A home is a big investment, but if you have a salary in the six-figure range you’re already off a pretty good start. As long as you have manageable debt, it’s a decent bet that you can find something that meets your needs. Income is just one factor that plays into your budget, but it’s a fair question to ask: How much house can you afford on $100K?

Buying a home is an exciting milestone, but figuring out your budget can be tricky If you’re wondering how much income you need to afford a $100,000 house, this guide covers the key factors to consider.

What is a $100k House?

A $100k house refers to a home with a purchase price around $100,000. In today’s competitive housing market, finding a home at this price point can be challenging depending on your location. $100k homes are typically smaller, older homes that may need some repairs and upgrades. Popular options can include condos, townhomes, cottages, and fixer-uppers.

Income Needed for a $100k Mortgage

The income you need to afford a $100k mortgage depends on several variables:

-

Down payment – The minimum down payment on a conventional loan is typically 3-5%. The more you can put down the less you’ll need to borrow.

-

Interest rate – Rates fluctuate but expect around 6-7% for a 30-year fixed mortgage. The higher the rate, the higher your monthly payment.

-

Other debts – Lenders look at your total monthly debts when qualifying you, including car loans, student loans, and credit card payments. More existing debt means you’ll need higher income.

As a general guideline, you may need a minimum annual income of around $35,000 to afford a $100k mortgage, assuming:

- 5% down payment of $5,000

- 30-year fixed mortgage at 7% interest

- Total monthly debts around $300

This would equate to roughly a $840 monthly mortgage payment, representing about 33% of your $2,917 monthly income. This falls within lenders’ typical approval range of 28-36% for your debt-to-income ratio.

Of course, your exact income needed will depend on the specifics of your situation. Use an online mortgage calculator to estimate your monthly payment and play around with different down payment and interest rate scenarios.

Factors That Impact Affordability

When determining how much house you can afford, lenders look at these key factors:

Down Payment Amount

The more you can put down, the better. A 20% down payment avoids private mortgage insurance (PMI), lowering your monthly costs.

Credit Score

The higher your score, the better mortgage terms and interest rates you can qualify for. Scores below 620 will make approval difficult.

Existing Debt Obligations

Your total monthly debt payments, including credit cards, student loans, auto loans, and more get factored into your debt-to-income ratio.

Income Verification

Lenders want to see stable income that covers your debts. Expect to provide W-2s, paystubs, tax returns, and possibly bank statements.

Home Location

If looking at high-cost areas, you may need to lower expectations on size or condition to find a $100k property. Location impacts affordability.

Tips for Affording a $100k Home

If your current income or savings don’t quite allow you to swing a $100k home, here are some tips to boost affordability:

-

Make a larger down payment – Every extra bit helps lower your monthly costs. Save up over time.

-

Pay down existing debts – Reduce monthly obligations to improve your debt-to-income ratio.

-

Boost your credit score – On-time payments and responsible credit use helps your mortgage eligibility.

-

Add a co-borrower – Combining incomes with a partner or family member makes approval easier.

-

Explore loan programs – First-time buyer programs can provide down payment grants or lower rates.

-

Consider lower-cost areas – You may find more options in smaller cities or rural locations. Expand your search area.

The Bottom Line

While buying a $100k home is achievable, it requires some budgeting diligence, particularly when it comes to saving up for a solid down payment. Improving your credit, reducing debt, and boosting income can help you reach your homeownership goals sooner. Be sure to get pre-qualified by a lender early on to understand your price range and plan accordingly.

Mortgage breakdown on a $100K salary

We’ve gone over what buying the mortgage on $100,000 looks like in one specific scenario, but what happens if we change up some numbers based on your situation?

While leaving the interest rate the same at 6.99%, we’ve changed factors like the debt being brought into the transaction and the cash you have to buy. If interest rates: lower or higher, you would obviously be able to afford more or less. But it’s not really possible to time the market. Beyond your personal qualifications, rates aren’t in your control.

| Existing debts | Cash on hand | Affordable | Stretching it |

|---|---|---|---|

| $0 | $15,000 | $349,444 | $477,956 |

| $2,000 | $15,000 | $124,857 | $255,867 |

| $1,000 | $40,000 | $258,093 | $389,102 |

Can I afford a $400K-$500K house?

It’s much easier to determine how much you can afford if you know the price of the house and then you can work backward. For this formula, there’s a way to calculate how much salary you would need to afford a house at any given price. For this, you need to know four things:

- Home price

- Monthly payment

- DTI expected by the lender

- Monthly debts outside your mortgage

You can get to the monthly payment by putting the home price, your interest rate and down payment into any mortgage calculator. The formula we used doesn’t include taxes and insurance, but you can add them in if you know them.

