If you’re getting a Federal Housing Administration (FHA loan), you’ll need to get an appraisal in most cases. An FHA appraisal both establishes the value of the property and makes sure it’s safe for the homeowner or prospective homeowner.

We’ll explain exactly how the FHA appraisal process works, help you create an actionable checklist, talk about the aftermath and then discuss the next steps.

Getting an FHA loan to buy a home can be a great option for many homebuyers. FHA loans require just a 3.5% down payment and have flexible credit requirements. However, some homebuyers worry that getting an FHA appraisal could lower the appraised value of the home and affect their ability to buy it.

So does an FHA appraisal really lower your home’s value? The short answer is no – an FHA appraisal should not lower the appraised value of a home just because it is an FHA loan. Here is a more in-depth look at how FHA appraisals work and why they do not negatively impact home values:

What is an FHA Appraisal?

An FHA appraisal is an appraisal required for getting an FHA-insured mortgage loan. FHA loans are backed by the Federal Housing Administration so the FHA wants to ensure the home is valued accurately to reduce their risk.

FHA appraisals are similar to conventional appraisals but have some additional requirements

- The appraisal must be completed by an FHA-approved appraiser.

- The appraiser must inspect both the interior and exterior of the property.

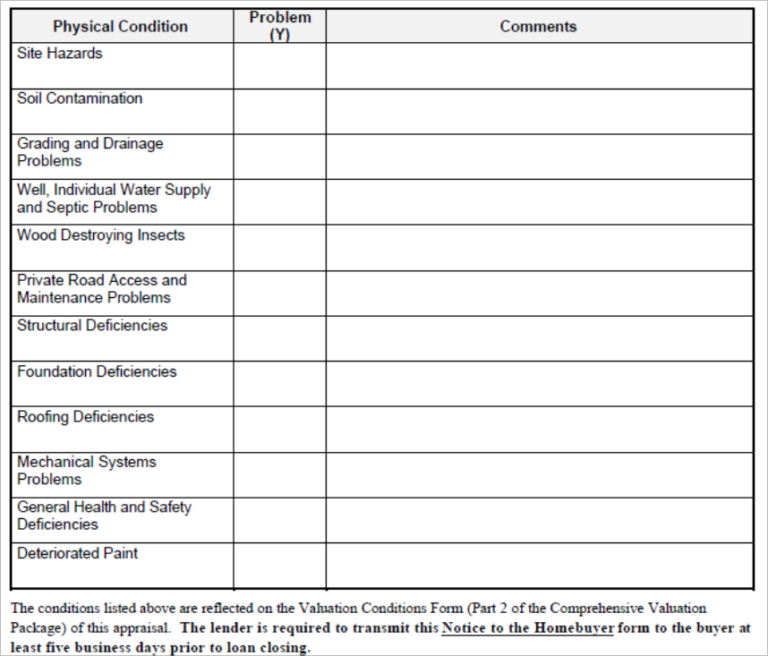

- The appraisal uses FHA minimum property standards to determine if the home is safe, sound, and secure. Any repairs needed to meet FHA standards are noted.

FHA Appraisal vs Conventional Appraisal

The key difference between an FHA appraisal and a conventional appraisal is the FHA appraiser must consider:

- If the home meets HUD minimum property standards and requirements

- If any repairs are needed and the estimated cost

A conventional appraisal will still assess the value and condition of the home, but does not use FHA minimum property standards.

However, the valuation approach itself is the same – the appraiser will look at similar homes recently sold in the area to determine value. So in most cases, an FHA appraisal value should be very close to a conventional appraisal.

Why FHA Appraisals Do Not Lower Value

There are a few key reasons why an FHA appraisal does not negatively impact home value:

-

Appraisers must remain unbiased – FHA appraisers follow the same standards and ethics as all appraisers. They must remain impartial and objective.

-

Appraisal is not dependent on loan type – The appraised value reflects the home’s worth on the open market. The type of loan does not impact the appraisal amount.

-

FHA standards offer protections – FHA minimum property standards help ensure the home is a sound investment. This can give buyers confidence in the property.

-

Repairs can be made – If repairs are required, the borrower can usually make them before closing to meet standards. This does not drag down appraisal amount.

