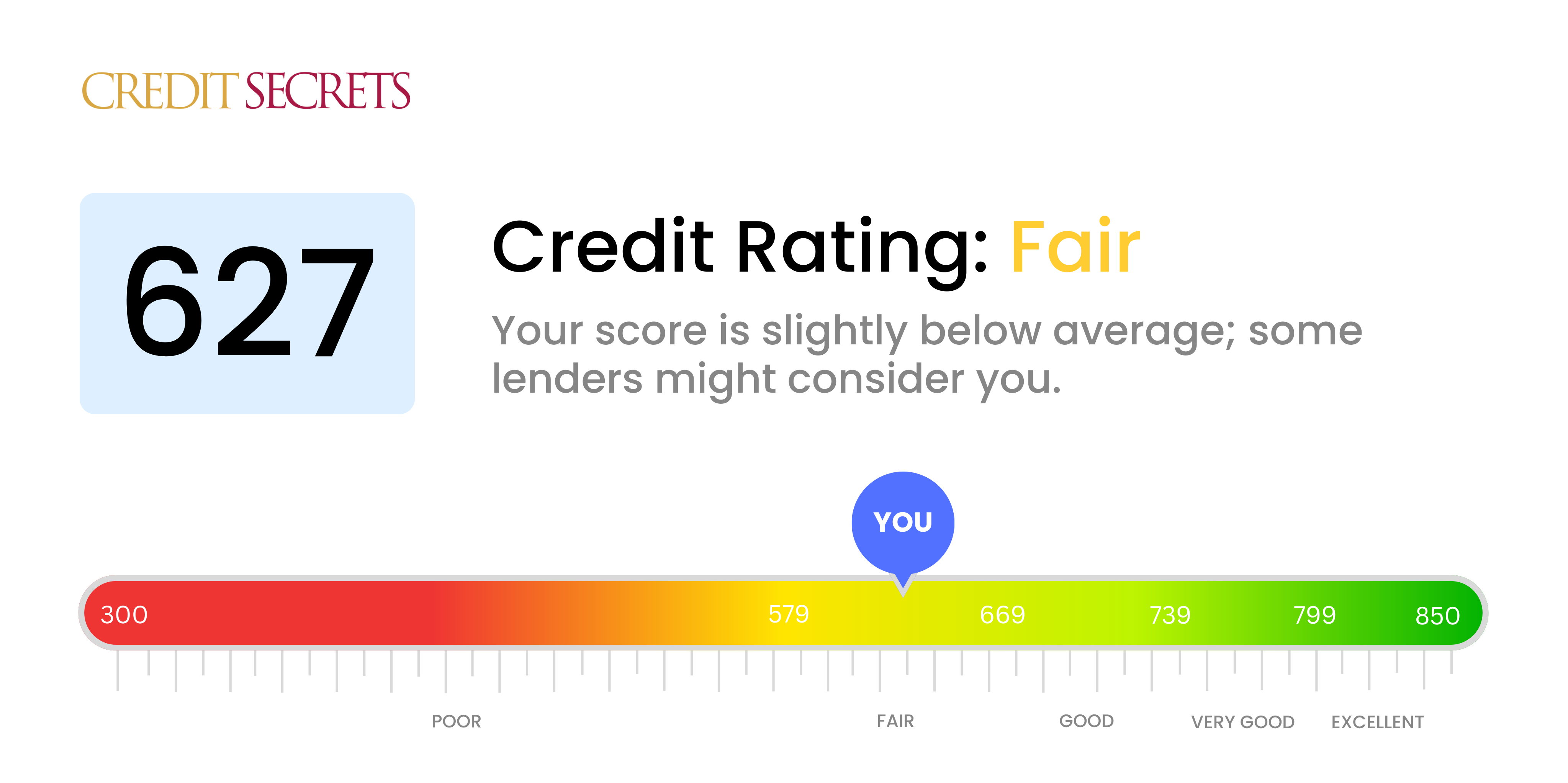

If you’ve got a 627 credit score, you might be wondering if that’s a good score or a bad score. According to Equifax Canada, one of the country’s two major credit bureaus (organizations that issue credit scores), a 627 credit score falls within the range generally considered to be a fair to decent credit score.

So, what does that mean really for your financial status and future? Let’s break it all down.

A FICO score of 627 falls in the “fair” credit range, which is not considered good. However, there are still financing options available with a 627 credit score Here’s what you need to know about a 627 FICO score, including how to improve it.

What is a Good FICO Credit Score?

A good FICO credit score generally falls between 661-780 on the FICO scoring model. Scores in this range are considered good to excellent credit, and will qualify for the best interest rates from lenders.

According to FICO, here are the credit score ranges:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

So while a score of 627 is not excellent, it falls within the fair range and meets the minimum requirements for most lenders. However, you will pay higher interest rates than borrowers with good or better credit scores.

What Credit Score Do You Need for Different Types of Credit?

The minimum credit score requirements vary depending on the type of credit you are applying for

-

Mortgages Most conventional mortgages require a minimum credit score of 620. FHA loans allow scores as low as 580

-

Auto Loans: Prime auto loans generally require a 661 FICO score or higher. Subprime auto loans are available starting at 600.

-

Credit Cards: Most standard credit cards require a 670 minimum score. There are subprime cards available for scores as low as 550.

