You can unfreeze your credit report at each of the three bureausâExperian, TransUnion and Equifaxâonline through your accounts, over the phone or by mailing the correct documentation.

Freezing your credit reports can help safeguard you against identity theft, but if youre planning on applying for a loan or credit card or taking any other action that requires access to your credit reports, youll need to unfreeze them.

To do so, youll need to contact each of the three credit bureausâExperian, TransUnion and Equifaxâindividually. Heres what you need to know to get started.

Placing a credit freeze can help protect you against identity theft and fraud But when you need to apply for a loan, credit card, or other service that requires a credit check, you’ll need to temporarily lift or completely remove the freeze Here’s a step-by-step guide to removing a credit freeze from Experian, Equifax and Transunion.

Overview of Credit Freezes

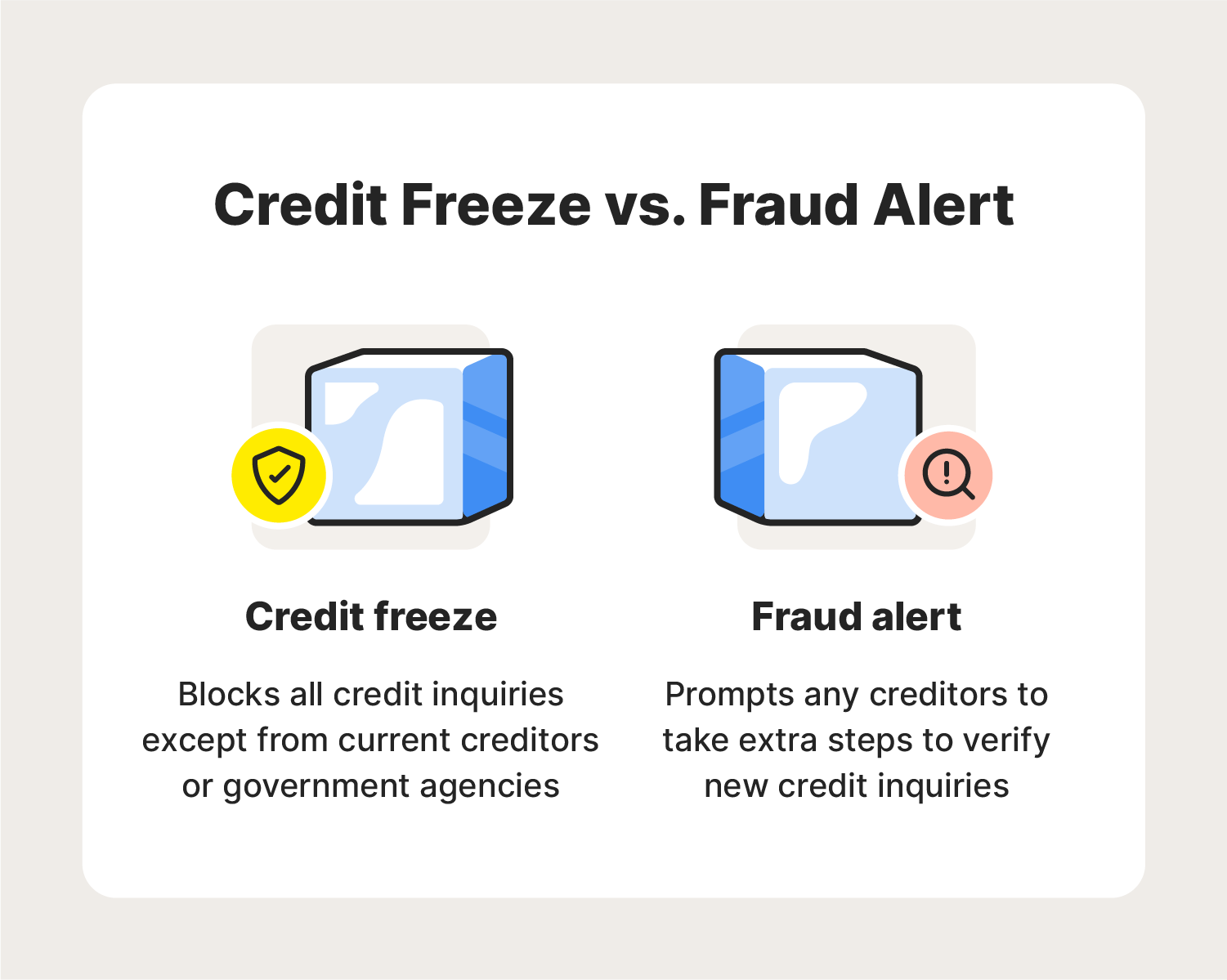

A credit freeze restricts access to your credit report and prevents lenders from being able to check your credit. Here are some key things to know

-

With a freeze in place, you won’t be able to open any new credit accounts until it is lifted Existing accounts are not affected.

-

You can temporarily lift the freeze when needed, such as when applying for a loan. This is called a temporary thaw.

-

You can also permanently remove the freeze altogether. This leaves your credit file open until you freeze it again.

-

Freezing and unfreezing your credit is free and can be done online, by phone, or by mail.

-

Credit bureaus must lift a freeze within an hour for online/phone requests, and within 3 days for mail requests.

Why Remove a Credit Freeze?

You may need to remove a credit freeze if:

-

You are applying for credit – you’ll need to temporarily lift the freeze during the application process.

-

You no longer feel you are at risk of identity theft – removing it permanently may be an option.

-

You froze the wrong credit report or no longer need the freeze.

-

The freeze was added by mistake or as part of a fraud alert.

Removing a freeze is quick and easy when done online or by phone. You’ll just need to contact each credit bureau individually.

