Are you dreaming of accessing elite banking privileges and wondering how to get your hands on a prestigious Discovery Black Card? You’re not alone! Many South Africans aspire to qualify for this premium banking product that offers exceptional rewards and benefits. Let’s dive deep into everything you need to know about qualifying for the Discovery Bank Black Credit Card Account.

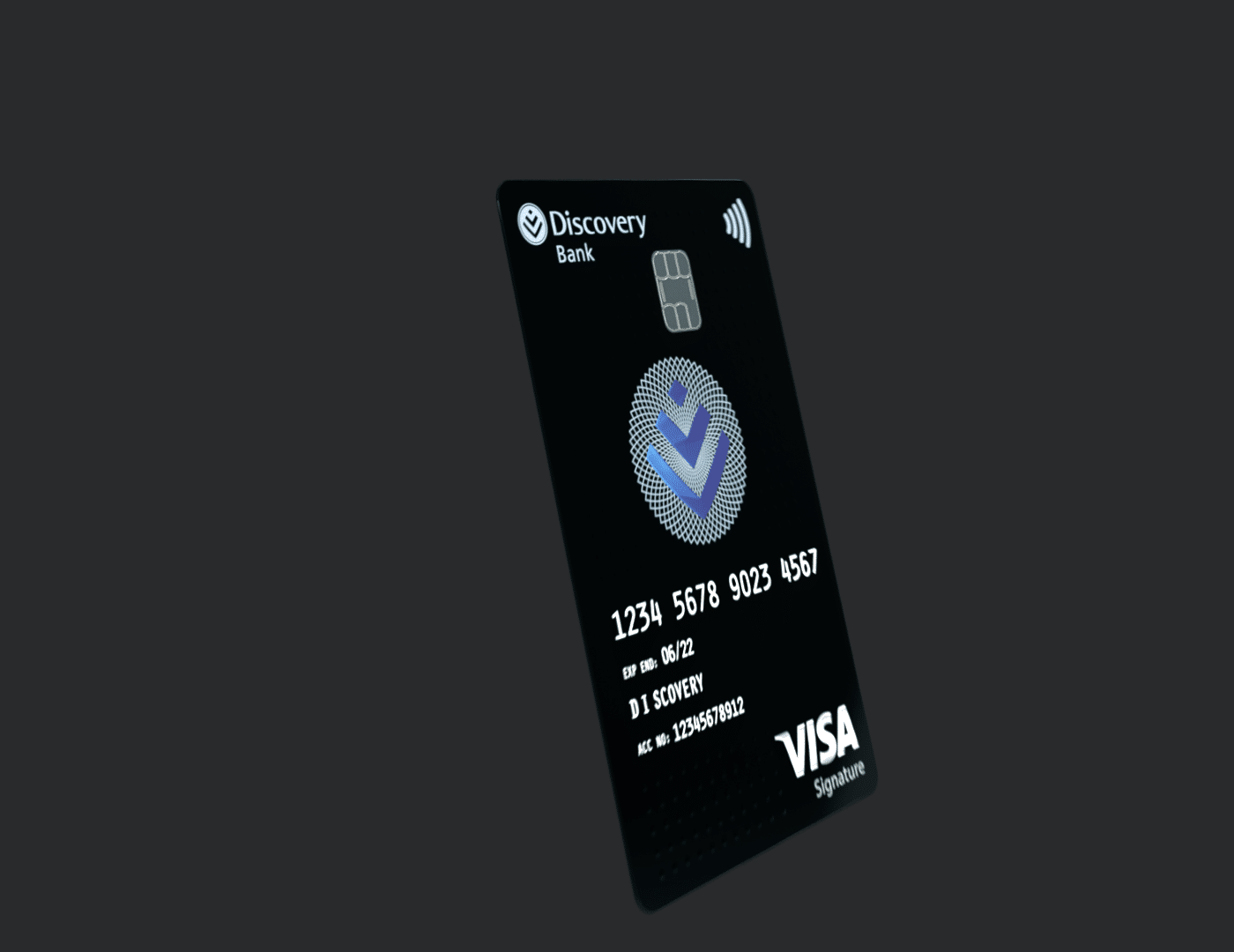

What Is the Discovery Bank Black Credit Card Account?

Before we talk about how to qualify, let’s understand what makes the Discovery Black Credit Card special. This isn’t just a regular credit card – it’s a full transactional banking solution designed for affluent clients who want superior banking services with exclusive perks and rewards.

The Discovery Bank Black Credit Card Account offers:

- Full transactional capabilities

- Up to 55 days’ interest-free credit on select transactions

- The most flexible credit facility in the market

- Real-Time Forex Accounts available 24/7

- Exclusive travel benefits and rewards

- Premium lifestyle rewards

The Main Qualification Requirement: Income Threshold

The primary qualification factor for the Discovery Black Credit Card is your annual income. According to the official Discovery website:

To qualify for a Discovery Bank Black Credit Card Account, you need an annual qualifying income between R850,000 and R2.5 million.