-

Personal Loans: Good personal loan rates start at 640. Approval is possible with a 600 score.

So a 627 FICO meets the minimum requirements for most types of credit, especially subprime lending. However, interest rates will be higher compared to applicants with good or better scores.

Is a 627 FICO Score Good or Bad?

-

A 627 is a below average, or bad, credit score. The average FICO score in the US is 716, so a 627 is 89 points lower.

-

17% of consumers have FICO scores between 580-669, which is considered fair. So a 627 is a relatively common score.

-

With a 627 FICO, you will pay higher interest rates and may be declined by lenders using a higher minimum score requirement.

-

Applicants with scores below 670 are generally classified as subprime borrowers. So a 627 is on the lower end of subprime credit scores.

While a 627 isn’t a terrible score, it makes financing more expensive. The good news is there are plenty of options to improve your 627 credit score over time.

How to Improve a 627 FICO Score

Here are the most effective ways to start improving a 627 credit score:

-

Pay all bills on time. Payment history is the biggest factor in your credit scores. Set up autopay or reminders to avoid late payments.

-

Lower credit utilization. Keep balances low on credit cards and other revolving credit. Below 30% is good.

-

Mix credit types. Have both revolving (credit cards) and installment (mortgage, auto) accounts.

-

Limit hard inquiries. Too many credit checks from new applications will lower your scores.

-

Build credit history. Older, established accounts improve your scores. Let your credit age over time.

-

Dispute errors. Review credit reports and dispute any inaccuracies with the credit bureaus.

With responsible credit habits over time, a 627 FICO score can easily move up to the good credit range. Most credit scoring models are designed so scores below 700 can improve significantly in under two years.

How Long Does It Take to Improve a 627 Credit Score?

Most credit experts recommend allowing at least 6 months before seeing a significant increase from credit repair efforts. Typically, you can expect to see a 50-100 point improvement after 12 months of responsible credit management.

With a concerted effort, a 627 score could potentially reach the good credit range of 661-780 within 1-2 years.

Improvement happens gradually, so you must continue good financial habits long-term to see your scores steadily increase over time. There is no quick fix for substantially boosting a score from fair to good.

Be patient and focus on making payments on time, lowering balances, and letting your credit age. With time, a 627 FICO has the potential to reach 700 or higher.

Summary

-

A FICO score of 627 is below average and considered fair, but not good, credit.

-

With a 627, you can qualify for credit but will pay higher interest rates. Most lending is considered subprime.

-

Scores below 580 are very poor. Scores above 660 are rated as good credit.

-

Responsible credit habits over 1-2 years can improve a 627 score to the good credit range.

-

A 627 meets the minimum credit score requirements for most loans and credit cards.

So while a 627 FICO isn’t a great credit score, it still offers plenty of financing options. With time and diligent effort, you can significantly improve a 627 score to access better rates.

Credit scores in Canada

Your credit score serves as a numerical summary, typically falling within a range of 300 to 900, amalgamating a wide array of financial data. It’s influenced by multiple factors and acts as a comprehensive reflection of your financial health. Put simply, the higher your score, the more favorably credit bureaus and potential lenders perceive you. A robust credit score opens pathways to numerous financial advantages, such as access to lower-interest loans, improved employment opportunities (especially in sectors like financial services, where employers often scrutinize credit scores during background checks), and an increased likelihood of securing a rental property.

Late or missed payments

This is a big one. Failing to make a loan payment, be it for a credit card or any other financial obligation, can have a significant negative impact on your credit rating. A substantial 35% of your credit score hinges on your capacity to consistently meet your loan obligations. Therefore, its crucial to scrutinize your credit history for any past instances of missed payments.

How Good Are Credit Scores Between 660-669?

FAQ

Can I get approved with a 627 credit score?

Borrowers with a 627 credit score may qualify for some loans and credit cards, but with less favorable rates and terms than those with a higher number.

What does a 627 credit score mean?

Your score falls within the range of scores, from 580 to 669, considered Fair. A 627 FICO® ScoreΘ is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

What FICO score is considered very good?

FICO’s industry-specific credit scores have a different range: 250 to 900. However, the middle categories have the same groupings, and a “good” industry-specific FICO® Score is still 670 to 739. Scores above that are considered very good or exceptional.

How rare is a 700 credit score?

| FICO® Score Range | Percent Within Range |

|---|---|

| 600-649 | 8% |

| 650-699 | 11% |

| 700-749 | 16% |

| 750-799 | 24% |

Is a FICO score of 627 good?

Approximately 74% of U.S. consumers have a FICO score higher than 627. If you have a 627 FICO score, you share it with tens of thousands of other Americans, but the reasons for your score are unique to your credit history. For insights into the specific causes of your score and suggestions on how to improve it, get copies of your credit reports and check your FICO score.

How do I improve a 627 credit score?

Best Way to Improve a 627 Credit Score: Apply for a secured credit card and pay the bill on time every month. Below, you can learn more about what a 627 credit score can get you and, even more importantly, how you can get a higher credit score.

What is a fair FICO score?

Approximately 27% of consumers with a FICO ® Score in the Fair range (580-669), including a score of 627, are likely to become seriously delinquent in the future. Think of your FICO ® Score of 627 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.