According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

A credit score of 787 is considered very good or even excellent by most standards. But what exactly does this score mean, and how can you work to improve an already high score? Let’s take a closer look.

What is a Good Credit Score?

Credit scores generally range from 300 to 850. The higher the score, the better it is considered by lenders. Here is a breakdown of the credit score ranges

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Exceptional

As you can see, a score of 787 falls into the “very good” range. It is well above the average credit score of around 690. Only about 25% of consumers have credit scores in this range.

The Benefits of a 787 Credit Score

A 787 credit score comes with many advantages when it comes to borrowing money and getting approved for new credit. Here are some of the key benefits:

-

Lower Interest Rates Lenders will often offer their very best rates to borrowers with scores in the very good/excellent range This means lower interest rates on mortgages, auto loans, credit cards and personal loans

-

Increased Approval Odds: With a 787 score, your odds of getting approved for just about any loan or credit card are very high. Lenders view borrowers with scores in this range as lower risk.

-

Better Credit Card Rewards: Credit card companies offer their top rewards credit cards and most lucrative signup bonuses to borrowers with excellent credit. Perks may include airline miles, cash back, hotel stays and more.

-

Higher Credit Limits: Creditors will often approve higher credit limits for borrowers with very good scores. This helps keep utilization low and further builds your credit.

