Most of us know we need to save for our future – but how much is enough?

There are several ways you can answer that question. You might want to know the amounts you need to be setting aside now to achieve financial security in the future. Or it might be more useful to know the size of the savings pot you need as a proportion of your earnings. Some people want to know how their savings compare to other people their age.

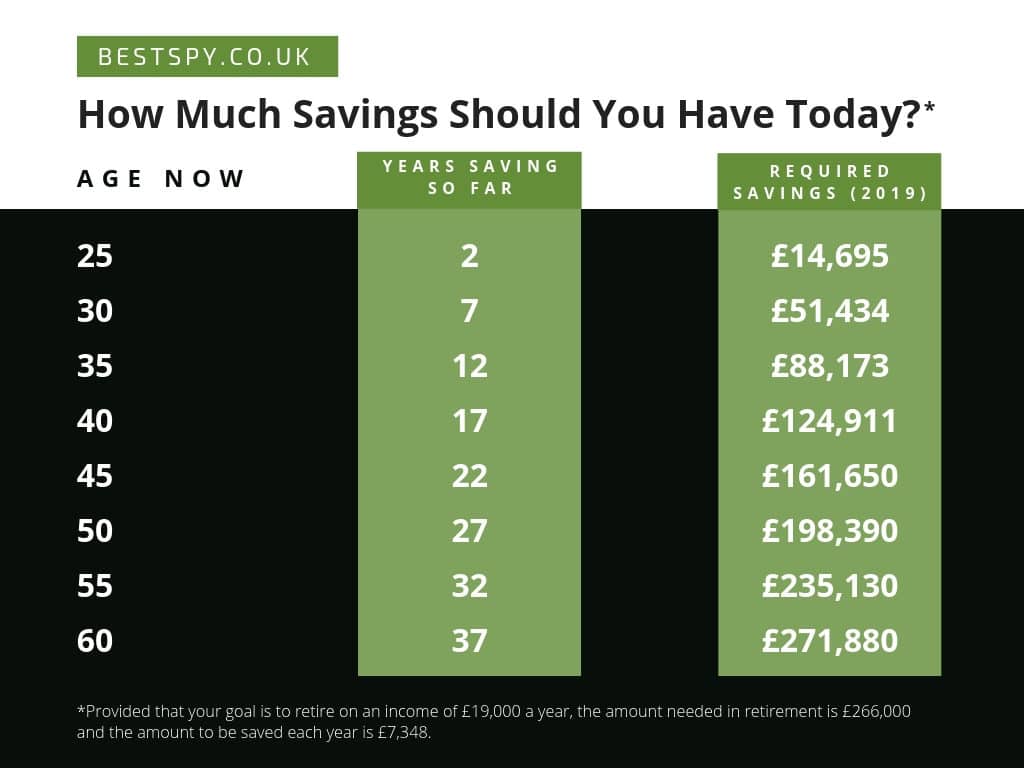

All of these can be useful in understanding how your saving is progressing. Here we lay out that information so you can see the savings landmarks you might need hit at some of your key life stages:

Remember – targets like these can sometimes appear hard to reach, particularly if you’ve delayed your savings to prioritise other things. That’s OK – it’s still useful to understand them and gauge your progress. Even if you feel you’re behind on your saving there is almost always something you can do to improve the picture.

Note: The calculations are based on assumptions, which may not reflect actual outcome, so members (you) should not rely on them for their (your) retirement planning. Additionally, Retirement Guidelines are based on different assumptions to the figures given for the target of £50k income.

Let’s be honest – reaching 50 can be a bit of a wake-up call when it comes to your finances. You’re probably thinking, “Do I have enough saved?” or “Am I on track for retirement?” I’ve been researching this topic extensively, and I want to share what I’ve learned about savings targets for 50-year-olds in the UK.

The Quick Answer: Savings Targets at 50

According to Fidelity’s retirement savings guidelines by age 50 you should aim to have four times your annual salary saved. So if you’re earning £60,000, your target would be £240,000 in savings. This includes money both inside and outside of pensions.

But don’t panic if you’re not there yet! These are guidelines, not strict rules and there’s still time to boost your savings.

How Do Your Savings Compare to the UK Average?

Sometimes it helps to know where you stand compared to others According to government statistics for the 45-54 age group

- The average held in ISAs is £25,362

- The median amount held in pensions is £80,000

Remember, these figures only include people who actually have ISAs and pensions. Many people don’t have either, so the true average across the entire population would be lower.

What If You Want a £50,000 Annual Retirement Income?

If you’re aiming high and want a retirement income of £50,000 per year, Fidelity’s calculations suggest you’d need:

- £357,567 in savings by age 50

- To be contributing £809 per month, increasing by 2% each year

- This assumes 5% investment growth after fees

This is definitely an ambitious target that most people won’t reach, but it gives you something to aim for.

Why Saving Becomes More Important in Your 50s

Your 50s can be a crucial decade for retirement saving. Here’s why:

- You’re likely in your peak earning years

- Some financial burdens (like mortgages or raising children) might be easing

- There’s still enough time to significantly impact your retirement pot

- Your investment horizon is getting shorter, so having adequate savings becomes more critical

It’s Not Just About Pensions

When we talk about “savings” at 50, we’re not just talking about pensions. Your financial position should include:

- Workplace and private pensions

- ISAs and other tax-efficient savings

- Other investments

- Property equity

- Emergency funds

Having a diverse mix of savings vehicles gives you more flexibility for the future.

