Robinhood is an app that lets you buy and sell stocks (pieces of companies) without paying money each time you make a trade. It’s like a digital shop for investing in companies, and it’s super popular because it seems free.

Even though Robinhood advertises “commission-free trading, ” which means it doesn’t charge you directly for buying or selling stocks, it still makes money from various hidden fees.

Most Robinhood fees are small but can still add up without you noticing immediately. In this guide, we’ll explain each and every fee Robinhood charges. Here is a quick summary:

Hey guys! I’ve been getting tons of questions from my readers about Robinhood’s fee structure, so today I’m diving deep into answering that burning question: does Robinhood have a monthly fee? As someone who’s been using investment platforms for years, I wanted to clear up all the confusion once and for all.

The Quick Answer

No, Robinhood does not charge a monthly fee for its basic account. Investing with a standard Robinhood investing account is commission-free for stocks, ETFs, and their options. They don’t charge you fees to open or maintain your account.

But wait – there’s more to the story! While the basic account is free there are some fees you should know about, plus an optional premium subscription. Let’s break it all down.

Robinhood’s Basic Account: Truly Free

When Robinhood says “commission-free trading” they actually mean it for their standard account

- No monthly account fees

- No minimum balance requirements

- No commission on stock trades

- No commission on ETF trades

- No commission on options trades

- No fee to open an account

- No fee to maintain an account

- No inactivity fees

This makes Robinhood particularly attractive for beginners or those with limited funds who want to start investing without worrying about fees eating into their returns.

Robinhood Gold: The Optional Premium Subscription

While the basic account is free, Robinhood does offer a premium subscription called Robinhood Gold. This is completely optional but provides additional features:

- Price: $5 per month

- Features include:

- Larger instant deposits

- Professional research from Morningstar

- Level II market data

- Margin investing at 5.75% annual interest (for eligible accounts)

- Reduced contract fee for index options ($0.35 instead of $0.50)

If your trading style benefits from these additional features, the Gold subscription might be worth considering. But if you’re just looking to buy and hold stocks or make occasional trades, the free account will serve you just fine.

Regulatory Fees You Should Know About

Even though Robinhood doesn’t charge commissions, there are some regulatory fees that Robinhood passes on to customers These aren’t Robinhood fees – they’re charged by regulatory organizations, and Robinhood just passes them through

1. Regulatory Transaction Fee

The Financial Industry Regulatory Authority (FINRA) charges this fee, which goes to the Securities and Exchange Commission (SEC). As of May 14, 2025, the SEC requires no further collections for the fiscal year and set the fee rate at $0. This fee rate will remain in effect until 60 calendar days after a new fee rate is published by the SEC.

2. Trading Activity Fee (TAF)

FINRA charges this to recover supervision costs. As of January 1, 2024, the fee is:

- $0.000166 per share for equity sells (except for sales of 50 shares or less)

- $0.00279 per contract for options sells

- The fee is rounded to the nearest penny and won’t exceed $8.30 per trade

3. American Depositary Receipt (ADR) Fees

If you trade ADRs (foreign stocks trading on US exchanges), the issuing banks may charge custodial fees ranging from $0.01-$0.03 per share.

4. Options Regulatory and Exchange Fees

The Options Clearing Corporation (OCC) charges these fees. Effective January 10, 2025, Robinhood collects a combined $0.04 fee for each options contract traded.

5. Consolidated Audit Trail (CAT) Fee

Starting on or after September 30, 2025, these transaction fees will apply:

- $0.0022 per contract for options

- $0.000022 per share for National Market System equities

- $0.00000022 per share for over-the-counter equities

6. Index Options Trading Fees

For index options like SPX, SPXW, VIX, etc., additional fees apply based on the specific index and contract conditions. For example, if you’re trading SPXW with a premium less than $1, there’s a $0.50 fee per contract.

My Experience with Robinhood Fees

I’ve been using Robinhood for about 3 years now, and honestly, the fee structure is one of the things I like most about it. When I first started investing, I was shocked at how much traditional brokers were charging per trade. It felt like I was fighting an uphill battle, losing $5-10 on each trade before I’d even made any money!

With Robinhood, I rarely notice the regulatory fees because they’re so minimal. For example, last month I sold 100 shares of a company, and the regulatory fee was about 2 cents. Not exactly breaking the bank!

The only time I really notice fees is when trading options, especially if you’re doing multiple contracts. But even then, they’re much lower than what traditional brokers charge.

