The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Historical information is not adjusted for stock splits. Visit our Dividend Calendar: Please note that the dividend history for Nasdaq stocks may also be combined the regular with the special dividend. Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Links cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com.

Nasdaq Dividend History provides straightforward stock’s historical dividends data. Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks.

These symbols will be available throughout the site during your session. Data is currently not available

These instruments will be available throughout the site during your session. Data is currently not available

Investing in dividend-paying stocks can be a smart way to generate passive income and build wealth over time. If you’re considering Coca Cola as an investment one of the first questions you might have is about their dividend payment schedule. So how many times does Coca Cola pay dividends? Let’s dive in and explore everything you need to know about Coca Cola’s dividend payments.

The Short Answer: Coca Cola Pays Dividends Quarterly

Coca Cola (KO) pays dividends four times per year, making it a quarterly dividend payer This is great news for investors who want regular income from their investments.

According to the company’s official information Coca Cola typically distributes dividend payments on

- April 1

- July 1

- October 1

- December 15

This schedule means that as a Coca Cola shareholder, you can expect to receive dividend payments approximately every three months, providing a consistent stream of passive income throughout the year.

Coca Cola’s Current Dividend Details

Let’s look at some key figures regarding Coca Cola’s current dividend situation:

- Annual Dividend: $2.04 per share

- Dividend Yield: 2.89% (This means for every $100 invested, you’d receive approximately $2.89 in dividends annually)

- Quarterly Dividend: $0.51 per share

- Next Ex-Dividend Date: December 1, 2025

- Next Dividend Payment Date: December 15, 2025

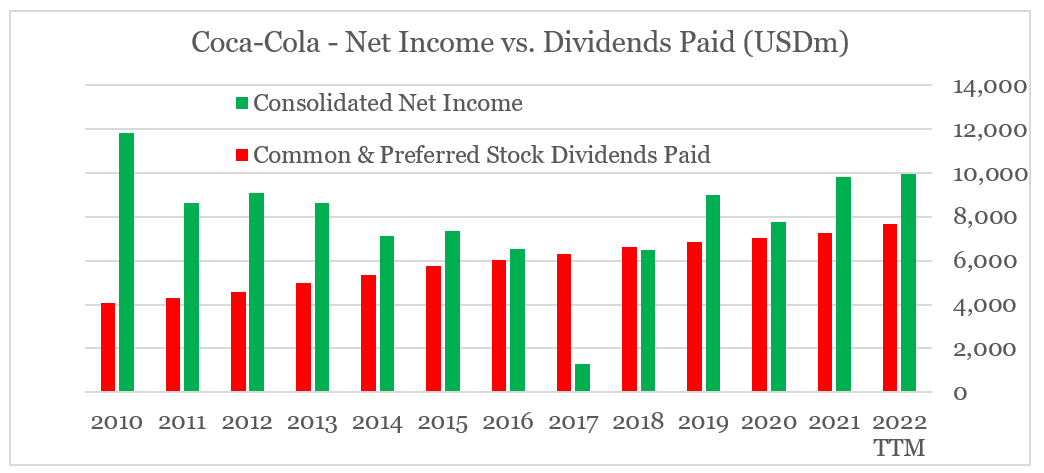

- Payout Ratio: 65.04% (This indicates that Coca Cola pays out about 65% of its earnings as dividends)

An Impressive Dividend History

One of the most impressive things about Coca Cola as a dividend stock is its remarkable track record. The company has increased its dividends for 53 consecutive years! This makes Coca Cola what investors call a “Dividend King” – a company that has increased its dividend payment annually for at least 50 years.

This consistent growth demonstrates Coca Cola’s financial stability and commitment to returning value to shareholders. The company’s dividend growth rates over different time periods are:

- 1-Year Dividend Growth: 5.22%

- 3-Year Dividend Growth: 5.01%

- 5-Year Dividend Growth: 4.33%

- 10-Year Dividend Growth: 4.52%

These numbers show that Coca Cola has not only maintained its dividend payments but consistently grown them over time, outpacing inflation in many years.

How to Receive Your Coca Cola Dividends

If you own Coca Cola shares, you have options for how you’d like to receive your dividends. According to the company’s FAQ:

“Shareowners of record can elect to receive their dividend payments electronically or by check in the currency of their choice. You can select your desired payment method by accessing your account online through Investor Centre at www.computershare.com/coca-cola or by contacting Computershare at 888-COKESHR (888-265-3747) or 781-575-2653 for details.”

This flexibility allows investors to receive their dividends in the way that works best for their financial situation and preferences.

Understanding Dividend Terminology

When investing in dividend stocks like Coca Cola, it’s important to understand some key terms:

Ex-Dividend Date

The ex-dividend date is crucial for dividend investors. For Coca Cola, the upcoming ex-dividend date is December 1, 2025. This date determines who receives the next dividend payment.

- If you buy the stock BEFORE the ex-dividend date, you WILL receive the upcoming dividend

- If you buy the stock ON OR AFTER the ex-dividend date, you will NOT receive the upcoming dividend (the seller gets it)

So if you want to receive Coca Cola’s December 2025 dividend payment, you need to purchase shares before December 1, 2025.

Payout Ratio

Coca Cola’s payout ratio is 65.04%, which is slightly higher than what some financial advisors consider ideal (usually under 60%). The payout ratio tells us what percentage of a company’s earnings are distributed as dividends.

