Hey there, friend! So, you’ve got a 700 credit score, and you’re wonderin’ how much of a car loan you can snag with that number. Well, I’m here to lay it out for ya straight—no fluff, just the real deal. A 700 score is pretty darn good, sittin’ comfy in the “prime” borrower zone, which means you’re likely to qualify for a solid car loan with decent terms. But, and this is a big ol’ but, the exact amount ain’t just about that score. Lenders peek at your income, your debts, and a bunch of other stuff before handin’ over the cash for that shiny new ride.

In this guide we’re gonna dive deep into what a 700 credit score means for your car loan dreams, what factors play a role in decidin’ how much you can borrow and how to boost your chances of gettin’ the best deal possible. Stick with me, and let’s roll through this together!

What Does a 700 Credit Score Even Mean?

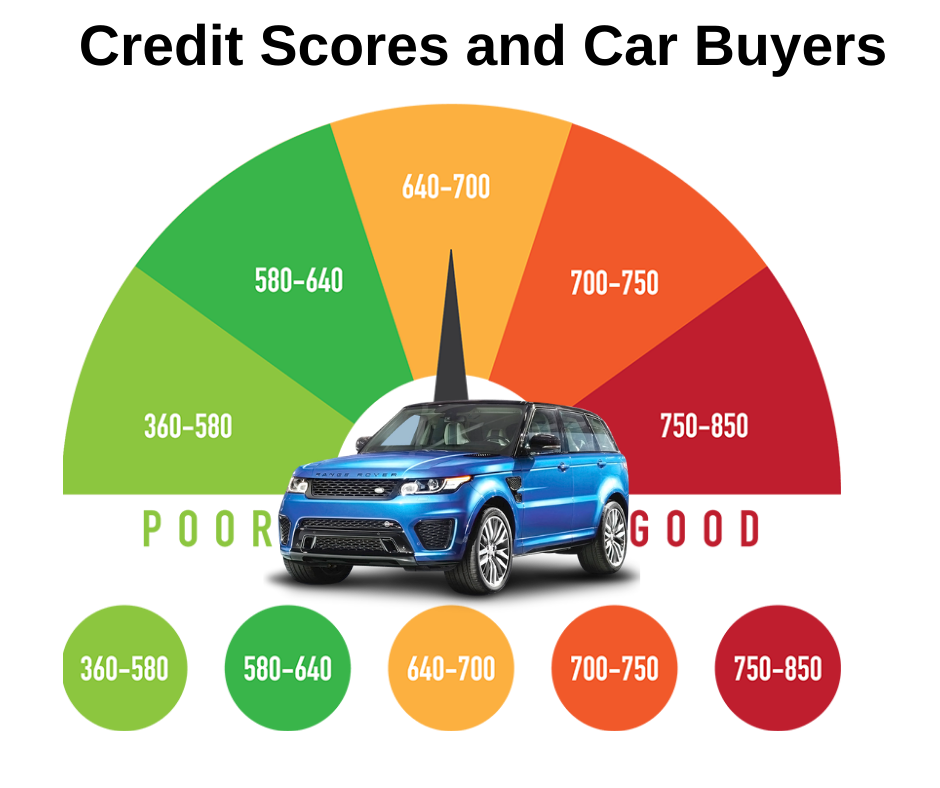

First off let’s chat about where a 700 stands in the grand scheme of credit scores. Most scoring models like the FICO one, range from 300 to 850. Here’s the quick breakdown of the bands

- Very Poor: 300-579 (Yikes, tough spot)

- Fair: 580-669 (Gettin’ there, but still shaky)

- Good: 670-739 (Hey, that’s you at 700! Solid ground)

- Very Good: 740-799 (Almost top-tier)

- Exceptional: 800-850 (The credit gods)

So, with a 700, you’re in the “good” category, often called a “prime” borrower. That means lenders see ya as less likely to miss payments or default compared to folks with lower scores. For a car loan, this is a great startin’ point—you’re probably above the minimum score most lenders want, so your application ain’t likely to get tossed out the window right off the bat.

But here’s the kicker: while 700 is good, it ain’t the best. Folks with scores of 760 or higher often get the sweetest interest rates and terms. You’re in a strong spot, but there’s room to climb if ya want the absolute best deals on that car loan.

How Much Car Loan Can You Get With a 700 Score?

Now, let’s get to the meat of it—how much can you actually borrow for a car with that 700 credit score? Truth be told, there ain’t a magic number I can slap on here ‘cause it depends on a lotta factors (more on that in a sec). But generally, a score of 700 should qualify ya for a decent-sized car loan, likely enough for a mid-range vehicle, dependin’ on your financials.