How Robinhood Makes Money Without Monthly Fees

You might be wondering – if Robinhood doesn’t charge monthly fees or commissions, how do they make money? Great question! Their revenue comes from several sources:

- Interest on cash: They earn interest on the uninvested cash in customer accounts

- Margin interest: When Gold members borrow on margin, Robinhood earns interest

- Payment for order flow: They receive compensation for directing orders to particular trading venues

- Robinhood Gold subscriptions: The $5 monthly fee from premium members

- Stock loans: Lending stocks held in margin accounts to other institutions

- Cash management: Their debit card program generates interchange fees

This business model allows them to offer commission-free trading while still operating a profitable business.

When Might You Pay Fees on Robinhood?

While basic trading is free, there are some specific actions that will trigger fees:

- Wire transfers: $25 for domestic incoming wires, $50 for international incoming wires

- Live broker assistance: $25 fee if you need a broker to place trades for you by phone

- Paper statements: $5 per statement if you request paper copies

- Index options trading: As detailed in their fee schedule

- Margin interest: If you borrow on margin as a Gold member

- Regulatory fees: As outlined above

Is Robinhood Really the Cheapest Option?

Robinhood definitely pioneered the commission-free trading movement, but nowadays many brokers have eliminated commissions. So how does it compare?

Robinhood shines for:

- New investors who want simplicity

- Those making small, frequent trades

- Mobile-first traders who value a clean interface

However, other brokers might be better if you:

- Need advanced research tools

- Want access to mutual funds (not offered by Robinhood)

- Require more sophisticated order types

- Value phone customer service

FAQ About Robinhood Fees

Q: Is there any hidden monthly fee with Robinhood?

A: No, the standard account has no monthly fee. Only Robinhood Gold costs $5/month.

Q: Does Robinhood charge for withdrawing money?

A: No, ACH transfers to and from your bank are free.

Q: Are there any inactivity fees if I don’t trade often?

A: Nope! You can keep your account open without trading and won’t be charged.

Q: How much does it cost to close a Robinhood account?

A: Nothing. Closing your account is free.

Q: Is there a fee for transferring stocks to another broker?

A: Yes, there’s a $75 ACAT fee to transfer your holdings to another brokerage.

My Final Thoughts

After using various investment platforms over the years, I gotta say that Robinhood’s fee structure is one of the most straightforward out there. The lack of monthly fees and commissions makes it particularly accessible for beginners or those with limited capital.

That said, the regulatory fees are something to be aware of, especially if you’re trading options or index options frequently. But for most casual investors, these fees are minimal compared to the old commission structure that used to dominate the industry.

If your primary concern is avoiding monthly fees while still having access to stocks, ETFs, and options trading, Robinhood is definitely worth considering. Just be sure to understand the full fee schedule before diving in, especially if you plan to use margin or trade index options!

Have you been using Robinhood? What’s your experience been with their fee structure? Drop me a comment below – I’d love to hear about your experiences!

Happy investing!

Comparing Transaction Fees: Swan Bitcoin vs. Robinhood Fees

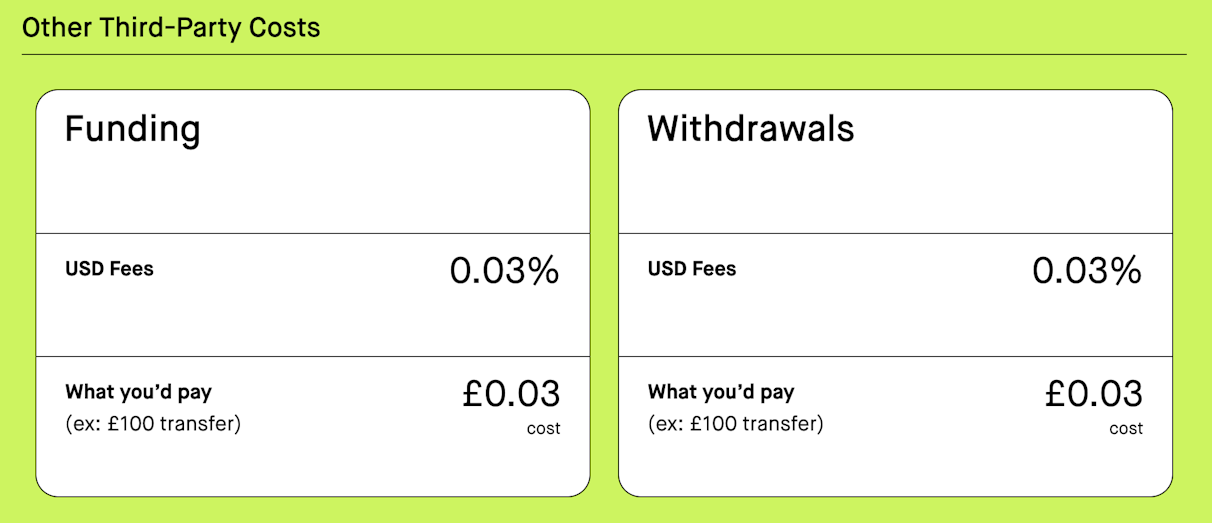

When comparing fee structures, it’s essential to understand how each platform charges for transactions and how these fees impact both small and large transactions.

