Paying off a $100k mortgage in only 5 years may seem like an impossible feat. But with strategic planning, financial discipline, and some major lifestyle adjustments, it is achievable for many homeowners.

Why Pay Off a Mortgage Early?

There are several benefits to paying off your mortgage ahead of schedule

-

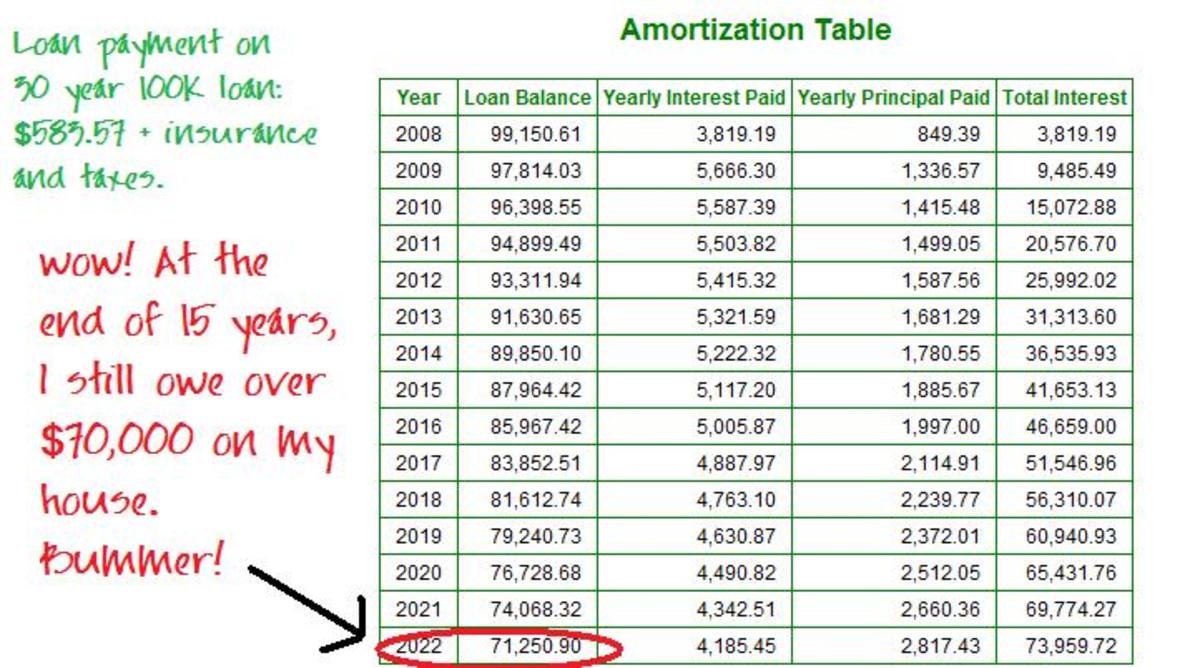

You’ll save a tremendous amount in interest payments. The sooner you pay off the loan, the less interest you’ll owe over the life of the loan.

-

You’ll build equity and wealth faster when more of your payment goes toward the principal each month.

-

You’ll own your home free and clear, which provides financial flexibility and stability.

-

You may be able to qualify for better interest rates if you need to borrow money in the future since you won’t have an existing mortgage payment,

-

You’ll have the peace of mind and satisfaction of being mortgage debt-free!

Of course, there are some risks and considerations as well:

-

You may face prepayment penalties depending on your mortgage terms. Make sure to review your loan documents.

-

It ties up your liquid assets, so you’ll have less cash on hand for emergencies and other goals.

-

You may miss out on higher investment returns if those funds were invested instead of used to pay off low-interest mortgage debt.

Overall, look at your entire financial situation to determine if an aggressive 5-year payoff aligns with your priorities and resources.

How Much Will it Take to Pay off a $100k Mortgage in 5 Years?

To pay off a $100k mortgage over 5 years, you would need to pay approximately $1,900 extra per month above your normal mortgage payment. This accounts for interest and assumes a 30-year loan at 5% interest.

Of course, your specific loan terms and interest rate will impact the exact amount. But in general, you need to double or even triple your normal monthly payment to accomplish this rapid payoff.