With a good score like yours, lenders are more willing to approve you for loans compared to someone with a fair or poor score. You might be lookin’ at loan amounts that cover a car priced between $20,000 to $40,000, assumin’ your income and other details check out. Interest rates could be reasonable too, probably in the range of 4-6% for a new car loan, though that’s just a ballpark based on what I’ve seen floatin’ around. Used cars might bump that rate up a bit.

But hold up—don’t go dreamin’ of a fancy sports car just yet. The loan amount and terms ain’t set in stone by your credit score alone. Lenders got a whole checklist they run through before decidin’ how much dough to hand over.

What Else Affects Your Car Loan Amount?

Your credit score is a big player, sure, but it ain’t the only one on the field. When you apply for a car loan, lenders take a good hard look at your overall money situation. Here’s what they’re eyeballin’ besides that 700 score:

- Your Income: How much you makin’ each month? Lenders wanna know if you got the cash flow to cover loan payments on top of your other bills. If your income is steady and decent, you could borrow more. If it’s low or spotty, they might cap the loan amount, even with a good score.

- Debt-to-Income Ratio (DTI): This fancy term just means how much of your income is already goin’ to debt payments. If you’re shellin’ out half your paycheck to credit cards or other loans, lenders might hesitate to pile on a big car loan. They usually like seein’ a DTI below 40-45% after the new loan.

- Loan Purpose: Since we’re talkin’ car loans, this is straightforward—it’s for buyin’ a vehicle. But the type of car (new vs. used) and its value matter. Lenders might be more generous with a new car ‘cause it’s worth more as collateral.

- Collateral Value: Speakin’ of collateral, a car loan is usually secured, meanin’ the car itself backs the loan. If you default, they take the car. So, the loan amount often ties to the car’s value—they won’t lend you $50,000 for a $20,000 beater.

- Your History with the Lender: If you’ve borrowed from ‘em before and paid on time, they might cut ya some slack or offer better terms. If you’ve got a rocky past, even a 700 score might not save ya.

- Economic Conditions: Sometimes, bigger stuff like interest rates set by the government or the lender’s own goals can tweak how much they’re willin’ to lend. Ain’t much you can control here, but it’s a factor.

So yeah, even if your score is a shiny 700, a low income or high DTI could shrink the loan amount. I’ve seen folks with great scores get turned down for big loans ‘cause their finances didn’t line up. It’s all about the full picture, ya know?

How Interest Rates Play Into This Mess

Let’s talk rates for a hot minute. Your credit score has a big say in the interest rate you get on a car loan, which affects how much you can afford to borrow. With a 700 score, you’re likely to get a better rate than someone with a 600, but not as sweet as someone rockin’ a 780 or higher.

A lower interest rate means lower monthly payments, so you could borrow more without breakin’ the bank. For example, a $30,000 loan at 4% over 5 years is way easier to handle than the same loan at 8%. With a 700, you might land in the middle—decent rates, but not the rock-bottom ones reserved for the top-tier scores. That’s somethin’ to keep in mind when figurin’ out your budget for a car.

Steps to Figure Out Your Car Loan Potential

Alright, now that we got the basics down, let’s walk through how you can figure out what kinda car loan you might get with that 700 score. I’ve been down this road myself, so here’s my no-nonsense guide:

- Check Your Full Financial Picture: Before you even think about applyin’, take stock of your income, monthly expenses, and existin’ debts. Calculate your DTI—add up all your monthly debt payments and divide by your monthly income. If it’s high, you might wanna pay down some debt first.

- Set a Realistic Budget: Decide how much you can afford to pay each month for a car loan. Don’t just guess—factor in insurance, gas, and maintenance too. Then, use an online loan calculator to see what loan amount fits that payment at a realistic interest rate (say, 5% for a 700 score).

- Shop Around for Lenders: Don’t just waltz into the first dealership or bank. Check with multiple lenders—banks, credit unions, online options. Some might offer better terms for your score than others. Plus, credit unions often got lower rates if you’re a member.

- Get Prequalified: This is a game-changer. Prequalifyin’ lets you see what loan amounts and rates you might get without a hard hit to your credit score. It’s like test-drivin’ your loan options. Most lenders do a soft check for this, which don’t hurt your score a bit.

- Pick the Right Car: Once you know your loan range, match it to a car. If lenders are offerin’ $25,000, don’t be eyein’ a $40,000 SUV unless you got cash to cover the gap. Stick to what fits the loan and your budget.

- Negotiate Like a Pro: When you’re at the dealership or finalizin’ with a lender, don’t just take the first offer. Haggle on the car price, the loan terms, even the interest rate if ya can. A 700 score gives ya some leverage—use it!

I remember when I was huntin’ for my last car, I got prequalified and knew exactly what I could borrow. Made the whole process less of a headache, lemme tell ya.

