MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed. Start comparing the low rates with multiple top companies using myAutoloan below

Getting a new car is always an exciting prospect. But figuring out financing can be stressful. One of the key factors in a car loan is the interest rate, also known as the annual percentage rate (APR). So when you see a rate like 2.49% APR advertised, it’s natural to wonder – is that a good rate for a car loan?

In this article, we’ll break down everything you need to know about APR for car loans. We’ll look at what exactly APR means, what makes for a good APR, and how you can get the best rate possible.

What Does APR Mean on a Car Loan?

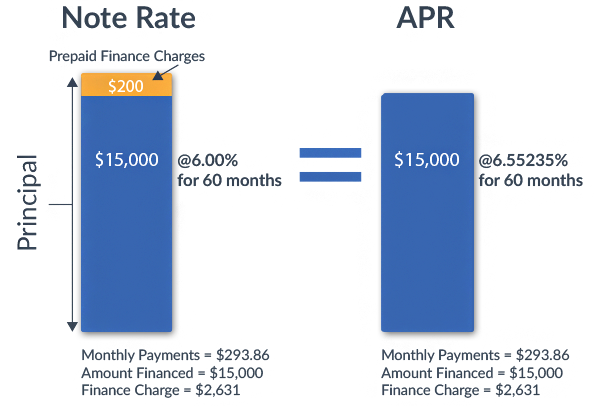

APR stands for annual percentage rate. It’s the interest rate you’ll pay on a loan, shown as a yearly percentage. So 2.49% APR means you’ll pay 2.49% interest per year on the loan amount.

The APR includes the base interest rate plus any fees and costs for getting the loan. This makes it a better representation of the true cost of the loan, compared to just looking at the base rate alone.

With a car loan, fees can include charges for processing paperwork, documenting the title, registration, etc. The APR folds those fees into the interest rate to show you the total cost.

What Makes for a Good APR on a Car Loan?

Whether a certain APR is “good” or not depends largely on two factors – the type of car and your credit score.

New vs Used Car APR

On average, interest rates for new cars tend to be lower than for used cars. According to Experian data here were the average APRs as of Q3 2022

- New car loan: 5.07%

- Used car loan: 8.42%

Rates can vary quite a bit though based on individual factors. For both new and used cars, the newest model years tend to have the lowest rates. Reliable brands like Toyota and Honda also tend to have lower rates.

As a rough benchmark, an APR under 3% for a new car or under 6% for a used car is considered good. But for the average buyer, rates under 10% are still competitive.

Credit Score and APR

The biggest factor in determining your APR is your credit score. The higher your score, the better interest rate you can qualify for.

According to Experian, here were the average APRs by credit score range in Q3 2022:

- Deep subprime (300-500): 14.08%

- Subprime (501-600): 9.41%

- Near prime (601-660): 6.07%

- Prime (661-780): 3.51%

- Super prime (781-850): 2.47%

So if you have excellent credit in the 700s or higher, an APR around 2.5% would be considered very good. But for someone with fair credit in the 600s, that same 2.5% rate would be phenomenal.

The importance of credit score means it’s crucial to check your credit before applying for an auto loan. Getting pre-approved for financing will show what rates you qualify for based on your current score.

How to Get the Best APR on a Car Loan

While your credit score is the biggest factor, there are some other things you can do to help get the lowest APR:

-

Shop around: Compare rates from multiple lenders. Online lenders often offer the most competitive rates.

-

Get pre-approved: This shows you actual rates you’re eligible for and can give you bargaining power.

-

Make a larger down payment: This reduces the amount you have to finance, lowering the risk for lenders.

-

Choose a shorter loan term: Opt for a 3 year loan over 5 years – you’ll pay it off faster and less in interest.

-

Improve your credit score: Pay down debts, correct errors on your credit reports, and make timely payments. A score over 700 can make a big impact.

-

Consider a co-signer: Adding someone with excellent credit can help you qualify for the best rates.

-

Look for promotions: Dealerships and manufacturers sometimes offer special rate offers, like 0% financing.

With some work, you can potentially get an APR lower than the average for your credit score range.

2.49% APR Car Loan – Payment Examples

To give a sense of what payments might look like at 2.49% APR, here are some examples:

- For a $20,000 loan over 5 years (60 months), the monthly payment would be $354.

- For a $30,000 loan over 6 years (72 months), the monthly payment would be $432.

- For a $40,000 loan over 7 years (84 months), the monthly payment would be $509.

You’ll pay more interest over the life of the loan with a longer term, but it does lower the monthly payment. Just be sure to factor in insurance, gas, and maintenance costs too.

You can use an auto loan calculator to estimate payments for any loan amount, APR, and term.

Should You Take a Car Loan with 2.49% APR?

The short answer is – it depends!

For someone with excellent credit looking at new car financing, 2.49% would be a very solid APR, but rates in the 2% range are also achievable.

For a used car buyer with average credit, 2.49% would be a great offer. But for others with poor credit, it may not be feasible anyway.

Here are a few pros and cons to weigh:

Pros:

- 2.49% is below the current average APR for both new and used car loans

- Manageable monthly payments, especially if you opt for a longer 5-7 year loan

- Interest charges will be reasonable at this rate if you pay off the loan swiftly

Cons:

- You may qualify for even lower rates, especially if your credit score is over 700

- A longer loan term means you’ll pay more total interest over the life of the loan

- Higher monthly payments with a shorter 3-4 year loan

Overall, 2.49% is a pretty competitive rate in today’s car loan market. If you’re seeing this APR offered, it’s likely a good option provided it fits your budget and financial situation. But be sure to compare other lenders and terms to find your optimal rate.