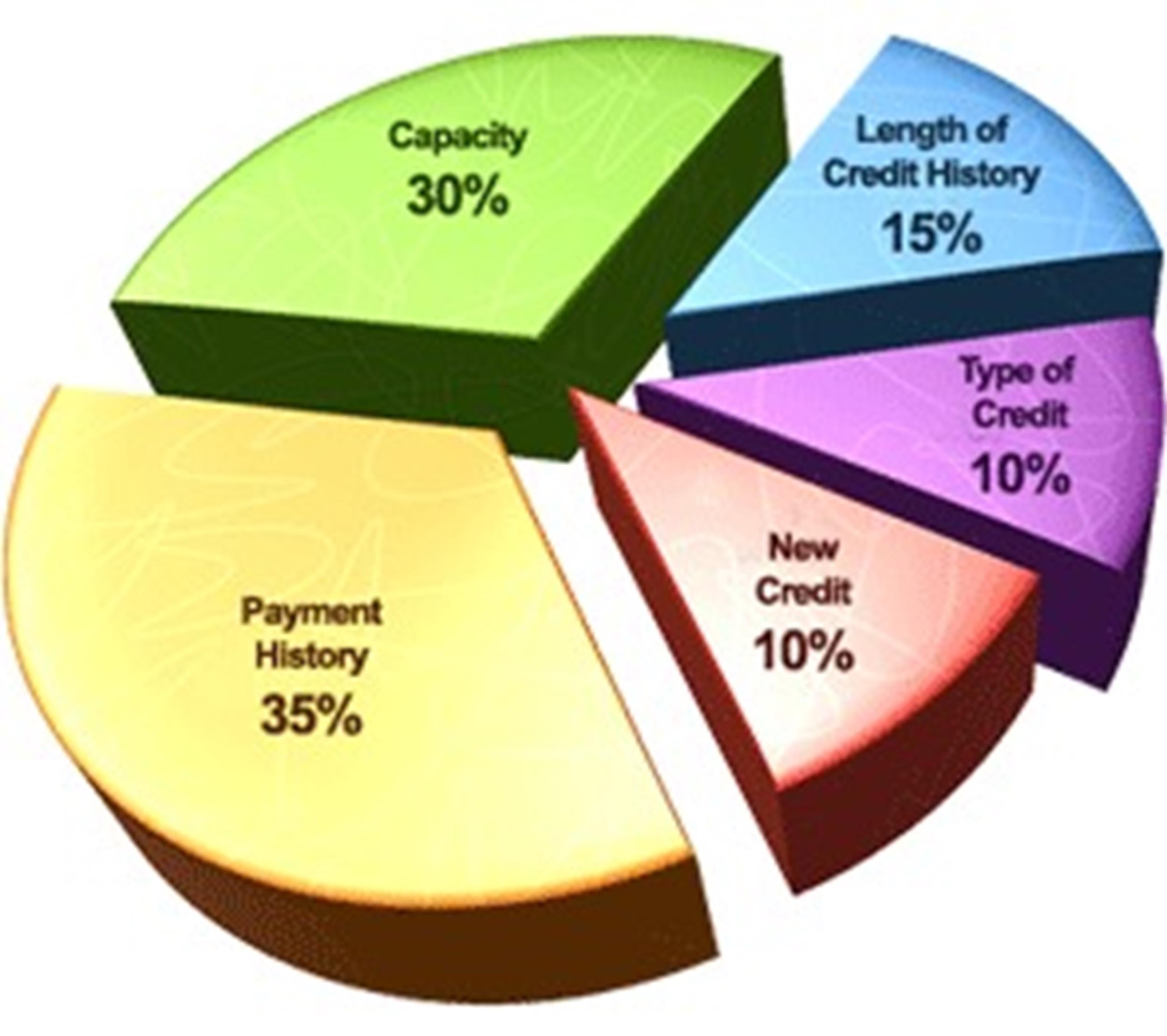

How to Improve an Already High 787 Score

While a 787 credit score is excellent, there are still a few steps you can take to push it even higher into the 800+ range:

-

Lower Credit Utilization: Keep balances low on credit cards and other revolving credit. Experts recommend keeping utilization below 30%.

-

Mix up Credit Types: Have a blend of installment loans (mortgages, auto, student loans) and revolving credit (credit cards). This shows you can manage different types of credit.

-

Limit Hard Inquiries: Too many credit applications in a short period can ding your score. Only apply for credit when needed.

-

Monitor Your Credit: Keep an eye out for any inaccuracies, fraud or identity theft by checking your credit reports regularly.

-

Increase Credit History: Keep old accounts open as having a longer credit history helps your score. The average age of credit for someone with a 787 score is about 7.5 years.

-

Ask for Credit Line Increases: This will lower your overall utilization and increase total available credit. Both help boost scores.

-

Sign Up for Credit Monitoring: This alerts you any time your score changes so you can address issues before they worsen.

Maintaining a Very Good 787 Credit Score

Once you’ve achieved a very good credit score, you’ll want to be sure to keep it there by continuing to practice good credit habits such as:

- Pay all bills on time each month

- Keep credit card balances low

- Limit new credit applications

- Check credit reports frequently

- Don’t close old credit accounts unnecessarily

- Ask for higher credit limits when possible

Who Has a 787 Credit Score?

Higher credit scores tend to correlate with age, as older consumers have had more time to establish credit history. Here is the percentage of people in different age groups that have credit scores in the 750-850 “exceptional” range:

- Gen Z (18-25): 15.4%

- Millennials (26-41): 24.4%

- Gen X (42-57): 26.1%

- Baby Boomers (58-76): 44.1%

- Silent Generation (77+): 58.7%

As you can see, less than 1 in 4 consumers under age 40 have credit scores over 750. So if you are on the younger side and have a score approaching 800, you are well ahead of most people your age.

Is a 787 Credit Score Good or Bad?

Given where it falls on the credit score range, a 787 credit score is undoubtedly very good. It signifies responsible credit usage and excellent payment history. Fewer than 1% of consumers with a score in this range are likely to default or become delinquent on credit obligations.

That said, there is always room for improvement. While a 787 credit score already qualifies you for great rates and loan terms, pushing your score over 800 could open up even more opportunities and savings.

Through diligent credit monitoring, keeping utilization low and having a mix of credit types, you may be able to nudge your 787 score into the exceptional zone. But even if your score stays put, you can be satisfied knowing that a 787 credit score ranks you ahead of most other consumers when it comes to borrowing power and creditworthiness.

How to maintain your credit score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. That’s the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 That’s because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

-

How to make a budget [Video]

Learning how to make and follow a budget is an important step on your journey towards financial confidence.

-

Tips to reduce your spending

Check out our advice for cutting down on your spending to help you save, even during challenging times.

-

Check your credit score

You can check your credit score with the TransUnion CreditView® Dashboard in the TD app. Checking in the TD app will not affect your credit score in any way. Get a free check of your credit score. Learn more

-

TD Debt Consolidation Calculator

Find your debt-freedom date and quickly calculate how soon you can be debt-free. TD Debt Consolidation Calculator Calculate

-

Looking for a credit card?

Use our Credit Card Selector Tool to help you choose. Looking for a credit card? Explore your options

What’s a utilization ratio or debt-to-credit ratio?

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that you’re a higher-risk borrower.5 That’s because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

What is a GOOD Credit Score in 2025? What’s the Average Credit Score Overall & By Age / Generation?

FAQ

Is 787 a good credit score to buy a car?

Usually, higher scores mean lower interest rates on loans. According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a used-car loan around 9.06% or lower. Superprime: 781-850.

Is a 900 credit score possible?

What is considered an excellent credit score?

Does anyone have an 850 credit score?