Plus three key ways to maximize your spousal benefits Part of the Series Understanding Social Security

If you’re eligible for Social Security spousal benefits, how much you’ll receive depends on a number of factors, including your age, the amount of your spouse’s benefit, and whether you have other retirement benefits available to you.

Who can get benefits? Once they reach the age of eligibility, anyone whose spouse, ex-spouse, or deceased spouse was or is eligible for benefits is eligible.

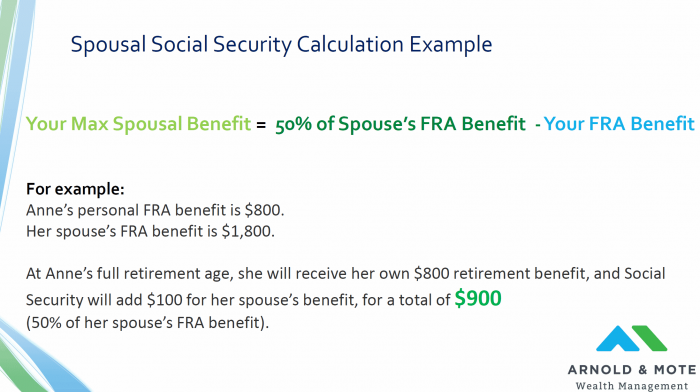

The maximum spousal benefit that you can receive is 50% of your spouse’s benefit at their full retirement age. The exact amount you’ll get and when you’ll get it depend on a number of factors, such as your age and past income, as well as those of your spouse.

That leaves some room for you to maximize the amount you receive. And if that amount is less than what you would get based on your own past income, you’ll automatically get the higher amount.

Read on to find out if you qualify for Social Security spousal benefits and to get information about how spousal benefits are calculated. Then youll know how to maximize them.

Have you ever looked at your retirement plans and wondered, “How do I figure out my spouse’s Social Security benefit?” You’re not the only one who has felt this way. It can feel like you need a math degree just to plan for retirement! I’ve spent hours trying to figure this out on my own!

The good news? It’s actually not as complicated as it seems. Let me break it down for you in simple terms that won’t make your head spin.

Who Can Get Spousal Benefits?

Before we get into the math, let’s make sure you qualify. According to new data, more than 2 million seniors receive spousal benefits, which will average about $1,011 a month in 2024 (after cost-of-living adjustments from 2023 and 2024).

You can claim spousal benefits if:

- You’re at least 62 years old (or caring for your spouse’s child who is under 16 or disabled)

- You’re currently married to someone who qualifies for Social Security benefits

- OR you were previously married to them for at least 10 years and haven’t remarried

- The qualifying worker (your spouse) is already receiving benefits (or for ex-spouses, you’ve been divorced for at least 2 years)

- The spousal benefit you’d get is larger than what you’d receive based on your own work history

So many people get this last part wrong: if you’ve worked and paid Social Security taxes, the government will figure out which benefit is higher: your own or your spouse’s. You’ll get the bigger one.

The Basic Formula for Spousal Benefits

The maximum spousal benefit you can receive is 50% of your spouse’s primary insurance amount (PIA). This is the amount your spouse would get at their full retirement age (FRA), which is between 66 and 67 for most people retiring now.

Here’s a simple example

- If your spouse would get $2,000 monthly at their FRA

- The most you could get as a spousal benefit at your FRA would be $1,000 (50%)

There is a catch, though: if you file early (before your FRA), your benefit will be less.

Early Claiming Penalties for Spousal Benefits

This is where things get a bit tricky. The Social Security Administration reduces your spousal benefit if you claim before reaching your own full retirement age:

- If you claim at 62 (the earliest possible age) and were born after 1960, you’ll only get about 65% of your maximum spousal benefit

- Using our example above: instead of $1,000, you’d get about $650 monthly

Unlike regular Social Security benefits, there’s no advantage to delaying spousal benefits beyond your FRA. You don’t get any extra money for waiting, so once you hit your full retirement age, you might as well claim if your spouse is already receiving benefits.

The Easy Way to Calculate Your Spousal Benefit

Thankfully, you don’t have to do all this math yourself! Here’s the simplest way to figure out your spousal benefit:

Step 1: Find your spouse’s Primary Insurance Amount (PIA)

Have your spouse create a my Social Security account at ssa.gov. In their account, they can find their estimated benefit at full retirement age – that’s their PIA.