This income requirement positions the Black Card as a premium banking product designed for high-earning individuals The monthly fee for this account is R255 (effective from July 1, 2025)

Additional Factors That May Affect Your Qualification

While income is the main requirement, Discovery Bank, like all financial institutions, will also consider several other factors when evaluating your application:

- Credit Score: A good credit history demonstrates your ability to manage debt responsibly

- Existing Debt Levels: Your current debt obligations may impact approval

- Employment Stability: Consistent employment history is viewed favorably

- Financial Behavior: How you manage your finances plays a role in qualification

Exceptional Benefits That Make the Black Card Worth It

If you meet the income requirements, the Discovery Black Card offers a suite of benefits that truly justify its premium status

Impressive Ðiscovery Miles Rewards

With this account, you can earn substantial Ðiscovery Miles (Discovery’s rewards currency) for everyday activities:

- Up to 50% back on healthy groceries at Checkers or Woolworths

- Up to 50% back on personal care items at Clicks or Dis-Chem

- Up to 15% back on fuel purchases at bp and select Shell service stations

- Up to 15% back on Uber rides

- Up to 5% back on Bank-Integrated Discovery Life plan premiums

- Base Ðiscovery Miles on all qualifying credit card purchases

You’ll receive 10 Ðiscovery Miles for every R1 reward you earn back!

Vitality Active Rewards

Earn thousands of Ðiscovery Miles weekly through the personalized gameboard with Vitality Active Rewards:

- Achieve weekly Spend, Exercise or Drive goals to unlock Activity tiles of up to Ð1,000

- Unlock Discovery tiles of up to Ð750 based on your Discovery products

- Spend at partner retailers to unlock Partner Spend tiles of up to Ð1,000

Substantial Discounts When Spending Ðiscovery Miles

Get up to 30% off when spending your Ðiscovery Miles

- Up to 15% off when shopping at over 40 retail partners (doubles to 30% on Miles Ð-Day on the 15th monthly)

- Up to 15% off when buying airtime, data, prepaid utilities or digital vouchers

- Up to 15% off on rewards in the Vitality Mall

Plus, you can spend miles on flights, accommodations, car hire, exchange them for cash, or send them to contacts.

Dynamic Interest Rates

Your Vitality Money status influences your interest rates:

- Up to 1.1% interest on positive balances in everyday accounts

- Up to 5.5% interest on demand savings accounts

- Up to 5% less interest on borrowing rates

Exceptional Travel Benefits

Black Card holders gain access to Vitality Travel with incredible discounts:

- Up to 60% off local flights

- Up to 50% off international flights

- Up to 25% off holiday accommodation and car hire

- Up to 15% cash back on Dream Destinations travel experiences

Airport Lounge Access

Enjoy premium airport experiences:

- Access to The Lounge at major South African airports (up to 12 domestic and 4 international visits yearly*)

- Six annual visits to over 1,200 international airport lounges via DragonPass

- Discovery Bank Priority Fast Track for faster security clearance at select airports

*Note: These benefits apply if you maintain an average monthly spend of at least R22,500 per month (effective January 1, 2025).

Real-Time Forex Accounts

The Black Card gives you access to Discovery Bank Forex Accounts in British Pounds, Euros, and US Dollars, available 24/7 on the banking app with these advantages:

- Real-time currency rates

- No fees for transfers between foreign currency and Rand accounts

- Foreign currency allowance management

- Free virtual cards for international payments

- Physical debit cards for cash withdrawals abroad

How to Apply for the Discovery Bank Black Credit Card

If you meet the income requirements and are interested in applying, here’s how to proceed:

- Visit the Discovery Bank website: Navigate to the Black Credit Card Account page

- Click “Join now”: This button is prominently displayed on the page

- Complete the application: Provide your personal and financial information

- Submit required documentation: Typically includes proof of income, ID, and residence

- Await approval: Discovery Bank will assess your application against their criteria

Maximizing Your Chances of Approval

If your income falls within the qualifying range but you’re concerned about other factors, here are some tips to improve your chances:

- Improve your credit score: Pay off existing debts and ensure all payments are made on time

- Reduce existing debt levels: Lower your debt-to-income ratio before applying

- Organize your finances: Ensure your financial documents clearly demonstrate your income

- Consider existing relationships: If you already have other Discovery products, this might strengthen your application

Is the Discovery Black Card Right for You?

Even if you qualify for the Black Card, it’s worth considering if it’s the right fit for your financial needs. The card offers exceptional value if:

- You frequently travel domestically and internationally

- You spend regularly at Discovery’s partner retailers

- You value premium banking services and rewards

- You’re actively engaged with the Vitality program

- You can maintain the required spending levels to maximize benefits

However, if you don’t utilize these benefits regularly, the R255 monthly fee might not represent good value for you.