- For small transactions: The absence of commission fees makes Robinhood an attractive option for small transactions.

- Small traders benefit from not paying a flat fee per trade, which can disproportionately affect smaller trade amounts.

- However, they still face small regulatory fees like the Trading Activity Fee, which is $0.000166 per share for equity sales.

- As of January 1, 2024, the TAF is $0.000166 per share (equity sells) and $0.00279 per contract (options sells) on Robinhood. This fee is rounded up to the nearest penny, which will be no greater than $8.30 per trade. Keep in mind, you may be charged more than the $8.30 fee because the fee limit is based on the execution of your order, which can occur with multiple trades.

- For large transactions: While the lack of trading fees benefits larger transactions, Robinhood users must consider the impact of regulatory fees, which can accumulate based on the transaction size.

- However, these fees are relatively minor compared to typical commission charges on other platforms.

When considering the membership and subscription fees between Swan and Robinhood, each platform offers different approaches catering to specific investors and services.

- Swan Bitcoin Membership Fees: Swan Bitcoin focuses primarily on Bitcoin and does not charge general membership or account fees.

- Robinhood Membership Fees: Robinhood offers a more traditional membership model through its Gold service.

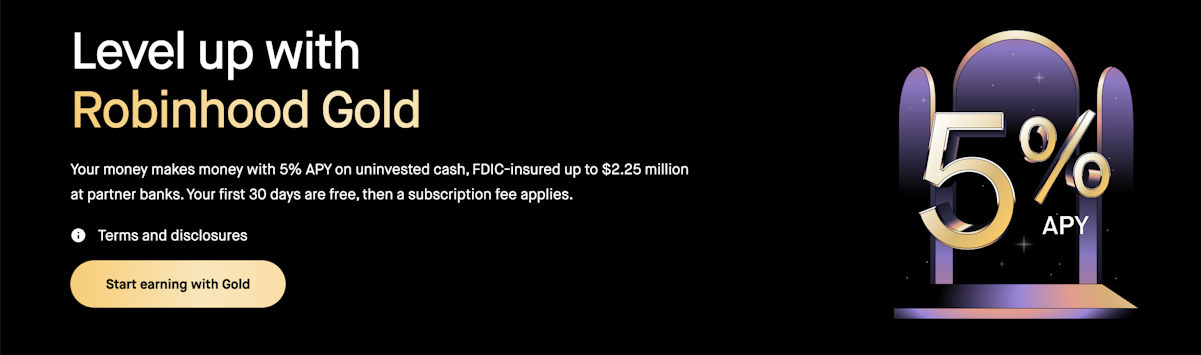

Robinhood Gold costs $5 per month and includes additional perks like earning higher interest on uninvested cash. This service provides value to more active traders or those looking for deeper financial insights and quicker access to funds.

Both Swan and Robinhood have distinct fee structures beyond basic trading fees, including withdrawal, inactivity, and transfer fees. Understanding these can help users gauge the overall cost of using each platform.

- Withdrawal Fee: Robinhood does not charge fees for ACH withdrawals but has wire transfer fees. Domestic wires are free, but international wire fees must be checked for hidden forex charges.

- Inactivity Fee: $0 No fee for inactivity. Replacement card $0 No fee for replacement card. Your funds will be held at or transferred to JP Morgan Chase Bank, N.A. an FDIC-insured institution.

- Transfer Fee: Robinhood charges a $75 fee for outbound transfers (ACATS), a significant cost if a user moves their portfolio to another brokerage. However, depositing funds via ACH and withdrawing funds from a bank accountis free.

- ZERO Fees: No fees on your first $10k! Enjoy zero fees on your first $10,000 of Bitcoin buys (or your next $10,000 for existing clients). No time limit, applies to single buys, recurring buys, and IRA buys. Learn more.

- Withdrawal Fee: Swan Bitcoin does NOT charge any fees for withdrawing Bitcoin to an external wallet, which is a significant benefit for users looking to move their Bitcoin to personal wallets or other exchanges.

