When you buy a home, do you know what costs and cash you’ll need to pay at closing? If you aren’t sure what “cash to close” means, what your closing cost amounts are or how to pay them, read on to learn more.

Closing on a home can be confusing especially when it comes to understanding the difference between closing costs and cash to close. While they sound similar these terms refer to distinct expenses in the home buying process. Knowing what each entails and how to budget for them is key to avoiding surprises at closing. In this comprehensive guide, we’ll break down the need-to-know details on closing costs versus cash to close to set you up for success on your home buying journey.

What Are Closing Costs?

Closing costs refer specifically to the fees charged by lenders and third parties to finalize and “close” on a mortgage loan. These costs cover services like appraisals credit checks and document processing required to underwrite and approve your home loan. Closing costs can range from 2% to 5% of the total mortgage amount, with the specific percentage varying by location and loan type.

Some common closing costs include:

-

Origination Fees: Charged by the lender for processing your loan application, assessing risk, and funding the mortgage. Often around 1% of the total loan amount.

-

Appraisal Fees: Covers the cost of hiring a professional appraiser to evaluate the property and confirm its market value. Typically $300-$500.

-

Credit Report Fees: Pays for the lender to access your credit report and score from the credit bureaus. Usually $25-$50 per report.

-

Title Fees: Covers title search, insurance, and examination to verify legal ownership of the property. Often $700-$2,000.

-

Recording Fees: Charged by local governments to officially record the property transfer and new mortgage. Varies by location but usually under $100.

-

Transfer Taxes: Levied when a property changes hands. Ranges from 0%-4% of home price depending on state/local laws.

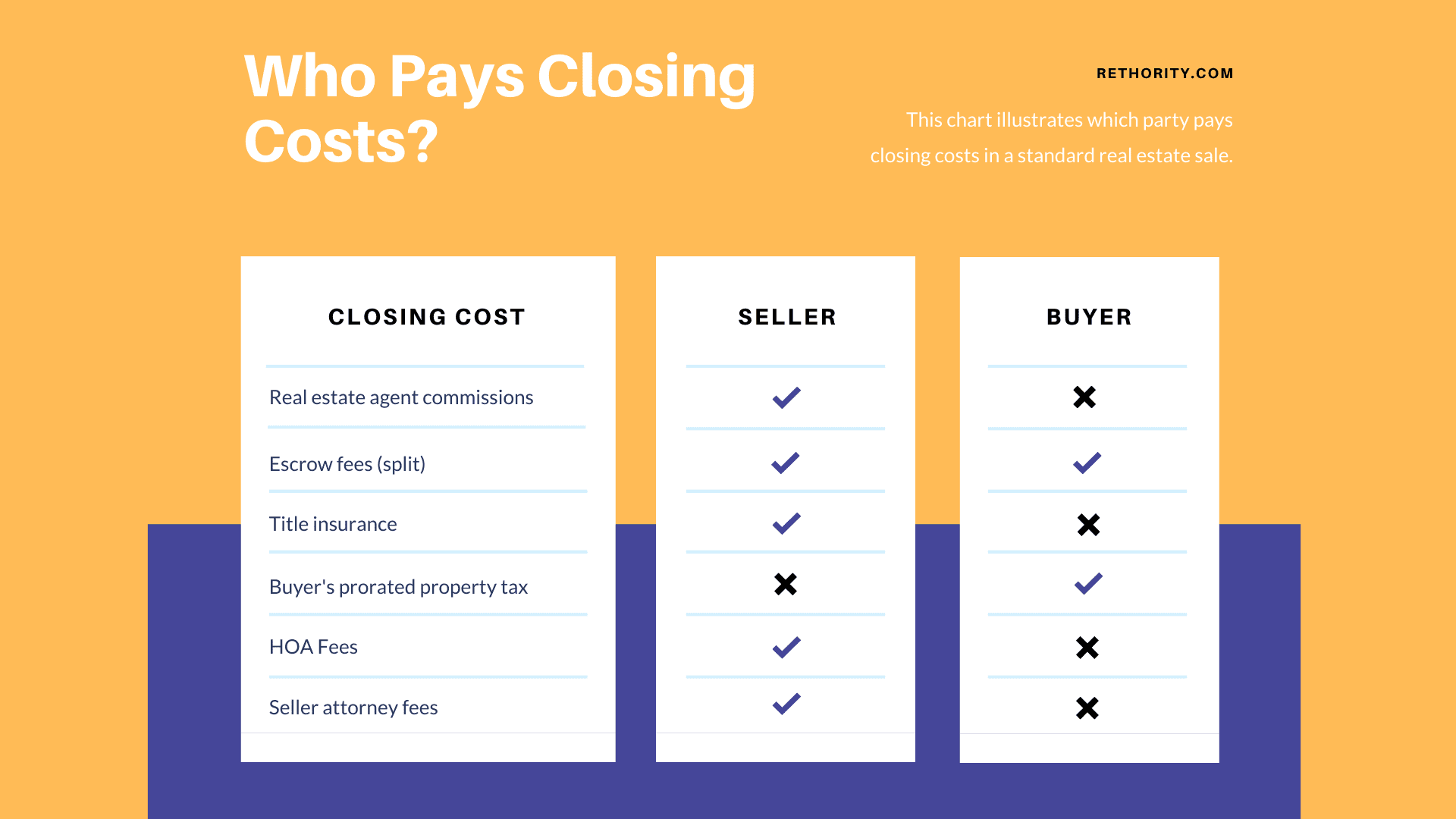

While required, closing costs are technically negotiable in some cases. Sellers may agree to cover a portion, and lenders may offer discounts for bundling services. Prepaid items like property taxes and insurance premiums also factor in.

