We drop our latest field notes to help co-owners build wealth, make memories, and feel good doing it.

Home co-ownership is when two or more people who are not married to one another share ownership interest in a home.

You can co-own a home with a friend, relative, partner, or a mix. Even married couples co-own homesâour Co-buying & Co-owning a Home 2025 Report found that 15% of all co-ownership arrangements involve a married couple plus at least one other co-owner.

Buying a home with someone else can be a great way to share expenses and build equity, but co-owning property also comes with risks If your circumstances or relationship with the other owner changes, you may eventually want to buy out their share of the house. Here’s what you need to know about the process of purchasing a joint owner’s stake in a property

Reasons for Buying Out a Co-Owner

There are several common reasons one co-owner may want to buy out the other:

-

Relationship changes – For married or unmarried couples who split up, buying out an ex can remove them from the property paperwork and mortgage.

-

Job relocation – If one owner moves away they may want to sell their portion to the other owner who stays in the home.

-

Financial changes – If one person struggles to afford their share of the payments, the other owner may need to buy them out to avoid default or foreclosure.

-

Differing goals – Co-owners may disagree on whether to sell the property or continue owning it together.

-

Death of a co-owner – The surviving owner may want to buy out the deceased’s share from their estate.

No matter the reason, buying out a joint owner requires careful navigation of legal and financial considerations.

Determine the Property’s Market Value

Before negotiating a buyout price, the current fair market value of the home must be established. There are a few options for assessing the property’s worth:

-

Hire an appraiser – Professional appraisers can survey the home and provide a detailed valuation report. This is the most accurate way to determine market value but also comes with appraisal fees.

-

Check online estimates – Websites like Zillow provide free automated value estimates based on public data. These aren’t official appraisals but can provide a ballpark figure.

-

Review recent sales – Looking at what similar homes in the neighborhood have sold for recently can provide an estimate of the property’s value.

-

Get opinions from real estate agents – Local agents are very familiar with home values in the area and can often provide free informal estimates.

Appraisals or estimates should reflect the home’s current as-is condition and market factors like interest rates and supply/demand. The co-owners can average multiple estimates to help agree on a fair market value.

Calculate Existing Home Equity

Next, determine how much equity currently exists in the property:

Home Value – $ Remaining Mortgage Balance = $ Available Equity

For example:

$400,000 Home Value – $250,000 Remaining Mortgage = $150,000 Total Equity

The available equity belongs to the co-owners based on their ownership percentages, often an even 50/50 split.

Negotiate a Buyout Price and Terms

With market value and equity figures established, the co-owners can now negotiate buyout terms:

- Buyout price – Typically based on the other owner’s equity share, but may be adjusted up or down based on negotiations

- Buyout timeline – Date by which the buyout must be completed

- Financing – How the buyer will fund the full buyout amount

- Future ownership – Will the property be co-owned going forward or change to sole ownership

It’s best to consult lawyers to formalize the buyout agreement in writing. The contract should outline exactly how much is owed, by when, and how it will be paid.

Secure Financing for the Buyout

The buying owner has a few options to obtain financing for the buyout:

- Cash-out mortgage refinance – Replace the current mortgage with a higher balance to cash out equity.

- Home equity loan – A second loan using the property as collateral.

- Personal loan – Unsecured loan based on the buyer’s creditworthiness.

- Savings – Tap into savings accounts, investments, etc. if funds allow.

Look for the lowest rates and fees on financing options that align with your credit profile and budget. Consider consulting a financial advisor as well.

Finalize Ownership Transfer

Once financing is secured, complete the buyout:

-

The buyer pays the full negotiated buyout price to the selling co-owner.

-

The seller signs over their ownership rights through a quitclaim deed.

-

The seller is removed from the property title and mortgage loan (if applicable).

-

Ownership records like the deed and title insurance are updated to reflect sole ownership by the buying party.

It’s crucial to execute all ownership transfers legally and properly. Real estate attorneys can provide guidance for ensuring transactions are completed by the book.

Buying out a joint owner is often complicated, but can be smoothed by open communication, fair valuation, and proper legal protections. With some care and diligence, you can reach an agreement that works for both parties.

Other Key Things to Know About Buying Out a Co-Owner

Here are a few other important tips when navigating the buyout process:

-

Consult lawyers or real estate professionals for guidance to avoid costly mistakes or disputes. Their fees are usually worth the peace of mind.

-

If possible, be proactive by having a co-ownership agreement upfront spelling out buyout procedures. This makes it much easier if a buyout is needed down the road.

-

Try to remain cooperative with the other owner by separating emotions from the business side of the transaction. This will result in the smoothest process.

-

If you hit an impasse negotiating buyout terms, mediation or even court intervention may be required as a last resort to force a sale.

-

Research lenders and loan options carefully to find the most affordable financing with favorable rates, terms, and fees.

-

If refinancing, shop around with multiple lenders and compare offers. Even small differences in interest rates can really add up over the life of a mortgage.

-

Consider tax implications of the buyout and ownership change. Consult a tax professional to maximize deductions and avoid surprises at tax time.

With some forethought, patience, and diligence, buying out a co-owner can unlock sole ownership while fairly compensating the other party’s exit. Seek support from financial and legal experts to guide you through the intricacies involved.

What happens if we disagree?

