Dreaming of saying goodbye to the 9-to-5 grind a whole decade and a half before traditional retirement age? You’re not alone! Early retirement at 50 is becoming an increasingly popular goal for many Americans who want to reclaim their time and enjoy life while they’re still young enough to make the most of it

But let’s face it – retiring at 50 means you’ll potentially need to fund 40+ years of retirement, which is no small feat. So how much money do you actually need to make this dream a reality? Let’s dive into the nitty-gritty details and create a roadmap for your early retirement journey.

The Big Number: How Much You’ll Need to Save

When planning for retirement at 50, a common guideline is to aim for approximately 25-30 times your expected annual expenses. This formula often called the “25x rule” or “30x rule” helps ensure your savings will last through your extended retirement period.

Let’s break this down with a real example:

If you plan to spend $60,000 annually in retirement, you would need:

- 25x rule: $1.5 million ($60,000 × 25)

- 30x rule: $1.8 million ($60,000 × 30)

The 30x rule gives a more conservative estimate that protects you even more against market drops and inflation. Since you’re leaving work early, it makes sense to be safe.

But wait – there’s more to consider! The amount you’ll need varies dramatically depending on where you plan to retire. According to CNBC’s analysis of retirement expenses across all 50 states, the annual cost of a comfortable retirement ranges from as low as $55,074 in Mississippi to a whopping $121,228 in Hawaii!

Understanding the 4% Rule for Early Retirement

Many financial experts recommend the “4% rule” for retirement withdrawals. There is a small chance that you will run out of money during your 10-year retirement if you take out 4% of your initial retirement savings every year, after taking into account inflation in the years that follow.

However, for early retirement at 50, you might want to consider a more conservative withdrawal rate of 3-3.5% to account for the longer time horizon.

Using our example above with the 25x savings rule ($1.5 million):

- 4% withdrawal rate: $60,000 annually

- 3.5% withdrawal rate: $52,500 annually

- 3% withdrawal rate: $45,000 annually

With the 30x savings rule ($1.8 million):

- 4% withdrawal rate: $72,000 annually

- 3.5% withdrawal rate: $63,000 annually

- 3% withdrawal rate: $54,000 annually

Factors That Affect How Much You Need

1. Location, Location, Location

Where you live during retirement significantly impacts your costs. Let’s look at some examples based on CNBC’s analysis:

Most Affordable States for Retirement (Annual Costs)

- Mississippi: $55,074

- Kansas: $56,899

- Oklahoma: $56,508

- Alabama: $56,769

- West Virginia: $58,528

Most Expensive States for Retirement (Annual Costs)

- Hawaii: $121,228

- District of Columbia: $99,980

- Massachusetts: $97,699

- California: $90,399

- New York: $88,444

If you don’t mind where you live, moving to a state with lower costs could cut your savings needs by a huge amount.

2. Healthcare Costs Before Medicare

One of the biggest challenges of retiring at 50 is covering healthcare costs before Medicare eligibility at 65. Private health insurance can be extremely expensive, potentially costing $10,000-$20,000 annually for a couple in their 50s.

You’ll need to budget for approximately 15 years of private health insurance before Medicare kicks in. Some options to consider:

- COBRA (typically available for only 18 months after leaving your job)

- ACA marketplace plans

- Health sharing ministries (alternative to traditional insurance)

- Part-time work with health benefits

3. Lifestyle Expectations

Be realistic about your retirement lifestyle. Many early retirees find they spend more in the initial “honeymoon phase” of retirement on travel and leisure activities. Your spending may follow a “smile curve” – higher in early retirement, lower in middle retirement, and potentially higher again in late retirement due to healthcare costs.

Consider these expense categories:

- Essential expenses: Housing, food, utilities, healthcare, transportation

- Discretionary expenses: Travel, hobbies, entertainment, dining out

- Legacy goals: Inheritance for children, charitable giving

Creating Your Early Retirement Savings Plan

1. Start Aggressive Saving NOW

Time is both your friend and enemy when planning to retire at 50. The earlier you start, the more compound interest works in your favor. Aim to save at least 40-50% of your income if you’re serious about early retirement.

For example, if you’re 35 years old with a $100,000 annual income, saving 50% ($50,000) annually for 15 years with a 7% average return could yield approximately $1.25 million by age 50.

