How long you keep your bank statements depends on the type of account and how you receive your bank statements. Most financial institutions provide electronic statements through online banking and make them accessible for years. Wells Fargo, for example, keeps deposit account statements for up to seven years. Check with your own bank or credit union for their specific policies.

If you still receive paper statements, its a good idea to keep them for at least a year. If an issue arises with one of your accounts requiring you to access those records, this makes it much easier to access those records. When disposing of paper statements, be sure to shred them so no one can access your account information from the discarded paper.

Banks keep records of your account statements for a certain number of years as required by law. However the exact number of years varies between financial institutions. As a customer, knowing how long your bank stores statements can help you access records when needed and also determine when to safely dispose of old records.

Why Banks Keep Statements

There are a few key reasons why banks hold on to your old statements

-

Compliance with regulations – Banks are required by law to retain certain financial records for a minimum period of time. This includes monthly or periodic statements issued to customers.

-

Support audits – Banking regulators routinely perform audits and may request to see statements and records. Keeping several years of statements helps banks comply.

-

Assist in disputes – Customers sometimes have questions or disputes about past transactions. Banks rely on statement records to investigate and resolve issues.

-

Provide customer access – Many banks allow customers to access several years of past statements online. Keeping the records makes this possible.

How Long Are Bank Statements Kept?

Most banks keep monthly statement records for between 3 to 10 years. However, policies are not standardized across banks. Here are the general guidelines:

