Short selling is a strategy that flips the usual idea of investing. Instead of buying a stock and hoping it goes up, short sellers borrow shares, sell them, and hope the price drops. Its a surprisingly common technique, with around 40%-50% of a typical stocks daily trading volume involving short sales.

While short selling can offer significant rewards, it comes with substantial risks. Usually, this strategy is executed through leveraged products like Contracts for Difference (CFDs). CFDs allow traders to speculate on price movements without owning the underlying shares. However, CFDs also amplify risks, making it essential to fully understand the mechanics and potential pitfalls of short selling before engaging in it.

Short selling, especially with CFDs, is not suitable for inexperienced traders or those who cannot tolerate significant risk. Only engage in short selling if you fully understand leverage, market dynamics, and risk management.

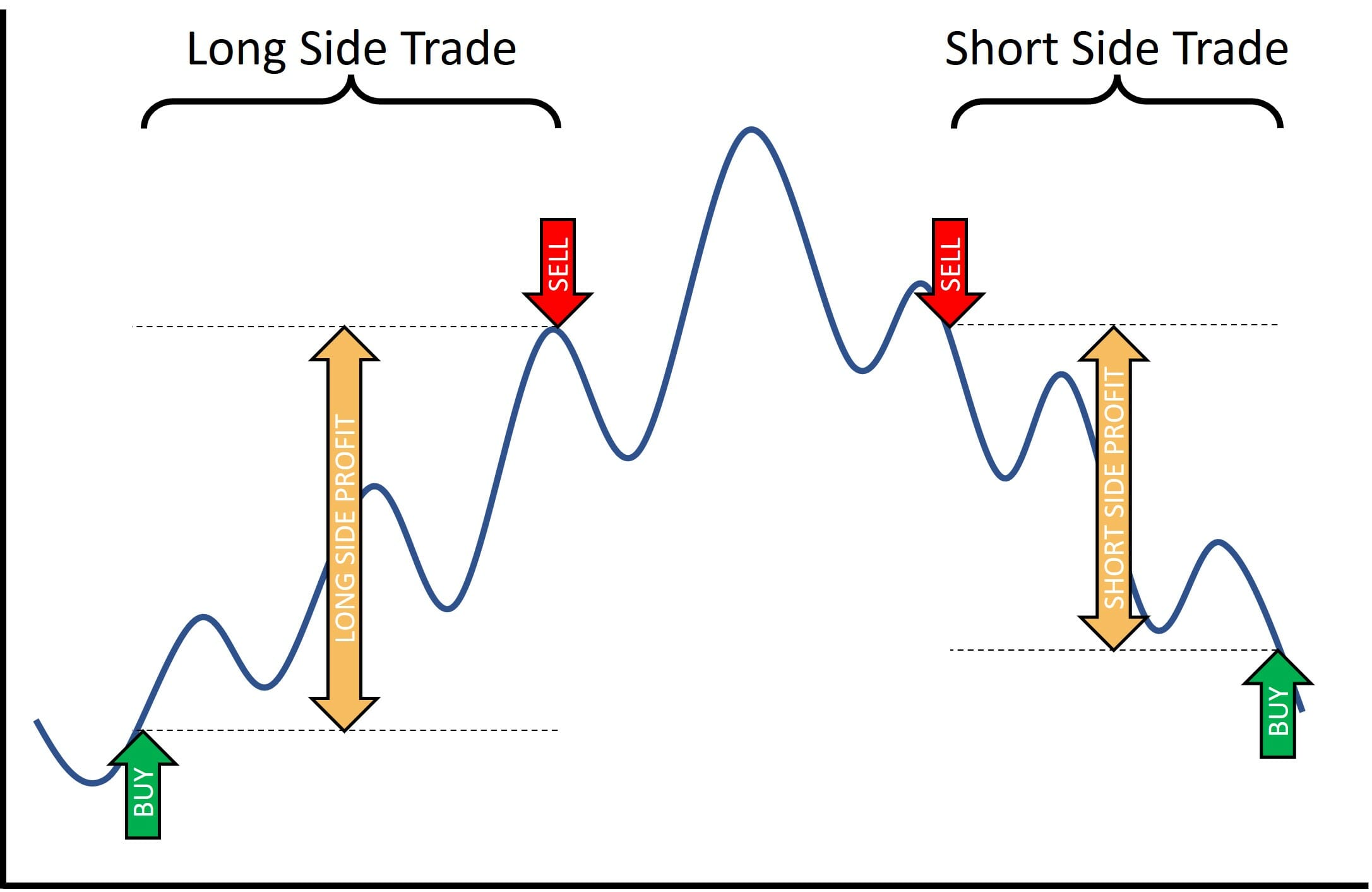

Are you looking to profit when stock prices fall? Short selling might be the strategy you’re looking for. While most investors focus on buying low and selling high, short sellers do the exact opposite – they aim to sell high and buy low. Let’s dive into the fascinating world of short selling and learn how you can potentially profit from market downturns.