A higher payout ratio might limit the company’s ability to reinvest in growth opportunities, but for a mature company like Coca Cola with stable earnings, this level is generally considered sustainable.

Is Coca Cola a Good Dividend Investment?

When evaluating Coca Cola as a dividend investment, several factors stand out:

Pros:

- Consistent Quarterly Payments: Four payments per year provide regular income

- Long History of Dividend Growth: 53 consecutive years of dividend increases

- Strong Brand Recognition: Coca Cola’s global presence and iconic brand provide business stability

- Above-Average Yield: At 2.89%, Coca Cola’s dividend yield is higher than the average S&P 500 company

- Dividend Growth Rate: The consistent 4-5% annual dividend growth helps investors stay ahead of inflation

Potential Concerns:

- Payout Ratio: At 65.04%, the payout ratio is somewhat high, though still manageable

- Growth Challenges: As a mature company, Coca Cola may face challenges in dramatically increasing revenue

- Consumer Shifts: Changing consumer preferences toward healthier beverages could impact future growth

How Coca Cola Compares to Other Dividend Stocks

When compared to other dividend stocks, Coca Cola stands in the:

- 46th percentile among companies in its sector

- 54th percentile among companies in the United States

- 58th percentile among companies worldwide

These percentiles refer to Coca Cola’s dividend yield, meaning its 2.89% yield is higher than 54% of companies in the US.

Some comparable dividend stocks in the consumer staples sector include:

- PepsiCo (PEP)

- Keurig Dr Pepper (KDP)

- The Kraft Heinz Company (KHC)

- Primo Brands Corporation (PRMB)

Dividend Reinvestment: Compounding Your Returns

While we’ve focused on Coca Cola’s quarterly dividend payments as income, many investors choose to reinvest these dividends through a Dividend Reinvestment Plan (DRIP). This strategy allows you to automatically purchase additional shares with your dividend payments, potentially accelerating your returns through compounding.

For example, if you own 100 shares of Coca Cola currently trading at around $70.55, you’d receive about $204 in annual dividends. By reinvesting these dividends, you’d purchase approximately 2.9 additional shares each year (at current prices), which would then generate their own dividends.

Over time, this compounding effect can significantly increase your total returns, especially when combined with Coca Cola’s consistent dividend growth.

My Personal Take on Coca Cola Dividends

I’ve been keeping an eye on dividend stocks for years, and Coca Cola is definitely one of the more reliable options out there. The fact that they pay dividends quarterly means you get that nice regular income flow, which is something many of us investors really appreciate.

What impresses me most isn’t just the quarterly schedule, but the consistency. When a company has raised its dividend for 53 straight years, that’s not just luck – it’s a fundamental business philosophy that puts shareholders first.

We should remember that past performance doesn’t guarantee future results, but Coca Cola’s global brand power and diverse product portfolio give me confidence that they’ll continue their dividend tradition for years to come.

Final Thoughts

To answer the original question – Coca Cola pays dividends four times per year, with payments typically made on April 1, July 1, October 1, and December 15.

For income-focused investors, Coca Cola represents one of the most reliable dividend stocks on the market with its:

- Quarterly payment schedule

- 53-year history of dividend increases

- Solid 2.89% current yield

- Steady dividend growth rate

Whether you’re building a retirement portfolio, seeking passive income, or just looking for stable investments, Coca Cola’s dividend program deserves serious consideration as part of a diversified investment strategy.

Remember that while dividend history provides useful information, it’s always important to conduct thorough research and possibly consult with a financial advisor before making investment decisions.

Have you invested in Coca Cola for its dividends? What’s your experience been like with quarterly dividend payers? I’d love to hear your thoughts and questions in the comments below!

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

We are actively working to enhance your experience by translating more content. However, please be aware that the page you are about to visit has not yet been translated.

We appreciate your undertanding and patience as we continue to imporove our services.

- KO

- Dividend History

The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Historical information is not adjusted for stock splits. Visit our Dividend Calendar: Please note that the dividend history for Nasdaq stocks may also be combined the regular with the special dividend. Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Links cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com.

Nasdaq Dividend History provides straightforward stock’s historical dividends data. Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session. Data is currently not available

To add instruments:

- Type a instrument or company name. When the instrument you want to add appears, add it to My European Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple instruments separated by spaces.

These instruments will be available throughout the site during your session. Data is currently not available

Does coca cola stock pays a dividend

FAQ

How many times will the dividend be paid?

How frequently does Coca-Cola pay dividends?

The Company normally pays dividends four times a year, usually April 1, July 1, October 1 and December 15. Shareowners of record can elect to receive their dividend payments electronically or by check in the currency of their choice.

What if I invested $1000 in Coca-Cola 20 years ago?

An initial

investment in Coca-Cola stock 20 years ago would be worth approximately $26,928 today, based on the stock’s price alone, but a much higher amount if reinvested dividends are included. With reinvested dividends, the value could be around $67,641 over the same 20-year period, demonstrating the power of long-term growth and compounding through dividend payments.

Is Coca-Cola a good dividend stock?

The Coca-Cola Company (KO): A Dividend King Among the Best S&P 500 Dividend Stocks. The Coca-Cola Company (NYSE:KO) is included among the 10 Best S&P 500 Dividend Stocks to Invest in.