One of the most stressful aspects of using a credit card is racking up a high balance. There are many reasons that you may have a high balance, including large unexpected bills or home and auto repairs. Or maybe you just really wanted a new couch, and it hit your wallet hard.

There are a number of factors that contribute to your overall score, but the one that will be most impacted by your high balance is your credit utilization ratio. This simply means the percentage of your overall credit that you have used.

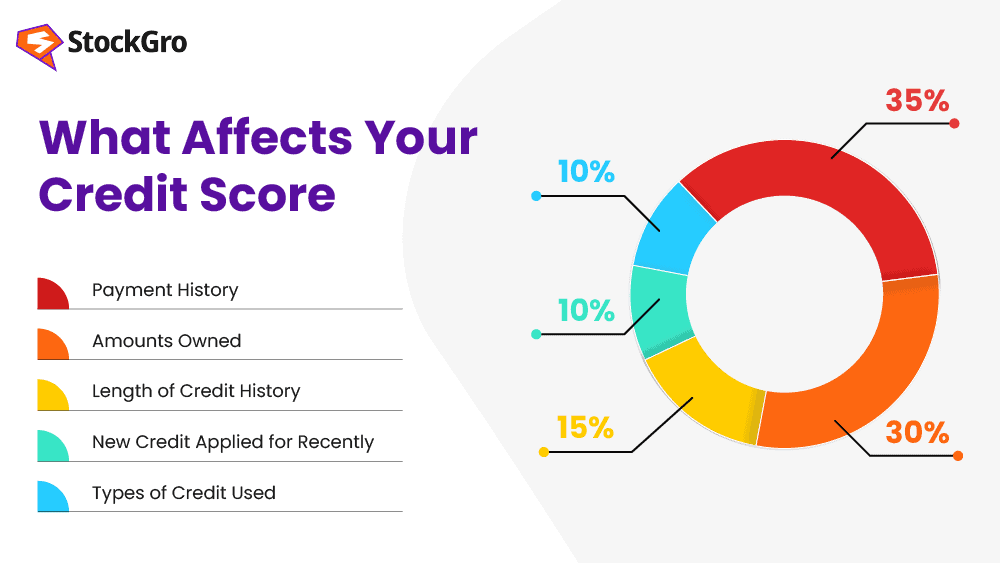

When thinking about carrying a balance, it’s important to remember that 30 percent of your FICO score comes from your credit utilization ratio.

Your credit score is one of the most important factors lenders use to evaluate your creditworthiness. A higher score means you’re more likely to get approved for new credit, while a lower score could lead to higher interest rates or rejected applications.

Many different elements factor into your credit score calculation, but one aspect many cardholders worry about is how their highest credit card balance impacts their score. Does maxing out your credit limit tank your credit, or is the highest balance insignificant as long as you pay on time?

In this article, we’ll explain what your highest balance means, how it does (and doesn’t) influence your score, and what you can do if you have a high balance you want to pay down.

What is Your Credit Card’s Highest Balance?

Your credit report contains several key details about each of your credit card accounts. including

- Current balance

- Credit limit

- Payment history

- Highest balance

The highest balance listed is the maximum amount you’ve ever charged on that card This could go back as far as the entire time you’ve had the account open

For example, let’s say you have a credit card with a $5,000 limit. Over the past few years, you’ve charged as much as $4,800 at one point. Even if your current balance is only $1,000, your highest balance would still show as $4,800.

This metric doesn’t reset – it’s intended to give lenders an idea of your spending patterns over time on each account.

Highest Balance vs. Credit Utilization

An important distinction is that your highest balance is not the same thing as your credit utilization ratio.

Credit utilization compares your current credit card balances to your total credit limit across all cards. Most experts recommend keeping this below 30%.

Highest balance simply shows the maximum you’ve ever charged on each individual card, regardless of whether you’ve paid that amount down already.

For scoring purposes, credit utilization carries much more weight. Your highest lifetime balances on their own don’t factor into your credit scores at all.

When Highest Balance Does Impact Your Credit

In most cases, that maximum balance figure itself has no effect. But there are a couple scenarios where an exceptionally high balance could indirectly influence your credit:

-

It becomes your current balance – If you’ve charged up to your card’s limit in the past and are still carrying that amount month-to-month, that balance will increase your credit utilization. Paying it down can improve your scores.

-

It’s used as your credit limit – On rare occasions, lenders may use your highest balance as a proxy for your credit limit if one isn’t reported. That could falsely inflate your utilization. Disputing the accuracy of your highest balance amount can help in such cases.

