Why Your DTI Ratio Matters More Than You Think

Having a debt-to-income (DTI) ratio of 17% is actually considered excellent by most financial standards. But what does this number really mean for your financial health? And why should you care? Let’s dive into this important financial metric that many folks overlook until they’re applying for a major loan.

As someone who’s worked with financial numbers for years, I can tell you that understanding your DTI is just as crucial as knowing your credit score when it comes to managing your money effectively. According to the 2024 Wells Fargo Money Study, more than 40% of Americans are actively seeking ways to overcome debt – and DTI knowledge is a powerful tool in that battle.

What Exactly Is a DTI Ratio?

Your debt-to-income ratio is basically a percentage that shows how much of your monthly income goes toward paying debts. It’s a simple calculation that gives lenders (and you!) a quick snapshot of your financial situation.

The formula looks like this:

Total Monthly Debt Payments ÷ Gross Monthly Income = DTI Ratio

For example, if your monthly debt payments equal $850 and your monthly income is $5,000, your DTI would be 17% (850 ÷ 5,000 = 0.17 or 17%).

Is 17% DTI Good? Absolutely!

According to Wells Fargo’s standards

- 35% or less: Looking Good – Your debt is at a manageable level relative to your income

- 36% to 49%: Opportunity to improve – You’re managing adequately but could benefit from lowering your DTI

- 50% or more: Take Action – With more than half your income going to debt, you have limited funds for saving or unexpected expenses

So at 17%, you’re well within the “Looking Good” category! You’ve positioned yourself in a place where most lenders would view your financial situation very favorably.

The Benefits of Having a 17% DTI Ratio

With a DTI ratio of just 17%. you’re experiencing several advantages

- Strong borrowing power – Lenders will see you as low-risk, potentially qualifying you for better interest rates

- Financial flexibility – You likely have money left after paying debts for saving, investing, or enjoying life

- Peace of mind – You’re better positioned to handle unexpected expenses without going further into debt

- Room for major purchases – If you want to buy a home or car, you have capacity to take on that additional debt

How Your 17% DTI Compares to National Averages

The average American has a DTI ratio that hovers around 36-43%, depending on which studies you look at. This means with your 17% ratio, you’re doing significantly better than most people! You’re managing your debt in a way that keeps it proportionally low compared to your income.

Breaking Down What Goes Into DTI Calculations

When calculating your debt-to-income ratio, remember to include:

- Mortgage or rent payments

- Car loans

- Student loans

- Personal loans

- Credit card minimum payments

- Child support or alimony

- Any other regular debt obligations

What’s NOT included:

- Utilities

- Food costs

- Insurance premiums (except those included in mortgage payments)

- Healthcare expenses

- Taxes (beyond those withheld from paychecks)

