No matter what stage of life youre in, one thing will always remain the same: Its never too late â or too early â to save money.Â

Let’s be real – when I was 23, I was more concerned with happy hour specials than retirement accounts. But looking back, I wish someone had given me the financial wake-up call I’m about to give you. Your 20s are actually the financial sweet spot where small savings can turn into MAJOR money later on. So how much should you actually have saved by 23? Let’s break it down.

The Hard Truth About Average Savings in Your Early 20s

According to the Federal Reserve Board’s 2022 Survey of Consumer Finances, the average American under 35 has about $20,540 in savings. But that’s a pretty broad age range! At 23 specifically, you’re likely on the lower end of that spectrum.

Truth is, there isn’t a magic number that works for everyone. Your savings goals should connect to YOUR lifestyle and situation. Are you drowning in student loans? Just started your first “real” job? Still living with parents? Each situation demands different savings strategies.

The 50/30/20 Budget Framework for 23-Year-Olds

One popular approach is the 50/30/20 budget framework

- 50% of your income goes to needs (rent, groceries, etc.)

- 30% goes to wants (dining out, entertainment)

- 20% goes to savings and debt repayment

Looking at the median monthly salary for 20-24 year olds ($3,136), here’s what that would look like:

| Category | Percentage | Monthly Amount |

|---|---|---|

| Needs | 50% | $1,568 |

| Wants | 30% | $941 |

| Savings | 20% | $627 |

So ideally, you’d be saving around $627 per month. That’s about $7,524 per year! But if that number makes you laugh nervously, don’t worry – many 23-year-olds aren’t hitting this target.

Emergency Fund: Your First Savings Priority

Before dreaming about retirement or vacation funds, you need an emergency fund. This is non-negotiable! According to the data, people under 25 have average monthly expenses of $4,130

That means your emergency fund targets should be:

- Minimum goal: 3 months of expenses = $12,390

- Ideal goal: 6 months of expenses = $24,780

I know those numbers seem HUGE when you’re 23. But this is a goal to work towards, not something you need immediately!

Retirement Savings: Starting Early is Your Secret Weapon

Even though retirement feels like a million years away at 23, this is literally THE BEST time to start saving for it. Why? Two words: compound interest.

By age 30, the general recommendation is to have 1x your annual income saved for retirement. If you start at 23, you’ve got 7 years to build toward that goal.

Check out how powerful early saving can be:

Someone who starts saving 15% of their income at age 25 could have $1,730,857 by age 65! But if they wait until 35, that drops to $884,187. That’s nearly HALF the money for just waiting 10 years!

Practical Savings Goals for 23-Year-Olds

Based on all this data, here’s what I think are reasonable targets for most 23-year-olds:

- Short-term emergency fund: $1,000-$5,000 (enough to cover a car repair or medical emergency)

- Progress toward full emergency fund: Working toward 3-6 months of expenses

- Beginning retirement contributions: At least enough to get any employer match in your 401(k)

If you’ve got those three things going, you’re already ahead of many people your age!

How to Actually Build Your Savings at 23

Here’s some real talk about how to save when you’re young and probably not making much money:

1. Automate Everything

Set up automatic transfers to your savings account the day after payday. You can’t spend what you don’t see! Even $50 per paycheck adds up.

2. Take Full Advantage of Your Employer Benefits

If your job offers a 401(k) match, contribute at least enough to get the full match. It’s literally free money!

3. Use Savings Buckets

Ally Bank and other financial institutions offer “buckets” within savings accounts so you can organize your money by goal without opening multiple accounts. This makes it easier to track progress toward specific targets.

4. Boost Your Income

In your early 20s, your earning potential is your biggest asset. Consider:

- Asking for a raise

- Taking on a side hustle

- Learning new skills to increase your value

5. Celebrate Small Wins

Saved your first $1,000? That’s huge! Treat yourself (reasonably) when you hit milestones.

What If You’re Starting From Zero at 23?

Maybe you’re reading this and thinking “I have literally zero saved and I’m already 23!” First, take a deep breath – you’re still SO young. Second, here’s a simple starter plan:

Month 1-3: Save $500-1,000 as a mini emergency fund

Month 4-12: Start contributing 1-5% to retirement while building your emergency fund

Year 2: Increase retirement contributions to 10-15% if possible

Why Your 20s Are So Critical for Saving

Your 20s are a financial superpower because of time. The money you save now has decades to grow before you need it in retirement.

Let’s look at an example: If you save $100 per month starting at age 23, with an average 7% return, you’ll have about $219,000 by age 65. If you wait until 33 to start, you’ll need to save $200 per month to reach the same goal!

Don’t Forget Balance – You’re Only 23 Once!

While saving is important, don’t sacrifice all your experiences just to hit a savings number. Your 20s are also about building memories, trying new things, and figuring out who you are.

Find the balance that works for YOU. Maybe that means saving 15% instead of 20%, or building your emergency fund more slowly so you can still travel occasionally. That’s ok!

My Personal Experience

When I was 23, I had about $800 in savings and thought I was doing great. Looking back, I wish I’d started putting even $50/month into a retirement account. Those early contributions would be worth so much more now!

But I also don’t regret some of the experiences I spent money on. The key is finding balance – save enough to set yourself up for success, but not so much that you’re not enjoying your youth.

The Bottom Line: A Realistic Savings Target at 23

If I had to give one target number for a 23-year-old, I’d say aim to have $5,000-$10,000 saved by your 24th birthday. This gives you a solid start on an emergency fund while being an achievable goal for most young professionals.

Remember, the most important thing isn’t the exact dollar amount – it’s establishing good savings habits that will serve you for decades to come. Start where you are, save what you can, and consistently work toward building your financial security.