What is Cash to Close?

Cash to close refers to the total amount a buyer must bring to the closing table to complete the transaction. This includes the down payment and closing costs, minus any credits or adjustments. Having an accurate estimate of your cash to close amount is essential for budgeting properly.

The cash to close is calculated as:

Down Payment + Closing Costs – Credits = Cash to Close

A few key points on what makes up cash to close:

-

Down Payment: The upfront percentage of the purchase price paid by the buyer. Typically 10%-20% for conventional loans.

-

Closing Costs: All fees charged by the lender and third parties, as outlined above.

-

Credits: Includes the earnest money deposit, seller credits, and any lender credits that reduce the amount due at closing.

-

Prepaids: Prorated property taxes, homeowners insurance, and HOA fees owed by the buyer at closing.

Having a complete understanding of the cash to close separates prepared buyers from the pack. It prevents any shocking shortfalls when signing the final paperwork.

Do I Pay Closing Costs or Cash to Close?

To summarize the key difference: Closing costs are a component of the total cash to close amount. As a buyer, you pay the cash to close, which encompasses the closing costs plus additional expenses like the down payment.

Here is an example to illustrate:

Purchase Price: $300,000

Down Payment: $60,000 (20%)

Closing Costs: $8,000

Seller Credits: $2,000

Cash to Close =

$60,000 + $8,000 – $2,000 = $66,000

In this scenario, the buyer would pay the full cash to close amount of $66,000 at closing. This covers the $60,000 down payment and $8,000 in closing costs, minus a $2,000 seller credit. The closing costs are just one component rolled into the total cash due.

When Do I Pay Closing Costs?

Closing costs are primarily paid at the closing appointment as part of your total cash to close amount. However, some closing costs like the appraisal may be due upfront after applying for a mortgage.

Your lender will provide a detailed Closing Disclosure statement 3 days before closing that outlines your exact closing costs and total cash due. This gives you time to gather funds or address any discrepancies. Bring a certified check, cashier’s check, or arrange a wire transfer for the full cash to close amount indicated.

How Can I Reduce My Closing Costs?

If your closing costs or cash to close amount exceeds your budget, here are some tips to reduce the hit:

-

Negotiate with the seller to cover certain fees or offer closing credits.

-

Shop around with multiple lenders and compare quotes on origination/title fees.

-

Opt for a no-closing cost loan that wraps fees into the mortgage.

-

Buy down the interest rate to lower overall borrowing costs.

-

Request discounts for bundling services with one company.

-

Seek grants, seller subsidies, or lender programs for first-time home buyers.

-

Time your purchase right to get prorated property taxes.

Key Takeaways

When preparing to close on a home, understanding the difference between closing costs and total cash to close is critical. Keep these key points in mind:

-

Closing costs refer specifically to lender and third party fees to process the loan.

-

Cash to close is the total amount you pay at closing, including the down payment, closing costs, credits, and prepaids.

-

Work with your lender and real estate agent to accurately estimate your costs and cash needed.

-

Shop around, negotiate, and explore programs to reduce your closing expenses.

While closing may seem daunting, being informed on what to expect sets you up for a smooth process. With the right preparation and budget, you’ll be poised to cover your closing costs and required cash to close on your new home investment.

Can cash to close be rolled into my mortgage loan?

Your total cash-to-close amount can’t typically be rolled into your mortgage because certain expenses, like your down payment, are due upfront. Depending on the type of loan, you may be able to roll some (or all) of your closing costs into your monthly mortgage payments.

If you’re a first-time home buyer, you may also be able to get costs like your down payment covered entirely, which can lower the amount due at closing. Be sure to speak with your lender if you’re looking to roll specific payments into your mortgage.

Cash to close: Definition

Cash to close (also called “funds to close”) refers to the total amount of money you’ll need to pay on closing day to finalize your home purchase or real estate transaction. Unless you’re doing a dry closing, you’ll need to know ahead of time what the cash-to-close amount will be so you can prepare the funds at closing.

Understanding Closing Costs On Home Purchase And Cash To Close

FAQ

Do I pay closing cost or cash to close?

Think of closing costs as just one of several components in cash to close — the other components are prepaid expenses and the remaining portion of your down payment. “Cash to close is a much bigger number than just the closing costs,” says Jeff Lazerson, president of Mortgage Grader in Laguna Niguel, California.

How should I pay my closing costs?

Technically you can’t bring cash to closing; instead you need to bring a check, certified funds, do a wire transfer, etc. Watch our Closing video for the proper methods for paying costs at closing. For refinance home loans you can increase the loan amount (assuming there’s room in the LTV) to pay for the closing costs.

What happens if you don’t have cash for closing costs?

4. Roll closing costs into the mortgage. If you can’t afford to pay your closing costs up-front, you may be able to roll all or some of the fees into your loan. You won’t pay anything at closing, but the lender adds the fees to your principal, increasing your total loan amount and monthly mortgage payment.

Can you use a credit card for closing costs?