Step 2: Calculate your benefit

You have two options:

- Use the calculator at the bottom of your spouse’s my Social Security page. Enter your birth date and planned claiming age to see your estimated spousal benefit.

- OR create your own my Social Security account and enter your spouse’s PIA in the “See what you could receive from a spouse” section.

For Divorced Individuals

If you’re divorced and want to claim on an ex-spouse’s record, this process can be trickier, especially if you’re not on good terms. You’ll need to contact the Social Security Administration directly with:

- Their name

- Their date of birth

- Their Social Security number (if you know it)

- Your marriage and divorce dates

If you don’t have all this info, the SSA can usually help you track it down.

The Official SSA Calculator

The Social Security Administration actually offers a calculator specifically for spousal benefits at ssa.gov. This tool lets you:

- Enter your date of birth

- Choose when you want to start receiving benefits

- See exactly what percentage of your spouse’s PIA you’ll receive

This is super helpful because it factors in all the reduction percentages automatically, so you don’t have to do any complicated math.

A Real-Life Example

Let me show you how this works with some real numbers.

Say John’s PIA (the amount he’ll get at his full retirement age) is $2,400 monthly. His wife Mary wants to know what she’d get as a spousal benefit.

Mary’s options:

- If she waits until her full retirement age (67): $1,200 monthly (50% of John’s PIA)

- If she claims at 62: $780 monthly (65% of the $1,200 she’d get at FRA)

But what if Mary has her own work record? Let’s say based on her own earnings, she’d qualify for $900 monthly at her FRA. In this case:

- At her FRA: She’d get the higher amount ($1,200 spousal benefit)

- If she claims at 62: Her own reduced benefit might be around $630, while her reduced spousal benefit would be $780, so she’d still get the spousal benefit

Common Mistakes People Make

I’ve seen folks make these mistakes when calculating spousal benefits:

-

Confusing PIA with actual benefit – Remember, spousal benefits are based on the worker’s primary insurance amount, not what they’re actually receiving if they claimed early or delayed

-

Not realizing the early claiming penalty – Claiming at 62 means a significant reduction that lasts for life

-

Thinking you’ll get both benefits – You don’t get your own benefit PLUS spousal benefits; you get whichever is higher

-

Waiting past FRA to claim spousal benefits – Unlike regular retirement benefits, spousal benefits don’t increase after full retirement age

What If Your Spouse Is Still Working?

One thing to keep in mind: if your spouse is still working and years away from retirement, these estimates might change. Their PIA will likely increase as they continue to earn and pay into Social Security.

That’s why it’s good to recalculate every few years as you get closer to retirement age. Your potential benefit could grow!

Special Considerations for Caregivers

If you’re caring for a child who is under 16 or disabled, there’s good news! The early claiming reduction doesn’t apply in this situation. You could receive the full 50% of your spouse’s PIA even before your full retirement age.

Recalculating as You Approach Retirement

Because Social Security benefits can change based on continued work and earnings, it’s smart to redo these calculations every few years, especially as you get closer to retirement age. Your spouse’s PIA might increase, which means your potential spousal benefit would increase too.

The Bottom Line

Calculating your spousal Social Security benefit doesn’t have to be a headache. The basic formula is simple: you’ll get up to 50% of your spouse’s primary insurance amount if you claim at your full retirement age, less if you claim earlier.

The easiest way to get an accurate number is to use the Social Security Administration’s online tools rather than trying to do all the calculations yourself.

Remember that if you’ve worked and earned your own benefit, you’ll receive either your own benefit or the spousal benefit—whichever is higher. The government does this comparison automatically when you apply.

Final Thoughts

Planning for retirement is kinda like putting together a puzzle – Social Security is just one piece, but it’s an important one! Understanding how much you’ll get from spousal benefits helps you create a more accurate retirement budget.

I hope I’ve helped demystify this process for you. Social Security rules can seem complicated at first glance, but once you break them down, they’re actually pretty straightforward.

Have you calculated your potential spousal benefit yet? Were you surprised by the amount? I’d love to hear your experiences in the comments below!

