Are you dreaming of reaching that magical seven-figure milestone that defines financial success in India? Becoming a crorepati isn’t just about bragging rights—it represents financial security and freedom that many of us aspire to achieve. The good news? It’s totally doable with the right plan and discipline!

I’ve put together this comprehensive guide to help you navigate the path to becoming a crorepati. Whether you’re just starting your career or already have some savings, these strategies can help you reach that coveted status faster than you might think.

Understanding What It Takes to Become a Crorepati

Before diving into strategies, let’s understand what we’re talking about. A crorepati is someone with wealth of at least one crore rupees (Rs. 1,00,00,000 or 10 million) While this seemed like an astronomical amount decades ago, today with inflation and rising incomes, it’s an achievable target for many middle-class Indians with proper planning

But here’s something crucial to consider – the value of 1 crore today won’t be the same 20 years from now. Due to inflation you might need 2-3 crores in the future to have the same purchasing power as 1 crore today. This is why your crorepati journey requires smart planning, not just aggressive saving.

Calculate Your Crorepati Timeline

The first step is understanding how much you need to invest regularly to reach your goal. Several factors influence this

- Your current age

- The age by which you want to become a crorepati

- Expected inflation rate

- Expected return on investments

- Your existing savings

Tools like the Crorepati Calculator on Advisorkhoj or Nippon India’s Crorepati Calculator can help you determine the exact monthly investment needed. For example, if you’re 25 years old, want to become a crorepati by age 45, expect 5% inflation and 12% returns on investments, and currently have no savings, you’d need to invest around Rs. 7,500 monthly through a SIP (Systematic Investment Plan).

Strategies to Become a Crorepati

1. Start Early and Harness the Power of Compounding

I cannot stress this enough – the earlier you start, the easier your journey. Compounding is like financial magic that works better with time.

Consider this example:

- Ravi starts investing Rs. 5,000 monthly at age 25 with 12% annual returns

- Priya starts investing Rs. 15,000 monthly but delays until age 35 with the same returns

By age 50:

- Ravi accumulates approximately Rs. 1.59 crores (invested Rs. 15 lakhs)

- Priya accumulates approximately Rs. 1.36 crores (invested Rs. 27 lakhs)

Ravi invested less but ended up with more money because time worked in his favor!

2. Choose the Right Investment Vehicles

Not all investments are created equal. Here’s where you should consider putting your money:

Equity Mutual Funds:

- Best for long-term wealth creation

- Historical returns of 12-15% over long periods

- SIPs help average out market volatility

Public Provident Fund (PPF):

- Safe government-backed investment

- Tax-free returns (currently around 7.1%)

- 15-year lock-in but partial withdrawals allowed after 7 years

National Pension Scheme (NPS):

- Long-term retirement planning

- Tax benefits under Section 80C and additional deduction under 80CCD(1B)

- Mix of equity and debt based on your risk profile

Real Estate:

- Potential for appreciation and rental income

- Requires larger initial investment

- Less liquid than financial assets

Stocks:

- Potential for high returns

- Requires knowledge and research

- Higher risk compared to mutual funds

3. Create Multiple Income Streams

Relying solely on your salary makes the crorepati journey longer and harder. Look for ways to increase your income:

- Side hustles: Freelancing, consulting, or tutoring

- Passive income: Rental properties, dividends from investments

- Skill upgradation: Improve your qualifications to boost your primary income

- Entrepreneurship: Start a small business alongside your job

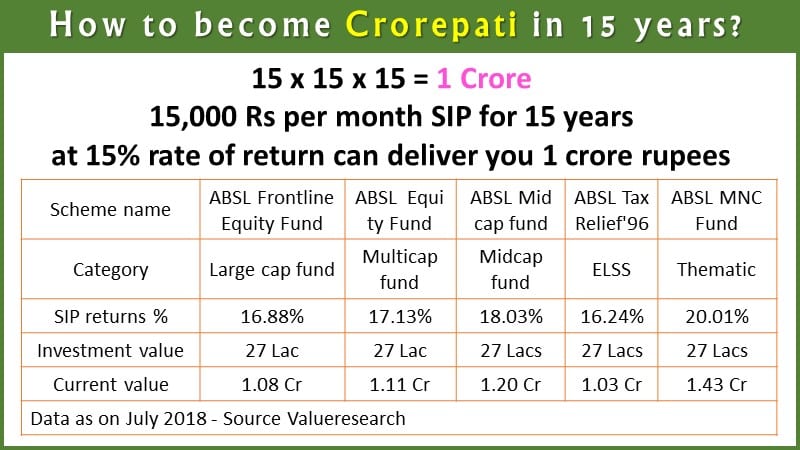

4. Embrace the SIP Approach

Systematic Investment Plans are the most practical way for salaried individuals to build wealth. Benefits include:

- Disciplined investing: Automatic monthly deductions

- Rupee cost averaging: Buying more units when markets are down

- Power of compounding: Returns earn further returns over time

- Flexibility: Start with as little as Rs. 500 monthly

For example, a Rs. 10,000 monthly SIP with 12% returns can grow to approximately Rs. 1 crore in about 20 years.