My Experience with Premium Banking Products

I’ve seen many clients upgrade to premium banking products like the Discovery Black Card without fully understanding how to maximize the benefits. In my experience, these cards offer tremendous value IF you align your spending patterns with the reward structure.

For instance, one of my clients saved over R30,000 in a year just through the flight discounts and lounge access benefits of their premium card. But another barely broke even on the annual fees because they rarely traveled and didn’t shop at the partner stores.

Alternatives to Consider

If you don’t quite meet the income requirements for the Discovery Black Card, consider these alternatives:

- Discovery Bank Gold Credit Card: Lower income requirements with many similar benefits

- Discovery Bank Platinum Credit Card: Middle-tier option with excellent rewards

- Other banks’ premium offerings: Compare with competitors’ premium cards

Final Thoughts: Is It Worth Qualifying For?

The Discovery Bank Black Credit Card Account represents exceptional value for those who qualify AND who will actively use its benefits. With its impressive rewards structure, travel benefits, and dynamic interest rates, it’s designed to deliver significant value to high-earning individuals.

If you meet the R850,000 to R2.5 million annual income requirement and align with the Discovery ecosystem, this card could transform your banking experience and deliver substantial rewards.

Frequently Asked Questions About Discovery Black Card Qualification

Can I qualify for a Discovery Black Card if my income is slightly below R850,000?

Unfortunately, Discovery Bank has clear income thresholds for their products. If your income is below R850,000, you might instead qualify for their Platinum Card offering.

Do I need to have other Discovery products to qualify?

No, having other Discovery products isn’t mandatory for qualification. However, existing relationships with Discovery might strengthen your application.

Is there a minimum credit score requirement?

Discovery Bank doesn’t publicly disclose a specific minimum credit score, but a good credit history will certainly improve your chances of approval.

Can business income be considered toward the qualification threshold?

Yes, Discovery typically considers various income sources, including business income, provided it can be properly documented and verified.

How long does the approval process take?

Most applications are processed within a few business days, though it may take longer if additional documentation is required.

Will my spouse’s income be considered for qualification?

Discovery Bank primarily assesses individual income rather than household income for their credit products.

Remember, qualifying for a premium banking product like the Discovery Black Card is just the first step – the real value comes from actively using its features and benefits to enhance your financial life!

Compare Discover credit cards to find the perfect fit

Discover credit cards include rewards like cash back or miles so you can pick the best rewards credit card for you.

All with no annual fee

Apply with more confidence

See if you’re pre-approved with no harm to your credit score6

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much well match.1

Earn 5% cash back on everyday purchases at different places you shop each quarter, up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

See how we calculate our ratings

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much well match.1

Earn 5% cash back on everyday purchases at different places you shop each quarter, up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

Intro APR Offer

x% intro APR† for x months on purchases.

Then x% to x% Standard Variable Purchase APR will apply.

Intro APR Offer

x% intro APR† for x months on purchases.

Then x% to x% Standard Variable Purchase APR will apply.

See how we calculate our ratings

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much well match.1

Earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically.2

Plus, earn unlimited 1% cash back on all other purchases.

Build your credit with responsible use.3

Your credit line will equal your deposit amount, starting at $200.4

x% Standard Variable Purchase APR† applies.

Build your credit with responsible use.3

Your credit line will equal your deposit amount, starting at $200.4

x% Standard Variable Purchase APR† applies.

See how we calculate our ratings

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much well match.1

Earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically.2

Plus, earn unlimited 1% cash back on all other purchases.

x% intro APR† for x months on purchases.

Then x% to x% Standard Variable Purchase APR will apply.

x% intro APR† for x months on purchases.

Then x% to x% Standard Variable Purchase APR will apply.

See how we calculate our ratings

Unlimited Discover Match®

Well automatically match all the Miles youve earned at the end of your first year.1 There is no limit to how much well match.

Earn 1.5x Miles on every dollar of every purchase8 — from hotels to groceries and online shopping.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers. x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers. x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

See how we calculate our ratings

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much well match.1

Earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically.2

Plus, earn unlimited 1% cash back on all other purchases.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Unlimited Cashback Match

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much well match.1

Earn 5% cash back on everyday purchases at different places you shop each quarter, up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Intro APR Offer

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until .

Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

What to do before you apply for a credit card

When you consider credit card offers, its important to know whether you want a card with no annual fee, a balance transfer offer, cash rewards or travel rewards, a 0% introductory APR, enhanced security programs, or other benefits.

Once you know the card features that matter to you, you can review the benefits of each credit card online and pick one most likely to approve someone with your credit score.

You might already be preapproved for a credit card that has everything you want-Discover makes it possible to find out before you submit a credit card application, and checking wont hurt your credit score.

Find information on Discover cards, how to apply for a credit card online, and more.