Paying bills with a credit card can be an easy and convenient way to earn rewards, get some extra time to pay, and simplify your finances by consolidating expenses onto one statement But could relying on plastic to pay your monthly expenses actually hurt your credit? The short answer is it depends

When used responsibly credit cards can help build your credit history and scores. But charging bills you can’t afford or carrying balances can damage your credit. To understand the potential impact you need to consider both how and which bills you pay by card.

How Credit Card Use Affects Your Credit Scores

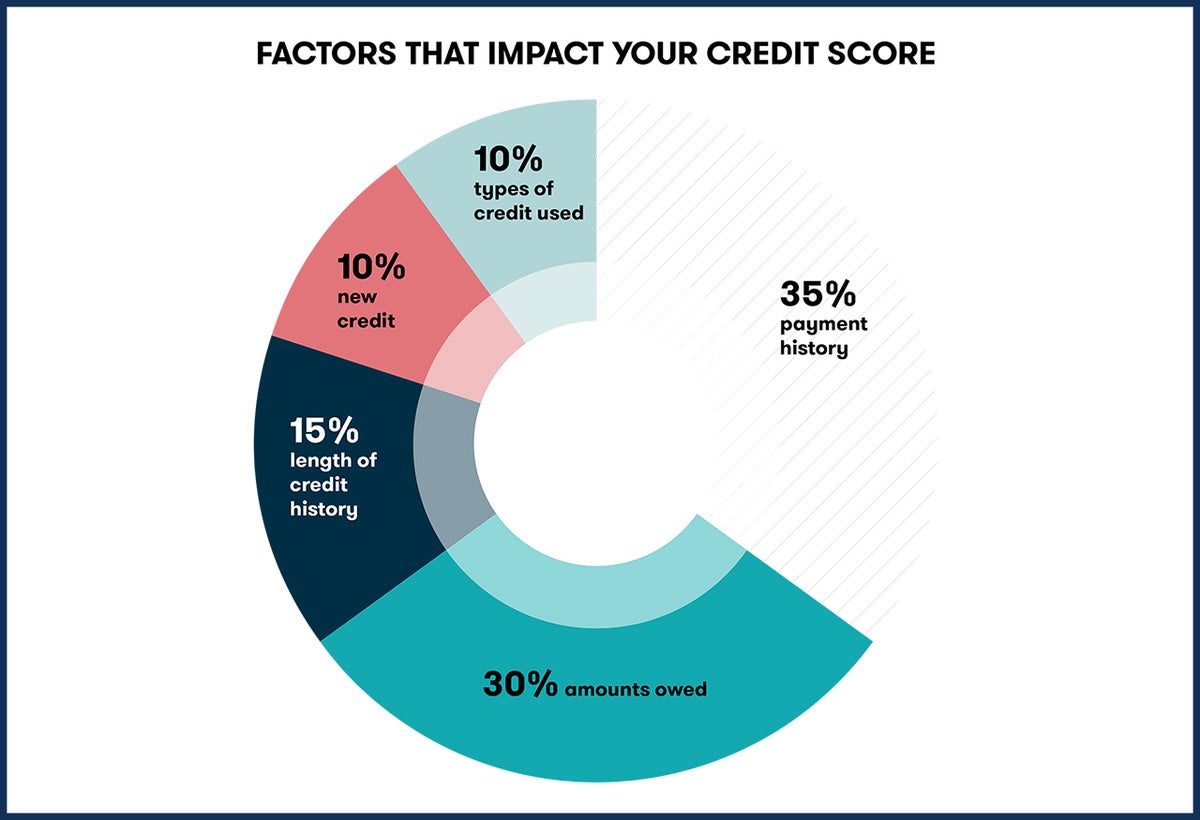

The two biggest factors credit scoring models like FICO and VantageScore use to calculate your scores are payment history and credit utilization. Together, these two categories make up 65% or more of your scores

-

Payment history looks at whether you pay your debts on time each month. A long track record of on-time payments helps your scores; missed payments hurt.

-

Credit utilization is the percentage of your total credit limits you’re using. Experts recommend keeping this below 30%. Maxing out cards hurts your scores.

So if you pay your credit card bills in full and on time every month, and don’t use too much of your available credit, charging expenses to a card could help build your credit through positive payment history.

But if you carry balances, miss payments, or max out your cards, relying on credit cards to pay bills can damage your credit through late payments and high utilization.

Which Bills Help or Hurt Your Credit When Paid by Card

Not all bills are created equal when it comes to how paying them with a credit card affects your credit.