What If You’re Behind on Savings at 50?

First, don’t panic! Many people find themselves playing catch-up with their savings in their 50s. Here are some practical steps you can take:

1. Maximize Pension Contributions

Your 50s are often your highest-earning years, making it the perfect time to increase pension contributions. Plus, you’ll benefit from tax relief on those contributions.

2. Take Advantage of Catch-Up Strategies

- Consider working a few more years beyond your planned retirement age

- Look at downsizing your home to release equity

- Review your investment strategy to ensure it matches your time horizon

3. Be Realistic About Your Retirement Lifestyle

You might need to adjust your expectations about retirement. Maybe you’ll need to work part-time for a few years or reduce your planned spending.

Case Study: Getting on Track in Your 50s

Let’s look at a realistic example:

Sarah is 50 and has £100,000 in pension savings – well below the 4x salary guideline. She earns £45,000, so ideally should have £180,000 saved. She decides to:

- Increase her monthly pension contributions from 8% to 15% of salary

- Work until 67 instead of 65

- Put an annual bonus of £3,000 directly into her pension

With these changes, she could potentially reach around £350,000 by retirement – a much healthier position.

Factors That Affect How Much You Need

Everyone’s circumstances are different. Consider these factors when evaluating your own position:

- Health – Any conditions that might affect your working life or future care needs?

- Property – Do you own your home? Could downsizing be an option?

- Family situation – Might you need to support adult children or elderly parents?

- Debt – Are you still paying off a mortgage or other significant debts?

- Retirement age – When do you actually plan to stop working?

My Personal Take

I’ve talked to many financial advisors about this topic, and they all say the same thing: there’s no one-size-fits-all answer. The 4x salary guideline is useful, but your personal circumstances matter more.

What’s most important is that you take stock now, at 50, while you still have time to make meaningful changes. Even if you’re behind, small improvements to your saving habits can make a big difference over the next 10-15 years.

A Simple Action Plan for Your 50s

If you’re reading this and feeling a bit overwhelmed, here’s a simple plan:

- Check your current position – Add up all your pension pots, ISAs, and other investments

- Calculate your gap – Compare to the 4x salary guideline

- Review your pension contributions – Are you maximizing tax relief?

- Consider consolidating pensions – Could you benefit from combining old workplace pensions?

- Get professional advice – A financial advisor can help you create a personalized plan

Pension vs. ISA: Where Should You Focus?

At 50, both have advantages:

| Pensions | ISAs |

|---|---|

| Tax relief on contributions | Flexible access at any age |

| 25% tax-free lump sum at retirement | All withdrawals tax-free |

| Employer contributions (workplace pensions) | Simple to set up and manage |

| Less accessible until retirement age | Can be used for pre-retirement goals |

Ideally, you’d contribute to both, but if your retirement savings need a boost, prioritizing pension contributions often makes sense due to the tax advantages.

Practical Savings Tips for Your 50s

• Review all your outgoings and cut unnecessary expenses

• Set up automatic increases to your pension contributions

• Consider salary sacrifice arrangements if your employer offers them

• Don’t take excessive investment risk at this age – you have less time to recover from market downturns

• Check if you have any unused pension allowance from previous years

• Review your State Pension forecast to see what you’ll get

The Bottom Line

At 50, the ideal savings position in the UK is around four times your annual salary. But don’t be disheartened if you’re not there yet – you’re definitely not alone, and there’s still time to improve your situation.

The most important thing is to take action now rather than putting it off. Even small improvements to your saving habits can make a significant difference over the next decade or so.

And remember – these are guidelines based on averages. Your personal situation, goals, and plans for retirement will ultimately determine what’s “enough” for you.

Have you checked your pension statements recently? If not, that might be your first step toward taking control of your financial future.

How do you compare?

The government publishes statistics of levels of saving by age. Specifically, these cover the money held by individuals in ISAs and pensions. The most recent figures cover the period up to 2022.

The statistics group people in age bands. For the 25-34 age group, the average held in ISAs is £9,4772, while the median amount held in pensions is £18,8003.

Note – these figures are the averages among people who have ISA and pension savings – there are a great many people without these, so the averages including those people would be far lower.

How much should you have saved by 50?

By age 50 you should be able to tell what kind of shape your finances are for the future and your eventual retirement. Hopefully with plenty of time still left to earn money and pay into savings, and with some of life’s financial burdens perhaps easing, these are the years when saving can accelerate.

How Much To Save For RETIREMENT in 20s, 30s, 40s and 50s | Retirement Pot Size

FAQ

What is the average savings for a 50 year old in the UK?

| Average savings | % with £100 or less in savings | |

|---|---|---|

| 25 to 34 | £3,544.16 | 21.78% |

| 35 to 44 | £5,995.92 | 12.99% |

| 45 to 54 | £11,013.99 | 11.22% |

| 55 and over | £20,028.60 | 7.59% |

How many Americans have $100,000 in savings?

How much money should a 50 year old have in the bank?

So, if you’re 50, you should be saving 3.5 to 5.5 times your salary for retirement.Jun 26, 2025

Can I retire at 50 with $500,000?

You can retire at 50 with $500,000; however, it will require careful planning and budgeting. As the table above shows, if you have an annual income of either $20,000 or $30,000, you can expect your $500,000 to last for over 30 years. This means you will run out of retirement savings in your 80s.