Its an age-old question we receive, and to answer it requires that we start with the basics: What is the definition of a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report. Your payment history, the amount of debt you have and the length of your credit history are some of the factors that make up your credit scores.

There are many different credit scoring models, or ways of calculating credit scores. Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Credit scores help creditors determine how likely you are to pay back money they lend.

Its important to remember that everyones financial and credit situation is different, and theres no credit score “magic number” that guarantees better loan rates and terms.

Your credit score is one of the most important numbers in your financial life. It determines everything from whether you can get approved for new credit cards and loans to the interest rates and fees you’ll pay. So how good is a credit score of 758? Let’s take a deeper look.

What is a Credit Score?

Your credit score is a three-digit number that lenders use to quickly assess your creditworthiness and risk level. The most commonly used credit scoring model is the FICO® Score, which ranges from 300 to 850. The higher your FICO® Score, the lower risk you are deemed to be by lenders.

FICO® Scores are calculated based on the information in your credit reports from the three major credit bureaus – Experian, TransUnion, and Equifax. The score looks at factors like your payment history, credit utilization, credit history length, credit mix, and new credit inquiries. Each factor is weighted differently in terms of its importance in calculating your overall score.

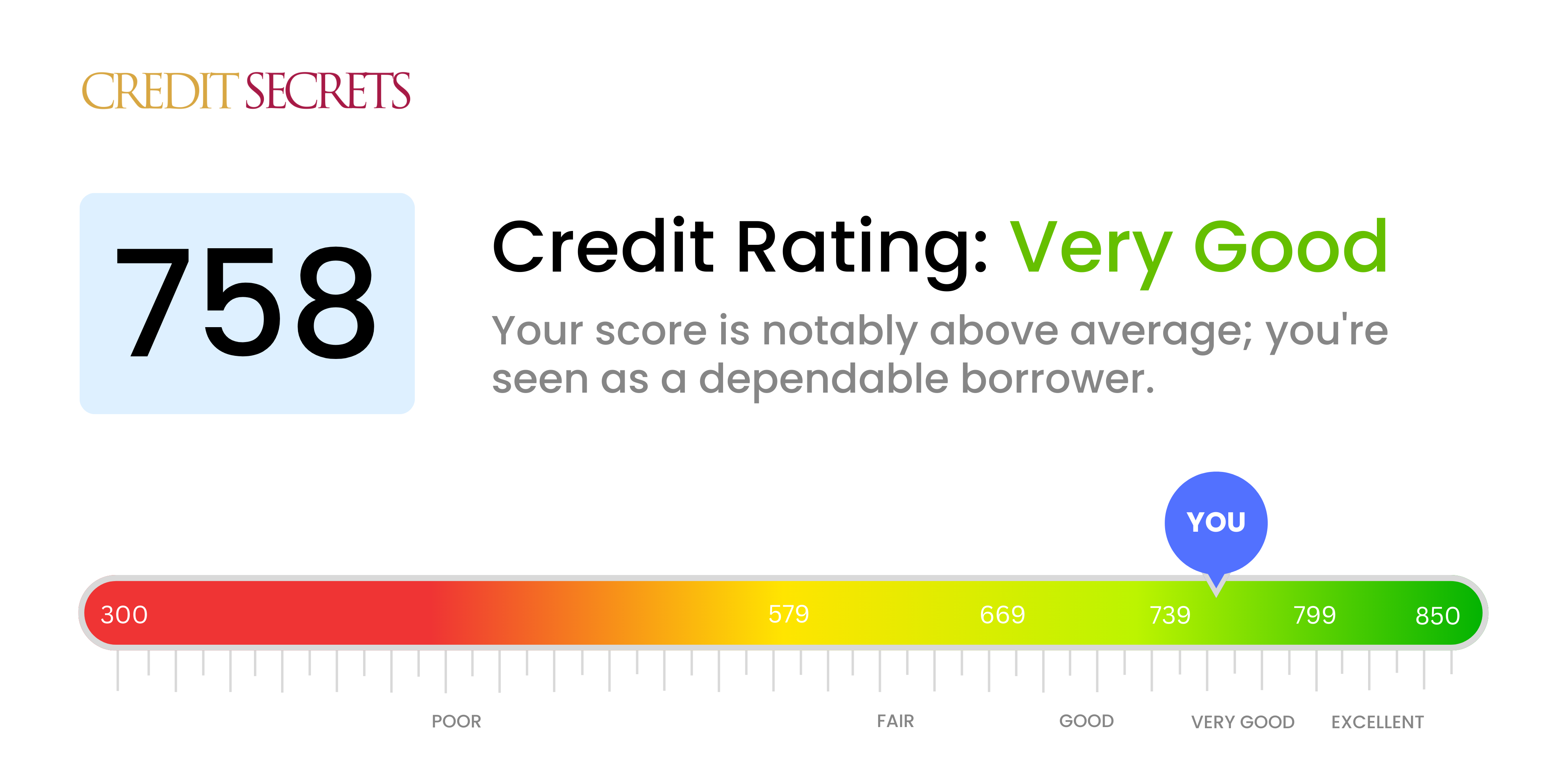

758 FICO® Score

A FICO® Score of 758 falls in the “Very Good” credit score range, which is 740-799. According to Experian data, a 758 credit score is well above the average FICO® Score of 714. Only 25% of consumers have credit scores in the Very Good range

People with Very Good credit are considered lower risk borrowers who likely have a proven history of managing credit responsibly by paying bills on time and keeping credit card balances low A 758 credit score puts you in a very good position when applying for credit.

Is a 758 Credit Score Good or Bad?