2. Maximize Tax-Advantaged Accounts

Utilize these accounts to their fullest:

- 401(k)/403(b): Contribute the maximum allowed ($23,000 in 2025, plus catch-up contributions if you’re over 50)

- IRA/Roth IRA: Contribute the maximum allowed ($7,000 in 2025, plus catch-up contributions if you’re over 50)

- Health Savings Account (HSA): Triple tax advantage – contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free

3. Plan for Early Withdrawals

Accessing retirement funds before 59½ without penalties requires strategy. Consider these options:

- Roth IRA conversion ladder: Convert traditional IRA/401(k) funds to Roth IRA, then withdraw the converted principal after five years without penalties

- Rule 72(t): Take substantially equal periodic payments (SEPP) from IRAs without penalties

- Taxable accounts: Build up investments in non-retirement accounts that you can access anytime

4. Diversify Your Income Sources

Don’t rely solely on investment withdrawals. Creating multiple income streams can reduce pressure on your portfolio:

- Rental properties: Generate ongoing passive income

- Dividend-paying stocks: Provide regular income without selling assets

- Part-time work: Even modest income can significantly reduce withdrawal needs

- Side businesses: Monetize hobbies or skills

Real-World Example: Retiring at 50 with $2 Million

Let’s look at a practical example of how retirement might work with $2 million saved by age 50:

Initial Parameters:

- $2 million portfolio

- 3.5% initial withdrawal rate

- $70,000 annual living expenses

Year 1-15 (Ages 50-65):

- Annual withdrawal: $70,000 (3.5% of $2 million)

- Private health insurance: ~$15,000/year

- Remaining for other expenses: $55,000/year

Years 16+ (Age 65+):

- Medicare begins, reducing healthcare costs

- Social Security benefits become available (though reduced due to early retirement)

- Portfolio likely to have grown if withdrawals stayed at or below 3.5%

5 Tips to Accelerate Your Path to Early Retirement

-

Live well below your means: Embrace frugality now to enjoy freedom later. Each $100 monthly expense reduction equals approximately $30,000 less needed in your retirement portfolio.

-

Eliminate debt before retiring: Especially high-interest debt. Mortgage-free living can dramatically reduce your retirement expenses.

-

Develop marketable skills for potential part-time work: Having the ability to earn even modest income during retirement provides a valuable safety net.

-

Prioritize health: Medical expenses can derail even the best retirement plans. Investing in your physical wellbeing now can reduce healthcare costs later.

-

Consider geographic arbitrage: Retiring in a lower-cost area, even temporarily, can stretch your savings significantly. States like Mississippi, Kansas, and Oklahoma offer the most affordable retirement options.

Common Mistakes to Avoid

-

Underestimating longevity: At 50, you could easily live another 40+ years. Plan accordingly!

-

Ignoring inflation: What costs $50,000 today will cost approximately $90,000 in 20 years at a 3% inflation rate.

-

Being too conservative with investments: While safety is important, being too risk-averse can lead to portfolio depletion due to insufficient growth.

-

Failing to plan for long-term care: This can be a major expense in later years. Consider long-term care insurance or setting aside funds specifically for this purpose.

-

Overlooking tax implications: Proper tax planning can save you thousands each year in retirement.

Bottom Line: Is Retiring at 50 Realistic for You?

Retiring at 50 is absolutely possible with proper planning and discipline, but it requires sacrifice and commitment. The earlier you start planning, the more achievable this goal becomes.

Working with a financial advisor who specializes in early retirement can help you create a personalized strategy. They can assist with complex aspects like tax planning, withdrawal strategies, and investment allocation tailored to your specific situation.

Remember, the journey to early retirement isn’t just about reaching a specific number—it’s about creating a sustainable lifestyle that will support you for potentially 40+ years after you leave the workforce. With careful planning and realistic expectations, you can make the dream of retiring at 50 your reality!

What’s your biggest challenge in planning for early retirement? Drop a comment below and let’s discuss it!

How To Retire At Age 50 (EXPLAINED in 5 Minutes)

FAQ

Is $2 million enough to retire at 50?

Retiring at age 50 with $2 million is possible but depends heavily on your personal circumstances, lifestyle, and location. While $2 million can provide a comfortable lifestyle, especially in lower-cost areas, you must carefully plan for long time horizons, healthcare expenses, inflation, and other financial factors unique to early retirement.

What is a good amount of money to retire at 50?

The amount of money needed to retire at age 50 varies significantly based on your annual spending, but a common benchmark is six times your annual salary or the general rule of having a nest egg that supports your lifestyle for the remaining years, often using the 4% rule.

Is $3 million enough to retire at 50?

If you want to retire at age 65, $3 million may not be enough. It depends on your desired lifestyle, spending habits, and location. A 4% withdrawal rate would give you about $120,000 a year, after inflation is taken into account.

Can I retire at 50 with $1 million dollars?

Yes, you can potentially retire at 50 with $1 million, but it depends heavily on your lifestyle, location, expenses, and how long you expect to live. Careful planning of finances, a solid and disciplined investment strategy, keeping healthcare costs in check until age 65, when Medicare eligibility starts, and taking inflation into account are all important for success.

How much money do you need to retire at 50?

Understanding your financial requirements is essential for successful early retirement preparation when determining how much you need to retire at 50. Retiring at 50 requires significant savings to cover 30 or more years without income. Many experts suggest saving about six times one’s annual salary by age 50, though individual needs vary.

Should you retire at 50?

Retiring at 50 offers freedom and time to pursue personal interests, but it requires careful financial planning. Key factors include lifestyle needs, long-term savings, healthcare costs, inflation and market changes that could affect retirement funds.