What Is Short Selling?

Short selling a stock is when a trader borrows shares from a broker and immediately sells them expecting the price to fall shortly after. If it does the trader can buy the shares back at the lower price, return them to the broker, and keep the difference, minus any loan interest, as profit.

In simpler terms, you’re basically betting that a stock’s price will decline. Unlike traditional “long” investing where you make money when prices rise, short selling allows you to profit when prices fall.

The 5-Step Process to Short a Stock

Let’s break down how to short a stock into five manageable steps:

Step 1: Open a Margin Account

Before you can short stocks, you’ll need to open a margin account with your broker. This isn’t the same as a regular brokerage account – it specifically allows you to borrow securities and requires minimum balances (maintenance margins) to cover potential losses.

Step 2: Identify a Stock to Short

Next, you’ll need to find a stock that you believe will decline in value. This could be based on:

- Fundamental analysis (weak financials, declining revenue)

- Technical analysis (bearish chart patterns)

- Thematic reasons (outdated business models)

- Market sentiment or news

Step 3: Locate Borrowable Shares

Your broker needs to locate shares that can be borrowed before you can short them. Most modern brokerages handle this process automatically, finding shares from other clients’ accounts or from institutional lenders.

Step 4: Place the Short Sale Order

Once shares are available for borrowing, you can place your order. You’ll see the shares available on your brokerage platform, and you can enter either a market order or limit order to short the stock.

Step 5: Monitor and Close the Position

After opening your short position, you’ll need to actively monitor it. To close the position (called “covering”), you buy back the shares at the current market price and return them to the lender. Ideally, you’re buying them back at a lower price than what you sold them for.

A Real-World Example of Short Selling

Let me walk you through a simple example to illustrate how shorting works:

Imagine stock XYZ is trading at $50 per share. You believe the price will fall, so you borrow 100 shares from your broker and sell them immediately, receiving $5,000 ($50 × 100 shares).

Scenario 1 (Profit): The stock price drops to $40 per share. You buy back 100 shares for $4,000 and return them to your broker. Your profit is $1,000 ($5,000 – $4,000), minus any interest or fees.

Scenario 2 (Loss): Instead of falling, the stock price rises to $60. To close your position, you must buy back 100 shares for $6,000. This results in a $1,000 loss ($5,000 – $6,000), plus interest and fees.

The Risks of Short Selling

I gotta be straight with ya – short selling ain’t for the faint of heart. Here are the major risks:

1. Unlimited Loss Potential

This is the biggest risk and it’s scary. When you buy stocks normally, the most you can lose is what you invested (if the stock goes to zero). But when shorting, there’s theoretically no limit to how high a stock can rise, which means your potential losses are unlimited.

2. Margin Calls

If the stock price rises instead of falls, your broker might issue a “margin call,” requiring you to deposit more funds to maintain the required equity levels in your account. If you can’t meet this call, your broker might force-close your position, potentially at a significant loss.

3. Short Squeezes

A short squeeze happens when a stock’s price rises rapidly, forcing short sellers to buy shares to cover their positions. This buying pressure drives the price even higher, creating a dangerous feedback loop. The GameStop saga of 2021 is a perfect example where short sellers lost billions.

4. Borrowing Costs

You’ll pay interest on the borrowed shares, which can eat into your profits, especially if you hold the position for an extended period. These fees can vary significantly and change suddenly.

5. Dividend Payments

If the company issues dividends while you’re shorting their stock, you’ll be responsible for paying those dividends to the lender. This creates an additional cost you need to factor in.

When Is the Right Time to Short Stocks?

Timing is crucial for successful short selling. Experienced traders typically look for these conditions:

- Bear markets: It’s easier to profit from shorts during established downtrends

- Deteriorating fundamentals: Companies with slowing growth or increasing challenges

- Bearish technical indicators: Breakdowns below support levels or bearish moving average crossovers

- Extreme valuations: Sectors or stocks that appear significantly overvalued

Short Selling Costs to Consider

Short selling involves several costs beyond regular trading commissions:

- Margin interest: Since short sales require margin accounts, you’ll pay interest on borrowed funds

- Stock borrowing costs: Shares that are difficult to borrow may have substantial fees, sometimes exceeding 100% annually

- Dividends: You must pay any dividends issued during your short position

Alternatives to Direct Short Selling

If the risks of short selling seem too high, consider these alternatives:

- Put options: These give you the right to sell a stock at a specified price, allowing you to profit from price declines with limited risk

- Inverse ETFs: These funds are designed to move in the opposite direction of a particular index or sector

- Short ETFs: Instead of shorting individual stocks, you can short ETFs that track entire sectors or markets

Short Selling Regulations

Short selling is heavily regulated to prevent market manipulation:

- In the U.S., the SEC requires brokers to locate shares before allowing short sales (Regulation SHO)

- “Naked” short selling (selling without borrowing) is prohibited

- The SEC can temporarily ban short selling during extreme market conditions

- Since October 2023, investors must report short positions to the SEC, and lending companies must report to FINRA

Is Short Selling Right for You?

