The path to a great credit score can be a long one, and it can have some bumps along the way. But if you keep your credit utilization ratio low and avoiding anything negative (like missing payments, etc.) those bumps should be minor.

Keep in mind that the credit game requires a fair amount of patience and that if your score is good enough to get you what you want, that’s all that really matters. Chasing perfection in scoring can become a fool’s errand.

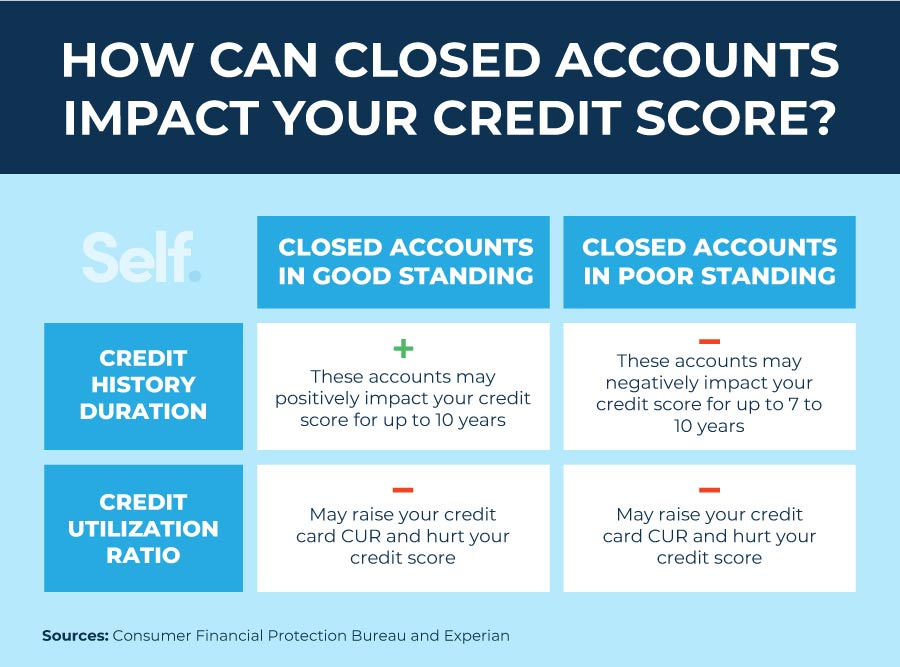

There are, however, certain things that can ding your score, so it’s best to be aware of them and try your best to avoid them. Learn now how a closed account can affect your score and decide if you really want to close it.

Your credit score plays a crucial role in your financial life It impacts everything from interest rates on loans to approval for rental applications. One important factor that makes up your credit score is the length of your credit history, also known as your credit age So how do closed accounts impact your credit age and score?

How Credit Scoring Models Calculate Credit Age

There are a few different credit scoring models, with FICO being the most commonly used. FICO continues to factor both open and closed accounts into its credit age calculation. So if you have a long history with accounts, even if some are now closed, this will benefit your FICO credit score.

VantageScore a newer credit scoring model and FICO competitor, only factors open accounts into its credit age calculation. So if you close accounts even older ones, this may lower your VantageScore since your remaining open accounts will be newer.

Overall, having older accounts on your credit report, whether open or closed, will help your FICO credit score which is used by most lenders. But it may hurt your VantageScore.

Do Closed Accounts Continue Aging on Credit Reports?

Closed accounts typically remain on your credit reports for 7-10 years depending on their status before being removed. During this time, their age continues growing.

So a credit card you opened 5 years ago but closed last year would still count as a 5+ year old account while it remains on your report. This helps demonstrate a longer credit history versus only current open accounts.

Once closed accounts drop off your credit reports after 7-10 years, they no longer impact your credit at all. But having an older closed account stay on your report for as long as possible can benefit your credit age and FICO score.

How Long Closed Accounts Stay on Credit Reports

Here is how long closed accounts typically remain on credit reports depending on their status:

- Closed accounts in good standing: Up to 10 years

- Closed accounts with late payments: Up to 7 years from date of first delinquency

This demonstrates the importance of keeping accounts in good standing before closing them. Having late payments can shorten the time they will count towards your credit history.

Paying down balances and keeping payments on time before closing an account ensures it will help your credit for as long as possible.

Tips to Build Credit Age with Closed Accounts

Here are some tips to maximize your credit age with open and closed accounts:

-

Keep accounts open longer before closing – Having accounts remain open longer before closing allows their age to build more on your reports over time. Try to keep accounts open at least 5 years.

-

Pay balances and keep payments on time – This allows closed accounts to remain for the full 10 years versus shortening to 7 years with delinquencies.

-

Retain your oldest accounts – Having longstanding accounts, even if closed, can significantly boost your credit history’s length. Keep oldest accounts open or close only as a last resort.

-

Open new accounts only as needed – Too many new accounts can lower average age so only open if you have a true need.

-

Prioritize FICO over VantageScore – Since FICO factors closed accounts, focus more on maximizing this score over VantageScore. But optimizing both is ideal.

The Impact of Closing Open Accounts

Closing very old, established accounts can certainly hurt your credit age and FICO score in the short term. But the impact is not usually drastic or long lasting.

For example, say you have a 15 year old credit card you close. Even after closing, this account will likely remain on your report for up to 10 more years counting towards your history. Any impact from removing an old account is small and temporary.

