Rent and certain other tradelines can appear on your credit reports if your landlord or the service provider reports your payments to credit bureaus. This reporting is not mandatory, but some financial apps can help you report rental payments and other bills to credit bureaus, which can help you build credit if you make timely payments.

You may think paying your rent and utilities on time each month will help build your credit. Unfortunately, this isn’t typically the case. The reality is that most landlords and utility companies don’t regularly report payments to the major credit reporting agencies.

This article explains alternative options to add utilities to a credit report, what tradelines are, how they work and what steps you can take to make sure your regular rent and utility payments are helping build your credit.

A tradeline is a term credit reporting agencies use to identify each credit account listed on your credit report. Each separate account is listed as a different tradeline. Information from each tradeline, such as payment history and available credit, is used to calculate your credit score.

Creditors, such as credit card companies, utility providers, and landlords, aren’t required to report your payments to any of the major credit reporting agencies. In fact, many utility providers, small business lenders, and landlords may not report these payments because they’re required to pay a fee to do so.

However, if you’re late making these payments, some companies and landlords will report these late payments. If your utility or rent debt is transferred to a collection agency, it’s likely to be reported on your credit report.

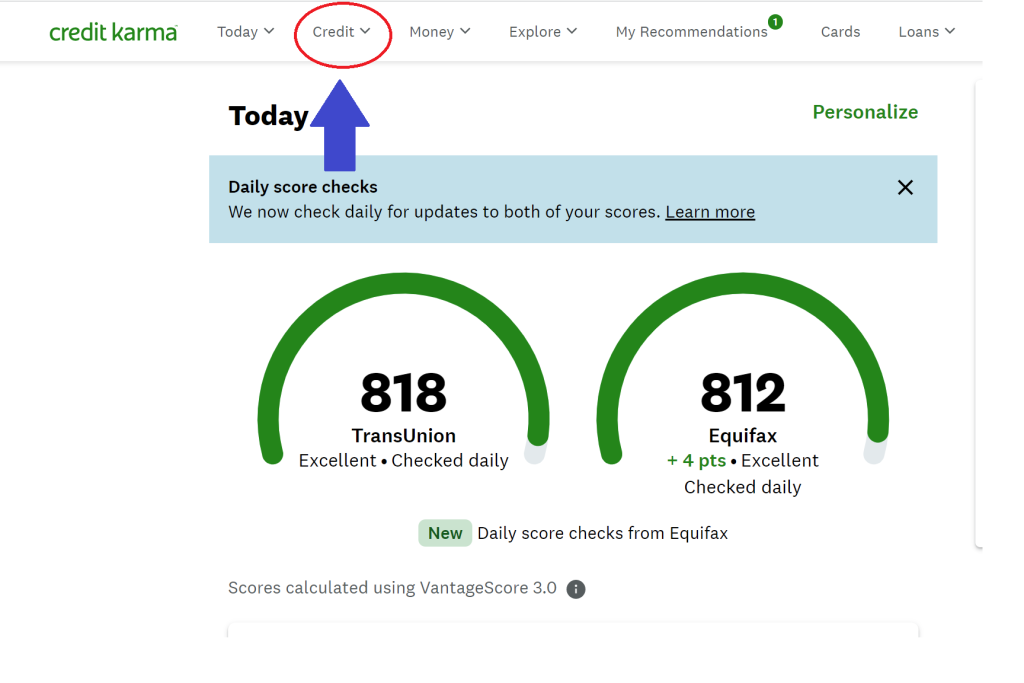

Improving your credit score can seem like a daunting task. However, Credit Karma has made it easier by allowing you to add your utility bills directly through their platform. This can help boost your credit score by creating a positive payment history. In this article I’ll walk you through exactly how to add utilities to Credit Karma and the benefits it provides.

What Bills Can You Add to Credit Karma?

The main types of utility bills you can add to Credit Karma include

- Electricity

- Gas

- Water

- Internet

- Cable/Satellite TV

- Cell Phone

Essentially, any recurring bill that you pay monthly can be added Credit Karma has partnered with various utility providers to allow easy account linking

How Does Adding Utilities to Credit Karma Help Your Credit?

Adding your utility bills and making on-time payments has several credit score benefits:

-

Builds credit history: For those with limited credit history, adding utility tradelines creates a longer credit history. The length of your credit history makes up 15% of your FICO Score.

