When applying for a mortgage, lenders will carefully examine your financial history to determine if you are likely to repay the loan. An important part of this process is reviewing your bank statements and credit reports. This allows the lender to verify your income, assets, debts, and overall ability to manage finances responsibly. But do mortgage lenders also look at closed accounts when evaluating an application?

Why Mortgage Lenders Review Bank Statements

There are a few key reasons why mortgage lenders closely analyze bank statements:

-

Income verification – Regular deposits from paychecks, Social Security, pensions, etc. show proof of steady income to make mortgage payments.

-

Down payment sourcing – Large deposits are scrutinized to ensure down payment funds came from an acceptable source like savings not loans or gifts.

-

Spending habits – Recurring payments, balances, fees indicate how you manage money on a monthly basis

-

Undisclosed debt – Additional withdrawals could reveal debts not showing on a credit report.

-

Account history – Frequent overdrafts or closures due to negative balances raise red flags.

So lenders look for signs of financial stability and the ability to take on mortgage debt. Closed accounts can provide additional insight into your money management skills.

Do Mortgage Lenders Review Closed Accounts?

Yes, lenders will review both open and closed accounts listed on your credit reports and recent bank statements.

They want to see your entire history of using credit and bank accounts responsibly. A pattern of closing accounts due to overdrafts or unpaid fees can hurt your chances of approval.

According to mortgage expert David Reiss, “Lenders will look at all of your assets and debts in order to determine if you can repay the loan. Closed accounts provide information about how you manage credit and bank accounts over time.”

How Far Back Do Mortgage Lenders Look at Closed Accounts?

-

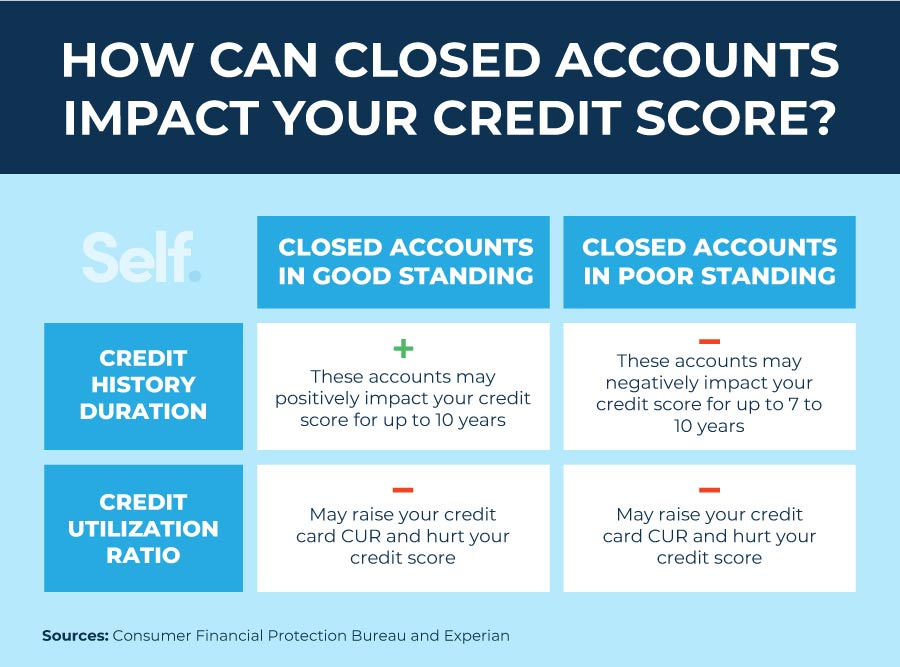

Credit reports provide a full history of opened and closed accounts typically going back 7-10 years.

-

Bank statements are usually required for the most recent 2-3 months. However, lenders may ask for additional statements going back further.

-

Verbal verification can reveal if any accounts were closed due to negative activity within the last 12 months.

So while credit reports provide a long history, mortgage lenders focus most closely on your finances from the past 1-2 years. Applicants with recently closed accounts due to unpaid debts or overdrafts often face increased scrutiny.

Do All Mortgage Types Check Closed Accounts?

Most mortgage programs will review closed accounts including:

-

Conventional loans – Backed by Fannie Mae, Freddie Mac, banks and credit unions.

-

FHA loans – Insured by the Federal Housing Administration.

-

VA loans – Guaranteed by the U.S. Department of Veterans Affairs.

-

USDA loans – From the U.S. Department of Agriculture.

The extent of closed account review depends partly on the lender’s own policies. But verifying credit history and money management skills is standard across mortgage loan types.

Should You Worry About Closed Accounts Hurting Your Mortgage Chances?

For most borrowers, a few closed accounts in good standing are nothing to worry about. However, recent closures due to overdrafts or unpaid debts can raise concerns for underwriters. Here are tips for explaining closed accounts:

-

Be upfront if any closures were due to negative balances or activity. Provide documentation like letters from your bank.

-

Show examples of good recent money management with current accounts.

-

Highlight sources of stable income, low debts, and strong credit history.

-

Allow time for closed accounts with problems to age off reports. Wait 12 months after closing before applying.

As long as you can show responsible use of credit and finances overall, a few closed accounts should not hurt your mortgage application. But be prepared to provide explanations just in case.

What About Closed Accounts With Balances?

One situation that causes greater concern is closed accounts that still have an outstanding balance. Examples include:

-

An overdrawn checking account that was closed by the bank.

-

A credit card closed for non-payment with a remaining balance.

-

Collections for utility or medical bills that were not fully paid.

