Its advantageous for short-term investors to qualify as traders, rather than investors, for federal income tax purposes. Unfortunately, theres no bright-line distinction between trader and investor status. Heres an overview of the IRS and U.S. Tax Court guidance to help determine if you qualify as a tax-favored securities trader.

As someone who’s navigated the tricky waters of trader tax status for years, I can tell you there’s a LOT of confusion about how many trades you actually need to qualify as a trader in the eyes of the IRS. Whether you’re day trading from your home office or managing your portfolio part-time knowing if you qualify for trader tax status (TTS) can make a HUGE difference in your tax situation.

Let me break down exactly what you need to know about trade volume requirements and other crucial qualifications to claim trader status, The answer isn’t as simple as a single number—but I’ve got the detailed breakdown you need,

The Magic Number: How Many Trades Are Required?

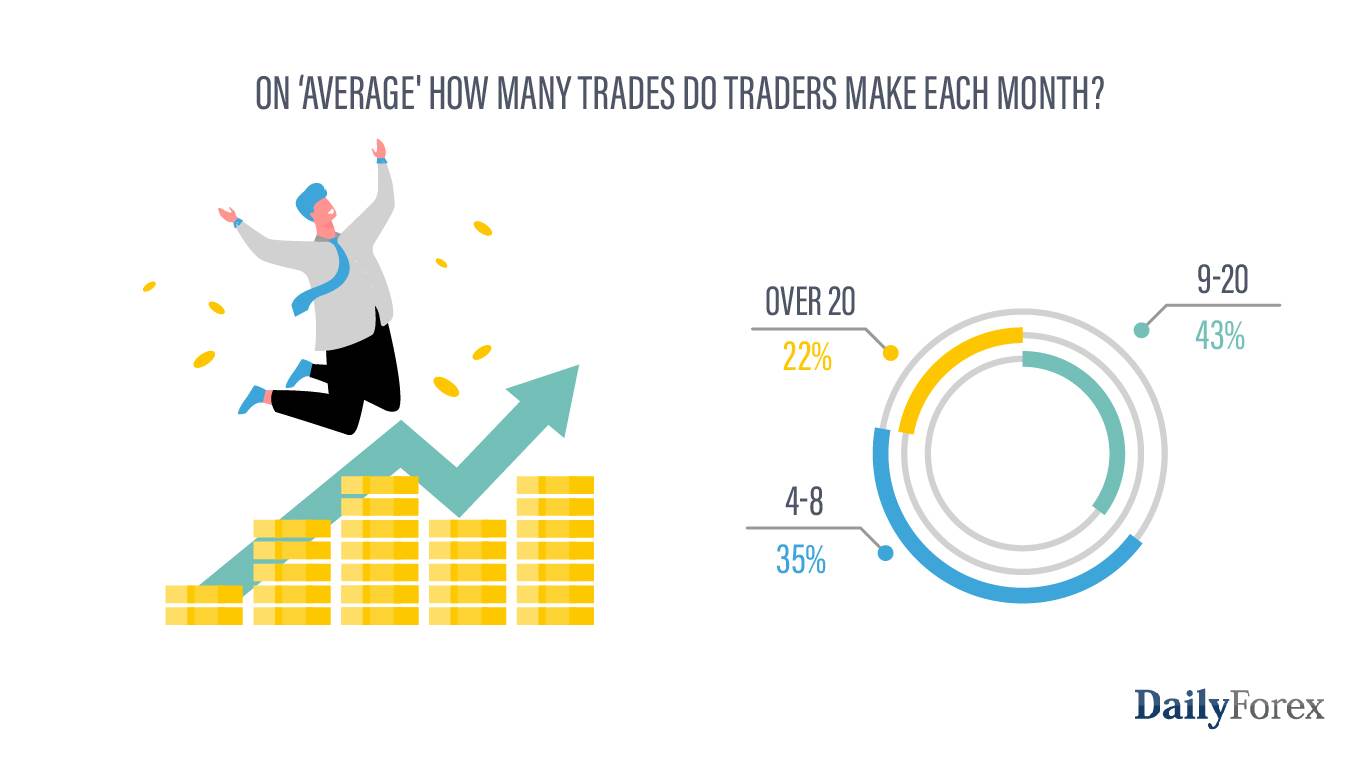

So, how many trades do you actually need to make to qualify as a trader? According to Green Trader Tax, here’s the recommended volume:

- Daily: An average of 4 transactions per day

- Weekly: 16 trades per week (4 days per week)

- Monthly: 60 trades per month

- Yearly: 720 trades per year (on an annualized basis)

These numbers come from tax court precedent, particularly the 2015 Poppe vs. Commission case, which established some guidelines. But volume is just ONE of the “big three” factors the IRS looks at.