The most important thing is to not close accounts with balances or late payments. As long as you pay down and maintain accounts before closing, the impact should be minimal in the long run.

Alternatives to Closing Old Accounts

If you have very old accounts you want to stop using, consider these alternatives to closing:

-

Downgrade to a no annual fee card – This allows the account to remain open and age while avoiding annual fees.

-

Use periodically to keep active – Charge a small purchase every 6-12 months to keep account open without changing habits.

-

Link to online account for autopay – Setup autopay for a small recurring charge like a subscription to keep account open without regular use.

The Bottom Line

Closed accounts typically remain on credit reports and continue aging for 7-10 years depending on their status when closed. This allows them to continue positively impacting your credit age and FICO score during this time.

The effect of closing old accounts is usually small, especially if they are maintained responsibly before closing. But keeping accounts open for as long as possible, or considering alternatives like downgrading, is ideal for maximizing your credit history length.

Overall, do closed accounts count towards credit age? For the most part, the answer is yes. Handled responsibly, closed accounts can benefit your credit score for many years even if no longer in use.

How does a closed account affect your length of credit history?

A credit score uses an algorithm that has been proven to be able to predict future delinquencies. As a backward-looking model that predicts the future, it relies heavily on past performance as well as other current factors such as credit utilization and credit mix.

Let’s talk about how closing a card account affects your length of credit history, which makes up 15% of your FICO credit score.

While your score will continue to include account history from all closed, as well as open, cards for as long as they remain on your credit report, the credit bureaus remove closed accounts in good standing after about 10 years and closed accounts with a history of late payments after seven years from the date of the delinquency.

Tip: Once an account no longer appears on your credit report, it’s the end of the line for that account having any impact, good or bad, on your score. But again, as long as you retain at least a few open and active cards well into the future, any such long-term effect on your length of credit history will be zero to minimal.

Why seven and 10? Because that’s what the customers of the credit bureaus want to see when underwriting consumers. If lenders suddenly wanted to see 20 years of history, the bureaus would do their best to provide it (and thereby increase sales of credit reports and other products).

The VantageScore model does not count closed accounts; only open ones are used to calculate credit age. So, the answer to your question is yes, closed accounts still count at least when it comes to your FICO score. The thing about credit history is that it is, well, historical.

It takes time to happen and there is no way to speed it up – there are no quick fixes for this piece of the credit score pie. However, below are some things you can do – and not do – to raise your score while you are waiting for your credit report to age.

Closing a credit card can raise your credit utilization ratio

When an installment loan, for say a car or furniture, gets paid off that account is closed. However, I want you to think twice before closing a revolving account (like a credit card) just because you haven’t used it in a while.

Don’t get me wrong – there are good reasons to close revolving accounts, like a high annual fee or poor customer service – but generally speaking, I recommend not closing accounts especially for someone with a limited credit history.

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Closing an account reduces your overall available credit, which is used in the utilization calculation. Utilization is figured two ways. First, the ratio of balance to credit unit is used, and second, the ratio of all your credit limits on all your cards to all your balances is factored in. Closing an account reduces the value of the second ratio.

Does Closing Accounts Affect My Credit Age? – CreditGuide360.com

FAQ

Does a closed account affect credit age?

Closed accounts may affect two metrics that determine the length of your credit history: the average age of your credit accounts and the overall amount of …Mar 19, 2025

Do closed accounts count toward credit history?

FICO includes closed accounts in their credit history calculations, so even if your account is closed, the time it was open will still factor into your overall credit age. Closed accounts typically remain on your credit report for 10 years if the account is in good standing.

Does closing a credit card affect credit age?

Closing a credit card account could negatively impact your credit. That’s because closing a credit card account can affect the average age of accounts on your credit report, as well as your credit utilization ratio.

What is the 2/3/4 rule for credit cards?

How long do closed accounts stay on your credit report?

Closed accounts stay on your credit report for a period of up to ten years. Let’s look at how this would affect your average age of accounts when looking at the two different models. It’s my opinion that when FICO9 is released (latest version of the FICO score) that they will no longer include closed accounts in your average age of accounts.

Do closed accounts affect your credit score?

From what we have seen, closed accounts often can still be a very powerful influence on one’s credit score. Remember, the age of a closed account still factors into your credit, and accounts continue to age even after they have been closed.

Can accounts age off credit reports after they’re closed?

Accounts can age off credit reports after they’re closed. Your age of credit, then, is calculated based on what is still being reported. Another important measurement is the average age of your accounts. This is simply the average age of all of your accounts as measured using the same date opened field.

Does closing an account remove age from your credit score?

“Credit scoring models like FICO and VantageScore do indeed consider the age of your oldest account and the average age of your accounts when calculating your credit scores. However, closing an account does not remove its history — including its age — from your credit reports.

What happens if a bank account is closed?

The lower your utilization, the better. Having open accounts gives you a higher overall credit limit, which can lower your utilization ratio and help improve your scores. Even if they do show as closed, any account closed in good standing (meaning it has no late payment history) will remain on your credit report for 10 years.

How much does credit age affect your credit score?

Your credit age accounts for 15% of your credit score. Apply for credit early, and keep your accounts open as long as you can. Length or age of credit history is how long you’ve had credit lines in your name. It accounts for about 15% of your credit score, and there’s not much you can do except be patient to help this factor improve.