Removing a Credit Freeze at Equifax

Here are the steps to remove a credit freeze from your Equifax credit report:

-

Go to the Equifax website and log in to your account. If you don’t have one, you can create a free account.

-

From your account homepage, find the option to temporarily lift or permanently remove your credit freeze.

-

Follow the instructions to remove the freeze permanently or temporarily.

-

If temporary, choose the timeframe you need the freeze lifted.

Alternatively, you can call Equifax at 1-800-685-1111 to remove the freeze over the phone. You’ll just need to provide identifying information.

Finally, you can submit a request by mail. Contact Equifax for the address and include documents to verify your identity.

Removing a Credit Freeze at Experian

To remove a freeze from your Experian credit report:

-

Log in to your Experian account. If you don’t have one, create a free account online.

-

From your account homepage, locate the option to manage your credit freeze settings.

-

Follow the prompts to temporarily lift or permanently remove the credit freeze.

-

If temporary, specify the duration you need the freeze lifted.

You can also call 1-888-397-3742. Provide your personal information to verify identity over the phone.

To remove by mail, write to Experian Security Freeze at P.O. Box 9554, Allen, TX 75013. Include documents to confirm your identity.

Removing a Credit Freeze at Transunion

Here is how to remove a credit freeze from your Transunion credit report:

-

Go to Transunion’s website and either log in to your account or create a free account if needed.

-

From your account homepage, look for the options to manage your credit freeze.

-

Follow the instructions to temporarily or permanently remove the credit freeze.

-

If temporary, select the time period you need the freeze lifted.

Alternatively, you can call 1-888-909-8872. Provide your personal details over the phone to confirm your identity.

To remove by mail, send your request and verifying documents to TransUnion LLC, P.O. Box 2000, Chester, PA 19016.

What Happens When a Credit Freeze Is Removed?

Once you successfully lift or remove a credit freeze:

-

Your credit report becomes available to lenders and other authorized parties.

-

If temporary, your report will re-freeze after the selected timeframe.

-

If permanent, your report remains unfrozen until you request another freeze.

-

Any new credit checks will display on your report during the unfrozen period.

-

Your credit score may temporarily decrease from the inquiries.

-

Existing credit accounts are not impacted – only new applications.

Tips for Managing Your Credit Freezes

-

Set calendar reminders to lift the freeze for any planned credit applications.

-

Opt for temporary lifts versus fully removing the freeze.

-

Check your credit report after re-freezing to make sure no inquiries were made without authorization.

-

Consider freezing children’s credit reports to protect against child identity theft.

-

Keep records of your freeze PIN codes and passwords in a safe, secure place.

Maintaining Your Credit Health

Along with judicious use of credit freezes, regular credit monitoring can help you maintain good credit health.

-

Check your credit reports from each bureau annually for errors or signs of fraud.

-

Review your credit scores to catch issues early – excellent scores lead to better rates.

-

Sign up for free credit monitoring to stay on top of your credit 24/7.

-

Practice good credit habits by paying bills on time, keeping balances low, and minimizing credit inquiries.

Freezing and unfreezing your credit reports as needed is an important identity theft prevention tool. Follow the step-by-step guide provided to quickly remove a credit freeze when you need access to your credit report. Monitoring your credit frequently is also advised to catch any unauthorized activity.

How to Unfreeze Your Experian Credit Report

To unfreeze your Experian credit report, log in to your Experian account or create one for freeâeither through your desktop browser or the Experian mobile app.

After you log in, you can navigate to the Help Center at the bottom of the page; in the mobile app, tap on the three bars at the top right of your dashboard to see the option. In the Help Center, youll find “Manage security freeze” or simply “Security freeze” in the quick actions section.

Alternatively, you can also call 888-EXPERIAN (888-397-3742), or send a request by mail to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013, along with the appropriate documentation.

In particular, youll need to include the following with your written request to verify your identity:

- Full name, Social Security number and date of birth

- Government-issued identification card, such as a drivers license

- Complete addresses for the past two years

- Copy of a utility bill or bank statement

When Do You Need to Remove a Credit Freeze?

A credit freeze limits who can view your credit reports and for what reasons. For example, you dont have to worry about thawing your credit report when applying for an apartment lease, undergoing a background check for a new job or buying an insurance policy.

You can also continue to receive prescreened credit offers with frozen credit reports.

However, if you plan to apply for credit in any form, youll want to unfreeze your credit reports before you do so. Even if youre just shopping around to compare rates via prequalification tools, its best to thaw your credit to be safe.

Theres no cost associated with freezing or unfreezing your credit reports.

Its quick and easy to remove a security freeze, and your decision whether to do so largely depends on why you froze your credit to begin with.

- If you froze your credit purely as a precaution, or because you knew you would not be authorizing access to your credit files for an extended period, then its probably fine to lift the freeze permanently if you are now actively seeking credit.

- If you froze your credit reports because you were a victim of credit fraud or believe your personal information was stolen or misused, then consider making your credit thaw temporary.

Ultimately, it depends on your reasons for freezing your credit in the first place. If youve been a victim of identity theft or know that your personal details have been compromised, consider thawing your credit only long enough to complete the necessary credit checks for a loan or credit card.

If you dont have any reason to believe that an identity thief has your personal information, you can keep your credit reports thawed for as long as youd like.

How to Freeze Your Credit Report in 3 Minutes

FAQ

How do I remove credit freeze from all three bureaus?

How do I unfreeze my account?

How fast can you unfreeze your credit?

Unfreeze requests: Online or by phone: agencies must lift the freeze within one hour. By mail: agencies must lift the freeze within three business days.

How do I get rid of temporary credit freeze?

Before applying for credit, you will need to lift your security freeze so that potential creditors can access your Equifax credit report. At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account. You can also manage your freeze by phone: call us at (888) 298-0045.