A FICO® Score of 758 is undoubtedly a good credit score. It’s well within the range lenders consider to be excellent credit, and you should have access to the best lending terms and rates available.

Here are some key points on why a 758 credit score is good

-

A 758 credit score is in the top 25% of consumers, well above the average score.

-

A 758 FICO® Score is 44 points above the “Good” credit range starting at 714.

-

With a Very Good 758 score, you are statistically less likely to miss payments or default on credit obligations. Only 1% of people with scores in this range are expected to become seriously delinquent.

-

Lenders will view you as an excellent credit risk and offer you the most competitive interest rates and product terms. You’ll qualify for premium rewards credit cards and the best mortgage rates.

-

You can feel confident applying for new credit if needed, as you’ll be approved in most cases with such a strong score.

-

A 758 credit score indicates you have a proven history of responsible credit usage over time. Lenders like to see established accounts.

-

You likely have a good credit mix with both revolving (credit cards) and installment (mortgage, auto, student loans) accounts. This also helps your approval odds.

While a 758 credit score doesn’t guarantee approval for every credit application, it does mean you are in a very strong position credit-wise. There are higher scores of course, but 758 is excellent.

How to Improve a 758 Credit Score

While a 758 FICO® Score is very good, there are still actions you can take to improve it even more. According to Experian, people with 758 credit scores have average revolving credit card utilization of 18.5%. To boost your score, focus on keeping individual and overall revolving utilization below 30%.

Also, avoid applying for too much new credit at once, as new accounts can temporarily ding your score a few points before rebounding. Limit new credit applications to when you truly need them.

Of course, continuing to pay all your bills on time is critical. Payment history has the greatest impact on your scores. Avoid late payments if possible and keep balances low.

Finally, having a mix of credit types can help. If you have credit cards already, adding an installment loan like a personal loan or auto loan may boost your score down the road. Just be sure to manage the new credit responsibly by making payments on time.

Maintaining a Very Good 758 Credit Score

Once you reach the Very Good credit score range, maintaining your 758 or higher score should be the priority. Here are some tips:

-

Check your credit reports regularly and dispute any errors with the bureaus to keep your reports accurate. Errors can negatively impact your scores.

-

Sign up for credit monitoring to track your FICO® Scores and get alerts for key changes. Monitoring helps detect identity theft too.

-

Keep overall credit card utilization low, ideally below 30% as that level leads to score drops.

-

Don’t close your oldest credit cards as your length of credit history factors into your score.

-

Mix up credit types – having both installment loans and revolving accounts helps.

-

Only open new credit if needed – new accounts lower average age of accounts.

-

Ask for higher credit limits – this lowers utilization. But only make the charges you can pay off each month.

Sticking to responsible credit habits like paying on time and not overextending your borrowing will help maintain and potentially raise your already excellent 758 credit score. Be patient and let your strong history work for you over time.

The Benefits of a Very Good Credit Score

Reaching a 758 FICO® Score unlocks many benefits, including:

-

Easy approval odds for new credit cards and loans at the best terms

-

Low interest rates saving you money on financing costs

-

Higher credit limits on new credit cards

-

Opportunities to refinance loans at lower rates

-

More bargaining power to negotiate better deals

-

Low security deposit requirements when applying for utilities, cell phone plans, etc.

-

Better chances at apartment rental approvals and better terms

-

Potentially lower insurance premiums (credit-based)

-

Greater career opportunities – employers often check credit

-

Sense of accomplishment and pride in your financial responsibility

A 758 credit score signifies that you are managing credit well and reaping the many rewards that come with being a Very Good borrower. It’s a great score to maintain.

Summary

A FICO® Score of 758 falls squarely in the Very Good credit range, meaning you have excellent credit. With responsible credit usage over time, a 758 score provides approval for the best loans and credit cards at low rates. You have access to premium rewards cards and competitive mortgage rates. While trying to improve from 758 is possible, maintaining this high level should be the priority. Do this by always paying bills on time, keeping credit card balances low, having a mix of account types, limiting inquiries, and monitoring your credit. The financial benefits of a 758 credit score are well worth the effort of preserving this Very Good credit standing.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

What are credit score ranges and what is a good credit score?

Credit score ranges vary depending on the scoring model. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores.

- 740 to 799: Very Good Credit Score Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good Credit Score Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair Credit Score Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor Credit Score Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, its likely youll need to take steps to improve your credit scores before you can secure any new credit.

Lenders use credit scores along with a variety of other types of information — such as information you provide on the credit application (for example: income, how long you have lived at your residence, and other banking relationships you may have) in their loan evaluation process. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

Is 758 A Good Credit Score? – CreditGuide360.com

FAQ

How many people have a 758 credit score?

Twenty-four percent have a FICO® Score between 750 and 799, making the “very good” bracket. Data source: FICO (2024). Nearly half of Americans score between 750 and 850, in the very good to exceptional range, while 25% of Americans have a score between 300 and 649, the poor to fair credit score range.

Can I buy a house with a 758 credit score?

“A homeowner can secure solid mortgage terms with a credit score of 700 or higher,” he adds. “740 is typically the score necessary to qualify for the ‘best’ rate, but there are products and programs out there that will improve interest rates for FICO credit scores above 760 or 780.”

How rare is a 750 credit score?

A credit score of 750 is considered “very good” and is above the average credit score in the United States. While it’s not as rare as an exceptional score of 800 or higher, it still places you in a relatively strong position with lenders.

Can you get a loan with a 758 credit score?

A credit score of 758 is considered excellent and is indicative of a responsible borrower who manages credit and debt well. If you have a credit score of 758 or higher, you are likely to have access to a wide range of financial products and services, including personal loans with favorable terms and conditions.