Taking out a loan to make a major purchase like a home or car is a big financial decision. While getting the best interest rate possible is ideal, many lenders offer the option to “buy down” the rate by paying points upfront. But how much do points actually save, and are they worth paying for?

In this comprehensive guide, we’ll explain what points are, how they work with loans, and specifically look at how much 2 points on a loan could potentially save you.

What Are Points on a Loan?

Points, also known as discount points or mortgage points are fees paid to a lender to reduce the interest rate on a loan. Each point is equal to 1% of the total loan amount.

For example, if you take out a $200,000 mortgage, each point would cost $2,000 (1% of $200,000). Paying points reduces the interest rate, which in turn lowers your monthly payments

Points are most commonly associated with mortgages, but can also be used with other types of loans like auto loans. The main benefit of paying points is getting a lower rate, which saves money over the full term of the loan.

How Do Points Work?

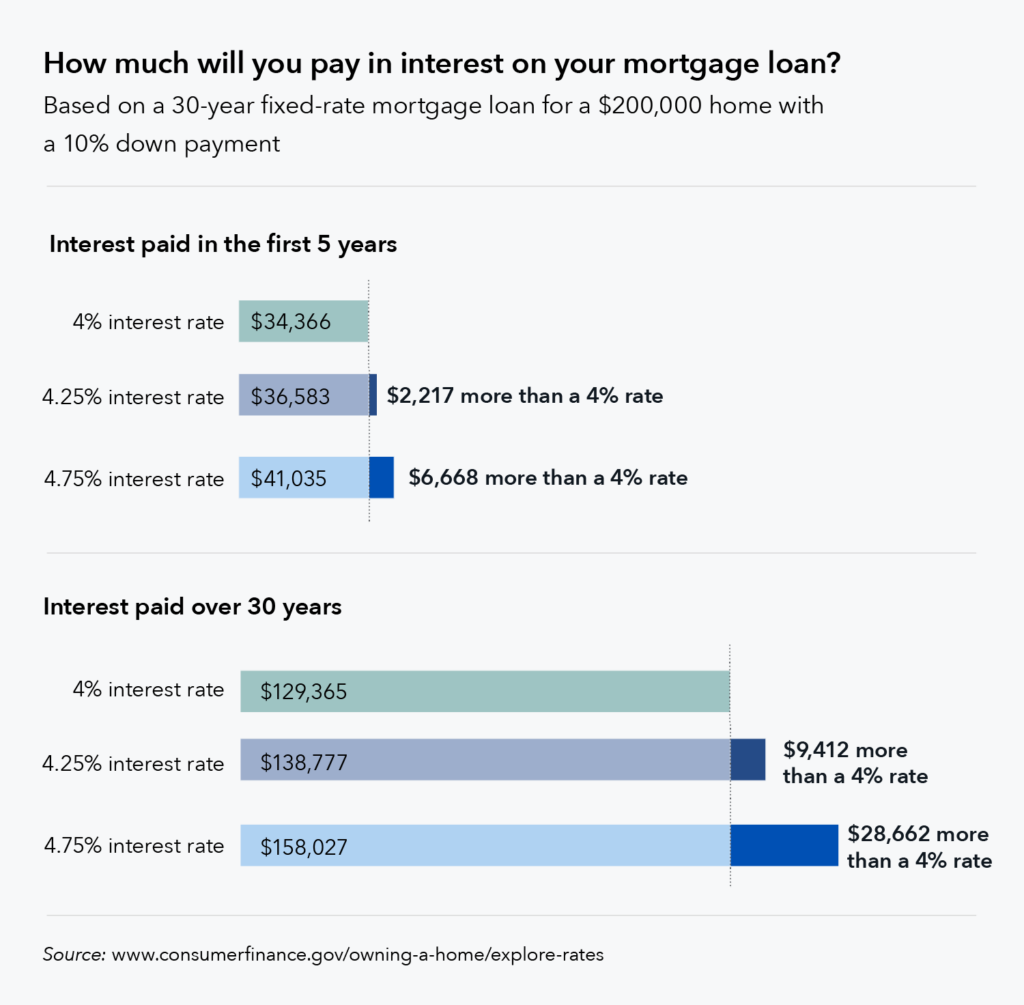

Let’s look at an example to understand how paying points can affect mortgage rates and payments:

- Loan amount: $200,000

- Loan term: 30 years

- Interest rate with 0 points: 5.5%

- Interest rate with 2 points: 5.0%

In this case, each point costs 1% of $200,000, or $2,000 So 2 points would cost $4,000 ($2,000 x 2). By paying $4,000 upfront, the rate is reduced by 05% for the full 30 year term.