-

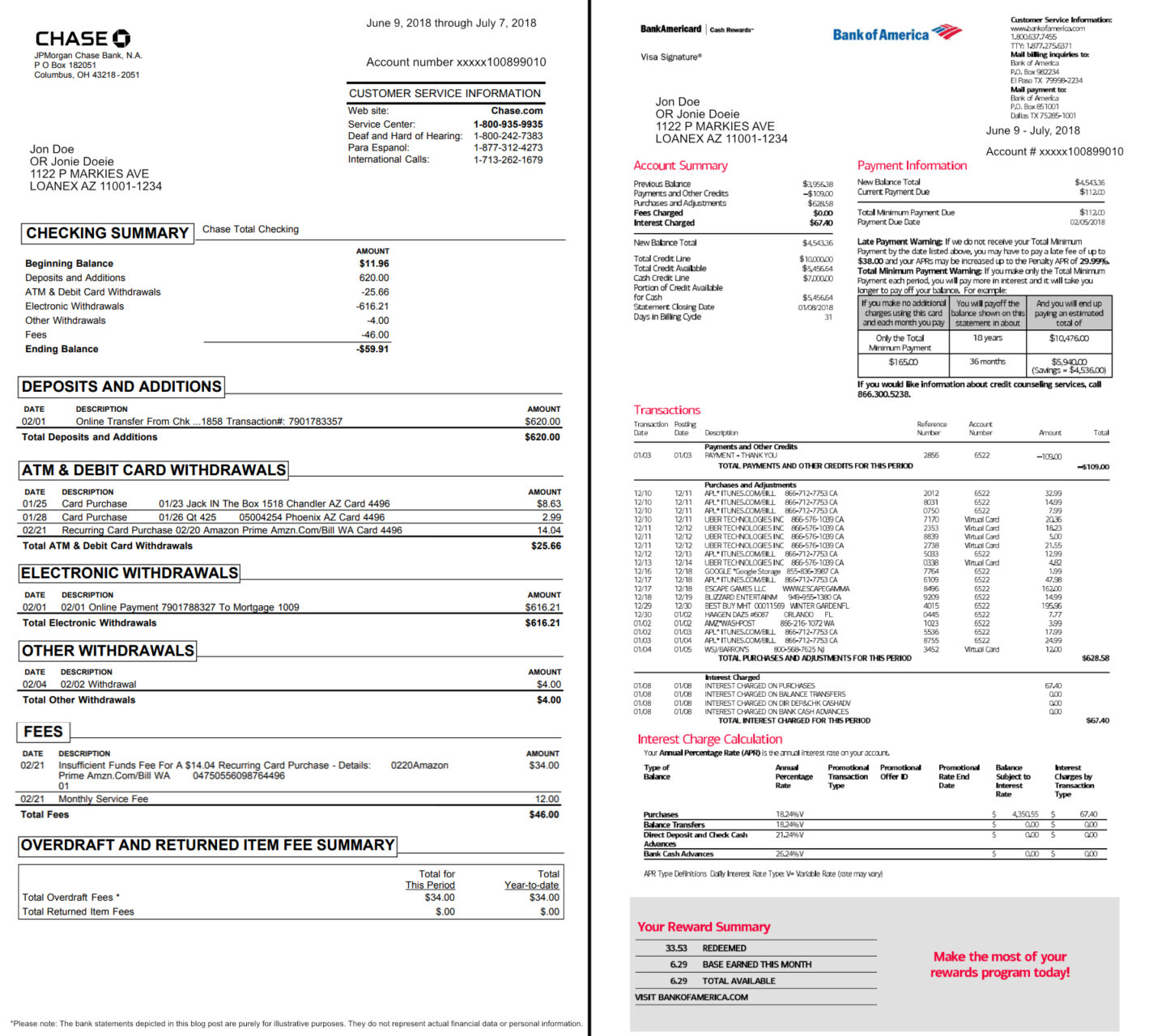

Big national banks – Banks like Chase, Bank of America, and Wells Fargo usually keep statements for 7 years. Some keep for as long as 10 years.

-

Regional and local banks – Smaller banks tend to keep statements for shorter periods of around 3 to 5 years.

-

Online-only banks – Since they lack physical branches, online banks like Ally and Marcus by Goldman Sachs retain statements for up to 7 years.

-

Foreign bank accounts – Overseas banks with US customers keep records for a minimum of 5 years.

So in most cases, count on your bank keeping monthly statements for 5 to 7 years. Check your bank’s website for their specific policy if needed.

What About Checking Accounts?

Banks keep records for both checking and savings accounts. However, the retention period may be longer for checking accounts.

There are two reasons for this:

-

Checking accounts tend to have more transaction activity and disputes. Longer records are useful for research.

-

Certain canceled checks can be claimed as tax deductions. Banks keep records to support tax filings.

For these reasons, some banks will hold checking account statements for 2 to 3 years beyond their normal retention periods. Always verify directly with your bank for their specific checking account policy.

What Happens After the Retention Period?

Once bank statements pass the retention period, they are typically purged from the bank’s systems and archives. Both online and paper records are destroyed.

This means as a customer, you will generally no longer be able to:

- View statements older than the retention period online

- Request copies of statements from the bank

- Have the bank research transactions beyond the retention window

So while keeping long-term records comes with storage costs for banks, it also provides customers with statement access and resolution support when needed.

Tips for Keeping Your Own Bank Records

Since bank statement access is limited to a fixed number of years, it’s wise to keep your own copies if possible. Here are some tips:

-

Download electronic copies – If your bank provides online access to statements, download periodic copies for your personal records.

-

Retain paper statements – If you receive mailed statements, store past years in a safe place at home or a safe deposit box.

-

Back up files – Keep any downloaded electronic statements in multiple secure places like external drives or cloud storage.

-

Review tax records – Checking account statements supporting tax deductions should be kept for 7 years based on IRS guidelines.

Keeping your own bank statements lets you access records whenever needed, even after they are purged from your bank’s systems.

Key Takeaways

-

Banks are mandated to keep customer statements for 3 to 10 years, with 5 to 7 years being typical.

-

Records are used to support audits, disputes and customer access.

-

Checking accounts often have longer retention periods than savings accounts.

-

Banks destroy records after they pass the retention period.

-

Customers should keep their own copies of statements for future reference.

Knowing how long your bank retains statements helps you plan for long-term access to important financial records. Be sure to verify the specific policy with your financial institution.

When You Need the Records

About two-thirds of Americans now use digital banking, either via a phone app or on a personal computer. More than half continue to get their bank and credit card statements by mail, though. Not surprisingly, older consumers are much more likely to prefer paper documents.

For simple bank statements, such as those for checking or savings accounts, you may not need the statements for much more than a standard monthly review of account activity. However, there may be times when you need a record of a transaction from several months ago, and that bank statement might be all that is available. For such cases, its a good idea to have at least a years worth of back statements.

How to Shred Your Documents

When youre ready to dispose of your bank statements, make sure you actually shred them. Just ripping them in half, isnt going to stop identity thieves from piecing together your personal information. Shredders are now small, portable, and cheap.

If your paper volume is enormous, shredding services can be bought. Some banks will shred your statements for free on request.

How Long Do Banks Keep Financial Records? – CountyOffice.org

FAQ

Can I get bank statements from 10 years ago?

How long do banks keep bank statements?

How far back can I get bank statements?

Do I need to shred 20 year old bank statements?

Bank statements and canceled checks. Even if they’re old statements, they should be shredded.Dec 17, 2023