Our calculator estimates the maximum amount you’re likely to qualify for, along with your monthly payments.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

Use this calculator to find out how much money you might be able to borrow with a home equity loan and how much it might cost.

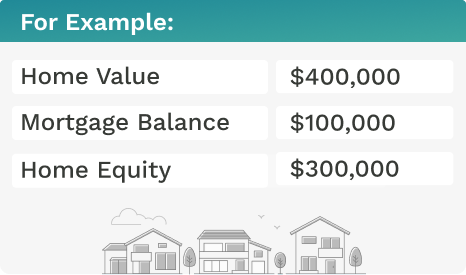

Home equity is the amount of your house you’ve “paid off.” Every time you make a mortgage payment or the value of your home rises, your equity increases.

As you build equity, you may be able to borrow against it with a home equity loan. With this kind of loan, you receive the money in one lump sum.

Your house is likely your biggest asset The equity you’ve built up in your home over time represents a significant portion of your overall net worth

Equity is the difference between what your house is worth and what you owe on your mortgage You can tap into this equity to access funds for major expenses like home improvements, debt consolidation, college tuition, and more

But how much of your home’s equity can you actually borrow? The amount varies based on factors like your credit score, income, and debt level. However, most lenders will let you borrow up to 80% of your equity.

What is Home Equity?

Before determining how much equity you can borrow, it’s important to understand what equity is in the first place.

-

Home equity is your ownership stake in your house. It’s calculated by subtracting your mortgage balance from your home’s market value.

-

For example, if your home is worth $300,000 and you owe $180,000 on your mortgage, you have $120,000 in equity ($300,000 – $180,000 = $120,000).

-

The more equity you have, the more your net worth grows as your property appreciates in value over time.

-

You build equity with each mortgage payment as you pay down your loan principal. Making extra payments can help you build equity faster.

How Lenders Determine Your Borrowing Power

When you apply for a home equity loan or line of credit, lenders will assess your finances to determine how much they’re willing to lend you. Here are some key factors they consider:

-

Loan-to-Value (LTV) Ratio: The LTV ratio compares the amount of your mortgage balance and any secondary loans to your home’s value. Most lenders cap total borrowing at 80% LTV.

-

Credit Score: Your credit score gives lenders insight into how reliably you’ve managed debts in the past. Scores of 620 or higher are generally required, but a higher score may allow you to borrow more.

-

Debt-to-Income Ratio: Your DTI shows how much of your gross monthly income is devoted to debt payments. The lower your DTI, the more comfortable lenders will be lending to you.

-

Employment and Income: Steady employment and verifiable income are key when applying for a home equity loan. Lenders want to see you can afford the payments.

How Much Home Equity Can You Typically Borrow?

Most lenders will let you borrow up to 80% of your available home equity. However, some lenders may allow you to borrow up to 90% or even 100% in some cases.

For example, if your home is valued at $300,000 and you have $100,000 in equity, here’s how much you might be able to borrow at different LTVs:

- 80% LTV: $80,000

- 85% LTV: $85,000

- 90% LTV: $90,000

- 100% LTV: $100,000

So in this scenario, while one lender may approve you for $80,000, another may give you the green light for the full $100,000.

What Are the Main Ways to Tap Home Equity?

You have three options when it comes to accessing your home’s equity:

1. Home Equity Loan

- You receive loan proceeds in one lump sum

- Repaid in fixed monthly installments over a set term

- Interest rate and monthly payments don’t fluctuate

2. Home Equity Line of Credit (HELOC)

- Acts like a credit card with a set borrowing limit

- Interest-only payments during the draw period

- Variable interest rate means payments can go up or down

3. Cash-Out Refinance

- Take out a new mortgage for more than what you currently owe

- Receive the difference in cash

- Make payments on the new, higher mortgage balance

Each option has pros and cons to weigh based on your financial situation and plans for the funds.

What Are the Risks Associated with Tapping Home Equity?

While accessing your equity can provide an affordable financing option, there are some risks to keep in mind:

- Your home serves as collateral on equity loans, meaning foreclosure is possible if you default.

- You’ll pay closing costs and fees to obtain financing.

- Interest may not be tax deductible if you don’t use funds for approved purposes.

- Your loan balance could exceed your home’s value if real estate prices drop.

Tips for Borrowing Safely Against Your Home Equity

- Shop around with multiple lenders to compare rates and terms.

- Be conservative and don’t borrow more than you can comfortably afford to repay.

- Have a plan for how you’ll use the funds before tapping your equity.

- Check your credit report and score so there are no surprises during underwriting.

- Consider working with a housing counselor if you have any doubts or concerns.

The Bottom Line

Tapping your home equity can provide access to significant funds, often at lower rates than other financing options. Just be sure you understand the risks, shop lenders carefully, and don’t overextend yourself. Most experts suggest limiting your total borrowing to no more than 80% of your home equity. With proper planning, you can prudently leverage your equity as a financial resource.

How to get a home equity loan

You’ll generally be eligible for a home equity loan or HELOC if:

- You have at least 20% equity in your home, as determined by an appraisal.

- Your debt-to-income ratio is between 43% and 50%, depending on the lender.

- Your credit score is at least 620.

- Your credit history shows that you pay your bills on time.

If you meet these requirements and know how much you need to borrow, you’re ready to start reaching out to lenders. If the lender that financed your primary mortgage offers home equity loans, that can be a good place to start your search; however, we recommend that you compare offers from a few lenders to get the best available rate and terms.

How does a home equity loan work?

A home equity loan lets you borrow from the equity that you’ve built in your home through mortgage payments and appreciation. You receive the money all at once and pay it back at a fixed interest rate.

This makes home equity loans a solid choice if you know exactly how much you’ll need to borrow. For example, you might use a home equity loan to replace your roof or put in new carpet.

To find out how much you may be able to borrow with a home equity loan, divide your remaining mortgage balance by your home’s current value. This is your loan-to-value ratio, or LTV. You can find the remaining balance on your loan on your most recent mortgage statement. Your most recent home appraisal can give you an idea of its current value.

Depending on your financial history, lenders usually want to see an LTV of 80% or less, which means you have at least 20% equity in your home. In most cases, you can borrow up to 80% of your home’s value in total.

An example: Let’s say your home is worth $200,000 and you still owe $100,000. If you divide 100,000 by 200,000, you get 0.50, which means you have a 50% loan-to-value ratio and 50% equity. Lenders that allow a combined loan-to-value ratio of 80% may let you borrow $60,000 more. That would bring the amount you owe to $160,000, which is 80% of the $200,000 home value.

How to Get Equity Out Of Your Home – 4 WAYS! | What is Home Equity | What is Equity

FAQ

How much of your home’s equity can you borrow?

You can typically borrow up to 85% of the value of your home minus the amount you owe. Also, a lender generally looks at your credit score and history, employment history, monthly income and monthly debts, just as when you first got your mortgage.

How much equity can I withdraw from my home?

What is useable equity? Lenders will typically lend you 80% of the value of your home – less the debt you still owe against it. This is considered your useable equity.

How much is a $50,000 home equity loan per month?

What is the monthly payment on a $50,000 home equity loan? At current market rates, the monthly payment on a $50,000 home equity loan with a 20-year loan term would be about $411.

What is the most equity you can take out of your house?

As a rule of thumb, equity loans are generally made for up to 80% of your home’s equity, and your credit score and income are also considered for qualification. Most loans require upfront costs such as origination fees, titles, credit reports and appraisal fees.