5. Increase Investments as Your Income Grows

Don’t keep your SIP amount constant throughout your career. As your salary increases, boost your investments proportionally. Even a small annual increase of 5-10% in your investment amount can significantly reduce the time needed to reach one crore.

6. Cut Unnecessary Expenses

Review your spending habits and identify areas to trim:

- Eating out frequently

- Subscription services you rarely use

- Brand-name products when generics work fine

- Impulsive shopping

Redirecting just Rs. 5,000 monthly from expenses to investments can accelerate your crorepati journey by several years!

7. Avoid Lifestyle Inflation

As your income increases, resist the temptation to upgrade your lifestyle proportionally. Instead, maintain your standard of living and direct the additional income toward investments. This doesn’t mean living miserly—just being thoughtful about which upgrades truly enhance your life.

Real-Life Crorepati Success Stories

Case Study 1: Suresh, the Consistent SIP Investor

Suresh, a software engineer, started investing Rs. 8,000 monthly in equity mutual funds at age 26. He increased his SIP by 10% annually as his salary grew. By age 42, his portfolio crossed the 1 crore mark, primarily due to his discipline and the power of compounding.

Case Study 2: Meera, the Diversified Investor

Meera began with a modest Rs. 3,000 monthly SIP in her 20s. As she learned more about investing, she diversified into direct stocks, real estate, and even started a small online business. Her multiple income streams and diversified investments helped her reach crorepati status by age 38.

Common Mistakes to Avoid on Your Crorepati Journey

- Timing the market: Trying to predict market highs and lows often leads to poor results.

- Investing without goals: Without clear targets, you might make inconsistent decisions.

- Ignoring insurance: A major health issue can wipe out savings if you’re not adequately insured.

- Frequent portfolio changes: Constantly switching investments based on short-term performance.

- Emotional decisions: Panic selling during market downturns or buying during euphoric bull runs.

Step-by-Step Crorepati Action Plan

- Month 1: Calculate your current net worth and set a timeline for becoming a crorepati

- Month 2: Create a budget, identify savings potential, and set up an emergency fund

- Month 3: Research investment options and start a SIP in quality equity mutual funds

- Month 4-6: Review and optimize your tax planning

- Every 6 months: Review your portfolio and rebalance if needed

- Annually: Increase your SIP amount as your income grows

- Every 3-5 years: Reassess your financial goals and make adjustments

The Role of Tax Planning in Wealth Creation

Smart tax planning can significantly accelerate your journey to becoming a crorepati:

- ELSS funds: Equity Linked Savings Schemes offer tax deductions and potential for high returns

- PPF and NPS: Tax benefits under Section 80C

- Health insurance: Deductions under Section 80D

- Home loan: Principal repayment (80C) and interest deduction (24b)

Remember, it’s not just about how much you earn, but also how much you keep after taxes!

What If You’re Starting Late?

Don’t worry if you’re starting your crorepati journey in your 30s or 40s. You’ll need to be more aggressive with your approach:

- Invest larger amounts: You’ll need to compensate for the lost time

- Seek higher returns: Consider a slightly more aggressive portfolio

- Create additional income streams: Focus on developing side hustles

- Reduce major expenses: Consider downsizing if possible

- Extend your timeline: Be realistic about when you can reach the goal

Final Thoughts: Consistency is Key

Becoming a crorepati isn’t about getting lucky with one big investment. It’s about consistently making smart financial decisions over time. The path might seem long, but with each passing month of disciplined investing, you get closer to your goal.

Start today, stay consistent, increase your investments as your income grows, and before you know it, you’ll be celebrating your entry into the crorepati club!

Remember, the journey to becoming a crorepati is a marathon, not a sprint. The most important step is the first one – so begin your investment journey today, no matter how small the amount. Your future self will thank you!

Would you like me to elaborate on any particular aspect of becoming a crorepati in India? I’m happy to dive deeper into investment strategies, SIP calculators, or success stories that might inspire your journey!

India’s #1 Business Coach Exposes Get-Rich-Quick Lies & Real Success | FO329 Raj Shamani

FAQ

How can I earn 1 crore in India?

Individuals must set clear financial goals, plan their approach, invest in equity mutual funds, and practice consistent tax planning to make Rs. 1 crore in 5 years. In India, some of the popular investment options are shares, bonds, ETFs, mutual funds, and Unit-Linked Investment Plans (ULIPs).

Is it possible to make 1 cr in 5 years?

It is possible to accumulate Rs. 1 crore in 5 years with a disciplined investment strategy involving SIPs, lump sum investments, or step-up SIPs. Starting early and staying consistent are crucial to take advantage of compounding and rupee cost averaging. Based on a 12% annual return, you’ll need to invest around Rs.

How to make 1 cr in 10 years?

How to become Crorepati in 10 years? To reach Rs 1 crore in 10 years, you will need to invest more aggressively. Example: If you invest Rs 43,000 per month in equity mutual funds or stocks with an average annual return of 12%, you could accumulate wealth of around Rs 1 crore in 10 years.

Is having 1 crore rich in India?

₹10 lakh: Middle class. ₹1 crore: Rich. ₹10 crore: High Net Worth Individual (HNI) ₹100 crore: Wealthy.