-

Demonstrates responsible usage: Making on-time utility payments shows lenders you can responsibly manage different credit lines. This helps improve your creditworthiness.

-

Improves payment history: Your payment history makes up a significant 35% portion of your FICO Score. On-time utility payments help build positive payment history.

-

Increases total accounts: Having a mix of account types (credit cards, loans, utilities, etc) helps improve your credit mix and total number of accounts. This accounts for 10% of your score.

As you can see, adding your utilities and making regular on-time payments can positively influence your credit profile in multiple ways.

Step-by-Step Guide to Adding Utilities to Credit Karma

Adding your utilities to Credit Karma is a quick and easy process. Just follow these steps:

- Log into your Credit Karma account

- Click on “Bills” in the left menu

- Click “Add accounts”

- Select your utility provider from the list

- Enter your account credentials to link the account

- Review and accept the terms and conditions

- Your utility bills will now show under the “Bills” section

Once added, you’ll be able to see your upcoming bills, balances due, and payment due dates all in one place.

Setting Up Bill Payments Through Credit Karma

In addition to tracking your bills, you can also set up automatic bill payments through Credit Karma upon account linking.

To do this:

-

When linking the account, check the box that says “Set up payments with this account”.

-

Enter your bank account information. This allows the biller to withdraw the owed amount each month.

-

Review the payment terms and provide authorization for withdrawals.

That’s it! The biller will now automatically pull payment from your linked bank account each month.

Tips for Managing Your Bills and Credit Score

Here are some tips to make the most out of managing bills through Credit Karma:

-

Set up payment reminders to avoid late payments. Late payments can negatively impact your score.

-

Review your upcoming bills regularly to stay on top of due dates and amounts owed.

-

If you can’t pay the full balance, pay at least the minimum to avoid penalties.

-

Contact the biller directly if you need to adjust payment dates or request an extension.

-

Review your credit report regularly to check for any errors with your utility payments. Dispute any inaccuracies.

-

Use autopay or bill pay features to ensure payments are made on time every month.

The Bottom Line

Adding your utilities to Credit Karma serves as an easy way to help build your credit history and demonstrate responsible financial habits. The ability to track, get reminders, and directly pay bills through Credit Karma provides convenience and credit benefits.

So if you’re looking for an easy way to boost your credit score, connecting your utilities to Credit Karma can help build positive payment history and improve your overall credit mix. Give it a try today!

What Bills Help Build Credit?

Trying to build a solid credit history? While traditional credit scores primarily focus on loans and credit cards, there are ways to get credit for other regular payments.

Here’s a breakdown of utility and other bills that may be eligible for reporting:

- Water bill

- Phone bill

- Internet bill

- Cable/satellite bill

- Gas and electricity bills

- Video streaming services

- Trash, garbage, sewer, and recycling services

How Do Rent and Utilities Increase Credit Score?

There are several ways rent and utility payments can help increase your credit score. First, if you currently have little to no credit history, adding new tradelines can help. The length of time you’ve held various credit accounts also plays a role in calculating your credit score. The sooner you start adding these payments to your credit report, the better.

Secondly, a consistent history of making on-time payments can also help boost your credit. Your payment history accounts for up to 35% of your overall credit score. Taking steps to add rent and utility payments to your credit account can increase the number of on-time payments on your credit report.

This combination can help you start building your credit, and over time, it may even help boost your credit score.

How To Add My Bills To Credit Karma (2025)

FAQ

How do I add my utility bills to my credit score?

Can I Report Utility Bills to Credit Bureaus? While you can’t report your utility bills and rent payments directly to the credit bureaus, there are alternative options. To add bills to credit report results, you can use a service provider to report these payments for you or use a credit card to pay these bills.

How do I add accounts to my Credit Karma?

You can add additional accounts by tapping the + sign at the top right of the Accounts tab or by tapping Link more next to Assets or Debts.

Can you put utilities on a credit card?

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes can often be paid with a credit card but with a processing fee. Loan payments are usually check or bank withdrawal payments only.

Does Credit Karma track bills?

Credit Karma does have tools for both tracking and paying bills, however. Once you set up a connection to a biller, you can see your upcoming payments, due dates, amount due, minimum payment amount, current balance, and any recent payments.