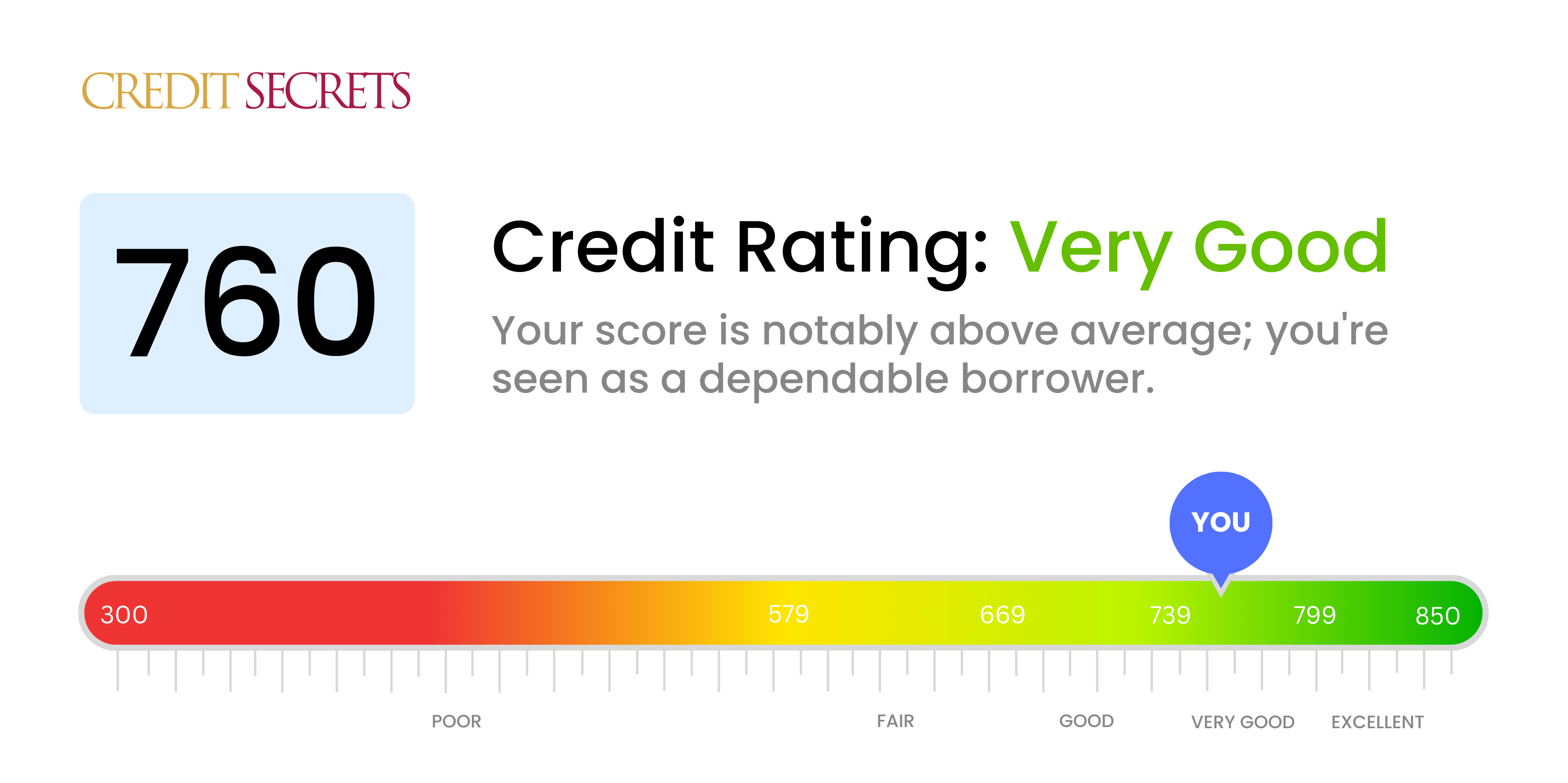

Having a credit score above 760 can open up a world of financial opportunities A score of 760 or higher is considered excellent credit, and will qualify you for the best interest rates and loan terms from lenders But reaching that high credit plateau takes diligent work.

Here are the key steps you need to take to get your credit score above 760

1. Pay All Bills On Time

Payment history has the biggest impact on your credit scores, accounting for 35% of your FICO score. Lenders want to see that you have a solid track record of making on-time payments.

Aim to pay all bills at least a few days before the due date. Set up automatic payments or calendar reminders so you never miss a payment. Paying late can lower your score by up to 110 points.

2. Lower Your Credit Utilization

The second biggest factor impacting your scores is your credit utilization ratio – the amount you owe versus your total credit limits. This makes up 30% of your FICO score.

Experts recommend keeping your utilization below 30%. People with scores above 760 tend to have very low utilization, less than 10%.

To lower your utilization:

- Pay down balances

- Ask for credit limit increases

- Use cards less often

Spreading balances over multiple cards can also help.

3. Limit New Credit Applications

Each time you apply for new credit, the lender will make a hard inquiry on your credit report. Too many inquiries in a short timeframe can indicate higher risk and lower your scores.

Aim to limit new applications to no more than one every six months. Be strategic in timing new credit accounts.

