“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Paying off your car loan early can be tempting. After all who wouldn’t want to save money on interest and own their vehicle sooner? However early repayment isn’t always the best move. Here’s a detailed look at when you should pay your car payment early versus when it’s smarter to stick to the original loan schedule.

When Paying Early Is a Smart Financial Move

Paying your car loan early can benefit you financially in several situations

You’re Able to Refinance at a Lower Interest Rate

Refinancing involves taking out a new loan to pay off your existing one. If you can qualify for a lower interest rate, you may keep the same monthly payment but slash your repayment timeline. Even a 0.5% rate drop can shave months off a 5- or 6-year loan. This allows you to pay off your car faster without dramatically increasing your payment.

You Have Access to Extra Cash

A financial windfall like a tax refund or work bonus provides an easy way to make a lump sum payment on your auto loan principal. When you pay extra toward the balance, you reduce the interest that accrues moving forward.

You Have a High Interest Rate

Loans with interest rates above 5% tend to benefit most from early repayment. Paying ahead of schedule prevents more interest from compiling at that steep rate. Even an extra $20 or $50 monthly can make a significant impact.

You Want to Reduce Monthly Debt Payments

Perhaps your goal is simplifying your budget by removing a car payment. When you pay off your auto loan early, you free up those funds each month for saving or other priorities.

Situations When Paying Early Doesn’t Make Sense

While fast repayment works in your favor sometimes, it can also backfire. Consider holding off if:

You Have a Prepayment Penalty

Many lenders charge 1-3 months interest as a penalty if you pay off a loan too early. Crunch the numbers to make sure the penalty won’t exceed your potential interest savings.

Your Loan Has Precomputed Interest

With this type of simple interest loan, the total interest owed is calculated upfront. Since most of the interest is packed into the early payments, paying ahead won’t reduce the total interest much.

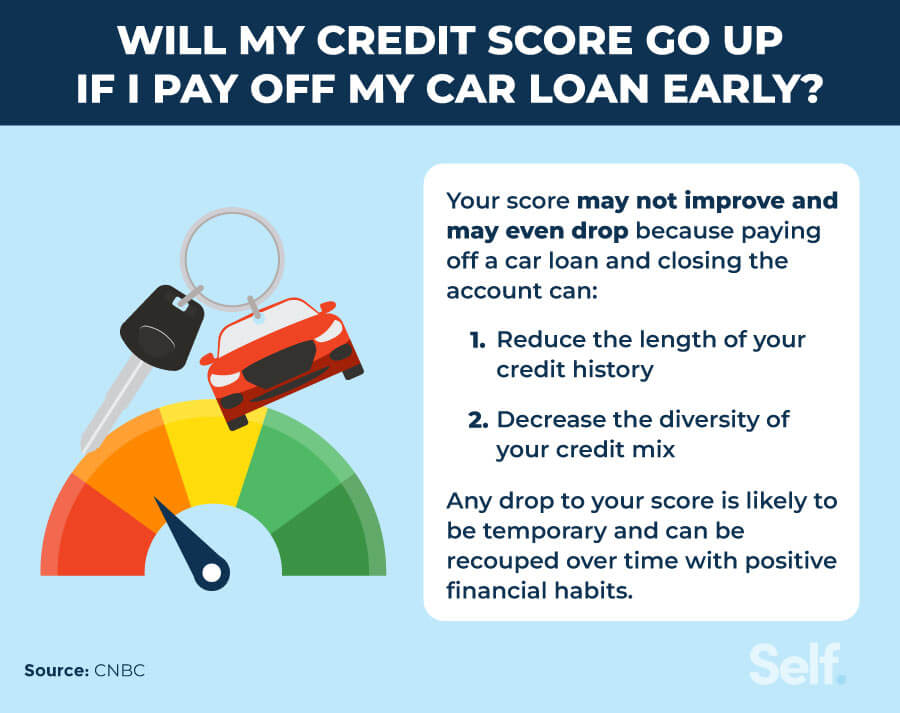

Your Credit Score is Fair or Poor

Keep in mind your credit mix impacts your scores too. Since installment loans like car loans tend to help scores, closing them can lower your mix of credit types.

You’re Low on Emergency Savings

Don’t pay extra toward a loan at the expense of your emergency fund or other financial goals. Paying one debt early often leads to relying on credit again later.

Ways to Pay Off Your Auto Loan Faster

If you’ve decided repaying your car loan ASAP aligns with your financial situation, here are proven strategies to get there:

-

Make biweekly payments – This adds an extra monthly payment yearly, accelerating payoff.

-

Pay half the monthly payment every 2 weeks – You achieve the same effect without changing your total monthly contribution.

-

Round up your payment – Increase your payment by $10, $20 or more monthly. This gradually chips away at the principal.

-

Pay an extra $100 monthly – Additional fixed payments act like rounding up but on a larger scale.

-

Pay annually instead of monthly – Paying your full annual car payment upfront prevents monthly interest accumulation.

-

Use a financial windfall – Put that tax refund, work bonus or gift money toward the principal.

-

Cancel unnecessary add-ons – If you financed extras like an extended warranty, request to cancel for a refund to put toward your loan.

The right approach boils down to your specific auto loan and financial situation. Paying ahead can accelerate payoff, but it also might not make practical sense. Run the numbers to determine if paying your car loan early aligns with your goals.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- • Auto loans

- • Personal loans

Calendar Icon 8 Years of personal finance experience Kellye Guinan is an editor and writer with over seven years of experience in personal finance.

- • Auto Loans

- • Personal loans

Calendar Icon 4 Years of experience Rebecca Betterton, a Certified Financial Education Instructor℠, is a writer for Bankrate who has been reporting on auto loans since 2021.

- • Social Impact Entrepreneurship

- • Economic & Public Policy

Emmanuel Nyame is a member of Bankrate’s Financial Review Board and the CEO of Twelvenets, where he leads campaigns that drive community and economic growth.

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

6 ways to pay off your car loan faster

Your best course of action will be to vary your approach when paying off your car loan ahead of schedule. You can calculate your early payoff savings, and once you have a solid idea of your goal, you can take advantage of a few methods to reach the finish line sooner.

Paying Off Car Loan Early | Principal vs Extra Payment Explained

FAQ

Is it better to pay my car payment early or on time?

It’s not a bad idea — you can save money by paying off your car loan early. But it’s not the best choice for everyone, especially if you don’t have an emergency fund. You can pay less interest if you pay your car off ahead of schedule, but make sure to tell the lender to put the extra toward your principal.

What is the 50/30/20 rule for car payments?

Set your car payment budget

50% for needs such as housing, food and transportation — which, in this case, is your monthly car payment and related auto expenses. 30% for wants such as entertainment, travel and other nonessential items. 20% for savings, paying off credit cards and meeting long-range financial goals.

Is it better to pay ahead or pay principal?

Paying ahead doesn’t save you any money at all. You just finish making payments sooner. You have to make extra payments to principal if you want to save money. Reducing the principal balance reduces the amount of interest charged each month. It will also pay off the balance faster than making extra payments.

What happens if I make my monthly car payment early?

… effort: less interest paid overall, reduced risk of going upside down on the loan, a lower debt-to-income ratio, and a step closer to financial independence