- No Inactivity Fee: Swan promotes regular purchasing but does NOT penalize users with inactivity fees, making it cost-effective for long-term holding without regular transactions.

- Transfer Fee: There are NO fees for transferring funds in fiat.

Overview of Swan’s Fee Structure

Swan primarily targets users interested in purchasing Bitcoin regularly through a recurring buys model. Fees are directly related to the amount and frequency of purchases.

Swan Bitcoin’s model makes it an especially appealing option for recurring low-time preference investors. Swan combines low fees with additional savings for frequent purchases and successful referrals.

Right now, Swan customer have ZERO fees for their first or next $10,000 in Bitcoin purchases.

Swan Bitcoin has low commissions (0.99%) for all purchases and sales whether made instantly, via wire transfer, direct deposit, or as part of a recurring transfer plan. Depending on your purchasing size, your fees can be up to 80% cheaper at Swan than if you buy Bitcoin through another platform.

Referral Incentive Program (Receive a $10 Bitcoin Bonus)

Swan is highly confident in the appeal of their service and has thus initiated the Swan Force Referral Initiative. This program is open to all who wish to become affiliates.

Enrolling in Swan Force is a breeze!

Once you’re in, you’ll be given a unique URL that you can easily share with others. If they decide to join Swan using your link, they’ll get a $10 bonus in Bitcoin. You’ll also earn 25% of their Bitcoin transaction fees for their first year’s purchases.

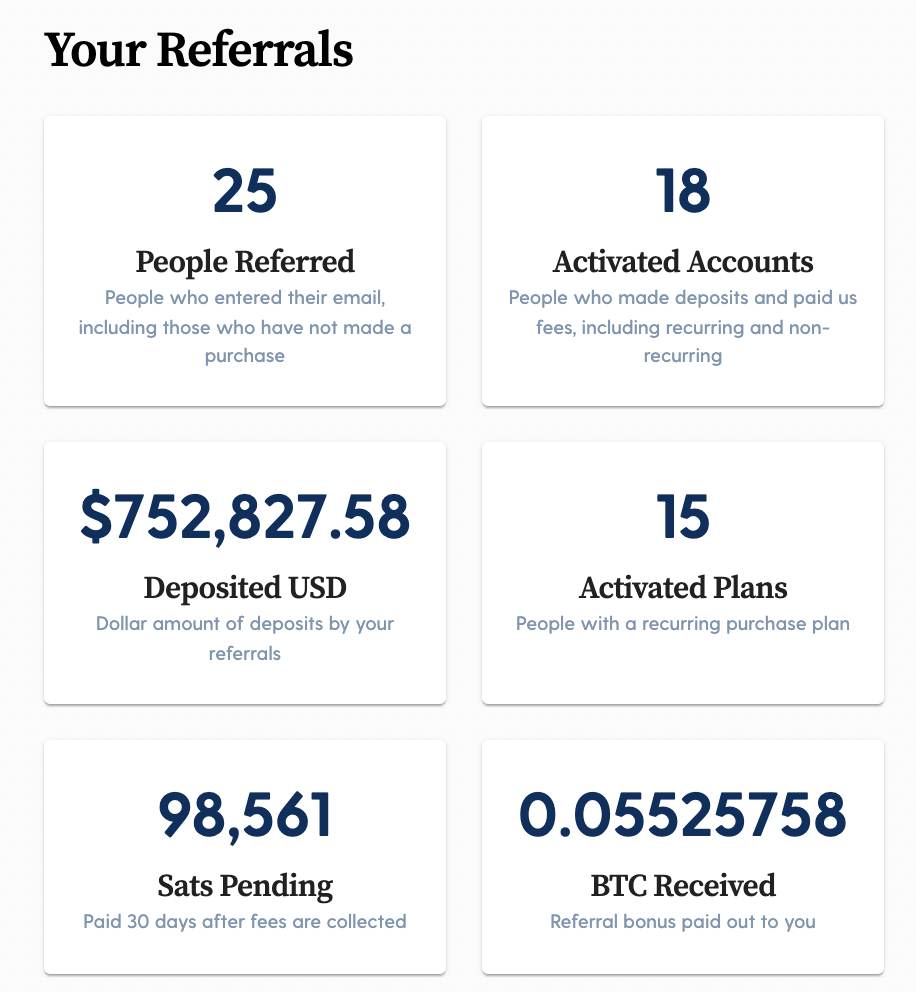

We’ve set up a dedicated referral dashboard for you to keep track of your referrals and earnings.