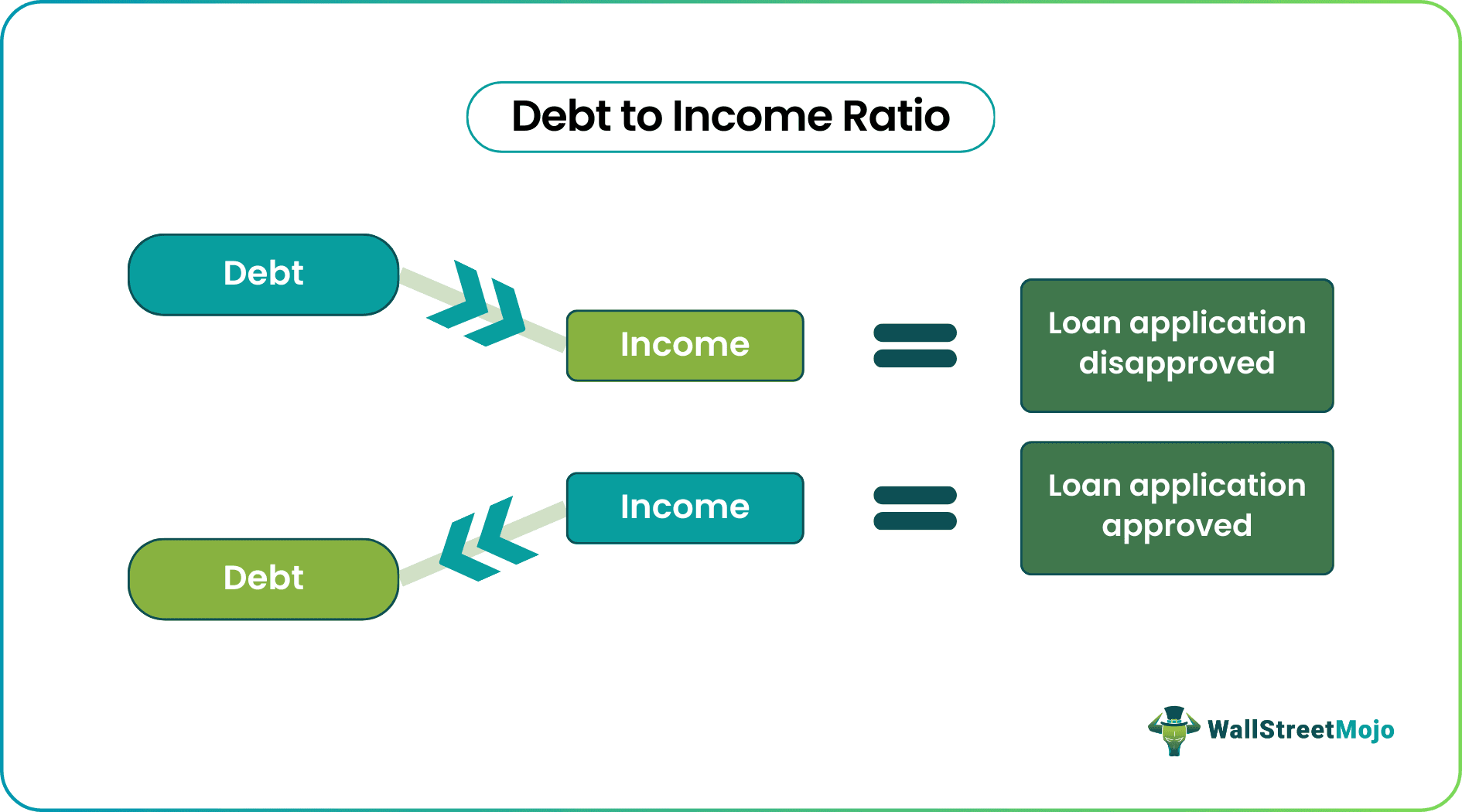

Why Lenders Care About Your DTI Ratio

When you apply for credit, lenders look at your DTI ratio to evaluate risk. A lower ratio (like your 17%) suggests you have a good balance between debt and income and are likely to have sufficient funds to make regular loan payments.

Even with perfect credit, a high DTI ratio could lead to loan rejections because it indicates you might be stretched too thin financially. Your low ratio gives lenders confidence in your ability to handle additional debt responsibly.

Could a 17% DTI Ratio Ever Be Too Low?

This might sound weird, but sometimes having too little debt can actually be suboptimal for your credit profile. Having some debt that you manage responsibly helps build your credit history. If you have no debt whatsoever, lenders have less information about how you handle financial obligations.

However, at 17%, you’re in that sweet spot where you have enough debt to demonstrate responsible credit management without being overburdened.

Strategies to Maintain Your Excellent DTI Ratio

To keep your ratio healthy:

- Pay off debts consistently – Continue making regular payments on time

- Avoid taking on unnecessary new debt – Just because you qualify doesn’t mean you should borrow

- Increase your income when possible – This lowers your DTI without reducing debt

- Use windfall money strategically – Consider applying bonuses or tax refunds to high-interest debt

- Monitor your DTI regularly – Recalculate it whenever your debt or income changes significantly

How Your 17% DTI Affects Different Types of Loans

Mortgage Loans

For conventional mortgages, lenders typically prefer a DTI under 36%, with no more than 28% going toward housing. With your 17% ratio, you’re well-positioned for mortgage approval, potentially qualifying for better rates and larger loan amounts.

Auto Loans

Auto lenders typically look for DTI ratios under 40%. Your 17% gives you substantial room to take on an auto loan while maintaining a healthy overall financial picture.

Personal Loans

Most personal loan lenders prefer DTIs below 36%. Your 17% ratio makes you an ideal candidate, likely qualifying you for the best rates available.

Real-World Scenario: How a 17% DTI Gives You Options

Let’s say you earn $6,000 monthly and have current debt payments of $1,020 (17% DTI).

If you wanted to buy a home, most lenders would be comfortable with your total DTI rising to about 36%. This means you could potentially take on an additional $1,140 in monthly mortgage payments while still being in a healthy financial position.

This gives you significantly more buying power than someone already at a 35% DTI ratio, who would have much less room to take on housing debt.

Common Questions About Low DTI Ratios

“Should I pay off all my debt to get to 0% DTI?”

Not necessarily! Having a low but existing DTI demonstrates you can handle credit responsibly. Plus, paying off certain low-interest debts might not be as beneficial as investing that money instead.

“Will my DTI affect my credit score?”

DTI doesn’t directly impact your credit score, but they’re related. High debt levels can lead to higher credit utilization, which does affect your score.

“How often should I calculate my DTI?”

I recommend checking it quarterly or whenever you experience a significant change in income or debt load.

“Can my DTI be too low?”

From a pure financial stability perspective, lower is generally better. However, having no debt history can make it harder to qualify for certain loans due to limited credit history.

Warning Signs Even With a Low DTI Ratio

Even with your excellent 17% ratio, watch for these warning signs that could indicate future financial troubles:

- Regularly making only minimum payments on credit cards

- Feeling stressed about bills despite your low DTI

- Using one form of credit to pay off another

- Seeing your DTI trend upward consistently

- Having no emergency savings despite low debt payments

When a 17% DTI Might Not Tell the Whole Story

While your DTI is excellent, it’s important to remember it’s just one financial metric. Other factors to consider include:

- Credit score – Even with low DTI, a poor score can affect lending decisions

- Savings rate – Are you using your available income to build savings?

- Income stability – Regular, predictable income is viewed more favorably

- Asset levels – Having assets provides additional financial security

The Bottom Line: Your 17% DTI is Fantastic!

A 17% debt-to-income ratio puts you in an enviable financial position that most Americans would love to achieve. You’ve managed to keep your debt obligations proportionally low compared to your income, giving you financial flexibility and strong borrowing power.

This doesn’t mean you should rush out and take on more debt just because you can! Instead, consider using this financial advantage to build wealth through saving and investing, while maintaining the responsible debt management that got you to this excellent position.

Remember that financial health is about balance – and your 17% DTI suggests you’ve found a great one between managing some debt while keeping plenty of your income free for other financial goals.

I’ve been working with clients on improving their DTI ratios for years, and honestly, when someone comes in with a 17% ratio, there’s not much “fixing” to do – just maintenance and smart planning for the future!

What financial goals are you considering now that you know your DTI ratio is in such great shape?