4. Build Credit History

The length of your credit history accounts for 15% of your FICO score. Lenders want to see you have a proven track record of using credit responsibly over time.

Keep old credit accounts open and active if possible. Having longer-term installment loans like mortgages and student loans can also help build a robust history.

5. Diversify Credit Types

While not a huge factor, having a mix of different credit types – like credit cards, retail accounts, and installment loans – can help boost your scores.

6. Dispute Any Errors

Incorrect or outdated information on your credit reports can drag down your scores. Comb through your credit reports regularly and dispute any errors with the bureaus.

This helps ensure your credit profile is accurately reflecting your financial habits.

7. Sign Up For Credit Monitoring

Credit monitoring services can notify you whenever key changes occur in your credit reports or scores. This helps you stay on top of your credit profile and quickly address any issues.

Many free services like CreditWise from Capital One provide monitoring. For full credit reports, a paid service like myFICO may be required.

Tips to Go From Good to Excellent Credit

If your credit score is already above 700, you are in great shape. But you may wonder – how can I take it to the next level, above 760? Here are some key tips:

-

Get credit reports from all three bureaus. Differences between bureaus could be lowering your scores with some lenders. Review reports from Equifax, Experian, and TransUnion to catch discrepancies.

-

Pay down balances. Even having credit cards at 10-20% utilization can drag down scores when aiming for excellence. Get balances as low as possible.

-

Limit hard inquiries. Each new account you open can ding your scores slightly. Slow down applications to avoid too many inquiries.

-

Become an authorized user. Ask a family member with great credit to add you as an authorized user to help build your history.

-

Wait for negative marks to fade. Most negative marks fall off your report after 7 years. Continue practicing good habits as you wait for those to disappear.

How Long Does It Take to Raise Your Credit Score Above 760?

Improving your credit score comes down to consistently practicing good financial habits over time. Pay all bills on time, keep credit utilization low, and monitor your credit reports.

If your score is already in the good to excellent range, it may take 6 to 12 months to reach over 760. The higher your starting score, the less room you have to improve.

But if you’re starting from a fair or poor score, it can take a few years to reach over 760. The key is persistence and not getting discouraged if progress seems slow. Over time, your good habits will be rewarded.

Maintaining Excellent Credit Over 760

Reaching an excellent credit score is an achievement to celebrate! But maintenance is critical, as scores can fluctuate month-to-month. Here are some tips to stay above 760 long-term:

- Review credit reports regularly to catch errors

- Keep credit utilization at 5% or lower

- Create a budget to avoid overspending

- Set up automatic bill payments

- Limit credit inquiries by spacing out new accounts

- Leave old accounts open to build history

Be patient and persistent. With diligence, you can enjoy the financial benefits of excellent credit for years to come!

Pay your bills on time

Credit scores are calculated by looking at various aspects of your credit report, and your payment history is the most important factor of them all.

In fact, whether or not youve paid past credit accounts on time counts as 35% of your FICO Score calculation. According to Experian, one of the three main credit bureaus, most people with credit scores of 760 typically pay their bills on time, with over 75% having a spotless late payment record.

If you have difficulty remembering to meet your various due dates for different bills, automate them so that the money comes directly out of your bank account on the same day each month. This way, you can be at ease knowing that all your bills are being paid on time.

Keep a low credit utilization rate

Another key factor in your credit score calculation (making up 30% of your FICO Score) is how much of your available credit, or total credit limit, you actually use. This is also known as your credit utilization rate, which shows your amounts owed.

Experian found that among consumers with FICO Scores of 760, the average utilization rate is 23.7%. Financial experts generally recommend keeping your utilization rate below 30% (and some even say to aim for a single-digit utilization rate under 10%).

To calculate your credit utilization rate, divide your total balance by your total credit limit, then multiple by 100 to get the percentage. For example, if you have an $800 balance across all your credit cards and you have a $2,000 credit limit (again, across all your credit cards), your CUR is 40%: ($800 / $2,000 = 0.4 X 100 = 40%).

How to RAISE Your Credit Score Quickly (Guaranteed!)

FAQ

How to get higher than 760 credit score?

- Pay your credit card bills on time. …

- Keep a solid payment history. …

- Consider your credit mix. …

- Increase your credit limit. …

- Don’t close old accounts. …

- Regularly monitor your credit report. …

- Only open a new credit card when you really need it.

How do I get my credit from 760 to 800?

- Keep track of your progress. …

- Always pay bills on time. …

- Keep credit balances low. …

- Pay your credit cards more than once a month. …

- Consider requesting an increase to your credit limit. …

- Keep unused accounts open.

How do I go from 760 to 800?

- Pay on Time. You don’t have to be a perfectionist to become a member of the 800 Club, but it does help. …

- Limit Credit Use. …

- Mix and Match Methods of Borrowing. …

- Credit History Matters. …

- Don’t Apply for Credit …

How to increase credit score from 750 to 900?

Make All Payments On Time

Timely repayment of credit card bills as well as loan EMIs is vital. Even a single default can drastically bring down your score. Set payment alerts to avoid missing due dates. If you cannot pay the full amount, pay the minimum due amount on time.