Tips to Boost Your Chances of a Bigger Loan

Wanna push for a higher car loan amount or better terms with that 700 score? Here’s a few tricks up my sleeve to help ya out:

- Keep Payin’ Bills on Time: Late payments can ding your score, even if it’s just one. Stay on top of every bill—set reminders if ya gotta. On-time payments show lenders you’re reliable.

- Lower Your Debt Load: If your DTI is creepin’ up, pay down credit card balances or other loans before applyin’ for the car loan. The less debt you’re jugglin’, the more lenders trust ya with a bigger loan.

- Save for a Bigger Down Payment: Got some extra cash? Put it toward a down payment. The more you put down, the less you gotta borrow, which can make lenders more comfy givin’ ya the green light. Plus, it lowers your monthly payments.

- Bump Up That Score a Lil’ More: A 700 is good, but pushin’ to 740 or higher could snag ya better rates. Pay down credit card balances to lower your utilization (keep it under 30% of your limit) and avoid new credit applications for now.

- Consider a Co-Signer: If your income or debt situation ain’t ideal, bringin’ in a co-signer with strong credit or income can boost your odds of a bigger loan. Just make sure they know the risks—they’re on the hook if ya can’t pay.

We’ve used some of these ourselves at times, and trust me, even small moves like payin’ down a card can make a difference when you’re talkin’ to lenders.

What If You Don’t Get the Loan Amount You Want?

Sometimes, even with a 700 score, you might not get approved for as much as you hoped. Don’t sweat it too much—there’s ways to work around it. Maybe your income ain’t high enough, or your debt load is scarin’ lenders off. Here’s what to do:

- Look at Cheaper Cars: Scale back on the car price. A used vehicle or a less fancy model might fit the smaller loan amount better. You can still get a reliable ride without breakin’ the bank.

- Work on Your Finances: Take a few months to boost income or cut debt. Then reapply. Lenders like seein’ improvement, even if it’s gradual.

- Try Different Lenders: Not all lenders got the same rules. If one says no or offers a low amount, another might be more generous. Don’t give up after one rejection.

- Ask for Feedback: Some lenders will tell ya why the loan amount was lower than expected. Use that info to fix whatever’s holdin’ ya back.

I’ve been there, thinkin’ I’d get a big loan only to get offered half. It’s frustratin’, but adjustin’ my plan got me rollin’ in a car I could afford.

Common Mistakes to Dodge When Applyin’ for a Car Loan

Real quick, let’s cover some slip-ups I see folks make when chasin’ a car loan with a score like 700. Avoid these, and you’ll save yourself a lotta grief:

- Applyin’ Everywhere at Once: Every hard application can ding your score a bit. Stick to prequalification first to narrow it down before goin’ all in.

- Ignorin’ Your Budget: Don’t borrow the max just ‘cause ya can. Make sure the monthly payment don’t strangle your wallet.

- Skippin’ the Fine Print: Read the loan terms. Hidden fees or a funky interest rate can sneak up on ya if you ain’t careful.

- Not Shoppin’ Around: Dealership financin’ might be easy, but it ain’t always the best rate. Check banks and credit unions too.

We’ve dodged a bullet or two by double-checkin’ stuff before signin’ anything. Learn from my near-misses, alright?

Wrappin’ It Up: Your Next Steps

So, how much of a car loan can you get with a 700 credit score? It’s a solid score that’ll likely get ya approved for a decent loan—think enough for a practical, mid-range car—but the exact amount depends on your income, debts, and other bits of your financial life. You’re in a good spot to start shoppin’ for that vehicle, but remember, lenders look at more than just that three-digit number.

Take a minute to review your finances, get prequalified with a few lenders, and set a budget that don’t leave ya broke. Push for the best terms by keepin’ your debt low and payments on time. And hey, if the loan amount ain’t what you pictured, tweak your plan or car choice till it fits.

I’m rootin’ for ya to drive off in a car you love without the stress of crazy payments. Got questions or need more tips? Drop ‘em below, and let’s keep this convo goin’! For now, get out there and start crunchin’ those numbers to make your car dreams real.“`

.png)

Find the right auto financing for you.

You can shop with confidence when you start with an auto financing pre-approval.

You could lower your monthly payment or pay off your loan sooner while keeping the vehicle you love.

Take the next step.

Shop for cars or apply for pre-approval so you know what you can spend at a participating dealership.

What Car Can I Get With a 700 Credit Score? – CreditGuide360.com

FAQ

How much loan can I get with a 700 credit score?

How much would a $70,000 car payment be?

For a $70,000 vehicle, assuming a $10,000 down payment, 5% interest, and 72 months, your payment would be approximately $967 per month.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

What credit score do you need for an $50,000 car loan?

… to get an auto loan with nearly any credit score, most lenders are looking for buyers in the prime credit score range with a credit score of 661 or above …Mar 31, 2025