Outside of these exceptions, your highest lifetime balance is generally insignificant. Far more important factors include making at least the minimum payment on time each month and keeping overall revolving balances low compared to limits.

Tips for Managing a High Credit Card Balance

If you do have a high credit card balance you want to pay down, here are some tips:

-

Pay more than the minimum when possible – This will help you chip away at the principal faster. Minimum payments on big balances can take years to pay off.

-

Consider a balance transfer card – Moving your debt to a card with a 0% introductory APR allows you to pay down the balance interest-free over time. Just be sure to have a payoff plan.

-

Limit or stop card spending – Until you pay down your balance, use cash or debit as much as possible to avoid adding to your credit card debt.

-

Request a credit limit increase – A higher credit limit can lower your utilization ratio, benefitting your score. But only do so if you can avoid running up more debt.

-

Improve payment history – If your high balance is due to missed payments, get current on your accounts and don’t pay late going forward. This will help counteract past mistakes.

While a high credit card balance itself has little bearing on your scores, taking steps to pay down or manage revolving debt can lead to credit score improvements over time. Monitoring your credit reports periodically helps you keep tabs on all balances and limits across your accounts as well.

Frequently Asked Questions (FAQs)

How long does your highest balance stay on your credit report?

Your credit report will show the highest balance you’ve had on each card for as long as you’ve had the account open. Even if you pay it down entirely, that maximum amount charged will still appear.

Can you remove your highest balance from your credit report?

No – the highest balance is considered an accurate historical account detail. You cannot delete or modify it, only dispute it if you believe it is incorrect.

Is it bad to have a high balance on just one credit card?

Having maxed out one card could inflate your overall credit utilization if you also have other open revolving accounts. Try to keep each individual card’s balance below 30% of its limit, if possible.

If I pay off my highest balance, will my credit score go up?

Simply paying down your balance will not erase your highest balance amount on your report. But lowering your utilization can benefit your score if it was high. Just don’t run balances back up after paying them down.

Does a past high balance hurt your chances of getting approved for more credit?

Lenders may view past high balances as a risk factor, but they evaluate many aspects of your credit report along with other qualifying criteria when making decisions. Good payment history and low utilization are generally more significant.

The Bottom Line

While credit utilization has a major impact on your scores, your highest lifetime balance itself is just a recorded data point with little direct scoring influence. But high revolving balances can indirectly hurt your credit through increased utilization.

Focus on paying down credit card debt to get your balances below 30% of your overall credit limits. Keep making on-time payments as well. With responsible credit card habits, your credit scores will reflect your trustworthiness over time.

How does a high balance affect credit utilization?

Credit utilization is the ratio of your credit card balance(s) compared to your credit limit(s). This factor accounts for approximately 30 percent of your total FICO score and is considered extremely influential (the primary factor) in your VantageScore.

Utilization is calculated for each credit card. It looks at how much of your credit you have used in relation to your credit limit. For example, a card with a $5,000 limit and a $500 balance will show a 10 percent utilization rate. Each card will be calculated the same way, and then all of your cards’ balances and limits will be totaled to come up with your overall utilization rate.

Experts recommend that consumers keep their credit utilization below 25 percent when possible to optimize their credit utilization ratio.

The card in the previous example is in great shape in terms of credit utilization, but if you have another $5,000 card with a $2,500 balance, that card will show a 50 percent utilization rate. Taken together, your overall utilization rate on these two cards would be 30 percent, which is not terrible.

But the 50 percent on the one card isn’t good. Depending on what else is in your file, this could result in a drop in your credit score.

A high balance or high credit notation, however, is a different situation. This number is the highest amount of money you have ever charged on your card versus the highest balance you have carried after a statement closing date. It does not figure into your VantageScore or FICO score, but it has other uses.

For example, if you have a card with a $5,000 limit, charge $5,000 on the card and then pay it down to $0 before your statement closes, your utilization will be 0 percent. But your high balance on your credit report would show $5,000.

So who cares? Prospective lenders want to know if you are a person who pays their bills on time and if you use your cards and can make money for the issuer. So, if my high balance is $100, it shows I don’t use my card much. If it’s a big number, I may be a more valuable customer generating higher swipe fees.

High balance notations may also factor into what credit limit you get on your card out of the gate. If the most you’ve ever charged was $1,000, there is no benefit but only more risk for a lender to give you a large card limit of, say, $25,000.

What you can do if you carry over a high balance

If you are struggling under the weight of high-interest payments that make lowering your high balance seem impossible, you do have options.