Bills That Help

-

Credit cards – Since card payments are automatically reported to the credit bureaus, paying your credit card bills on time consistently can help your credit.

-

Loans – Installment loans like personal loans, student loans, and auto loans are also regularly reported. Paying these with a card if allowed can build your credit history.

-

Utilities – If your utility company reports on-time payments, charging these bills to earn rewards can help. Many don’t report, however.

-

Rent – Paying rent with a card through a service like Plastiq has potential to help. But fees often make this impractical.

Bills That Hurt

-

Mortgage – Most lenders don’t accept credit cards for mortgage payments to avoid processing fees. If yours does, the high balance could hurt through utilization.

-

Medical Bills – Paying medical expenses with a card is generally not recommended. If unpaid, medical bills can seriously damage your credit.

-

Bills You Can’t Afford – Putting bills on a card when you don’t have the cash to pay hurts through high utilization and potential late payments.

Neutral Bills

-

Cell Phone – On-time cell phone payments typically aren’t reported unless seriously delinquent. But rewards could make using a card worthwhile if no fees.

-

Insurance – Paying insurance bills with a card earns rewards with no credit impact as long as you pay on time. But some insurers charge fees.

-

Cable/Internet – Like cell phones, on-time payments usually aren’t reported. Rewards cards can make sense for these if no fees.

Tips to Pay Bills With a Credit Card Without Hurting Your Credit

Paying bills with a credit card strategically can help your credit while earning rewards. Follow these tips to avoid hurting your scores:

-

Only charge bills you can afford to pay in full each month to avoid interest and credit damage.

-

Keep utilization low by limiting charges to 30% or less of your credit limits.

-

Make sure payments post on time by setting payment reminders and automating payments.

-

Avoid fees that erase rewards by researching which providers accept cards at no cost.

-

Be selective about which bills go on your card, avoiding large recurring costs like rent and mortgage.

-

Compare cards to find the best fit based on the types of bills you pay regularly. Cash back cards may suit utility bills, for example, while travel rewards work for insurance.

-

Consider the sign-up bonus when applying for a new card, and meet minimum spend organically through bills rather than overspending.

The Bottom Line

When used wisely and with financial discipline, credit cards can help establish positive payment history and improve your credit profile over time. But paying bills you can’t afford or carrying a balance can hurt your credit through late payments and high utilization.

Being selective about which bills you charge, keeping balances low, paying on time, and avoiding fees allows you to earn rewards without credit damage. Monitoring your credit scores also helps you catch any impacts early before they become lasting problems.

Other ways to build credit

Building credit can be simple, but it takes some discipline. Here are our top tips to improve your credit score:

How to get credit for your bills

It’s possible to get credit for paying your bills on time, even if your payments aren’t reported to the credit bureaus. Here’s how:

- Use a credit card when possible. Some companies allow you to pay your bills with a credit card. This can help you build credit as long as you make your monthly credit card payments on time. See what bills you can pay with a credit card in the table above. Keep an eye out for surcharges and convenience fees, though. If it costs more to use a credit card, use another payment method. There are other, cheaper ways to build credit.

- Sign up for Experian Boost. Experian Boost is a free service that allows you to add your cellphone, utility and rent payments to your Experian credit report. This can boost your FICO Score and add on-time payments to your Experian credit report. Note, however, that Experian Boost only lets you report payments to your Experian credit report. Your TransUnion and Equifax reports won’t be affected.

- Report your rent payments. You can report your rent payments to the credit bureaus, but most rent payment reporting companies charge a fee. For instance, Boom charges $3 a month to report your payments and Credit Rent Boost charges $6.95 a month.

Get free, personalized recommendations on how to improve each of the factors that affect your credit score with LendingTree Spring. We’ll show you how your credit stacks up and what to do to boost your score.

Does Carrying a Balance on a Credit Card Hurt Your Credit Score? (Q&A)

FAQ

Is it bad to use a credit card to pay bills?

It might affect your credit scores: If you can’t pay off your credit card balance after paying your bills with a credit card, you could increase your credit …Feb 27, 2025

Does paying bills on credit card affect credit score?

Paying a bill will affect your credit if the company reports payments to the credit bureaus or if you use a credit card. When a person or company reports your payments (or nonpayments), the credit bureaus will add this information to your credit report — this will impact your credit score.

How much does paying off a credit card affect your credit score?

Paying off debt is more likely to help your credit scores than to hurt them. You are likely to see your credit scores improve after paying off debt unless the debt you repaid meets the unique criteria listed above.

Does your credit score go down when you use your credit card?