The “Big Three” Qualification Factors

The IRS doesn’t actually have specific statutory laws that define trader tax status with objective tests Instead, we rely on case law that applies a two-part test

- Your trading activity must be substantial, regular, frequent, and continuous

- You must seek to catch swings in daily market movements and profit from short-term changes rather than long-term holding

To meet these requirements, Green Trader Tax identifies three primary factors (the “big three”) that are most important:

1. Volume

As we mentioned above, aim for about 720 trades annually (60 monthly). Each open and closing transaction counts separately, not as a round trip. If you’re scaling in or out of positions, each of these counts as well.

2. Frequency

You should be executing trades on approximately 4 days per week, which is about a 75% frequency rate of trading during market days.

3. Average Holding Period

The IRS has indicated through the Endicott Court that your average holding period should be 31 days or less. This is considered a “bright-line test” in determining trader status.

Beyond the Numbers: Other Important Qualification Factors

Volume alone isn’t enough. Here are other crucial factors that determine your trader tax status:

Time Commitment

- Hours: Spend more than 4 hours daily, almost every market day, working on your trading business

- Consistency: Trading full-time or part-time for a good portion of the day while markets are open

- Continuity: Few to no sporadic lapses in trading activity throughout the year (vacations are fine)

Business Structure

- Intention: Have a genuine intention to run a business and make a living (doesn’t have to be your primary income)

- Operations: Maintain significant business equipment, pursue education, use business services, and have a home office

- Account size: Maintain at least $25,000 on deposit with a U.S.-based broker to achieve “pattern day trader” status (minimum recommended account size is $15,000)

What DOESN’T Count Toward Trader Status

Just as important as what qualifies you is understanding what activities DON’T count toward your trader tax status. The IRS and tax courts don’t count these four types of trading activity:

- Outside-developed automated trading systems: Using computerized trading services with minimal trader involvement doesn’t qualify

- Trade copying services: Using trade copying software typically doesn’t count toward your TTS qualification

- Engaging a money manager: Hiring a registered investment adviser (RIA) or commodity trading adviser (CTA) to trade your account doesn’t count

- Trading retirement funds: Only trading in taxable accounts counts—activity in non-taxable retirement accounts is excluded

The Mark-to-Market Election: A Powerful Tool for Traders

If you qualify as a trader, you gain access to an important tax strategy: the mark-to-market election under Internal Revenue Code section 475(f).

This election allows you to:

- Treat gains and losses from securities as ordinary gains and losses

- Avoid the limitations on capital losses

- Bypass the wash sale rules that typically apply to investors

To make this election, you must submit a statement by the original due date (not including extensions) of your tax return for the year PRIOR to when you want the election to become effective. The statement must include:

- That you’re making an election under section 475(f)

- The first tax year for which the election is effective

- The trade or business for which you’re making the election

Be careful! Late elections are generally not allowed, and once made, this becomes your only permissible accounting method for securities in the tax year for which the election is effective.

Why Trader Status Matters: The Benefits

You might be wondering why I’m obsessing over these requirements. Well, qualifying for trader tax status offers significant tax advantages:

- Business expense deductions: You can deduct trading-related expenses on Schedule C

- Home office deduction: If you trade from home, you may qualify for this valuable deduction

- Health insurance and retirement benefits: Potential tax-advantaged options for health insurance and retirement contributions

- Better tax treatment: With the mark-to-market election, you can avoid capital loss limitations and wash sale rules

Investor vs. Trader vs. Dealer: Know the Difference

It’s crucial to understand how the IRS distinguishes between these three categories:

Investors

- Buy and sell securities for personal investment

- Expect income from dividends, interest, or capital appreciation

- Hold securities for substantial periods

- Report on Schedule D with capital gain/loss treatment

- Subject to capital loss limitations and wash sale rules

- Investment income isn’t subject to self-employment tax

Traders

- In the business of buying and selling securities for their own account

- Seek to profit from daily market movements, not dividends or interest

- Engage in substantial, continuous, and regular trading activity

- Report business expenses on Schedule C

- Can elect mark-to-market accounting

- Gains/losses not subject to self-employment tax

Dealers

- Regularly purchase or sell securities to customers

- Maintain inventory and have customers

- Derive income from marketing securities or being compensated as intermediaries

- Must use mark-to-market accounting

- Must keep records clearly separating personal vs. business securities

Record-Keeping: Absolutely Essential

If you’re hoping to qualify as a trader, meticulous record-keeping is non-negotiable. You must:

- Keep detailed records of all trades

- Document time spent on trading activities

- Separate investment securities from trading securities (ideally in different accounts)

- Identify securities held for investment on the day you acquire them

- Maintain documentation of your trading strategy and business plan

My Personal Take: Be Realistic About Your Status

In my experience working with traders, many people THINK they qualify for trader tax status when they actually don’t. The IRS scrutinizes this area closely, especially for:

- Part-time traders

- Traders showing losses

- Individual traders (vs. entity traders)

I always recommend being honest with yourself about whether you truly meet these requirements. The consequences of claiming trader status inappropriately can be costly!

The Bottom Line: Meet the Golden Rules

To wrap this up, let me summarize the key points about trade frequency requirements:

- Aim for 720+ trades annually (60 per month, 16 per week)

- Trade on 75% of market days (about 4 days per week)

- Keep average holding periods under 31 days

- Dedicate 4+ hours daily to your trading business

- Maintain continuity with few interruptions

- Run your trading like a business with proper equipment, education, and structure

- Keep meticulous records that separate trading from investment activities

Remember, trader tax status isn’t determined by a single factor but by the overall pattern and substance of your trading activities. Meeting the volume requirement alone isn’t enough—you need to satisfy the full spectrum of qualifications.

If you think you might qualify, I strongly suggest consulting with a tax professional who specializes in trader taxation before claiming this status on your tax return. The benefits can be substantial, but so can the risks of claiming it incorrectly!

Have you been tracking your trade frequency? Are you close to meeting these requirements? Understanding where you stand now is the first step toward potentially claiming trader tax status in the future.

Review the IRS Guidance

According to the IRS, you must meet the following three conditions to be properly classified as a securities trader for federal income tax purposes.

- You must seek to profit from daily market movements in the prices of securities and not from dividends or capital appreciation.

- Your activity must be substantial.

- You must carry on the activity with continuity and regularity.

Consider the following factors to help determine if you engage in the business of trading securities:

- The typical holding periods for the securities you buy and sell,

- The frequency and dollar amount of your trades during the year,

- The extent to which you pursue the activity to produce income for a livelihood, and

- The amount of time you devote to the activity.

If your trading activities dont amount to a business, youre considered an investor. It doesnt matter if you prefer to call yourself a trader or a day trader.

Important: You can be a trader in some securities and hold other securities for investment. The special federal income tax rules apply only to your trading portfolio. So, you should keep detailed records to distinguish securities held for investment from securities bought and sold in your trading business. Securities held for investment must be identified as such in your records on the day you acquire them. The easiest way to meet this requirement is to simply hold all your investment securities in a separate brokerage account.

Tax Advantages of Professional Trader Status

Potential upsides of qualifying for professional trader status for tax purposes include:

Traders can deduct expenses on Schedule C and benefit from SE tax exemption. Theyre considered to be in the business of buying and selling stocks (and other securities, if applicable) for a profit. Therefore, traders can fully deduct trading-related expenses on Schedule C like any other sole proprietor. However, unlike most sole proprietors, they dont have to pay self-employment (SE) tax on their net profit from trading.

Traders can make the “mark-to-market” election. Traders who make this election enjoy two important tax advantages. First, they dont have to worry about the wash-sale rule, which defers a tax loss when the same stock is bought or sold within 30 days before or after a loss sale. The disallowed wash-sale loss gets added to the basis of the shares that caused the problem. But, with the mark-to-market election, a trader doesnt have to spend any time on unproductive bookkeeping to comply with the wash-sale rule, freeing up time for researching and trading stocks.

Second, traders who make this election are exempt from the $3,000 annual limit on deducting net capital losses ($1,500 if you use married-filing-separate status). Thats because, as a mark-to-market trader, gains and losses from trading are considered ordinary gains and losses, like garden-variety business income and expenses. So, if a trader has a bad year, his or her net trading loss can be fully deducted, rather than being limited to $3,000 (or $1,500).

How many trades should you take per day

FAQ

How many trades for trader status?

We recommend an average of four transactions per day, four days per week, 16 trades per week, 60 a month, and 720 per year on an annualized basis. Count each open and closing transaction separately, not round-trip.

What is the 3 5 7 rule in trading?

What qualifies as a trader?

What is the 90% rule in trading?

The Rule of 90 is a grim statistic that serves as a sobering reminder of the difficulty of trading. According to this rule, 90% of novice traders will experience significant losses within their first 90 days of trading, ultimately wiping out 90% of their initial capital.