Short selling isn’t for everyone. It might be appropriate if:

- You have significant trading experience

- You understand and can accept the risks

- You have sufficient capital to withstand potential losses

- You’re willing to actively monitor your positions

For beginners, I’d recommend starting with paper trading (simulated trading with fake money) to practice before risking real capital.

Tips for Successful Short Selling

If you decide to try short selling, keep these tips in mind:

- Do your research: Thoroughly analyze companies before shorting

- Set stop-loss orders: Limit potential losses if the trade goes against you

- Start small: Begin with small positions until you gain experience

- Watch borrowing costs: Be aware of how interest charges affect your profit potential

- Stay informed: Monitor news and developments that could affect your positions

- Have an exit plan: Know when you’ll close your position, whether at a profit or loss

Common Short Selling Metrics

Traders often use these metrics to identify potential short opportunities:

- Short interest ratio (SIR): Measures the ratio of shorted shares to floating shares

- Days-to-cover: The number of days it would take to cover all short positions based on average trading volume

- Short interest as percentage of float: Indicates what portion of available shares are being shorted

Short selling can be a powerful tool in a trader’s arsenal, especially during market downturns. However, it comes with significant risks that shouldn’t be underestimated. The potential for unlimited losses makes it particularly dangerous for inexperienced investors.

If you’re new to investing, I’d recommend mastering traditional buying and selling strategies before venturing into shorting. And if you do decide to short stocks, start small, use stop-loss orders, and never risk more than you can afford to lose.

Remember, even professional traders and hedge funds have been wiped out by short positions gone wrong. Approach this strategy with the caution and respect it deserves.

Have you ever tried short selling? What was your experience? I’d love to hear your thoughts in the comments below!

Open a short position

You open a CFD position to “short” 100 units of a stock priced at USD 100 each, effectively speculating that the stock will drop. The notional value of the trade is USD 10,000 (100 x USD 100).

The stock price drops as expected due to disappointing quarterly results. The value of the CFD position now reflects a price of USD 70 per unit, making the total value USD 7,000 (100 x USD 70).

Short squeeze risk

A short squeeze occurs when a stock that has been heavily shorted starts to rise sharply in price. As the stock climbs, short sellers rush to buy back the shares to cover their losses, which drives the price up even further. This cycle can lead to substantial losses for those who havent exited their positions early.

The infamous GameStop short squeeze of 2021 is a prime example of how a short squeeze can lead to unexpected financial consequences for traders.

Regulations around short selling can change depending on market conditions. Authorities sometimes impose temporary bans on short selling during periods of market instability, as they did during the 2008 financial crisis and the COVID-19 pandemic. Such restrictions can limit your ability to exit positions at the right time, increasing your loss exposure.

In addition to market volatility, timing plays a crucial role in short selling. Stocks can remain overvalued for longer than expected, causing you to hold your position and incur additional interest on borrowed shares. If your timing is off and the stock doesnt decline quickly, the costs of maintaining the short position can erode your profits or even result in a loss.

Understanding Short Selling

FAQ

How do you short a stock example?

For example, let’s say a stock is trading at $50 a share. You borrow 100 shares and sell them for $5,000. The price subsequently declines to $25 a share, at which point you purchase 100 shares to replace those you borrowed, netting $2,500.

Is shorting a stock illegal?

Short selling is not illegal, but it’s subject to stricter regulatory oversight to ensure fair market practices. While it’s a common investment strategy, unethical activities sometimes related to short selling, such as spreading false information to manipulate stock prices, are illegal.

What happens if I short a stock and it goes to $0?

There’s a ceiling on your potential profit, but there’s no theoretical limit to the losses you can suffer. For instance, say you sell 100 shares of stock short at a price of $10 per share. Your proceeds from the sale will be $1,000. If the stock goes to zero, you’ll get to keep the full $1,000.

Can a normal person short sell?

To short a stock, you’ll need to have margin trading enabled on your account, allowing you to borrow money. The total value of the stock you short will count as a margin loan from your account, meaning you’ll pay interest on the borrowing. So you’ll need to have enough margin capacity, or equity, to support the loan.