Here’s the formula for minimum salary:

(Monthly payment ÷ DTI + Existing monthly debts) × 12

For the home price, we’ll run the calculation at both $400,000 and $500,000. Let’s keep going with an interest rate of 6.99%. Lenders have different requirements, but because we’d been using 36% as an affordability benchmark, we’ll keep rolling with that. Assume $600 in existing debts. When you do that, here’s how the math comes out:

| Home price | Down payment | Salary |

|---|---|---|

| $400,000 | 3% | $93,158.95 |

| 3.5% | $92,715.86 | |

| 5% | $91,386.60 | |

| 10% | $86,955.72 | |

| 20% | $78,093.98 |

Based on the assumptions above, you would be able to afford a $400,000 home in any of the usual down payment scenarios. Let’s see what happens if we want a $500,000 home:

| Home price | Down payment | Salary |

|---|---|---|

| $500,000 | 3% | $114,648.68 |

| 3.5% | $114,094.82 | |

| 5% | $112,433.25 | |

| 10% | $106,894.66 | |

| 20% | $95,817.47 |

As you can see, the only way to afford a $500,000 home on a 36% DTI with the rest of the assumptions above is to make a 20% down payment. Actual lender DTI guidelines are going to vary, but always be mindful of your own budget.

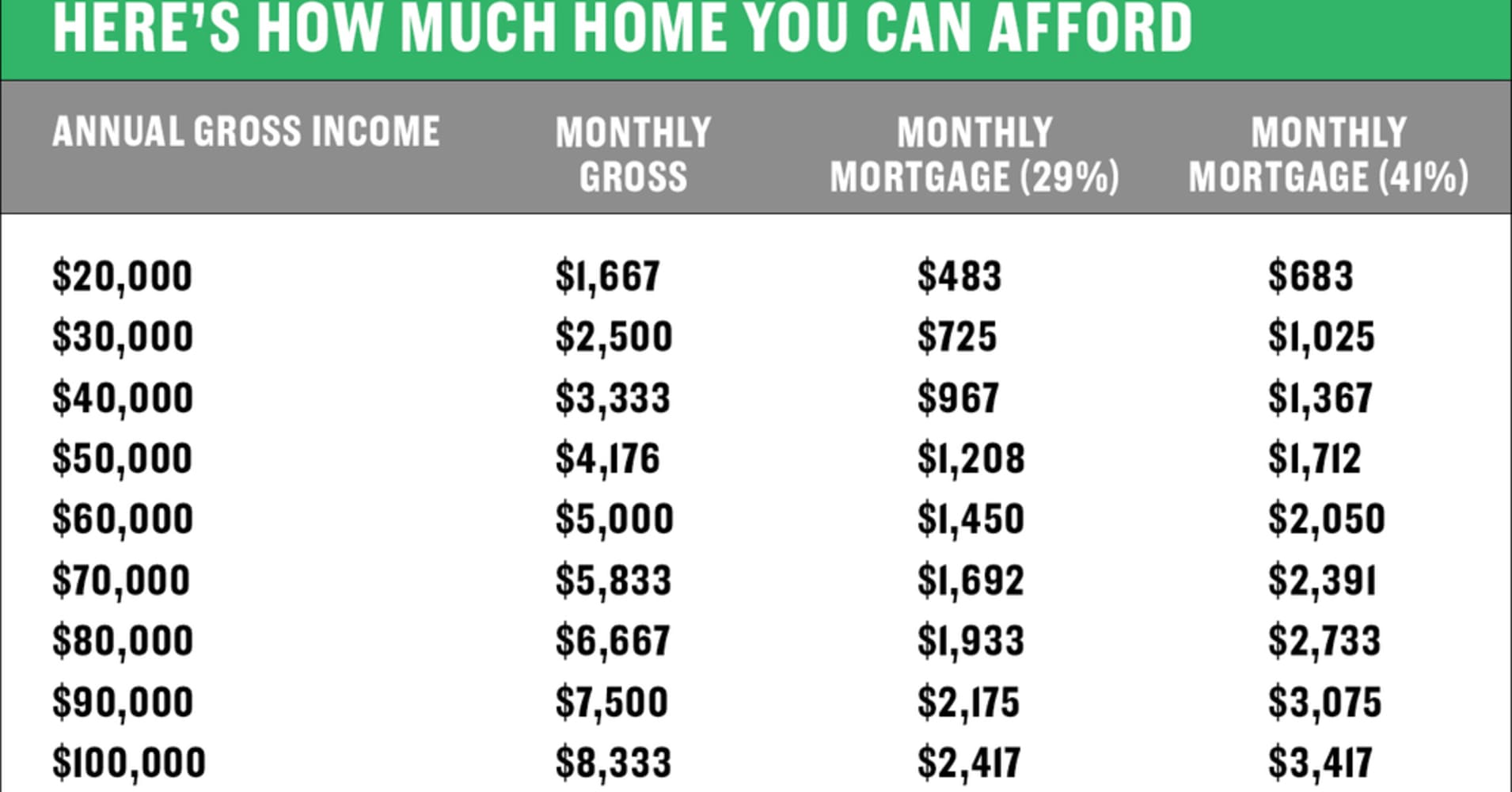

How Much Home You Can ACTUALLY Afford (By Salary)

FAQ

How much income is needed for a 100K mortgage?

How much do I need for a 100K mortgage?

Most lenders will loan around 4-4.5 times your income. So, to get a £100,000 mortgage, you’ll need to earn between £18,000 and £25,000. This is below the average UK annual salary, currently £37,430 (June 2025).

How much house can I afford if I make $36,000 a year?

Can I buy a house if I make 25K a year?

Yes. On $25K a year, you may afford around $580 a month for housing. With a 6% rate and a 3% down payment, you could buy a house worth around $100,000. Talk to home lenders for low-income buyers to get an accurate estimate based on your location and debt.