There are three main avenues:â

â¡ï¸ Plan and build consensus early/often to minimize the scope for conflict â

Prevention is the best medicine. When given due attention, planning and building consensus, setting terms, and codifying by executing a Co-ownership Agreement is powerful.

â¡ï¸ Include alternative dispute resolution in your Co-ownership Agreement

The next line of defense is alternative dispute resolution. Mediation and arbitration are two ways to leverage neutral third-party intermediaries to avoid costly legal battles.Â

ââ¡ï¸ Lawyer up

Most of the attorneys weâve worked with over the years caution against this option. Legal action and litigation are costly, and in some cases, the costs can exceed the home equity youâve built. In the most extreme cases, litigation can last for many months, freezing the asset and preventing co-owners from partitioning or selling the property until the long arm of justice has taken its course.

Do we need a written agreement?

Absolutely. Getting things in writing isnât just a good ideaâitâs essential. Co-owners should create a Co-ownership Agreement that covers all aspects of the co-ownership arrangement, including participation, ownership structure, finances, terms, risk handling, and exit strategy.Â

A robust agreement is much more than a piece of paper or PDF. It reflects a consensus between parties and provides a framework for managing co-ownership over the whole lifecycle. Rather than a static document hidden in a drawer, it should be dynamic, easy to update, and verifiable.

Understanding Co-Ownership: How Multiple Owners Share Ownership of a Property!

FAQ

How to buy out a joint owner?

They would need to agree on a sales price for the 50% interest. Then one can either take out a mortgage on the property to pay the buyout, or they could mutually agree for the selling sister to accept monthly payments on a land contract or some other type of contract.

What are the disadvantages of joint ownership?

Since every owner has a co-equal share of the asset, any decision must be mutual. You might not be able to sell or mortgage a home if your co-owner does not agree. Creditor Issues. If a co-owner has outstanding debts, their creditors could seize an interest in your home or bank account.

What happens when one partner wants to sell and the other doesn’t?

How do you split jointly owned property?

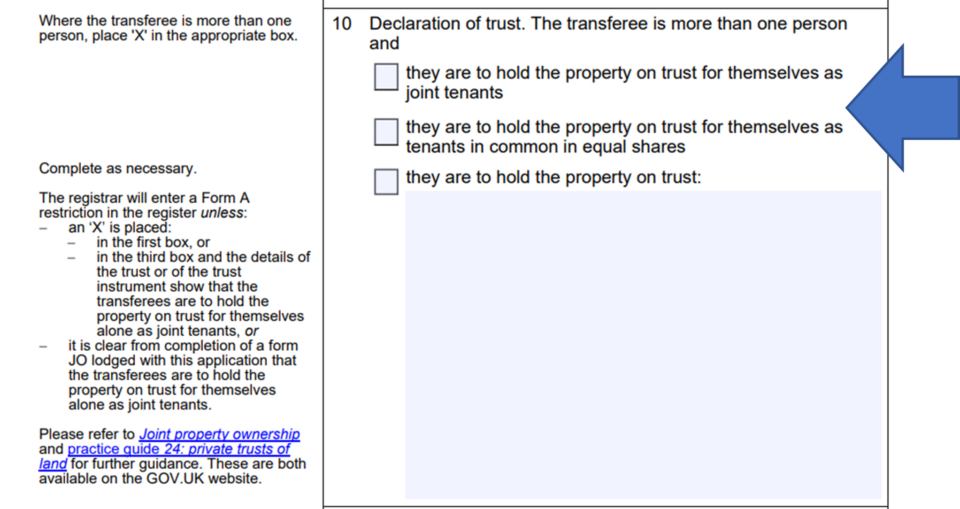

Within this document, the joint owners confirm how they will share the beneficial interest on the title: they are to hold the property on trust for themselves as joint tenants – this means the beneficial interest is held 100% jointly (no separate shares) so your split is an equal share.

Can I buy out a joint owner of a house?

In some cases, buying out a joint owner of a house becomes complicated. If you want to remain in the home and your co-owner wants to sell, your co-owner can sue for custody of your home, just as married couples petition for custody of a child. This is called requesting a partition of jointly owned property.

Can a joint owner sell a property?

As a joint owner, you can only transfer your interest in the property. All co-owners have to agree to sell the entire property. Property owners may force the sale of the property or a partition. Owners in a tenancy in common or joint tenancy with the right of survivorship can petition the court to partition the property.

What are the different types of joint property ownership?

There are three major forms of joint property ownership (or “concurrent ownership”): tenancy by the entirety. Specific state laws will dictate the ins and outs of these concurrent ownership alternatives where you live, but here is an overview of the rights of concurrent property owners.

What is joint ownership of property?

Joint ownership of property is a common arrangement that allows multiple parties to share the benefits and responsibilities of property ownership. It is often used by families, friends, or business partners investing in real estate together. However, this type of ownership requires careful consideration of legal, financial, and tax implications.

Does joint ownership limit your rights and options?

But joint ownership can limit your rights and options—not only while you own the property, but also when you want to transfer ownership to an heir or another buyer. There are three major forms of joint property ownership (or “concurrent ownership”):

What are the nuances of joint property ownership?

Explore the nuances of joint property ownership, including types, financial responsibilities, and tax implications for informed decision-making. Joint ownership of property is a common arrangement that allows multiple parties to share the benefits and responsibilities of property ownership.