Most mortgage lenders will want these types of debts to be paid off before they will approve your loan. The concern is that you still owe money related to those closed accounts.

By paying off collections and remaining account balances prior to your home purchase, you can avoid this issue altogether. If balances cannot be paid quickly, wait to apply for a mortgage until they are taken care of.

Key Takeaways on Closed Accounts and Mortgage Applications

When reviewing your finances, mortgage lenders will look at both open and closed accounts. A few general tips can help avoid problems:

-

Don’t close accounts specifically for the mortgage application. Underwriters will be suspicious.

-

Pay off any outstanding debts related to closed accounts.

-

Be ready to explain any closures due to negative circumstances like overdrafts.

-

Show financial responsibility with current accounts, credit, and money management.

-

Allow 12 months after closures with problems before applying for a mortgage.

While closed accounts shouldn’t automatically disqualify you, lenders want to see a history of responsible finances. Understanding their concerns and taking steps to explain or resolve closed account issues can help your mortgage application proceed smoothly.

What do mortgage lenders look for on bank statements?

When you apply for a mortgage, lenders look at your bank statements to verify that you can afford the down payment, closing costs, and future mortgage payments. And the more straightforward your application file, the more likely you are to be approved. Even if unintentionally, you certainly don’t want to raise any red flags.

Read on to learn how you can avoid common underwriting pitfalls and optimize your chances of mortgage approval.

In this article (Skip to…)

How far back do lenders look at bank statements?

Mortgage lenders typically seek two months of recent bank statements during your home loan application process.

You need to provide bank statements for any accounts holding funds you’ll use to qualify for the loan, including money market, checking, and savings accounts.

Loan officers use bank statements to assess a borrower’s financial health and credibility when considering a loan application.

Here are a few key reasons why they analyze bank statements:

- Income Verification: Loan officers check for regular deposits, paychecks, or other sources of income to ensure that the borrower has a steady income to repay the loan.

- Expense Analysis: They examine the borrower’s spending habits and recurring expenses to gauge their ability to manage money responsibly. This includes looking for consistent bill payments, existing debts, and overall financial commitments.

- Account Stability: Loan officers want to see a stable financial history. Frequent overdrafts, large unexplained transfers, or erratic account behavior could raise concerns about the borrower’s financial stability.

- Risk Assessment: By reviewing bank statements, loan officers evaluate the risk associated with lending money to the individual. They assess if the borrower’s financial situation aligns with the loan amount and terms requested.

- Fraud Detection: Bank statements help in detecting potential fraudulent activity or inconsistencies in financial records. This is crucial for ensuring the borrower’s credibility.

Two months’ worth of bank statements is the norm because any credit or deposit accounts older than that should have appeared on your credit report.

One uncommon exception is for self-employed borrowers who hope to qualify based on bank statements instead of tax returns. In this case, you must provide the past 12-24 months of bank statements.

However, even in this case, loan officers may still regard large deposits differently.

Warning Mortgage Lenders, Beware the Closed Account with a Balance. Credit Score Tips

FAQ

Can mortgage lenders see closed accounts?

It can take 30-60 days for the lender to report the closed account to the credit reference agencies. A closed account can remain on your credit file for up to 6 years but will be marked as “closed”. You may find that your credit score initially decreases when you close old accounts that you no longer use.

Do lenders check your bank account the day of closing?

Your loan officer will typically not re-check your bank statements right before closing. Mortgage lenders only check those when you initially submit your loan application and begin the underwriting approval process.

Can lenders see old bankruptcies?

The credit bureaus collect information regarding bankruptcy cases from the Bankruptcy Court’s public records. No matter the status of your case (open, closed, discharged, dismissed, etc.) the credit bureaus can still report your case on your credit report for up to ten years.

What are red flags on bank statements for mortgages?

Red flags on a bank statement

Firstly excessive overdrafts or bounced payments can be major red flags. They show poor money management and can make most lenders question your ability to make monthly mortgage repayments throughout the mortgage term. Secondly, large unexplained cash deposits can be queried.

Will my loan officer check my bank statements before closing?

Your loan officer will typically not re-check your bank statements right before closing. Mortgage lenders only check those when you initially submit your loan application and begin the underwriting approval process. Verify your home buying eligibility. Start here

Do lenders have to sign off on bank statements?

Before the lender fund the loan, the underwriter will have to sign off on your bank statements. How Many Months of Bank Statements Do Mortgage Lenders Require? Lenders typically request two months of statements for each of your bank, brokerage, and investment accounts in order to qualify for a mortgage.

How do I Close on a new home mortgage?

One of the final and most important steps toward closing on your new home mortgage is to produce bank statements showing enough money in your account to cover your down payment, closing costs, and reserves if required. When you’re buying a new home and approaching the finish line, emotions are high and timing is tight. Need a Second Opinion?

Can a lender refuse to finance a mortgage?

A lender may refuse to finance a mortgage or allow the potential buyer to use the funds from the account for the purposes of the mortgage and closing costs if the financial information doesn’t adequately satisfy the verification requirements. Lenders can request your bank statements or seek a POD from your bank; some lenders do both.

Will a closed account be removed from my credit report?

Closed accounts, whether they were closed by you or closed due to payoff or transfer to another lender, are not automatically removed from the credit report. The status of the account will be updated to show that it is no longer open, but the payment history of the account will remain on your report.

Why do Lenders look at bank statements when applying for a mortgage?

When you apply for a mortgage, lenders look at your bank statements to verify that you can afford the down payment, closing costs, and future mortgage payments. And the more straightforward your application file, the more likely you are to be approved. Even if unintentionally, you certainly don’t want to raise any red flags.