Your future self will thank you!

What are your biggest challenges when it comes to saving in your early 20s? Have you started saving for retirement yet? I’d love to hear your experiences in the comments!

How much do you need to save in your 20s?

Your 20s is the time to set strong savings habits. Using the 50/30/20 model, you could aim to save upward of $500 every month (or as much as you can). Saving where and when you can and being strategic with windfalls (such as a bonus), and dedicating additional income (like an annual raise) can help you work toward this goal.Â

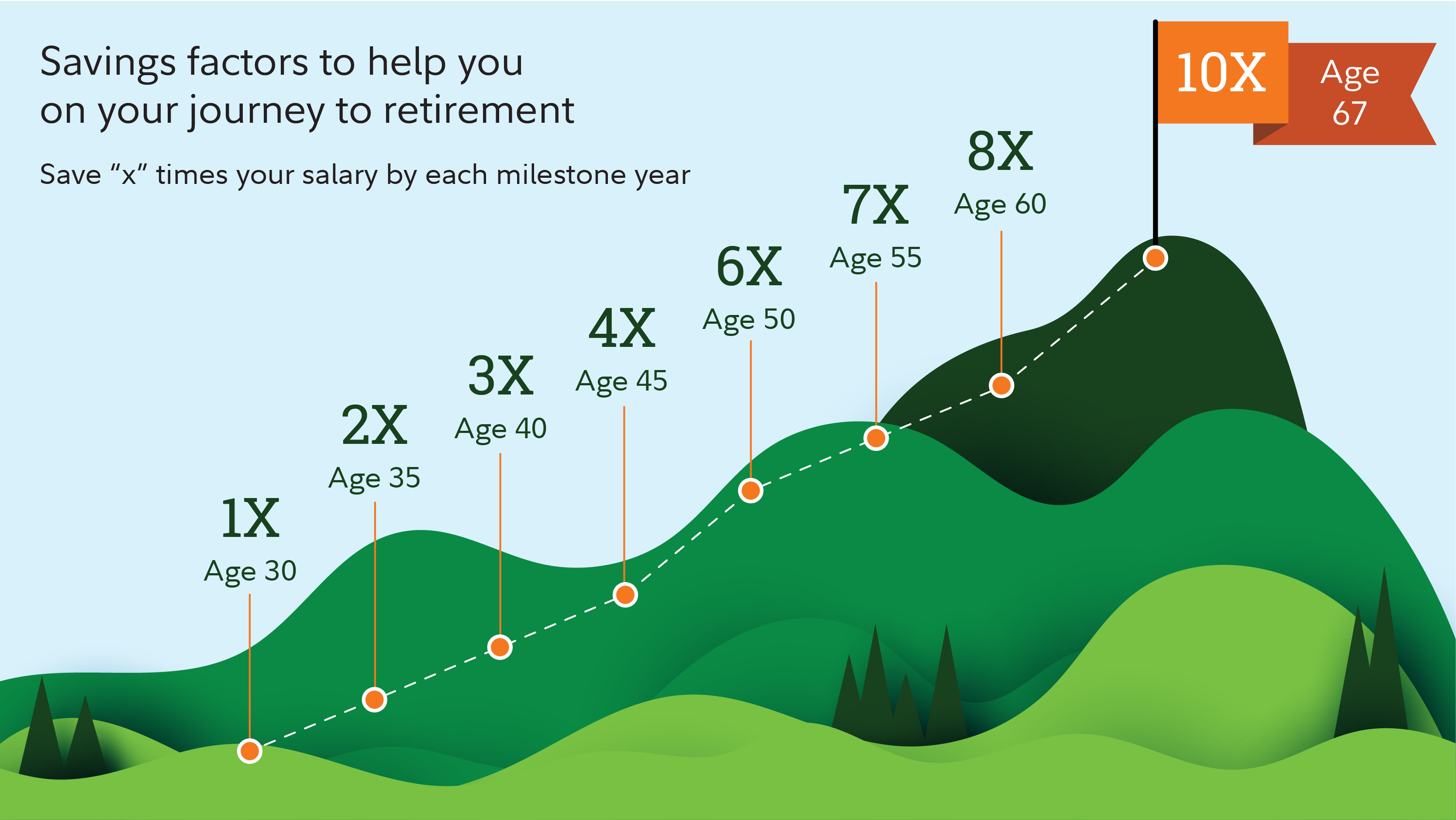

Retirement savings goal by age

|

ââBy age |

âYou should aim to saveâ¦Â |

|---|---|

|

â30Â |

â1x your income |

|

â40Â |

â3x your income |

|

â50Â |

â5x your income |

|

â60 Â |

â7x your income |

Keep in mind the above is a guide. The amount you should save for retirement will depend on:

- Your income

- Your planned retirement age

- The kind of lifestyle you want to have in retirement

One way to make the most of your retirement savings is to start by investing 5% to 15% of your paychecks in a tax-advantaged retirement account like a traditional or Roth IRA or a 401(k) until retirement.Â

I’m 23, How Should I Be Investing?

FAQ

How much should a 23 year old have in their savings account?

Aim to have three-to-six months’ worth of expenses set aside. To figure out how much you should have saved for emergencies, multiply the amount of money you spend each month on expenses by either three or six months to get your target goal amount.

At what age should I have $100,000 saved?

How much money should I be making as a 23 year old?

The median salary of 20- to 24-year-olds is $784 per week, which translates to $40,768 per year. Many Americans start out their careers in their 20s and don’t earn as much as they will once they reach their 30s.

What is a good amount of money to have saved in your 20s?

In your 20s, financial experts often recommend saving at least 20% of your income. However, the exact amount you should save depends on your individual financial goals, lifestyle, and expenses.