-

Check for errors on your credit reports: Incorrect negative information can unfairly lower your scores. Dispute any errors.

-

Add a co-signer: Asking a family member with excellent credit to co-sign reduces the lender’s risk.

-

Shop around: Compare rates from multiple lenders to find the best deal. Get pre-qualified before going to the dealer.

-

Improve your credit: Pay all bills on time, lower balances, and resolve collection issues. A 670+ score unlocks better rates.

With a few credit-boosting strategies, a 650 score can potentially improve to a 670 or 700+ score within several months to a year. Holding off on your car purchase briefly to boost your score could end up saving you thousands on your auto loan’s interest charges.

The Bottom Line

While excellent credit in the 700s or higher can secure the very best auto financing terms, a credit score of 650 is still considered fair. You should be able to get approved for an auto loan with around 650 credit score. Just don’t expect ultra-low interest rates.

Do plenty of shopping around among both direct lenders and dealerships. With some negotiation, you may be able to get an interest rate under 7% on a used car loan with 650 credit. Improving your score and making a large down payment can also help offset the higher rates that come with fair credit auto loans.

Auto loan origination by credit score

People with all types of credit scores do get approved for car loans. Consumer credit reporting company Experian provides insight into the percentage of new and used auto loans financed by credit scoring tier.

The breakdown below uses the VantageScore model and reflects auto loans originated in the first quarter of 2025.

|

Credit score |

New car loan distribution |

Used car loan distribution |

|---|---|---|

|

Superprime: 781-850. |

47.44%. |

22.34%. |

|

Prime: 661-780. |

35.62%. |

35.26%. |

|

Nonprime: 601-660. |

10.87%. |

18.35%. |

|

Subprime: 501-600. |

5.61%. |

20.69%. |

|

Deep subprime: 300-500. |

0.46%. |

3.36%. |

|

Source: Experian Information Solutions, 1st quarter 2025. |

||

Know where your credit score stands

When buying and financing a car, a good first step is to know where your credit score stands. You can get your credit report and score for free through NerdWallet, or you can request a free weekly credit report from each credit bureau at annualcreditreport.com.

FICO and VantageScore are the two most commonly used credit scoring models, and each has scores ranging from 300 to 850. Some auto lenders also heavily use an industry-specific FICO model that weighs certain factors, such as past car-loan payments. Its range is 250 to 900. The cut-off number that places a person in a “bad credit” tier differs by credit scoring model, but it’s generally in the mid-600s or below.

While you can purchase your FICO automotive score, your basic free credit report and score should be enough to understand where you stand. You can compare your score to industry averages to measure how difficult it will be for you to get an auto loan — and at what interest rate.

Find a good loan based on current rates

Best Credit Union for Car Loan 2024 | Biggest Car Buying Secret!

FAQ

Will I get approved for a car loan with a 650 credit score?

What credit score is needed for a $20,000 car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.

What can a 650 credit score get you?

What credit score is needed for a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)