Other Key Auto Loan Questions

Beyond just the APR, there are a few other important questions to consider when taking out a car loan:

-

What is the total interest I’ll pay? Calculate both the monthly payment and total interest costs.

-

What loan term makes sense? Shorter terms have higher monthly payments but you pay off the loan faster.

-

What fees are involved? Ask about any origination fees or prepayment penalties.

-

Is there a down payment requirement? Most lenders require 10-20% down for a car loan.

-

Are there incentives or discounts? Look for special offers that could lower your APR.

-

Can I pay extra each month? Paying ahead can help you pay off the loan early and reduce interest paid.

Being an informed borrower will help ensure you get the best auto financing deal possible!

The Bottom Line

A 2.49% APR on a car loan is generally pretty good – for borrowers with strong credit, it’s an excellent rate. For those with average credit, it would be a competitive offer.

The most important thing is that the monthly payment fits comfortably within your budget. Be sure to consider all costs of owning the car. An auto loan calculator can help estimate payments at 2.49% or any other rate.

Focus on improving your credit, comparing lenders, and negotiating the best deal you can. With some savvy financing decisions, you can drive off with that new car and a solid APR too!

How To Get Lower Interest Rates on Your Auto Loan

If you’re looking for the best auto loan rates, we’ve provided some key tips and resources to get you started.

Below you can learn about the best companies and rates for different auto loan categories:

Average Auto Loan APRs by State

Rates for auto loans can be affected by the monetary policies in each state, which are mainly influenced by federal treasury rate changes. This causes market rates to fluctuate and differ between states. Below, you can compare recent average APRs for new and used cars within all U.S. states and Washington, D.C., according to Edmunds.

| State | Average New Car Loan APR | Average Used Car Loan APR |

|---|---|---|

| Alabama | 7.99% | 12.58% |

| Alaska | 7.6% | 11.03% |

| Arizona | 7.47% | 12.08% |

| Arkansas | 7.93% | 12.03% |

| California | 6.79% | 10.91% |

| Colorado | 6.38% | 10.48% |

| Connecticut | 5.95% | 10.3% |

| Delaware | 6.68% | 11.11% |

| Florida | 7.65% | 11.58% |

| Georgia | 8.34% | 12.8% |

| Hawaii | 7.21% | 12.55% |

| Idaho | 6.89% | 9.83% |

| Illinois | 6.66% | 11.39% |

| Indiana | 6.78% | 11.01% |

| Iowa | 6.81% | 10.23% |

| Kansas | 6.99% | 11.16% |

| Kentucky | 7.36% | 12.07% |

| Louisiana | 7.41% | 12.39% |

| Maine | 6.24% | 9.37% |

| Maryland | 7.08% | 11.03% |

| Massachusetts | 6.3% | 9.84% |

| Michigan | 6.39% | 10.67% |

| Minnesota | 5.16% | 10.17% |

| Mississippi | 7.83% | 13.49% |

| Missouri | 6.67% | 11.07% |

| Montana | 6.88% | 12.17% |

| Nebraska | 5.72% | 9.94% |

| Nevada | 7.35% | 13.04% |

| New Hampshire | 6.17% | 9.95% |

| New Jersey | 6.4% | 11.2% |

| New Mexico | 8.51% | 12.34% |

| New York | 6.63% | 10.37% |

| North Carolina | 7.06% | 11.41% |

| North Dakota | 6.43% | 11.79 |

| Ohio | 7.08% | 11.82% |

| Oklahoma | 7.25% | 11.55% |

| Oregon | 6.53% | 10.15% |

| Pennsylvania | 6.23% | 10.1% |

| Rhode Island | 6.73% | 10.09% |

| South Carolina | 7.74% | 12.39% |

| South Dakota | 6.75% | 11.46% |

| Tennessee | 7.52% | 11.36% |

| Texas | 7.54% | 12.26% |

| Utah | 6.33% | 9.8% |

| Vermont | 6.51% | 9.08% |

| Virginia | 6.66% | 10.95% |

| Washington | 6.1% | 9.38% |

| Washington, D.C. | 7.63% | 11.03% |

| West Virginia | 7.24% | 12.23% |

| Wisconsin | 5.54% | 9.49% |

| Wyoming | 6.81% | 10.78% |

Car Loan Interest Rates Explained (For Beginners)

FAQ

What is a good APR for a car loan?

Is a 2.5 interest rate good for a car?

A good interest rate for a new car is anything below 4.07%, while for a used car, a good interest rate is lower than 8.62%.

What APR will I get with a 700 credit score for a car?

| FICO score | New car loans | Used car loans |

|---|---|---|

| Prime (661 to 780) | 6.70% | 9.06% |

| Near prime (601 to 660) | 9.83% | 13.74% |

| Subprime (501 to 600) | 13.22% | 18.99% |

| Deep subprime (300 to 500) | 15.81% | 21.58% |

How much is 2.9% APR for 72 months?

72 months at 2.9% APR: 72 monthly payments of $15.15 per thousand borrowed. 60 months at 2.9% APR: 60 monthly payments of $17.92 per thousand borrowed. 48 months at 2.9% APR: 48 monthly payments of $22.09 per thousand borrowed. 36 months at 2.9% APR: 36 monthly payments of $29.04 per thousand borrowed.