-

FHA is widely used – FHA loans account for about 20% of the mortgage market. Homes with FHA loans sell for full market value all the time.

When Do FHA Appraisals Come in Low?

In some cases, an FHA appraisal may come back lower than the contract price. But this is not necessarily due to it being an FHA loan. Some common reasons an FHA appraisal could be lower include:

-

Home overvalued – The seller may have overpriced the home. The appraisal brings price expectations back in line with market value.

-

Recent price spikes – In a hot market, prices may have spiked recently above true value. The appraisal acts as a correction.

-

Poor condition of home – If the home is in poor shape and repairs are very costly, this can affect appraised value.

So in these cases, it is not the FHA appraisal itself that lowered the value – it is independent factors revealing the true market value. The buyer may need to negotiate with the seller if the appraisal amount is lower than expected.

How to Avoid an FHA Appraisal Coming in Low

If you are concerned about an FHA appraisal negatively impacting value, there are a few things you can do:

-

Have the home pre-inspected – Hire an independent inspector to ensure no major issues and get repair estimates.

-

Check recent sales – Look at comparable homes sold recently to support your offer price.

-

Negotiate repairs – Ask the seller to make any necessary repairs before closing.

-

Provide documents – Supply documents like inspection reports and repair estimates to the appraiser.

-

Consider an appraisal waiver – If you make a large down payment, you may qualify to waive the appraisal.

The Bottom Line

In most cases, an FHA appraisal will not negatively alter the appraised value of your future home. FHA appraisals aim to determine the fair market value just like any other appraisal. As long as you purchase a home priced appropriately for your market and in sound condition, an FHA appraisal should not result in any surprises or cause problems with your home purchase. So you can shop for FHA loans with confidence knowing the appraisal itself will not lower your home’s worth.

The home sale appraisal comes back low

For our first scenario, let’s assume you offered $380,000, had the offer accepted and the appraisal comes back at $360,000. Because the bank won’t approve a loan for more than the home is worth, there are two options:

If the seller is amenable, they might lower the price to what it appraises for, particularly if they’re motivated to move on. Otherwise, you can renegotiate. If you do this, you have to bring whatever the difference is between the appraised value and the final purchase price to the closing table in addition to your down payment and other closing costs.

You might be able to avoid the back-and-forth haggling by putting a clause in your purchase agreement that says you’ll pay a specific amount above the appraised value up to a certain dollar figure.

If the seller is unwilling to budge on the price or you can’t come to an agreement, you may be left with no choice but to walk away. If that happens, you’ll need to make sure that you have an appraisal contingency in your purchase agreement.

The appraisal contingency gives you the power to renegotiate and walk away if the appraisal comes back low. If you don’t have this contingency, you could lose your earnest money deposit. An earnest money deposit is an amount of money put in escrow representing a promise that you’re taking the final steps to secure financing to buy the property. In order to retain your deposit when you walk away, you must be moving on due to a contingency defined in the agreement.

The appraisal comes back at or higher than the expected amount

If the appraisal comes back at least as high as you agreed to pay in your purchase agreement or how much you’re refinancing for, this is the best possible scenario. You just move forward with your transaction.

Home inspectors will look at the major components of a home to ensure everything is in working order. A home inspector will examine a home’s:

- Roof and gutters

- Attic and insulation

- Walls and ceilings

- Windows and doors

- Floors

- Foundation

- Appliances

- HVAC system

- Plumbing and electrical systems

VA Appraisals – How to Handle a Low Appraisal on FHA or VA Loan

FAQ

Do FHA appraisals come in lower?

Yes, appraisal gaps are allowed with FHA loans. However, borrowers are required to cover the difference themselves to keep their home purchase on track or avoid losing money.

Are FHA loan appraisals more strict?

Yes, FHA loan appraisals are generally considered more strict than conventional loan appraisals.

What if an FHA appraisal comes in higher than an offer?

If a home is appraised to be higher than the asking price, the lender will only issue a mortgage for the appraisal amount.

How to fight a low FHA appraisal?

- Try to Renegotiate the Asking Price of the Real Estate. See if your seller is willing to negotiate the price based on the results of the appraisal. …

- Try Negotiating Closing Costs With the Seller. …

- When the Appraisal Is Higher Than the Asking Price of The House for Sale.