Prep your budget and lifestyle, because making these large monthly contributions will likely require some sacrifices. But the long-term benefits may make it worthwhile for some homeowners.

Steps to Pay Off a $100k Mortgage in 5 Years

Paying off a sizable $100k mortgage in just 60 months requires diligent preparation, goal-setting, and follow-through. Here are some practical steps:

1. Review loan terms and penalties – Understand if your mortgage has a prepayment penalty or limits on additional payments. This will impact your payoff plan.

2. Increase your monthly payment – As noted above, you’ll need to substantially increase your regular monthly payment. Automate these contributions.

3. Make biweekly payments – Making half your payment every two weeks will result in an extra monthly payment per year, accelerating payoff.

4. Pay lump sums – Use your tax refund, bonuses, inherited money, or any windfalls to make extra principal payments and reduce the balance.

5. Refinance your loan – You may be able to get a lower rate with a shorter term to ramp up monthly paydown of the principal.

6. Get a side hustle – Earn extra income that’s solely dedicated to making extra mortgage payments each month.

7. Cut expenses – Evaluate your budget and lifestyle to trim costs on eating out, entertainment, subscriptions, shopping, and bills.

8. Sell assets – Consider selling valuable assets like cars, collectibles, or investments to free up cash for mortgage paydown.

9. Rent out space – Can you generate rental income by renting out a basement apartment or spare bedroom? Direct this cash toward your mortgage.

10. Track progress – Stay motivated by tracking your monthly and annual progress so you can celebrate mortgage freedom.

With focused effort, paying off a $100k mortgage in 5 years is possible. Implement these steps to make your ambitious mortgage payoff goal a reality!

Frequently Asked Questions

How much do I need to pay each month to pay off $100k in 5 years?

You’ll need to pay approximately $1,900 extra each month above your regular required mortgage payment. Of course, the exact amount depends on your loan terms, interest rate, payment frequency, etc.

What is the monthly payment on a $100k mortgage?

For a 30-year fixed-rate mortgage at 5% interest, the monthly payment on a $100k loan would be around $537. But your specific loan terms will determine your actual monthly payment amount.

What percentage of my income should go towards my mortgage payment?

Financial experts often recommend keeping your monthly mortgage payment under 28% of your gross monthly income. But also make sure to account for taxes, insurance, maintenance, and utilities.

Should I pay off my mortgage early or invest extra funds?

It depends on your loan interest rate versus projected investment returns, taxes, risk tolerance, and other factors. Crunch the numbers for your situation and consider consulting a financial advisor.

Are there penalties for paying off my mortgage early?

Some older mortgages have prepayment penalties. But most modern mortgages allow early payoff without penalty. Check your loan documentation to understand any fees or restrictions.

How can I come up with extra money to pay off my mortgage early?

Options include budgeting hard to cut expenses, earning more income from a side gig, downsizing your lifestyle, putting windfalls toward the mortgage, selling assets, renting out space, and more. Get creative!

Final Thoughts

Paying off a sizable $100k mortgage in just 5 years takes immense motivation, preparation, and sustained focus. It requires sacrifice, discipline, and some tough lifestyle changes. But for some homeowners, the long-term benefits outweigh the short-term pain.

Carefully consider your entire financial situation. Make sure an aggressive payoff aligns with your priorities. Then implement a multi-pronged action plan to accomplish this ambitious mortgage paydown goal.

Stay positive and focused, even during difficult months. The mortgage freedom finish line will make every bit of effort worthwhile. Monitor your progress, celebrate milestones, and enjoy a life with one less monthly bill!

Real Estate Advice Straight to Your Inbox

It’s always good to keep your finger on the pulse of real estate trends so you can make informed decisions. Enter your email to get monthly content that’ll help you navigate the housing market with confidence. Enter Your Email By submitting this form you are agreeing to the Ramsey Solutions

Mortgage Payoff Calculator Uses

With this Mortgage Payoff Calculator, estimate how quickly you can pay off your home. By calculating the impact of extra payments, you can learn how to save money on the total amount of interest you’ll pay over the life of the loan.