Here’s how the monthly principal & interest payments compare:

- Payment with 0 points at 5.5%: $1,135

- Payment with 2 points at 5.0%: $1,073

Buying down the rate by paying 2 points saves $62 per month ($1,135 – $1,073). Over 30 years, that adds up to over $22,000 in interest savings.

However, it takes time for the upfront cost of the points to pay off. In this example, it would take about 5 years to break even ($4,000 paid upfront divided by $62 monthly savings).

How Much Do 2 Points Lower Interest Rates?

In general, each point typically reduces mortgage rates by 0.25%.

So, buying two points would lower your interest rate by 0.5%. However, the exact rate reduction depends on the lender.

Some lenders may discount the rate further per point, while others provide less of a reduction. It’s important to ask your specific lender how much two points would save on your loan.

For other types of loans, the rate reduction per point varies:

- Auto loans: 0.25% per point

- Personal loans: 0.15% per point

- Student loans: 0.25% per point

Again, these are general guidelines – the actual rate reduction with points depends on the lender.

Should You Pay for Points?

Whether paying for points makes sense depends on a few key factors:

1. How much are points costing? Calculate 1-2% of your total loan amount to estimate the upfront cost. Each point costs 1% of the loan.

2. How much do they reduce rates? Ask your lender exactly how much they’ll discount the rate per point.

3. How long is the loan term? Points pay off over time, so longer loans like 30 year mortgages benefit the most.

4. How long will you keep the loan? To break even, you’ll need to keep the loan at least as long as the points take to pay off.

5. What’s your budget? Can you afford to pay the points upfront or finance them into the loan?

Crunching the numbers for your specific loan scenario will determine if points make sense financially. Generally, paying points is best for stable borrowers who plan to keep a loan long term.

Pros and Cons of Paying Points

Here are some key advantages and disadvantages of paying points on a loan:

Pros

- Lower interest rate and monthly payments

- Interest savings over the loan term

- Tax deductions – points are deductible in the year they are paid

Cons

- Large upfront cost

- Takes time to break even (often years)

- Lost savings if refinancing or selling home before break even

Alternatives to Paying Points

Some options besides buying down rates with points include:

-

Comparing lender rates – Shop around for the best no-points rate.

-

Negotiating rates – Ask if lenders can lower rates further without points.

-

Paying down principal – Making extra payments reduces interest costs.

-

Adding co-signer – Having a co-signer with better credit can improve rates.

-

Improving credit score – Rates are tied to credit scores, so boosting yours may lower rates.

The Bottom Line

Paying points allows borrowers to buy down interest rates on loans, saving money each month and over the full repayment period. Specifically, two points on a loan will generally reduce rates by around 0.5%.

To determine if points are worth paying, look at the upfront cost, monthly savings, loan length, and how long you plan to keep the loan. For buyers who can afford them and will keep a mortgage long term, points can provide substantial interest savings. But shop around and compare options, as points don’t make sense for every borrower’s situation.

See how much you might be able to borrow.

Mortgage points, also known as discount points, are a form of prepaid interest. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. A mortgage point is equal to 1 percent of your total loan amount. For example, on a $100,000 loan, one point would be $1,000. Learn more about what mortgage points are and determine whether “buying points” is a good option for you.

Estimated monthly payment and APR example: A $464,000 loan amount with a 30-year term at an interest rate of 6.500% with a down payment of 25% and no discount points purchased would result in an estimated principal and interest monthly payment of $2,933 over the full term of the loan with an Annual Percentage Rate (APR) of 6.667%.1

Estás ingresando al sitio de U.S. Bank en español Algunos materiales y servicios podrían estar disponibles solamente en inglés. Los enlaces incluidos en esta comunicación podrían dirigirte a sitios web en inglés.

This mortgage points calculator provides customized information based on the information you provide. But, it also makes some assumptions about mortgage insurance and other costs, which can be significant. It will help you determine whether you should buy mortgage points.

What Does 2 Points Mean On A Loan? – CreditGuide360.com

FAQ

How much does 1 point cost on a loan?

A mortgage point is equal to 1 percent of your total loan amount. For example, on a $100,000 loan, one point would be $1,000.

How much does 2 points lower your mortgage?

So, if your mortgage rate is 5%, one discount point would lower your rate to 4.75%, two points would lower the rate to 4.5%, and so on.

What does it mean to pay 2 points?

Determine the upfront cost for the points: For each point, you will pay 1% of the loan amount. If you were to buy two points, that would mean 2% of the loan amount. 2. Subtract the new, reduced monthly payment (after the interest rate reduction) from what would have been your monthly payment without any rate reduction.

What does 2 points on a $100,000 house loan equal 2000?

Points. An amount paid to the lender, typically at closing, in order to lower the interest rate. Also known as “mortgage points” or “discount points.” One point equals 1% of the loan amount (for example, 2 points on a $100,000 mortgage would equal $2,000).