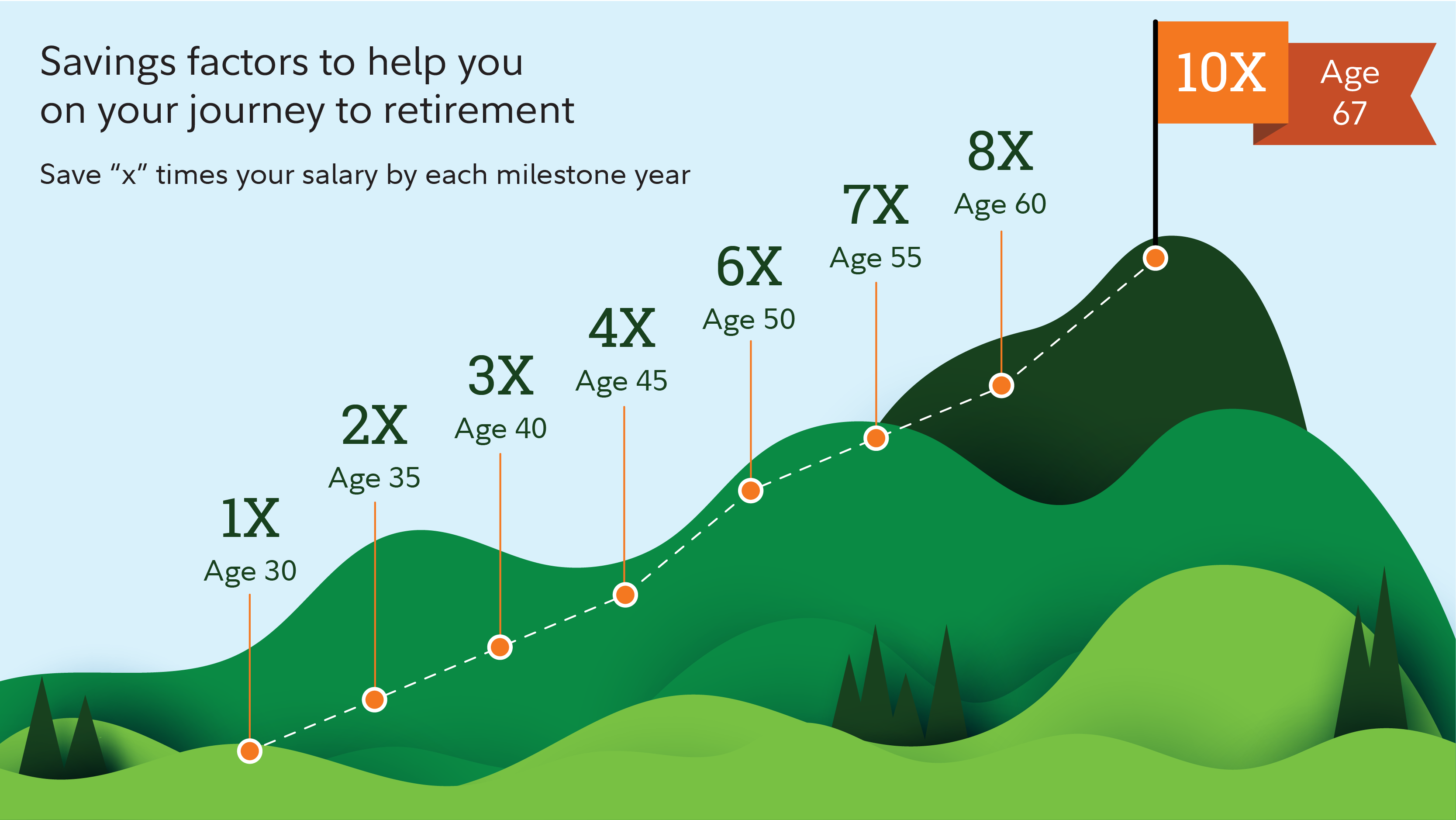

How much should you save for retirement?

There are certain benchmarks that experts suggest investors stick to when it comes to their retirement planning. The chart below highlights how much people should consider saving by their age group: 1 So, if you’re 50, you should be saving 3. 5 to 5. 5 times your salary for retirement.

What is the annual cost to retire comfortably?

The annual cost to retire comfortably varies by as much as $66,000 between states. The highest cost is in Hawaii, according to a recent GOBankingRates analysis of retirement expenses in all 50 states and the District of Columbia.

How many retirees have no retirement savings?

A recent AARP survey found 20% of respondents ages 50 and over had no retirement savings. Over 50% of current retirees who don’t have enough saved said that everyday costs like rent and utilities (34%), debt payments (31%) unexpected costs (18%), and healthcare costs (16%) kept them from saving enough.

Should I reassess my retirement plan?

Inflation reduces purchasing power over time, so investments should aim to outpace inflation to maintain your lifestyle. To ensure financial stability, regularly reassess your retirement plan, considering lifestyle changes, healthcare costs, and potential income sources. Should I Retire at 50?