Quick Summary: How to Calculate Your Spousal Social Security Benefit

- Make sure you qualify for spousal benefits

- Find your spouse’s Primary Insurance Amount (PIA)

- Your maximum spousal benefit is 50% of their PIA (if you claim at your full retirement age)

- If you claim early, your benefit will be reduced (as low as 32.5% of your spouse’s PIA)

- Use the SSA’s online calculators for the most accurate estimate

- Remember: you’ll get either your own benefit or the spousal benefit – whichever is higher

Now you’re armed with all the info you need to figure out your spousal Social Security benefit. No math degree required!

Spousal Benefits Loophole

You may have heard or read about other ways to increase the amount of your spousal benefit. Unfortunately, under new Social Security rules, a popular strategy has been abolished.

Survivors Benefits for Widows and Widowers

With Social Security survivors benefits, a widow or widower can get up to 100% of their spouse’s benefit amount if the spouse has reached full retirement age at the time of the application.

The payment is reduced to between 71½% and 99% of the deceased’s benefits if the widowed person is at least 60 years old but younger than full retirement age. So it pays to hold off until you reach your full retirement age to maximize the amount you’ll receive.

Disabled surviving spouses can apply for survivors benefits as early as age 50.

Social Security: Spousal Benefits 101

FAQ

How to calculate spousal Social Security benefits for spouse?

To figure out spousal Social Security benefits, you need to find the “Primary Insurance Amount” (PIA) for the spouse who makes more money. This is the amount of money that person will get when they reach Full Retirement Age (FRA). The maximum spousal benefit is then 50% of this PIA. If the spouse claiming the benefit has their own work record and a higher benefit amount, they’ll receive their own amount plus any spousal “excess” benefit needed to reach 50% of the higher-earning spouse’s PIA.

When can a wife collect half of her husband’s Social Security?

Once a wife turns 62, she can start getting Social Security benefits based on her husband’s record. She can do this at any age if she is caring for a child under 16 or a disabled child of any age who is getting benefits based on her husband’s record. The benefit amount can be up to half of her husband’s primary insurance amount (PIA) at his full retirement age, but claiming early will result in a permanently reduced benefit.

Does a married couple receive two Social Security checks?

Yes, married couples can receive two separate Social Security checks if both spouses are eligible for benefits based on their own work records, or a combination of their own benefit and a spousal benefit, which can equal the higher of the two amounts.

How much does a spouse get from Social Security when their spouse dies?

Payments start at 71. 5% of your spouse’s benefit and increase the longer you wait to apply. For example, you might get: Over 75% at age 61. Over 80% at age 63.

How is Social Security spousal benefit calculated?

The person’s main insurance amount is the amount of their monthly retirement benefit if they make a claim at the exact age of retirement. A Social Security spousal benefit is calculated as 50% of the other spouse’s PIA. Note that the age at which the other spouse files for Social Security benefits doesn’t affect this calculation.

How do I get Social Security spousal benefits?

Check out the advisors’ profiles, have an introductory call on the phone or introduction in person, and choose who to work with. Spousal benefits from Social Security are based on the higher-earning spouse’s retirement benefit, with a maximum amount of 50% of that benefit if claimed at full retirement age (FRA).

How much Social Security spousal benefits can a spouse claim?

Spousal benefits from Social Security are based on the higher-earning spouse’s retirement benefit, with a maximum amount of 50% of that benefit if claimed at full retirement age (FRA). The amount depends on when benefits are claimed and whether the individual qualifies for their own Social Security.

How do I find out what my spousal benefit would be?

Enter your date of birth here and the age you plan to claim benefits to see what your spousal benefit would be. You can also note your spouse’s PIA and then open your own my Social Security account. Enter the PIA in the “See what you could receive from a spouse” section. Then, choose your claiming age or claiming date to get your results.

How do you calculate Social Security retirement benefits?

Find the high earner’s primary insurance amount (PIA). That’s their Social Security retirement benefit if they claim at their FRA, which is often age 67. Divide by two, to arrive at half of the PIA above. If the lower-earning spouse has a benefit of their own, subtract that from half of the PIA in the previous step.

Who can claim Social Security spousal benefits?

For spouses to receive the benefit, they must be at least age 62 or care for a child under age 16 (or one receiving Social Security disability benefits). In addition, spouses cannot claim the spousal benefit until the worker files for their benefit. There are other important caveats about the spousal benefit as well.