While its possible to get an auto loan with nearly any credit score, most lenders are looking for buyers in the prime credit score range with a credit score of 661 or above for the best terms and rates.

Theres no minimum credit score required to get an auto loan. However, a credit score of 661 or aboveâconsidered a prime VantageScore® credit scoreâwill generally improve your chances of getting approved with favorable terms. For the FICO® ScoreÎ, a good credit score is 670 or higher.

Heres what you need to know about how your credit score affects a car loan, what credit score you need to get approved and other things to consider before applying.

Your credit score is one of the most important factors lenders consider when approving you for a car loan. The higher your score, the better interest rate and loan terms you can qualify for. So if you’re wondering how much car loan you can get approved for with a 670 credit score, this article will explain everything you need to know.

What is Considered a Good Credit Score?

Before we dive into what you can expect with a 670 credit score, let’s first understand credit score ranges The most commonly used credit scoring models are FICO and VantageScore, which both rate credit scores from 300 to 850 Here is how the score ranges generally break down for both models

- Excellent Credit: 750-850

- Very Good Credit: 700-749

- Good Credit: 650-699

- Fair Credit: 600-649

- Poor Credit: Below 600

So a 670 credit score falls into the good credit range, but it’s on the lower end. While not excellent, a score of 670 still shows lenders that you are a relatively low-risk borrower who pays bills on time and manages credit responsibly

What Kind of Interest Rates Can I Expect with a 670 Score?

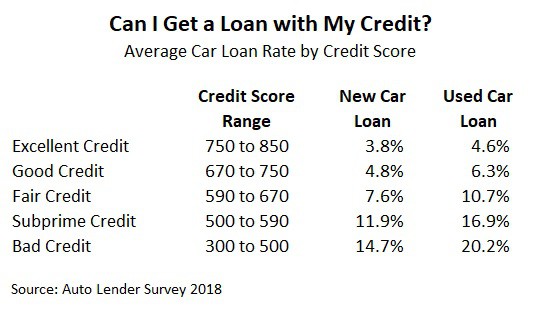

The interest rate you qualify for is directly tied to your credit score. The higher your score, the lower your interest rate. According to recent data from myFICO here are the average interest rates you can expect with a 670 credit score

- New Car Loan: 5.82%

- Used Car Loan: 7.83%

So with a 670 credit score, you can expect interest rates for a new car in the 5-6% range and used car around 7-8%. These are still relatively good rates compared to applicants with lower scores.

How Much Can I Borrow for a Car with a 670 Credit Score?

The amount of car loan you can qualify for will depend on a few key factors:

- Your income – Lenders want to see you can afford the monthly payments.

- Your existing debts – Too much existing debt can negatively impact approval odds.

- Down payment amount – The more you put down, the lower the loan amount.

- Loan term – Longer terms equal smaller monthly payments.

Even with a 670 credit score, having a solid income, low debt-to-income ratio, and sizable down payment of 10-20% can help you get approved for a bigger loan. Here are general car loan amounts a 670 credit score can qualify for:

- New Car: $15,000 – $30,000

- Used Car: $10,000 – $20,000

With good financials, you may even be approved for a loan up to $40,000 for a new car or $25,000 for used.

Tips to Increase Your Car Loan Amount

If you need to finance more for a car than what a 670 credit score will qualify for, here are some tips:

- Improve your credit score – Increasing your score even by 10-20 points can help a lot.

- Get a co-signer – Adding someone with better credit can help you borrow more.

- Make a larger down payment – Putting down 20% or more shows lenders you’re financially committed.

- Extend the loan term – Going for a 5 or 6 year loan term can help lower payments.

- Provide proof of income – Solid income helps counterbalance a lower score.

The Takeaway

While a credit score of 670 is not perfect, it’s still considered good credit and can help you qualify for an auto loan in the $15,000 to $30,000 range, especially with some other strong financial factors. Improving your score and credit will open up better loan offers. But overall, a 670 FICO or VantageScore means you still have access to financing options to purchase a car.

What Is the Minimum Credit Score to Buy a Car?

Theres no specific minimum credit score for a car loan. Banks, credit unions, online lenders, dealerships and auto finance companies can choose their own minimum credit score requirement for borrowers.

Some lenders might have a hard cutoff point, while others may set a minimum based on other factors, such as how much youre borrowing and the size of your down payment.

Auto lenders can also choose from different types of credit scores, including VantageScore credit scores, base FICO® Scores and industry-specific auto FICO® Scores. Although most credit scores use a similar 300 to 850 range, the lenders minimum credit score might depend on the type of score they use.

How to Get a Car Loan With Bad Credit

You can get a car loan with bad credit, but you may have fewer options and end up paying more interest and fees than someone with a higher credit score.

If you have a low credit score, consider whether buying a car right now makes sense or if waiting to improve your credit is a better option. If you need to buy a car urgently, here are a few steps you can take to prepare and potentially improve your options:

- Check your credit. Although you likely wont know which credit score the lender will use, you can still check one of your credit scores and review your credit report. You might find that there are ways to quickly improve your credit score before applying.

- Get prequalified. Some auto lenders offer online prequalification, which can show you estimated loan offers using a soft credit inquiry. This process doesnt affect your credit scores. Try to get offers from several types of lenders so you can compare terms.

- Increase your down payment. A larger down payment might help you qualify for a lower interest rate. Even if it doesnt, borrowing less money will lead to paying less interest.

- Ask someone to cosign. You could see if a close friend or family member who has good credit is willing to cosign the loan. It could help you qualify and get a better offer, but theyll also be legally liable for the debt and the loan can affect their credit.

Buyers with very low or no credit might be tempted to head to buy here, pay here (BHPH) dealers, which finance their own sales and generally have more lax eligibility requirements.

However, these loans tend to be very expensive, and your on-time payments may not help you build a positive credit history. Try several banks, credit unions, online lenders and non-BHPH dealers first to see what they can offer.

How a Car Loan Affects Credit Score – Auto loans raise or lower scores? How fast? How many points?

FAQ

Can you finance a car with a 670 credit score?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score☉ , a good credit score is 670 or higher.

What credit score is needed for a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

How big of a loan can I get with a 670 credit score?

A 670 credit score generally falls within the “good” credit range, and you can likely get approved for a variety of loans, including personal loans, auto loans, and potentially even mortgages, depending on other factors like income and debt-to-income ratio.

What credit score is needed for a $25,000 car loan?

The credit score required and other eligibility factors for buying a car vary by lender and loan terms. Still, you typically need a good credit score of 661 or higher to qualify for an auto loan.